- BTC has declined by 2.43% over the past 24 hours, at press time.

- Bitcoin’s leveraged positions declined amidst economic uncertainty in the U.S.

Over the past day, as the crypto market crashed amidst U.S. economic uncertainty, Bitcoin [BTC] dipped to November 2024 levels.

Since hitting a low of $76k, Bitcoin has made a moderate recovery. In fact, as of this writing, Bitcoin was trading at $80,338. This marked a 2.43% decline over the past 24 hours.

These struggles in Bitcoin’s prices amidst U.S. macroeconomic difficulties have left investors pessimistic adding fear to risk markets.

Bitcoin’s leveraged positions decline

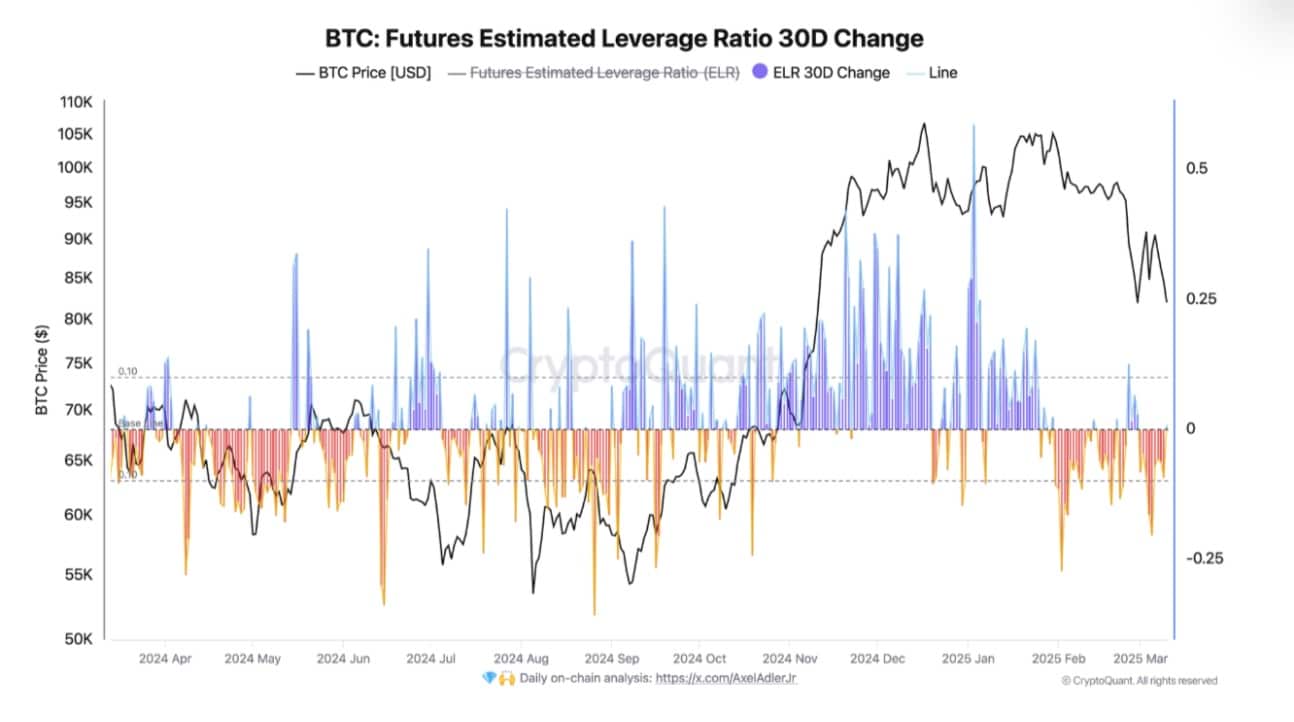

