- Bitcoin recently registered a major period of price stabilization after an extended period of consolidation

- Its volatility has fallen in recent weeks, alongside its price action on the charts

Bitcoin [BTC] recently underwent a period of price stabilization, often referred to as sideways movement – A phase that has historically preceded a surge in retail investor interest. After an extended period of consolidation though, Bitcoin may be on the brink of a positive shift now, with growing retail demand poised to drive its price higher.

A shift towards growth and market optimism

Over the last 30 days, retail investor activity for Bitcoin has declined by approximately 2% – A notable decrease compared to the 20% drop in January.

Source: CryptoQuant

Such a moderation in retail demand means that the market has reached a point of stabilization, setting the stage for potential growth. Also, at press time, analysis highlighted the 30-day change in retail demand, revealing how previous periods of growth in demand have been linked with price hikes.

The smaller decline in retail activity over the past month could indicate that the consolidation phase is nearing its end. As retail demand begins to grow again, it may create a positive shift in market sentiment, favoring Bitcoin’s price in the short term.

Bitcoin’s strong foundations for future growth

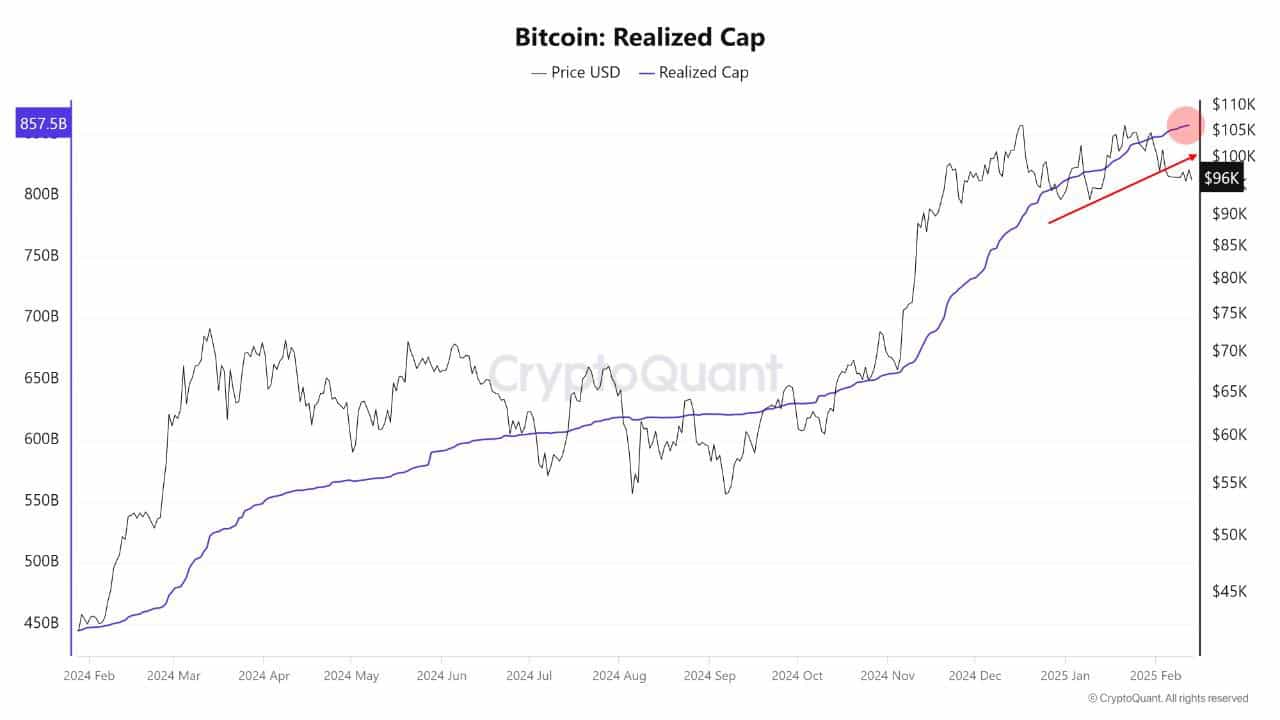

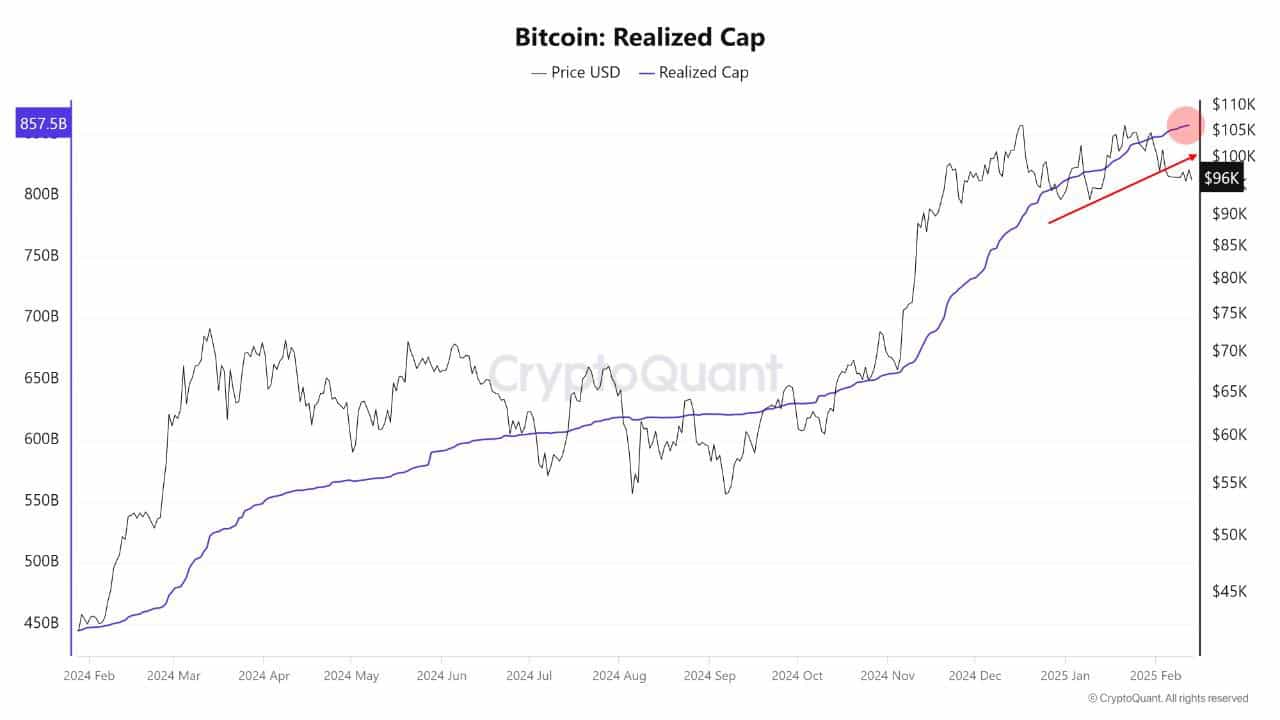

Bitcoin’s realized market cap recently hit an all-time high of $857 billion. This achievement simply reinforces the ongoing strength of Bitcoin’s bull cycle – A sign of robust market health despite occasional price corrections.

Source: CryptoQuant

Certainly, long-term holders are capitalizing on higher prices, signaling confidence in the asset’s long-term value. Simultaneously, new investors are entering the market and absorbing sell pressure, while maintaining upward momentum.

This interplay between long-term holders and new investors means that bullish sentiment for Bitcoin has remained strong. This also supports the likelihood of sustained price growth in the near term.

