- U.S. retail investors saw a sharp drop in BTC buying activity after the market opened, mirroring institutional trends.

- The broader market remains bullish, with billions of dollars worth of BTC purchased.

Bitcoin’s [BTC] price action remains uncertain. The asset has dropped 12.42% over the past month and struggled to maintain a bullish stance, up 0.26% in the last 24 hours until press time.

Current sentiment suggests BTC could see a major price rally, as notable buying activity is observed from retail investors and whales. However, low liquidity levels threaten this rally.

U.S. investors and institutions panic-sell BTC

There has been a notable decline in interest from U.S. retail and institutional investors over the past 24 hours, according to data.

The Coinbase Premium Index (CPI), which tracks U.S. retail investor activity on Coinbase relative to other exchanges, shows that selling pressure has intensified as the CPI dropped below zero.

Source: CryptoQuant

This shift follows bullish sentiment on the 17th of February, when the crypto market saw a strong price surge. However, ETF activity suggests a more bearish outlook.

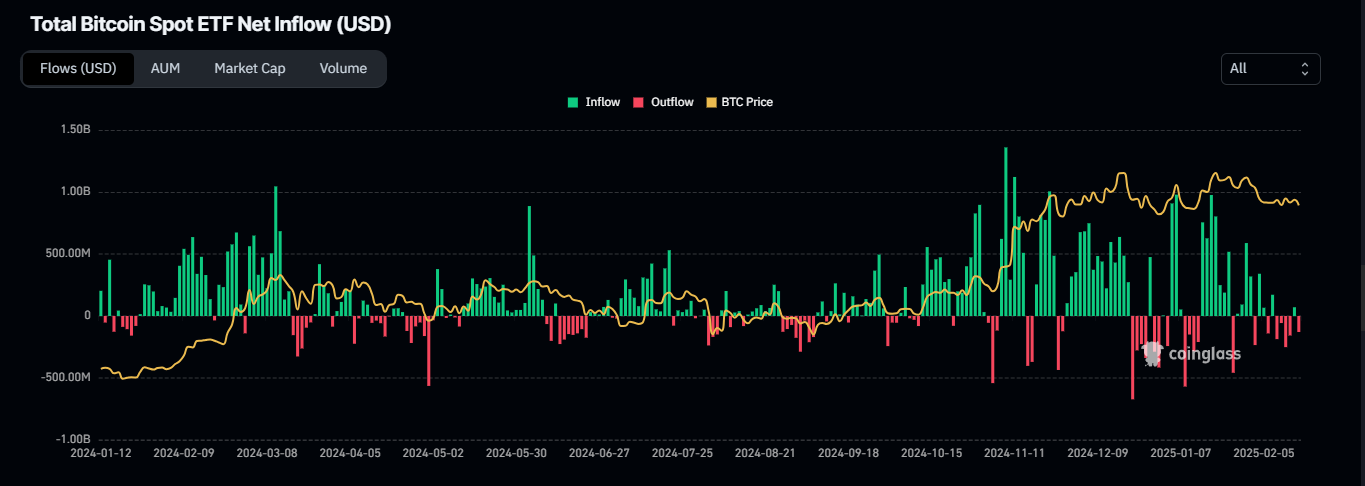

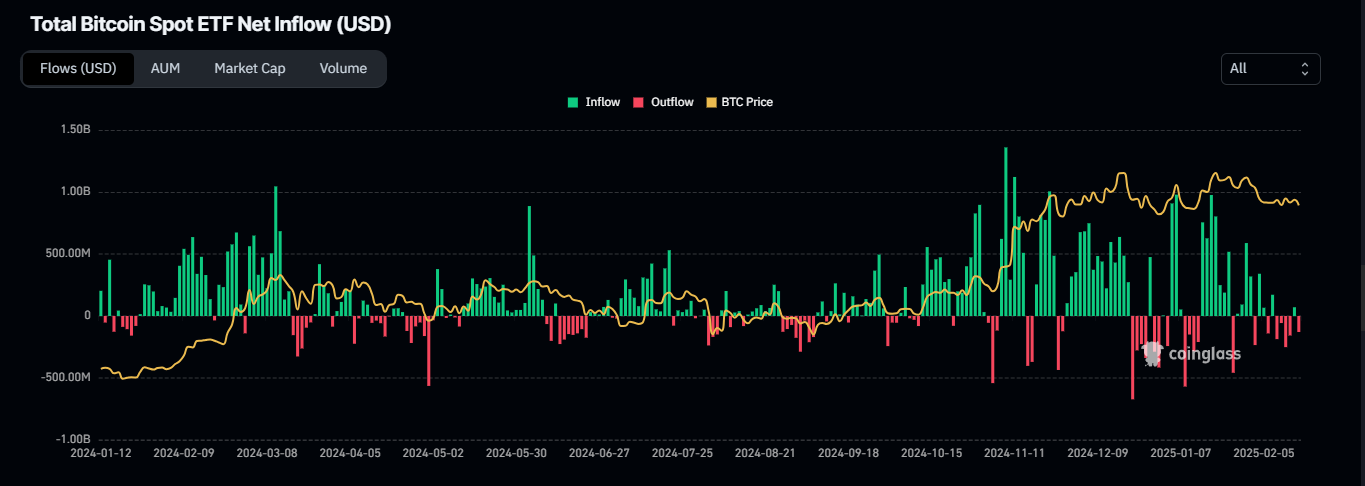

In February, spot BTC ETFs saw an inflow of $70.60 million, suggesting buying activity. However, on the 18th, a major outflow of $129.10 million was recorded, meaning more BTC was withdrawn from these institutions.

Source: Coinglass

This was a continuation of the market outflows that occurred from the 10th to the 13th of February, as institutional investors continued selling their BTC holdings.

Bullish sentiment stays strong

Despite recent sell pressure, some bullish sentiment remains. According to CryptoQuant, an address linked to over-the-counter (OTC) trades for long-term holding has accumulated a significant amount of BTC.

At the time of analysis, over 28,000 BTC—worth more than $2.6 billion—had been purchased by these addresses. This could lead to a supply squeeze, reducing circulating BTC.