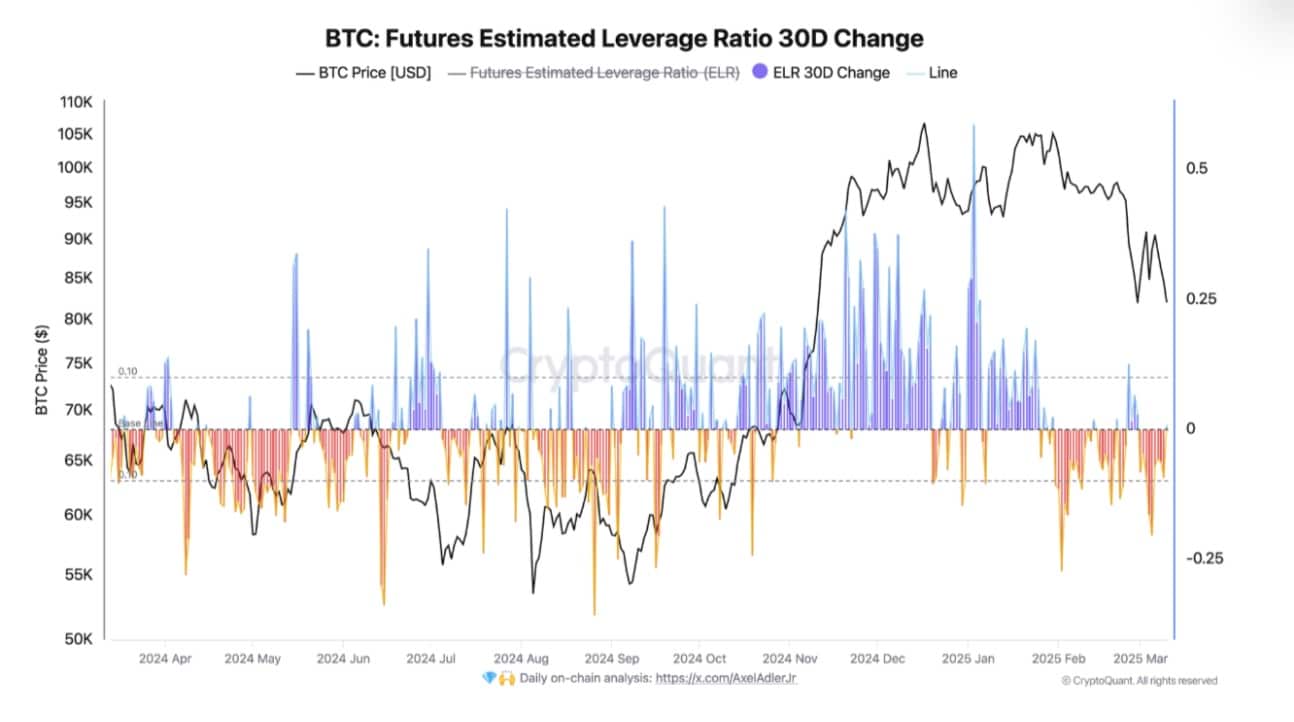

According to CryptoQuant, since the 29th of January, the Futures Estimated Leverage Ratio has been evolving within the negative area.

Source: CryptoQuant

At press time, the Estimated Leverage Ratio (ELR) was around -0.13 suggesting that traders are reducing leverage as their risk appetite declines.

This implies that traders are less optimistic and are avoiding speculative market activities reflecting strong bearish sentiments.

The current market trend arises from political and economic uncertainty over Trump’s policies. The U.S. government’s agenda is adding fear to risk markets leaving traders to secure their positions and diminish risk exposure.