Impact of profitable positions on price

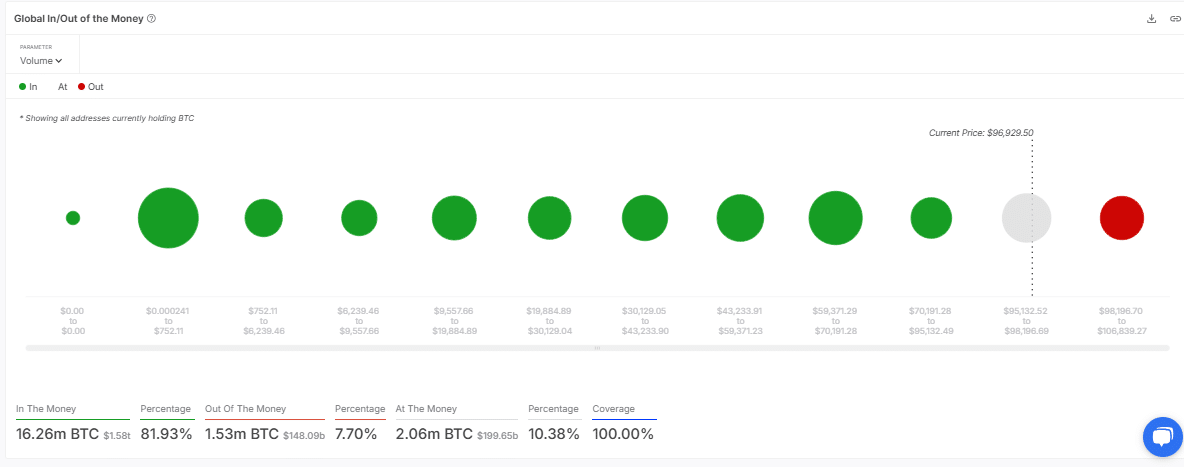

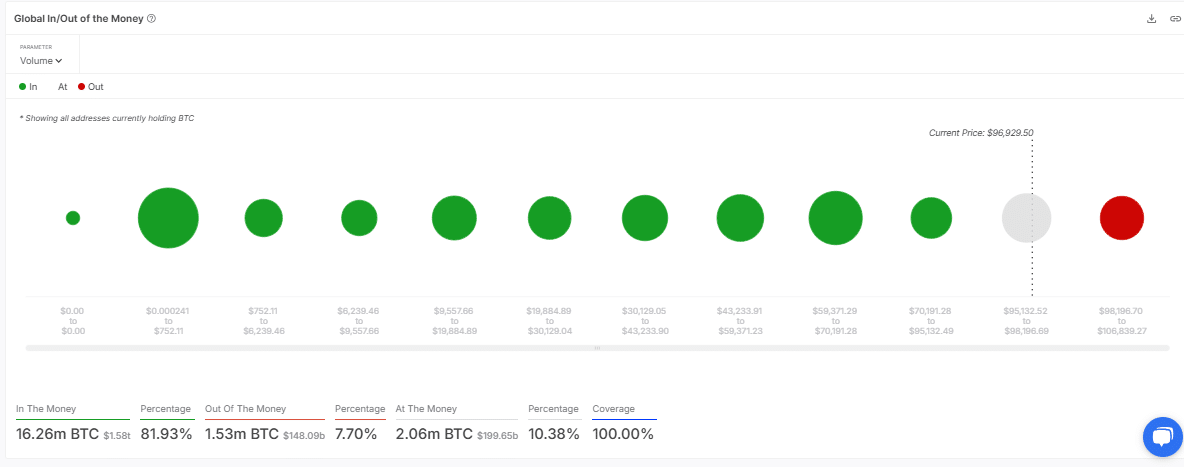

According to an analysis of Bitcoin’s Global In/Out of the Money metric, the crypto’s price of approximately $96,929.50 has placed a significant portion of addresses ‘In the Money.’ Such a finding also hinted that many investors are in profitable positions right now.