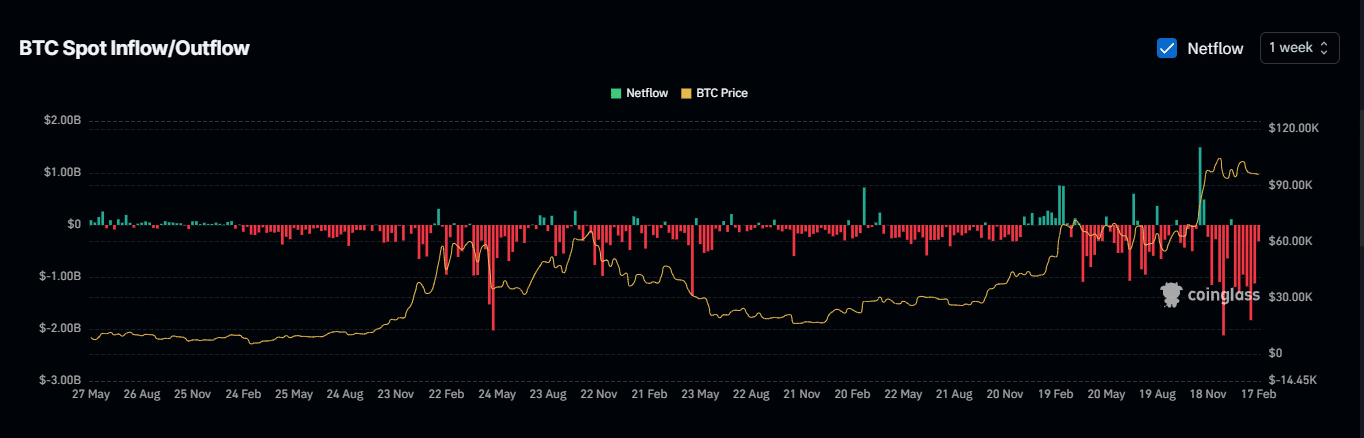

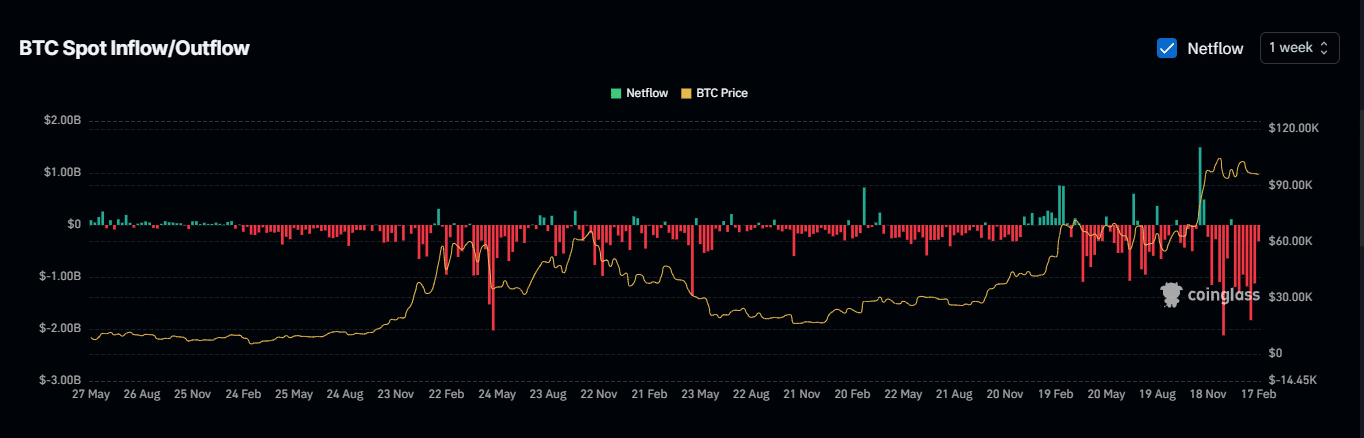

A closer look at the spot market reflects similar buying trends. In the past week alone, $314.70 million more BTC was bought than sold.

Asset netflow data shows consistent BTC accumulation since January 2025, further supporting a bullish outlook.