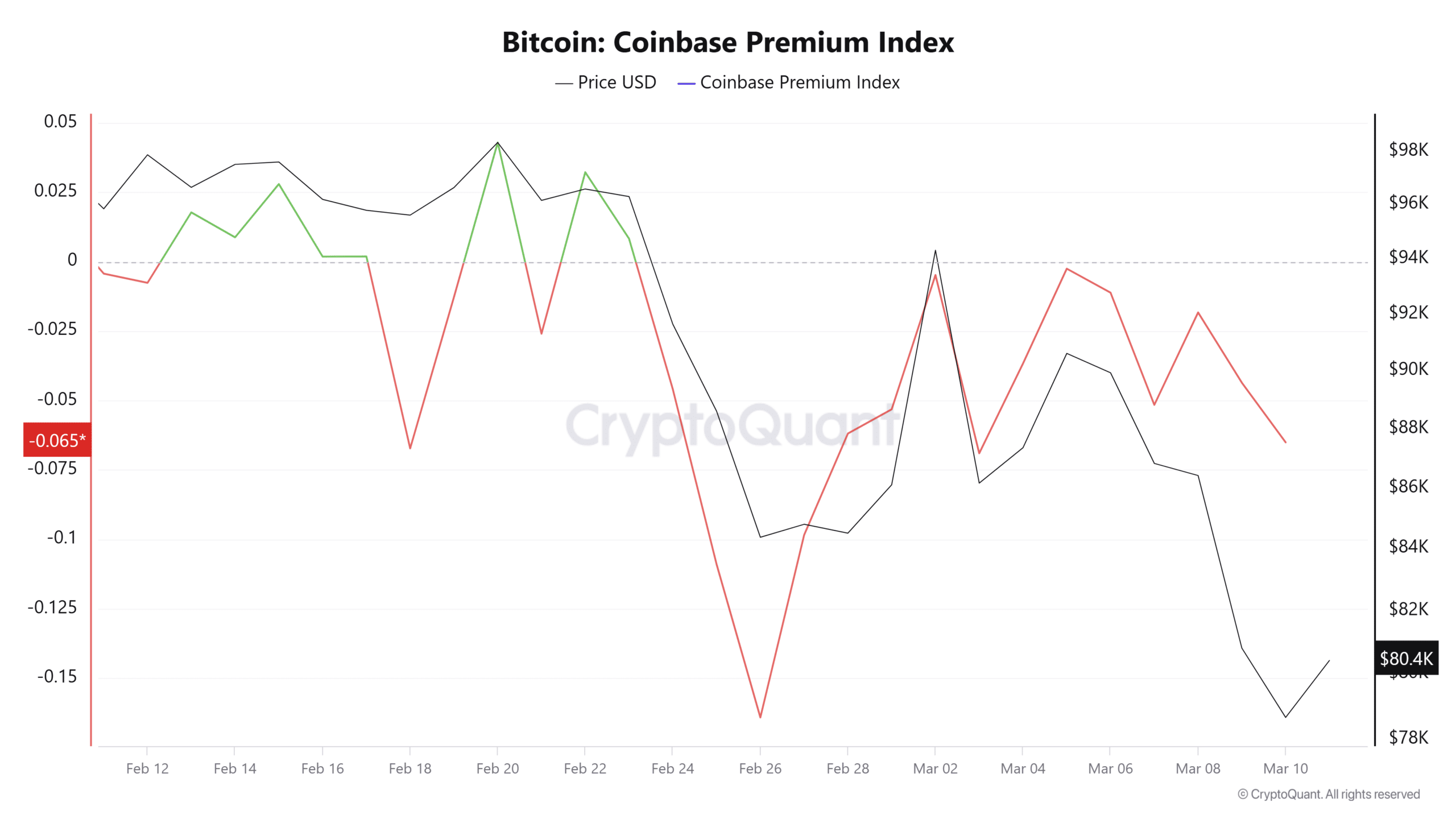

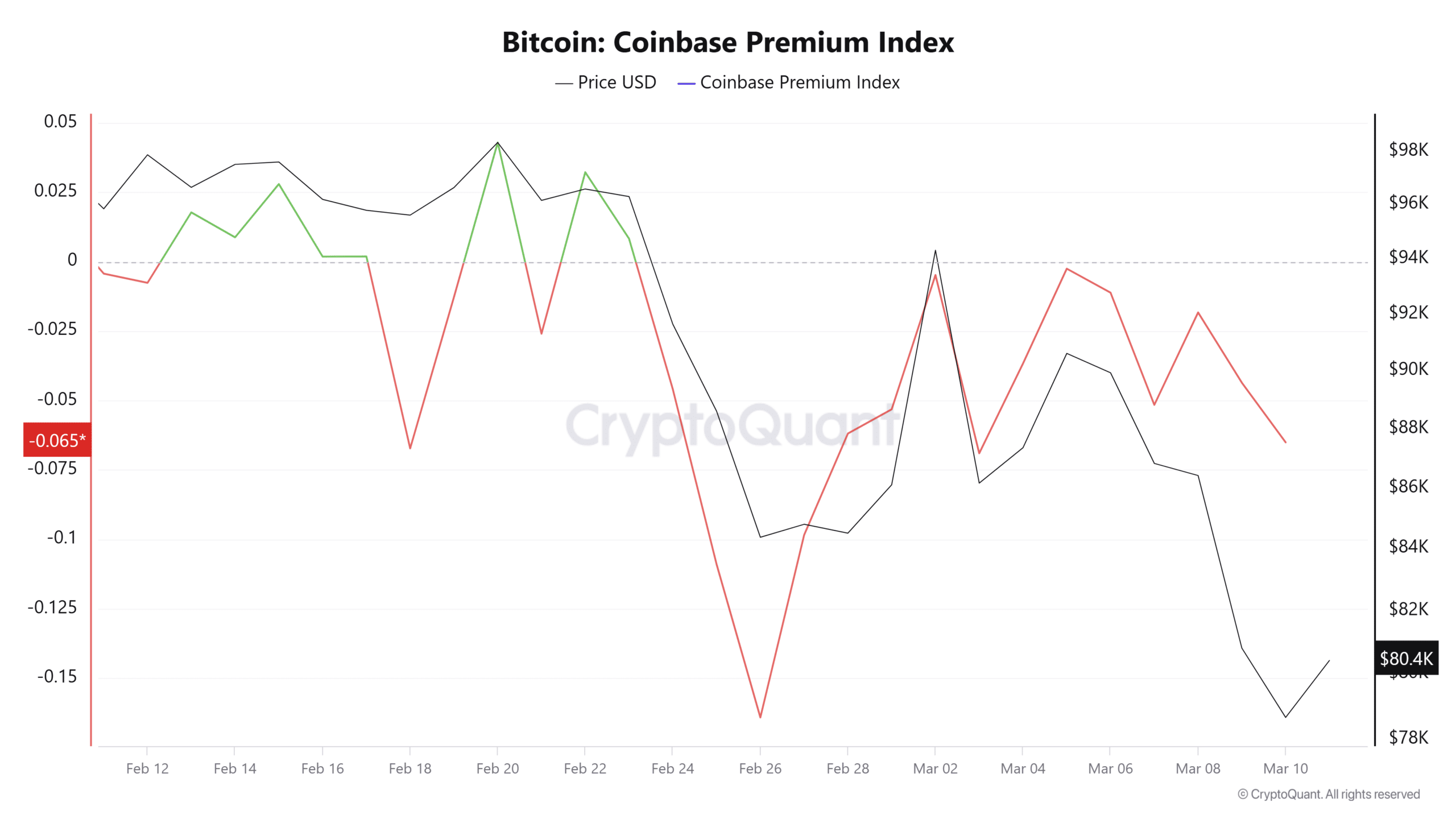

Source: CryptoQuant

AMBCrypto observed the impact of these policies on crypto markets and Bitcoin, as the Coinbase Premium Index has remained negative over the past two weeks.

When this turns and remains negative for a long period, it suggests that U.S. investors are selling without institutional accumulation. As such, the broader market sentiments among traders remain bearish, and expect the bear trend to continue.

