- Bitcoin’s CDD, UTXO losses, and Network Growth suggest Bitcoin is in a holding pattern amid mixed sentiment.

- Mild buy-side dominance and persistent volatility reflect cautious optimism without strong momentum.

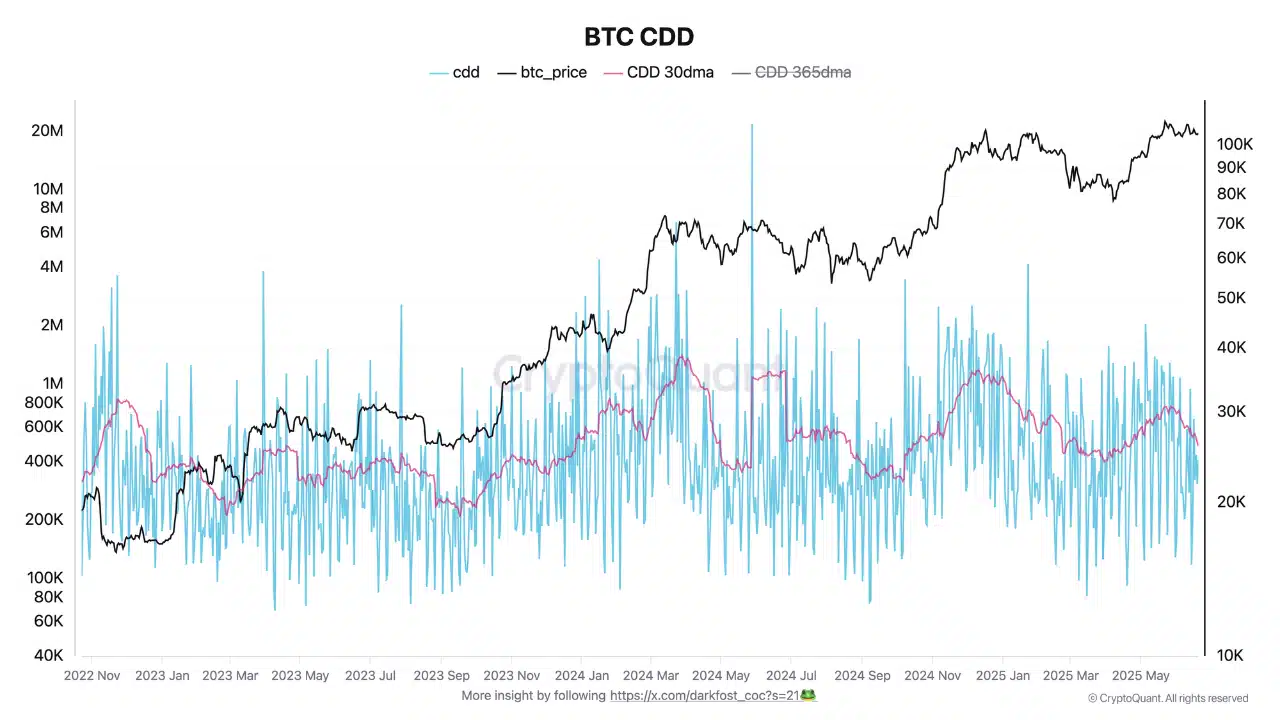

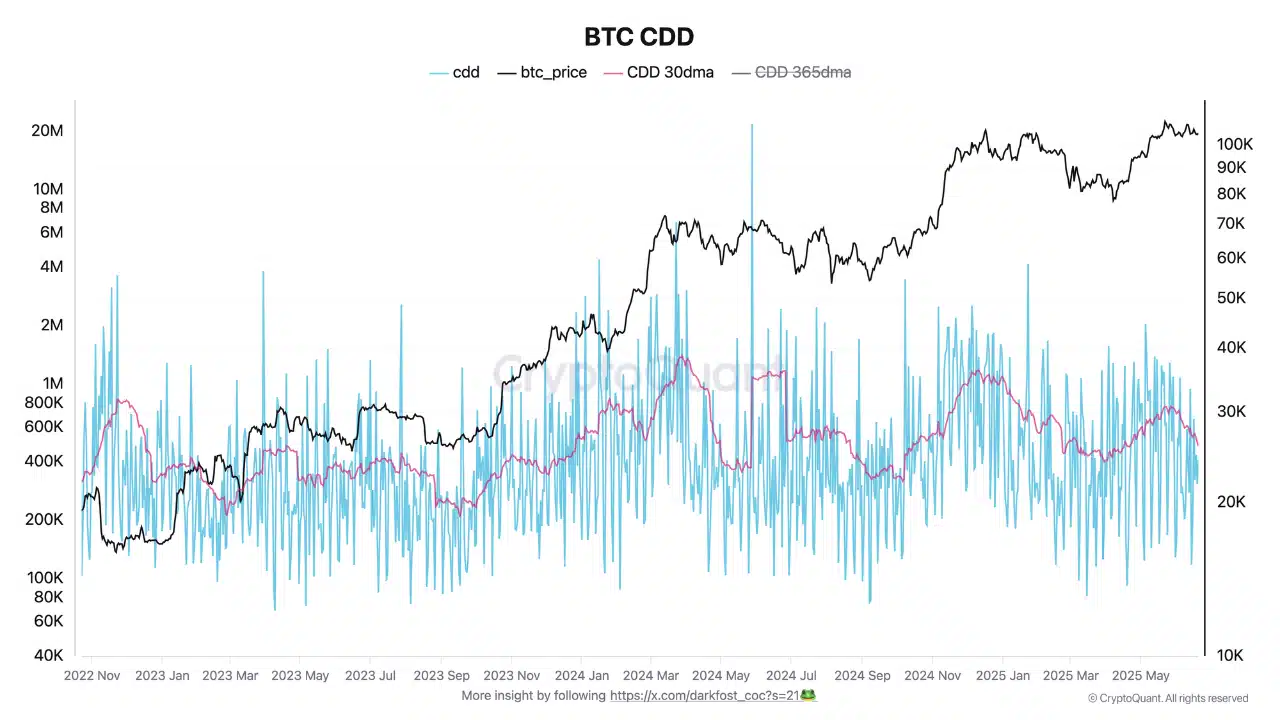

Bitcoin’s [BTC] Coin Days Destroyed metric declined to 500K, down from peaks above 1 million. This suggested long-term holders showed restraint despite BTC’s approach to all-time highs.

In fact, the CDD 30-Day Moving Average confirmed this cool-off, hinting at a clear shift from aggressive profit-taking to quiet accumulation.

Naturally, it supports the idea that diamond hands still aren’t done playing the long game.

Source: CryptoQuant

Bitcoin’s UTXOs in Loss surged 42.81% to 12.23 million, while UTXOs in Profit slipped 1.2% to 305.15 million.

This indicates that a notable portion of recent buyers entered at higher prices and are now holding underwater positions. So the stress is localized, not market-wide, at least for now.

Source: CryptoQuant

Are buyers still here?

The BTC Taker Buy/Sell Ratio ticked up to 1.028, a 1.04% gain that put buy-side takers slightly ahead.

This level, just above the neutral line, implies that perpetual market participants remain cautiously optimistic. However, the modest strength in buy volume does not signal a full-blown bullish breakout.

This subtle buying interest hints at conviction but without the noise.

Source: CryptoQuant

BTC volatility remains elevated, yet controlled.

The latest reading of 0.011 shows sharp spikes but no follow-through. These bursts have been frequent since mid-April but haven’t flipped the overall trend.

This tells us something simple: traders are alert, not alarmed. Volatility might look wild on the chart, but it’s not tipping the market into chaos.

Source: Santiment

What does the crash in network growth mean for Bitcoin demand?

Bitcoin’s Network Growth nosedived from over 500K to 76.5K, a steep drop that could signal weakening user interest.

This contraction shows a significant decline in new addresses interacting with the network, indicating a slowing of organic demand.

The spike in June likely resulted from temporary excitement that could not be sustained.

Source: Santiment

Put it all together, fewer long-term sellers, rising unrealized losses, modest buy pressure, and cooling network growth, and you get a market in limbo.

Bitcoin isn’t signaling a top, but it’s not charging ahead either. Until on-chain indicators like Network Growth or Taker activity strengthen, BTC may stay stuck in consolidation, quietly coiling for its next move.