Source: Coinglass

Low liquidity levels threaten an upward move

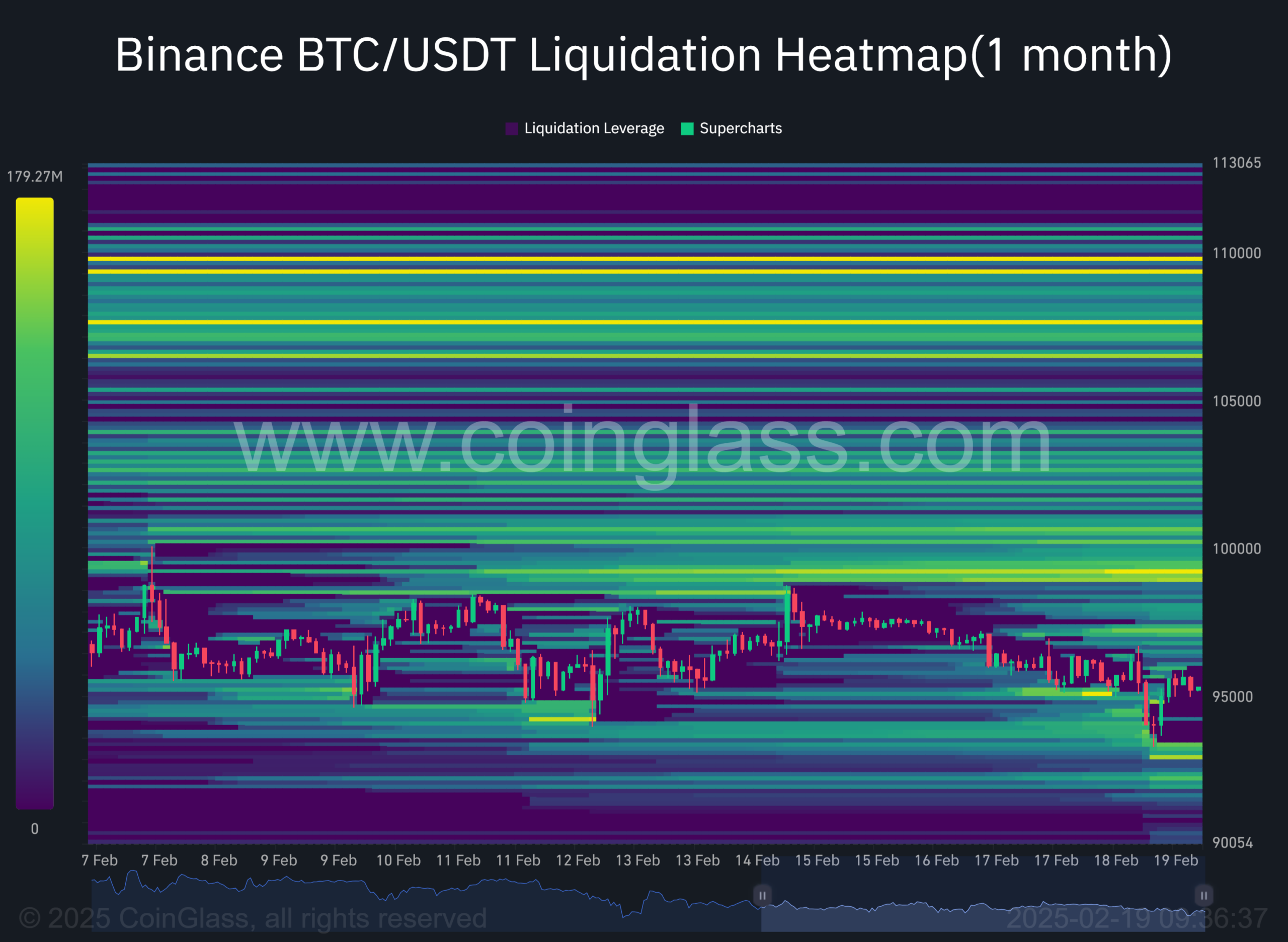

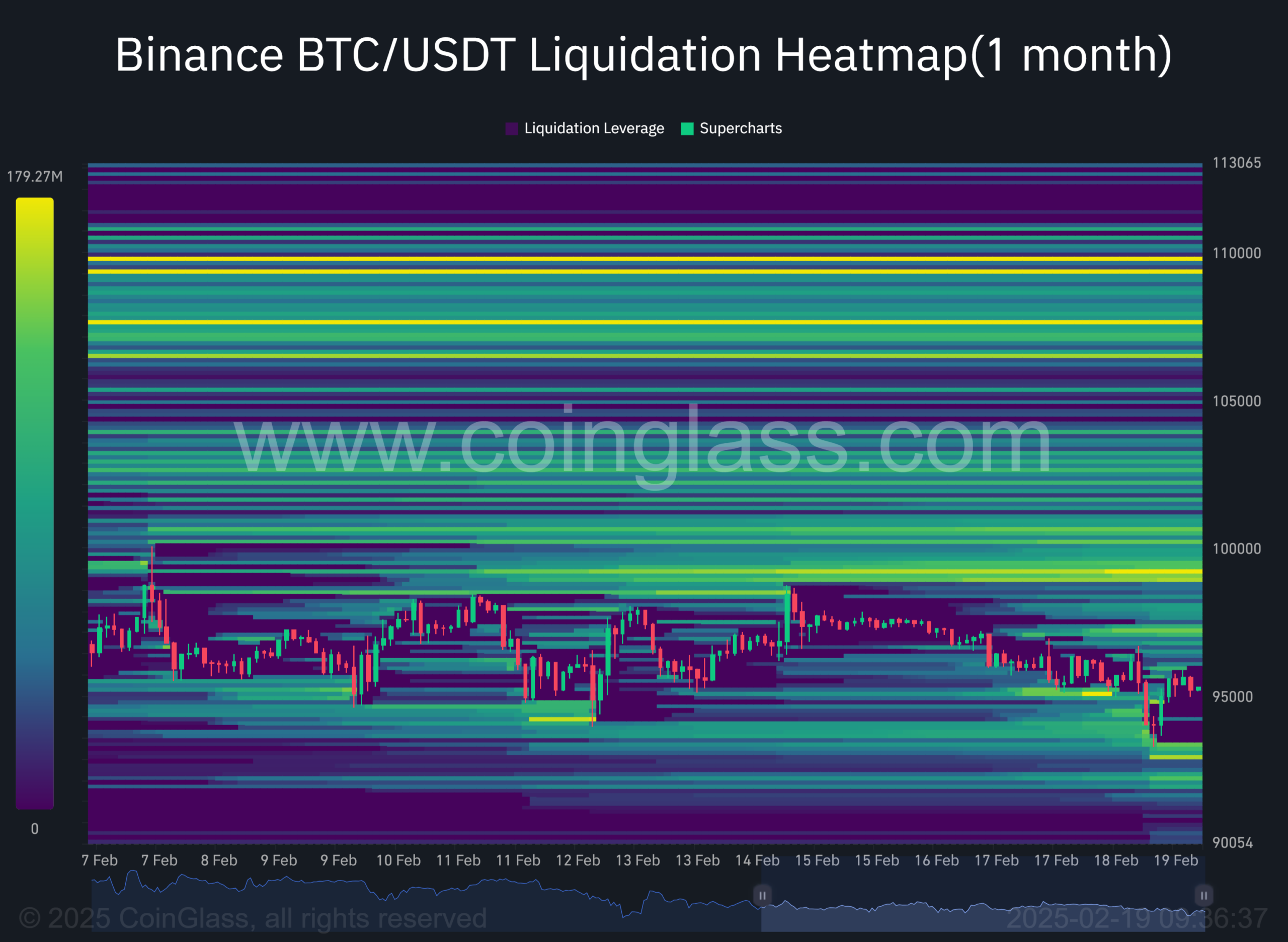

According to Binance’s liquidation heatmap on the monthly timeframe, a major liquidity level is positioned at $92,930.28, where $136.1 million worth of BTC buy orders have been placed.

Source: Coinglass

Typically, liquidation levels act as magnets that pull the price toward them. If this holds for BTC, it may drop to this level before quickly rebounding.

For now, market sentiment remains mixed, and further data and on-chain activity will provide clarity on BTC’s next move.