Source: IntoTheBlock

This often triggers a fear of missing out (FOMO) sentiment, with potential buyers seeking to enter the market before further gains occur.

Fewer ‘Out of the Money’ addresses reduce selling pressure, potentially allowing for a more stable and consistent price hike. The prevailing situation seemed to show that a favorable ratio of profitable positions could further contribute to momentum in Bitcoin’s price.

A precursor to potential to more upside?

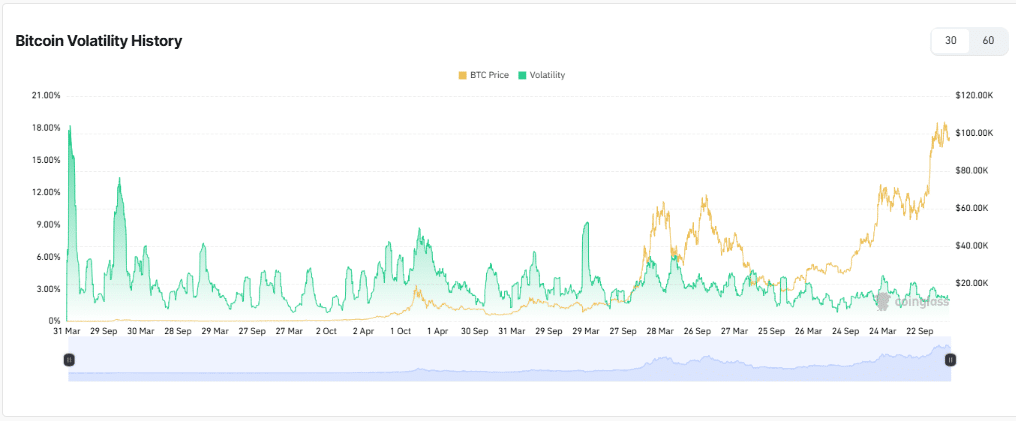

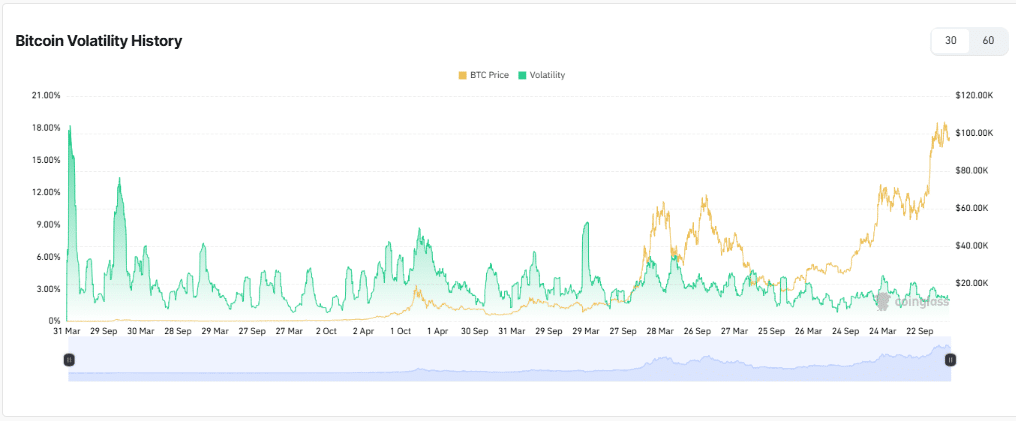

Finally, Bitcoin’s volatility has fallen in recent weeks, alongside its price action. Since periods of lower volatility often precede significant price movements, it can be assumed that the market may be consolidating before a breakout.

Source: CoinGlass

This combination of low volatility, high market cap, and positive retail demand is very important for BTC’s price action. A fall in volatility, combined with other bullish indicators, might be a precursor to a bullish trend, with Bitcoin potentially breaking out of its consolidation phase.