- BlackRock and NYSE Arca push for ETH ETF staking, aiming to boost returns and attract institutional investors.

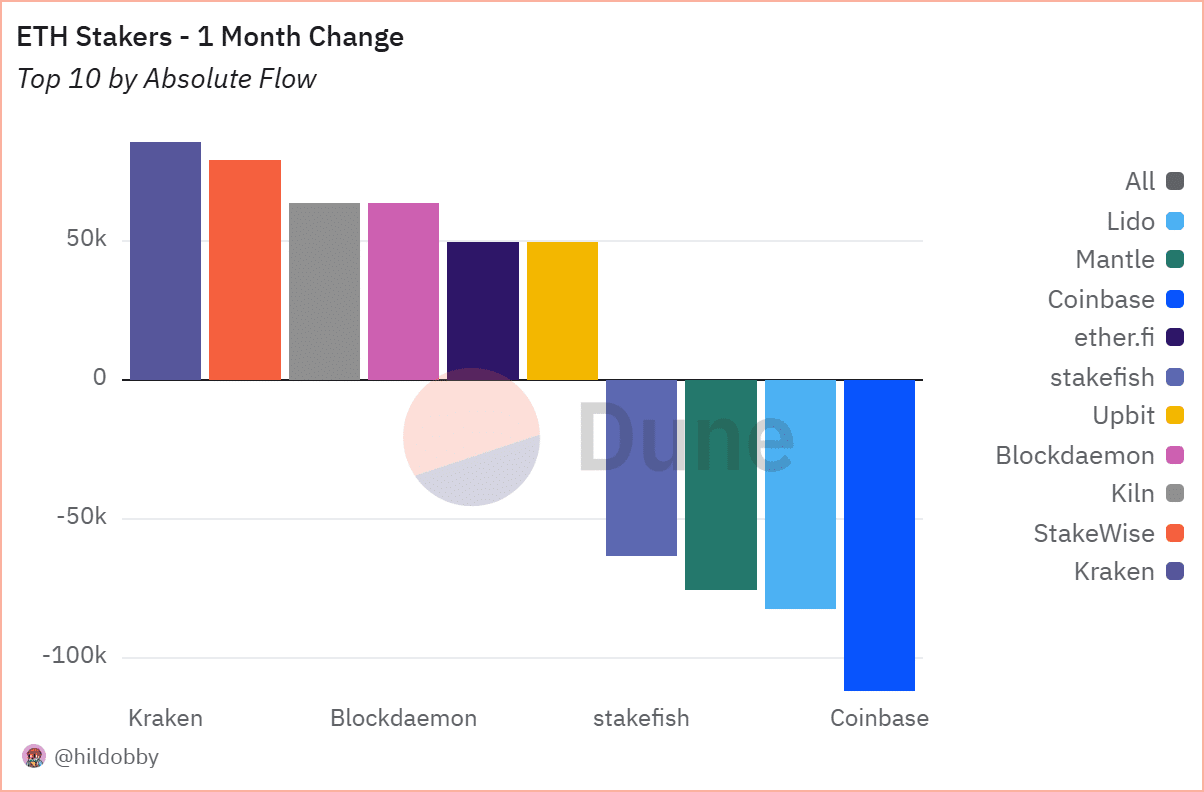

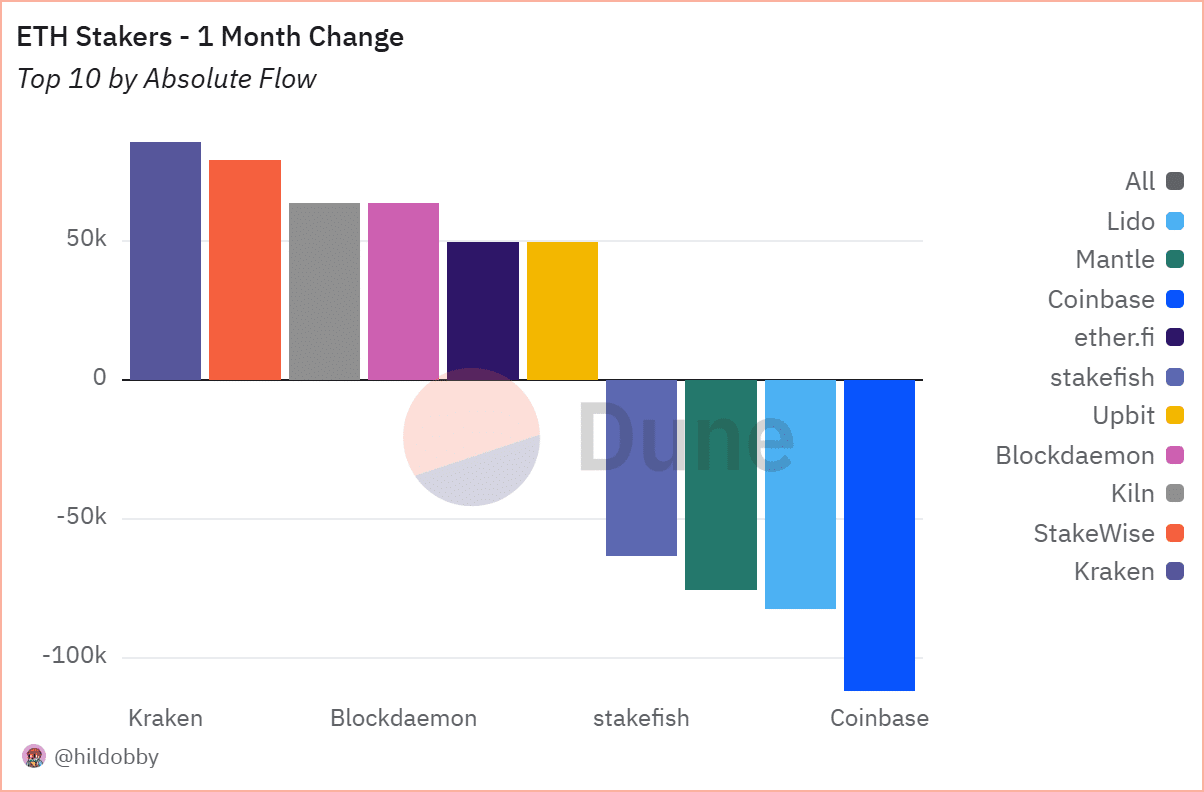

- Recent staking data shows increased participation, with Kraken and Blockdaemon leading deposit growth while Coinbase sees outflows.