Source: X

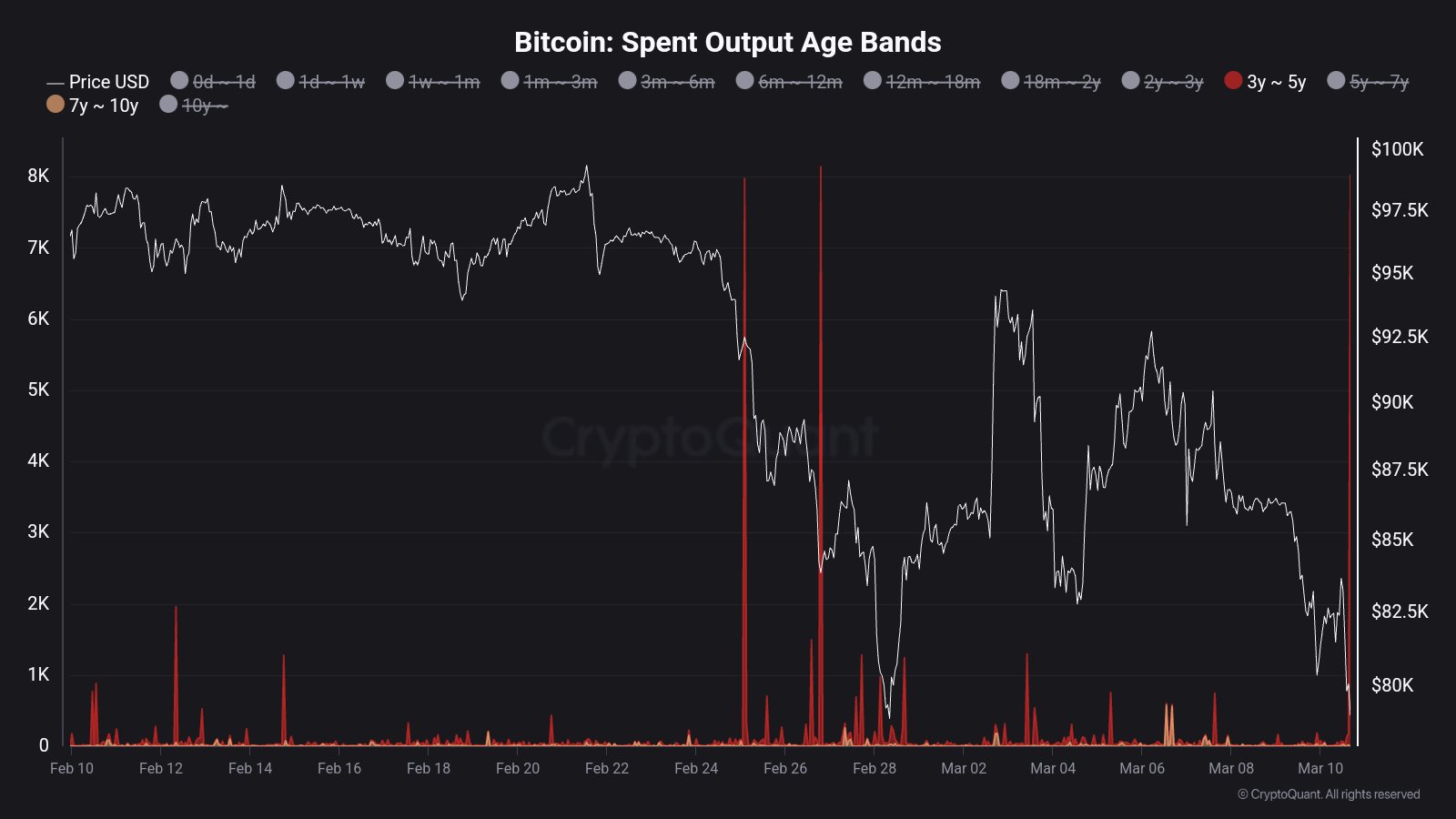

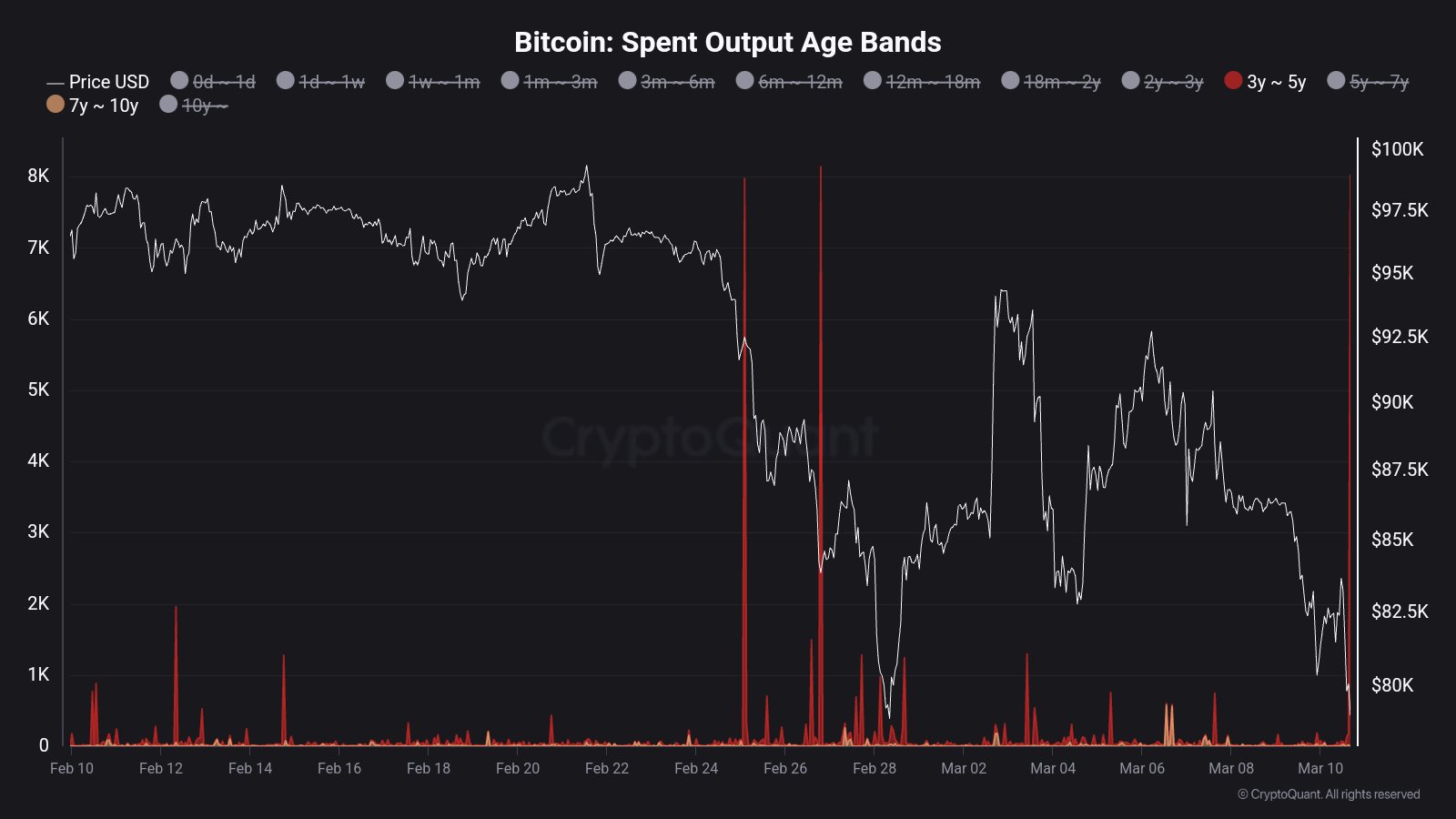

The market’s bearish sentiment has intensified as dormant coins are starting to move. Notably, 8,000 BTC that have remained inactive for three to five years have recently become active.

If these coins are transferred to exchanges, the likelihood of a sell-off increases. Historically, the movement of older coins often creates substantial selling pressure.

