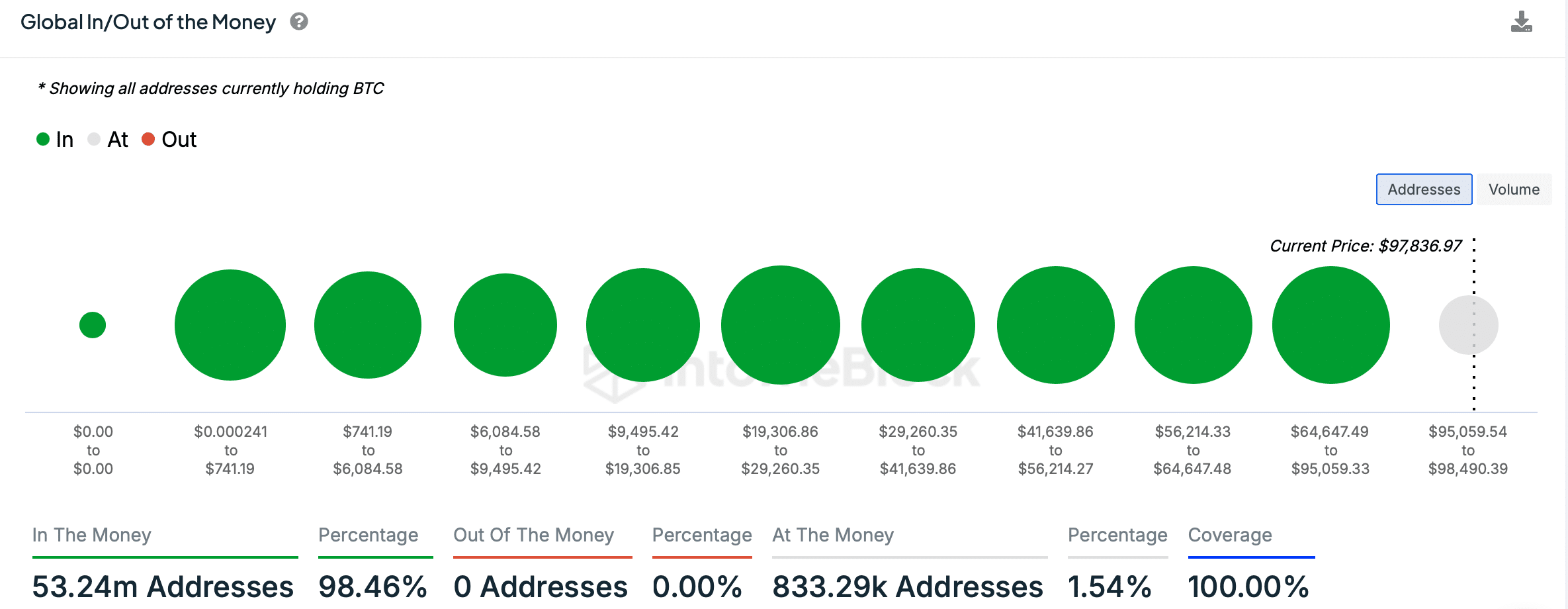

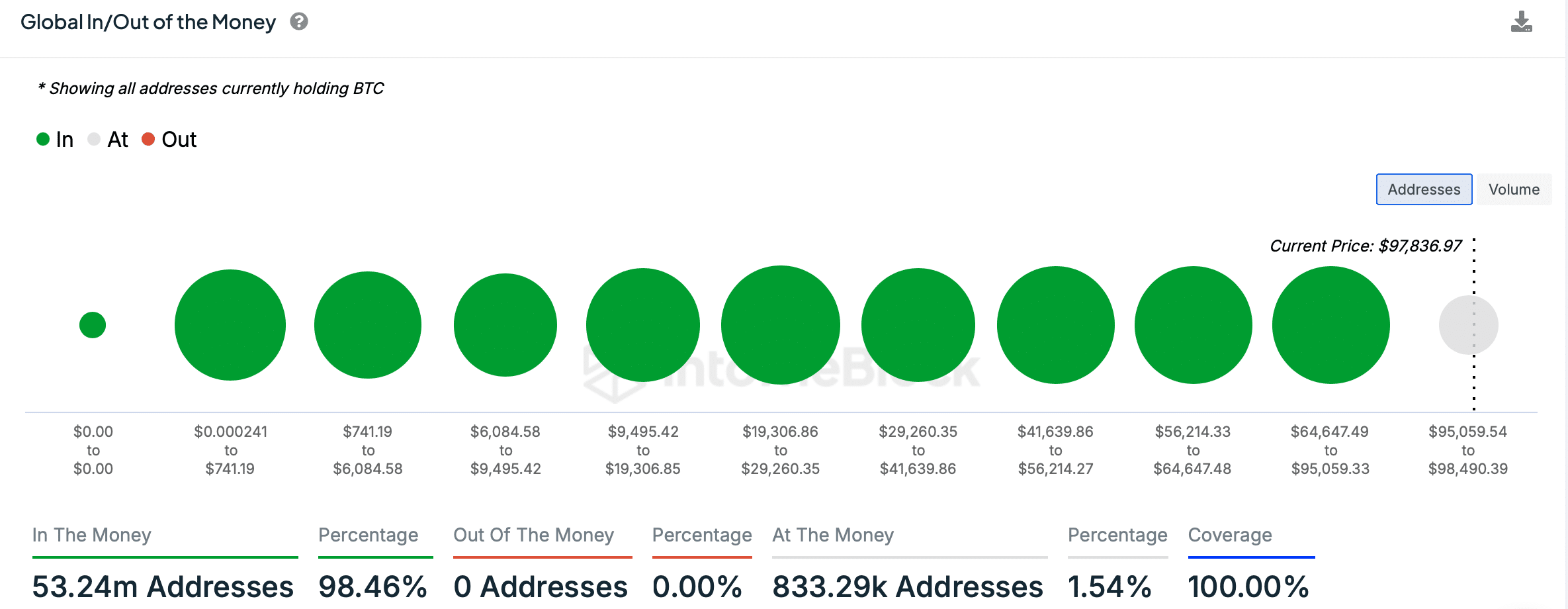

- More than 98% of BTC addresses were in profit, thanks to its bullish price trend.

- Accumulation was high, but indicators suggested that Bitcoin was getting overvalued.

Bitcoin [BTC] lived up to investors’ expectations last week by pumping its price well enough. However, the king coin started to consolidate over the past few days as it continued to move towards the $100k mark.

Meanwhile, a crucial BTC metric turned bearish, hinting at a pullback.

Bitcoin investors are getting ‘GREEDY’

BTC managed to push its price by 8% last week. In fact, AMBCrypto reported earlier that this push allowed BTC to flip its $96k resistance into a new support, hinting at a further rise above $100k.

Thanks to that, 53.24 million BTC addresses were in profit, which accounted for 98% of the total number of Bitcoin addresses.

Source: IntoTheBlock

However, the coin started to consolidate in the last 24 hours as its daily chart turned red. At press time, the king coin was trading at $97.7k. While that happened, Ali Martrinez, a popular crypto analyst, posted a tweet revealing a notable development.

