- Bitcoin lost its key support level and yet, retail futures positioning remains stubbornly bullish

- A classic double-edged sword scenario where market direction hinges on spot demand stepping in

“Tariffs are here to stay,” said Trump. Soon after, the markets reacted. At the time of writing, Bitcoin [BTC] had pulled back by 8.66% on the charts, retesting sub-$80k levels as $1.30 billion in liquidations swept the market.

Meanwhile, 478k addresses at $78,981 hovered near breakeven, while 5.94 million wallets from $61,129 cashed out profits. As longs unwinded and weak hands folded, Bitcoin shed over $130 billion in market capitalization.

And yet, a rising bid-ask ratio is a sign of increasing buy-side interest. Retail long positions were steady at 73% too. Historically, such set-ups have preceded liquidity sweeps followed by sharp reversals.

In fact, a similar set-up in March led to a sharp rebound from $77k – Could this dip be another bear trap?

A key catalyst underpinning market sentiment

The FOMC countdown is on – 30 days out, and markets are bracing for impact. Despite elevated FUD, the bid-ask ratio remains in the 99th percentile, signaling persistent buy-side interest.

With Q2 uncertainty growing, rate cut bets are heating up, with some expecting up to four cuts to counter post-tariff demand slowdown. Recession odds have jumped from 40% to 60%, and even JP Morgan now sees rate cuts coming soon.