Source: CryptoQuant

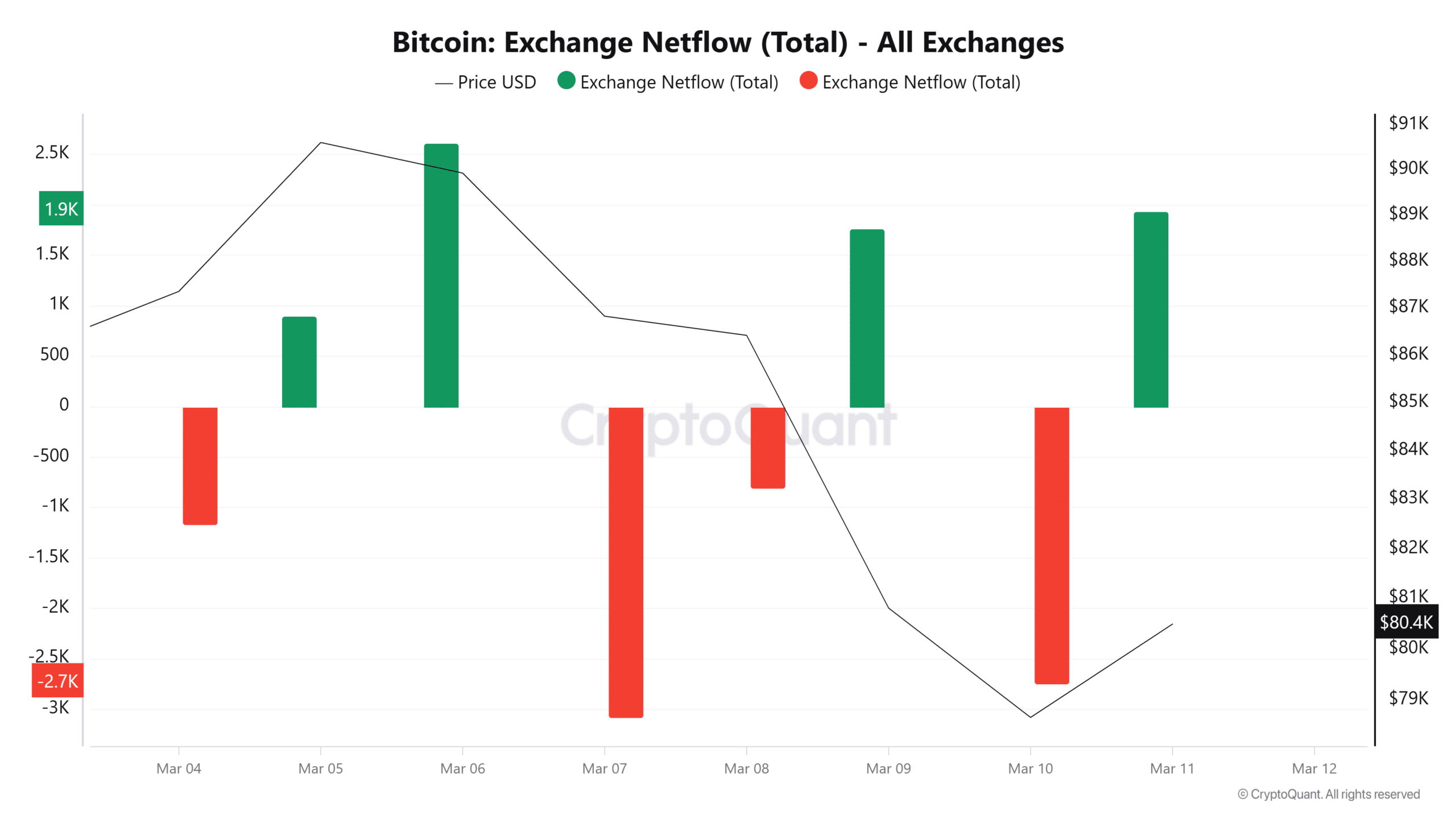

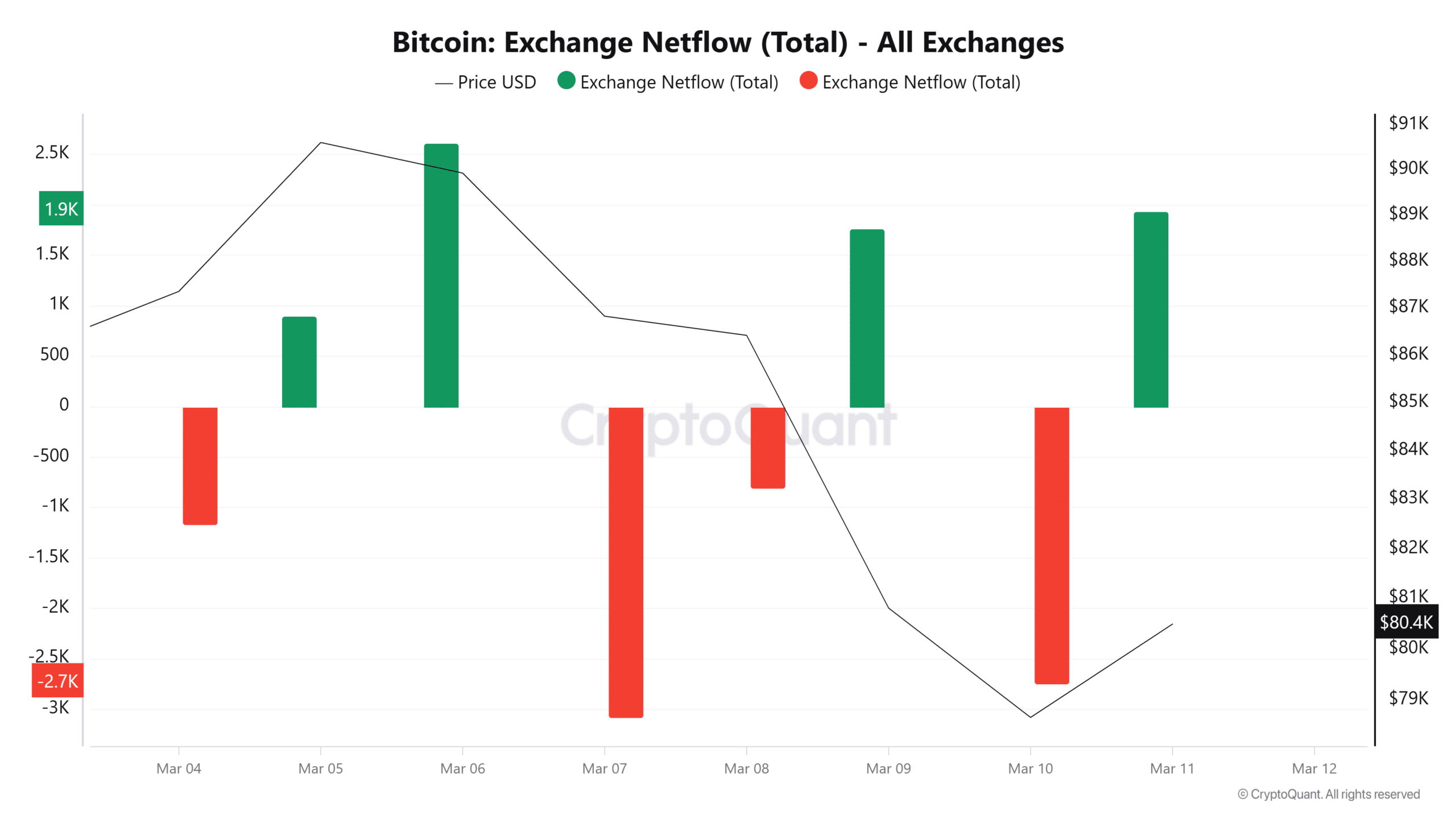

We can see that these coins have moved to exchanges; looking at the Exchange Netflow suggests that there’s significant inflow as it has turned positive with over 1.6k BTC.

As such, the past day saw over 50k BTC flow into exchanges. This suggests that the markets have experienced strong bearish sentiments over the past day.

What next for BTC

With investors reducing leveraged positions, it reflects strong bearish sentiments currently in the market. Inasmuch, Bitcoin’s future trajectory is highly linked to the U.S. economy and macroeconomic policies. Therefore, until the U.S. economy stabilizes, BTC volatility will continue.

Therefore, if the trend witnessed over the past day continues, BTC could drop again to $77592. However, a shift in market sentiments, as the U.S. economy cools down, a move to $84k will restore market confidence thus boosting the crypto to move higher levels.