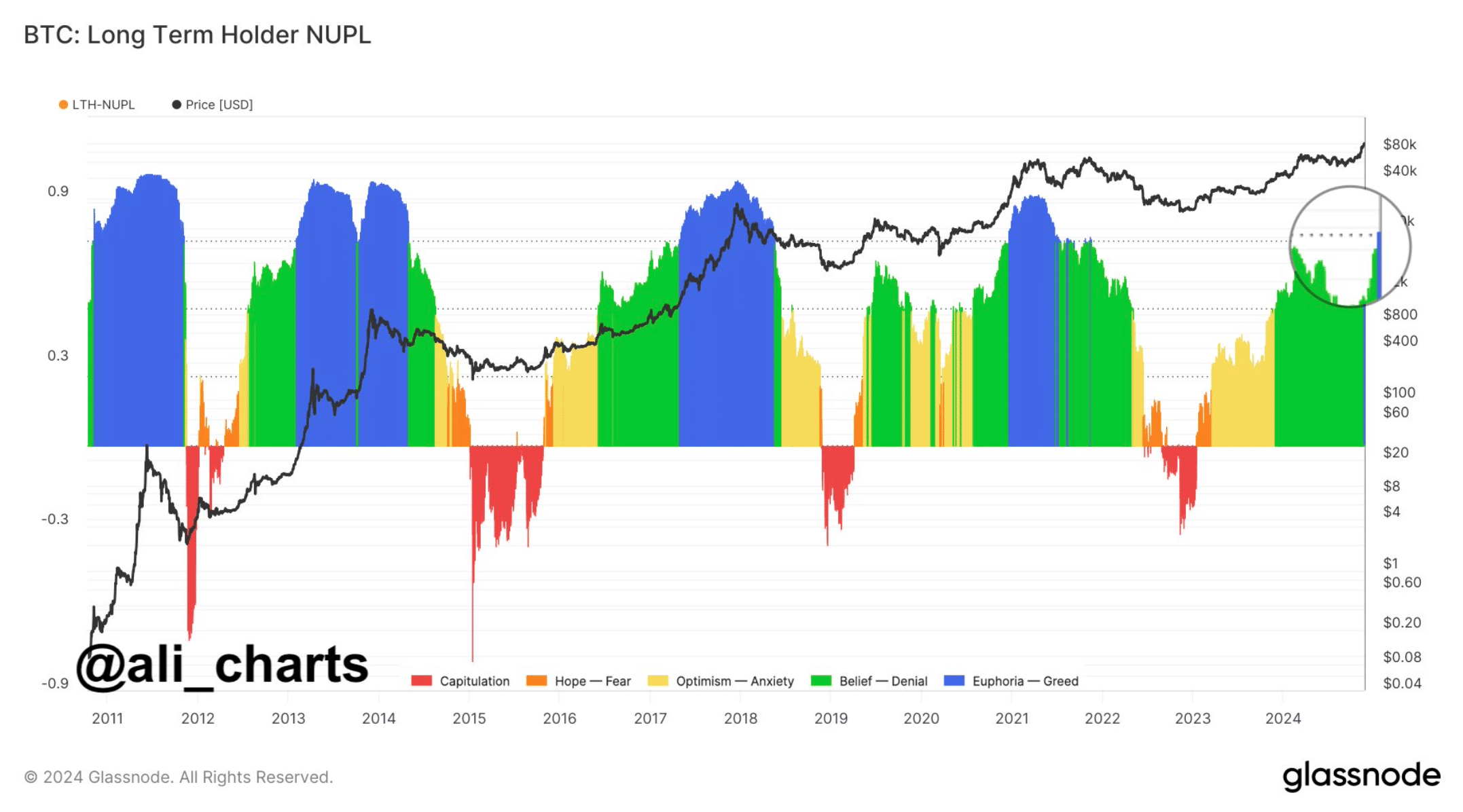

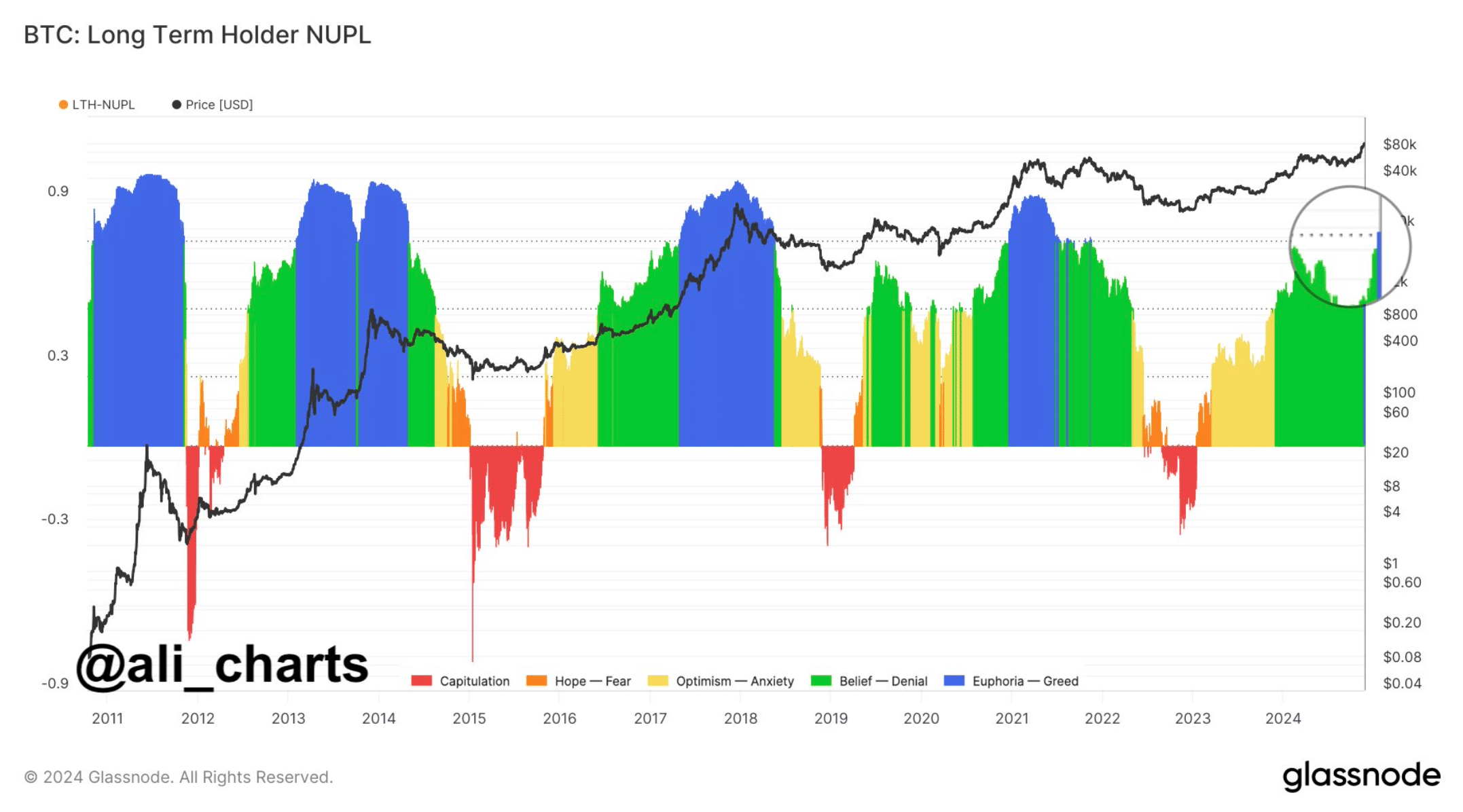

As per the tweet, long-term BTC holders were showing signs of growing greed. Historically, this behavior suggests it could take 8-11 months for BTC to hit a market top.

If this turns out to be true on this occasion, BTC reaching a market top might get delayed. To be precise, investors might see BTC reaching that level only by June or September 2025.

Source: X

Assessing BTC’s metrics

To see whether the rising greed in the market will result in a correction, AMBCrypto assessed Glassnode’s data. After a sharp decline, Bitcoin’s NVT ratio started to rise again. This meant that BTC was getting overvalued, suggesting a price drop soon.