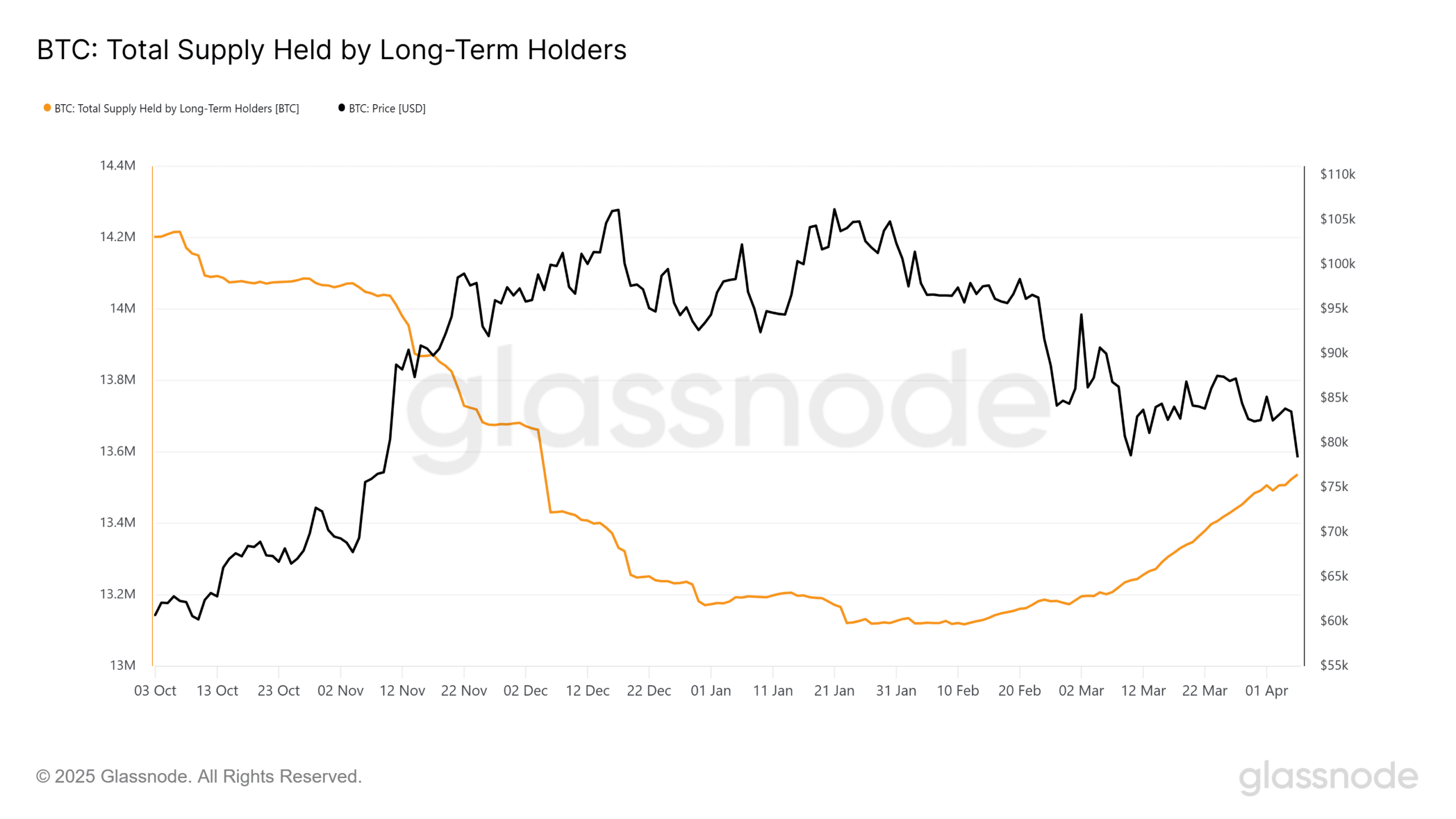

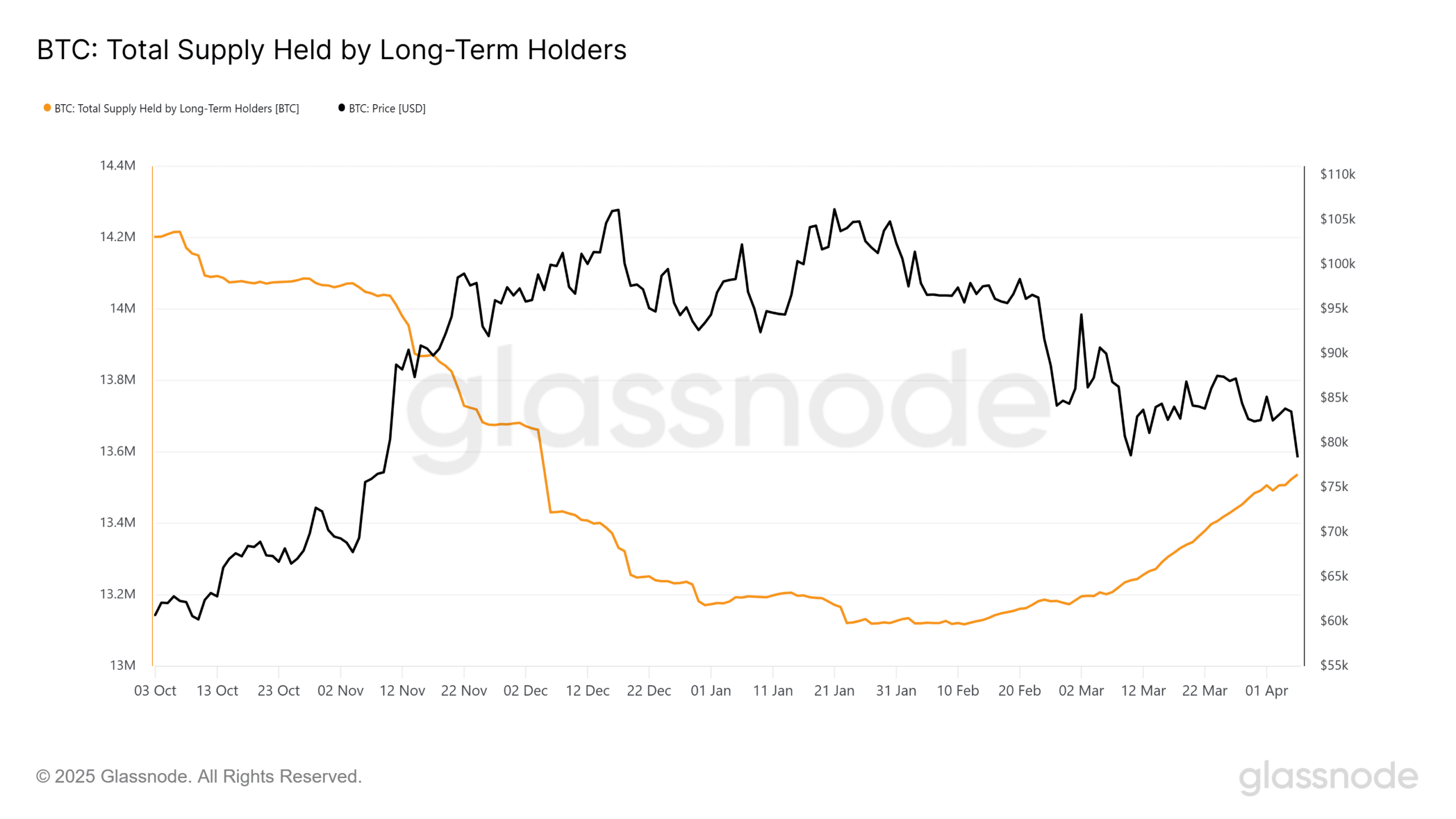

For Bitcoin, the stakes are high – Its resilience hinges on how the Fed moves next. Until then, volatility is likely, though short-term. Interestingly, BTC’s long-term holders (<155 days) have ramped up accumulation, adding 14k BTC since 6 April – Marking a three-month high.

Source: Glassnode

Meanwhile, derivatives positioning remains unshaken – Funding Rates (FR) have held green throughout the week, reflecting sustained bullish leverage.

However, without a surge in spot demand, this positioning risks unwinding. So far, on-chain metrics have highlighted muted dip-buying – A sign that investors are most likely in a risk-adjustment mode, rather than accumulation.

And yet, Bitcoin’s 50-50 long-short equilibrium at current levels presents a prime set-up for a bear trap. According to AMBCrypto, if liquidity absorbs sell-side pressure, a volatility squeeze could trigger rapid upside expansion.

Bitcoin’s fragile bullish structure

Undoubtedly, Bitcoin’s bullish set-up is now showing cracks – Key support levels are breaking, yet derivatives traders remain heavily long. If buy-side absorption holds though, a sharp reversal could be on the table.

On the 12-hour heatmap, a $72.94 million liquidity cluster at $75,798 was swept, triggering a 1.20% bounce. Whether this signals absorption or just a temporary relief remains to be seen.

Source: Coinglass

Still, a strong bear trap could be in the making. In light of growing Open Interest, mounting Fed pressure and LTH accumulation at a three-month high, Bitcoin’s current dip might be in line with a “high-risk, high-reward” set-up.

If liquidity clusters keep getting absorbed, Bitcoin could be ready for an aggressive reclaim.