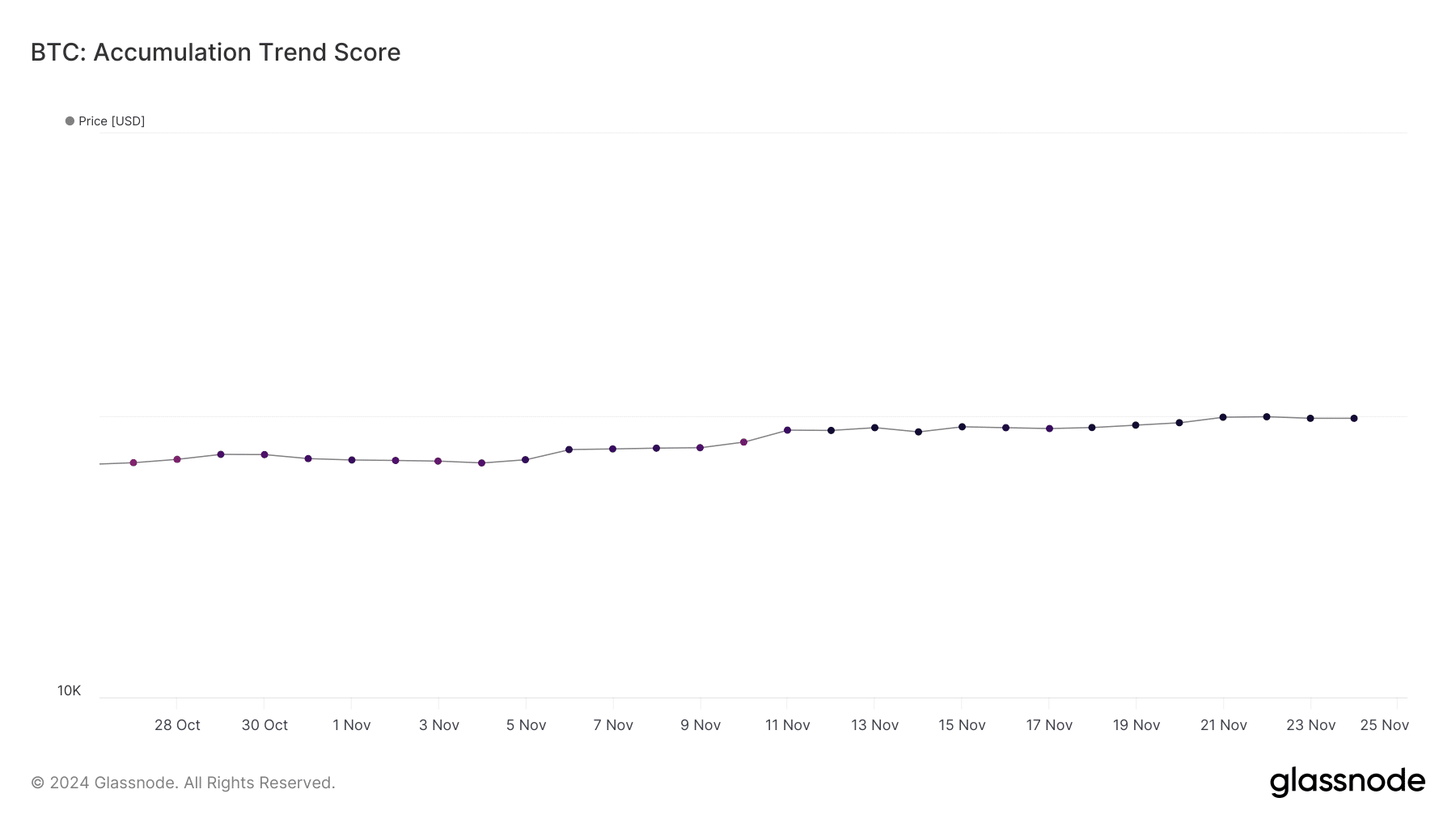

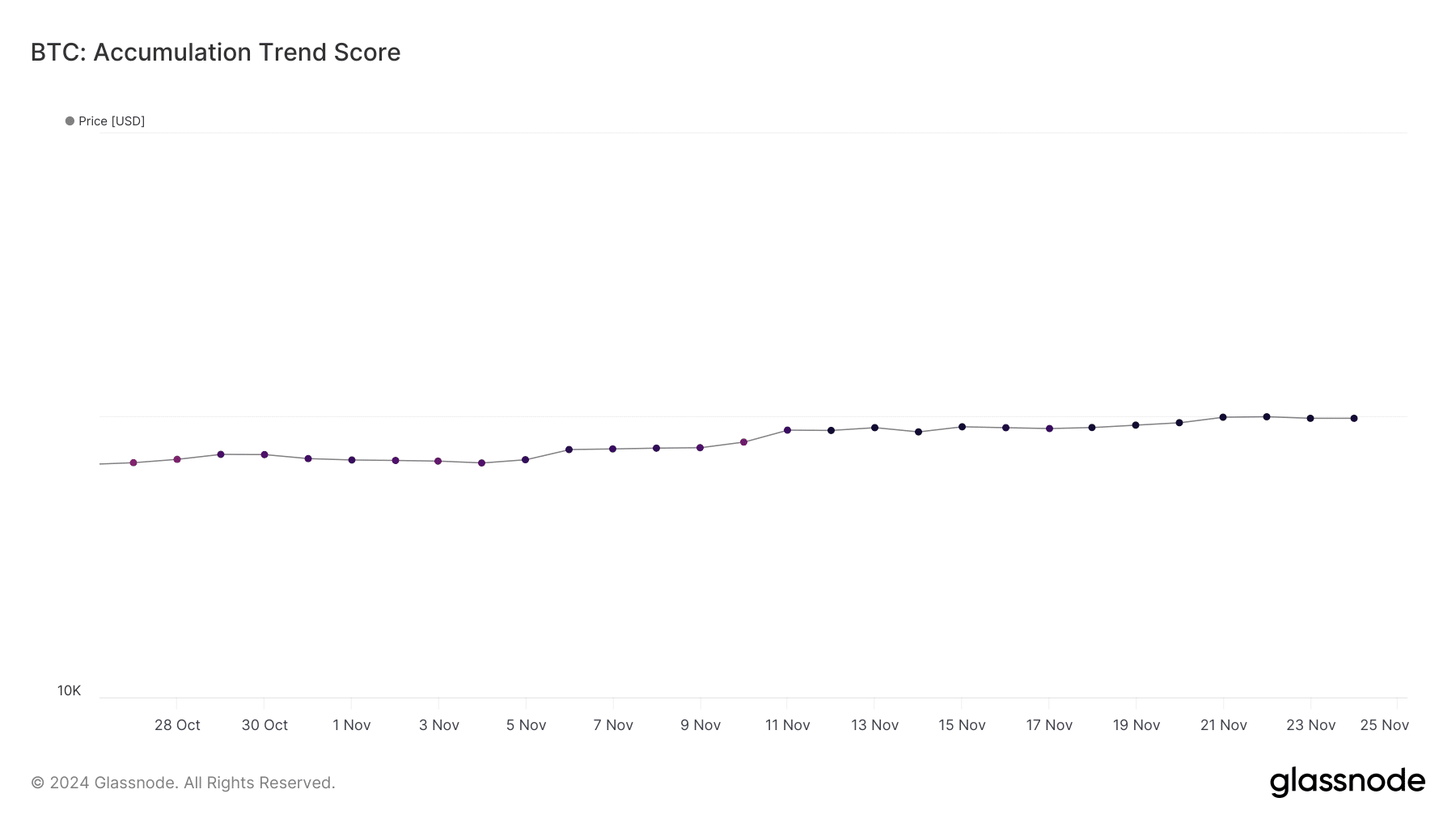

Nonetheless, the market at large continued to remain optimistic on BTC. This was evident from the coin’s accumulation trend score, which had a value of over 0.9.

For initiators, a value closer to 1 indicates high buying pressure. Generally, rising buying pressure results in continued price hikes. Therefore, the chances of BTC not getting affected by the rising greed in the market can’t be ruled out yet.

Source: Glassnode

Apart from that, Bitcoin’s Open Interest (OI) also remained high. Whenever the metric rises, it indicates that the chances of the ongoing price trend continuing are high. Nonetheless, a look at BTC’s daily chart revealed that the coin was testing a trendline resistance.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The MACD displayed the chances of a bearish crossover. Moreover, the Relative Strength Index (RSI) was resting in the overbought zone.

This might trigger a sell-off, which could restrict BTC from breaking above the resistance in the near-term.

Source: TradingView