The demand for Ethereum[ETH] staking is rising, fueled by growing institutional interest and regulatory advancements. BlackRock has voiced its support for staked ETH ETFs, emphasizing their potential to enhance returns for investors.

Simultaneously, NYSE Arca has submitted a proposal to the U.S. Securities and Exchange Commission (SEC) to allow staking for Bitwise’s Ethereum ETF.

With Ethereum staking trends shifting, the landscape of ETH investment products is evolving rapidly.

BlackRock’s take on staked ETH ETFs

BlackRock’s Digital Assets Head, Robbie Mitchnick, recently stated that while the firm’s ETH ETF is a success, it remains “less perfect” without staking capabilities.

He highlighted that staking provides additional yield and aligns with Ethereum’s proof-of-stake model. Mitchnick believes that unlocking staking in ETFs could be a game-changer, attracting a broader investor base.

However, he also acknowledged the challenges of implementing staking within the ETF structure due to regulatory constraints and operational complexities.

NYSE Arca’s proposal for staking in Bitwise’s Ethereum ETF

NYSE Arca has taken a step forward by filing a request with the SEC to incorporate staking into the Bitwise Ethereum ETF.

If approved, this would significantly shift how ETH ETFs function, allowing them to generate staking rewards and potentially enhance investor returns. The SEC’s decision will be closely watched, as it could influence how other crypto-based ETFs are structured in the future.

Ethereum staking trends: Analyzing the data

Recent data highlights significant shifts in ETH staking dynamics.

According to data from Dune Analytics, Kraken and Blockdaemon have led the growth in staking deposits over the past month, while Coinbase has experienced the most substantial outflows.

Source: DuneAnalytics

This divergence reflects shifting preferences among institutional and retail investors regarding custodial staking solutions. Meanwhile, platforms like Lido, stakefish, and Upbit have maintained steady inflows, reinforcing their dominance in the staking ecosystem.

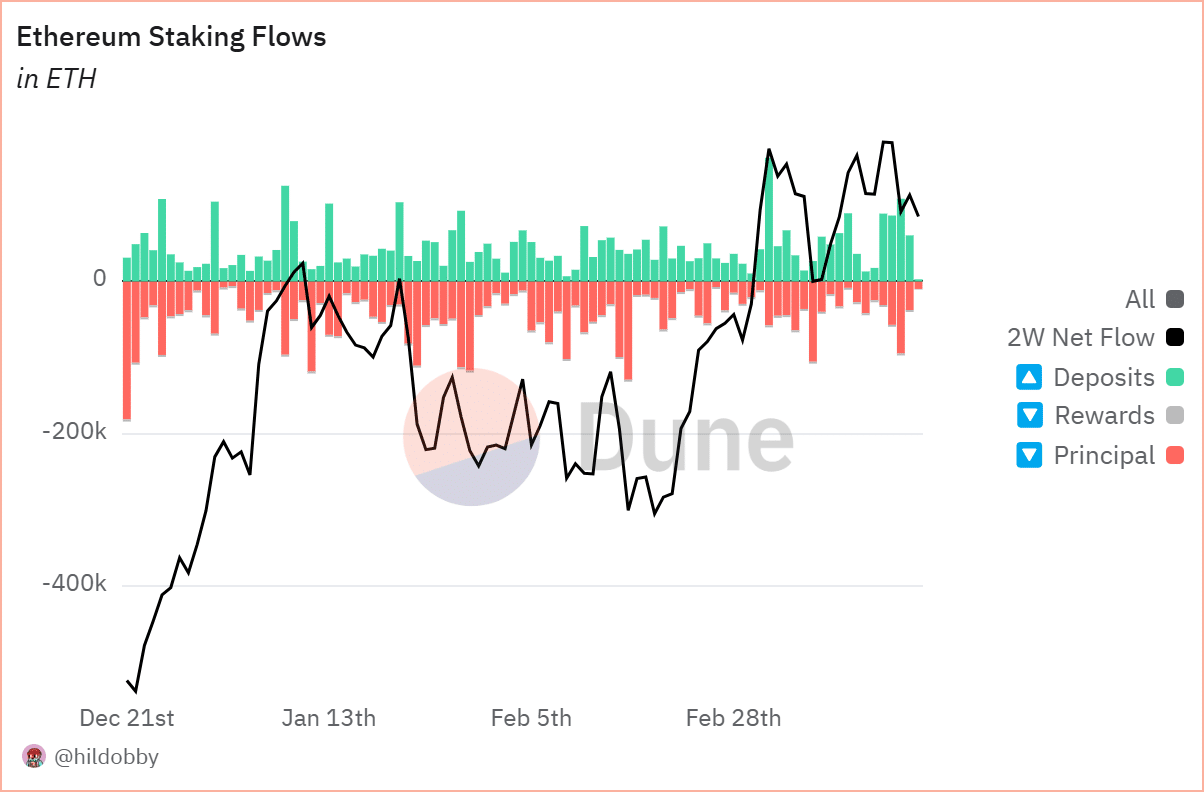

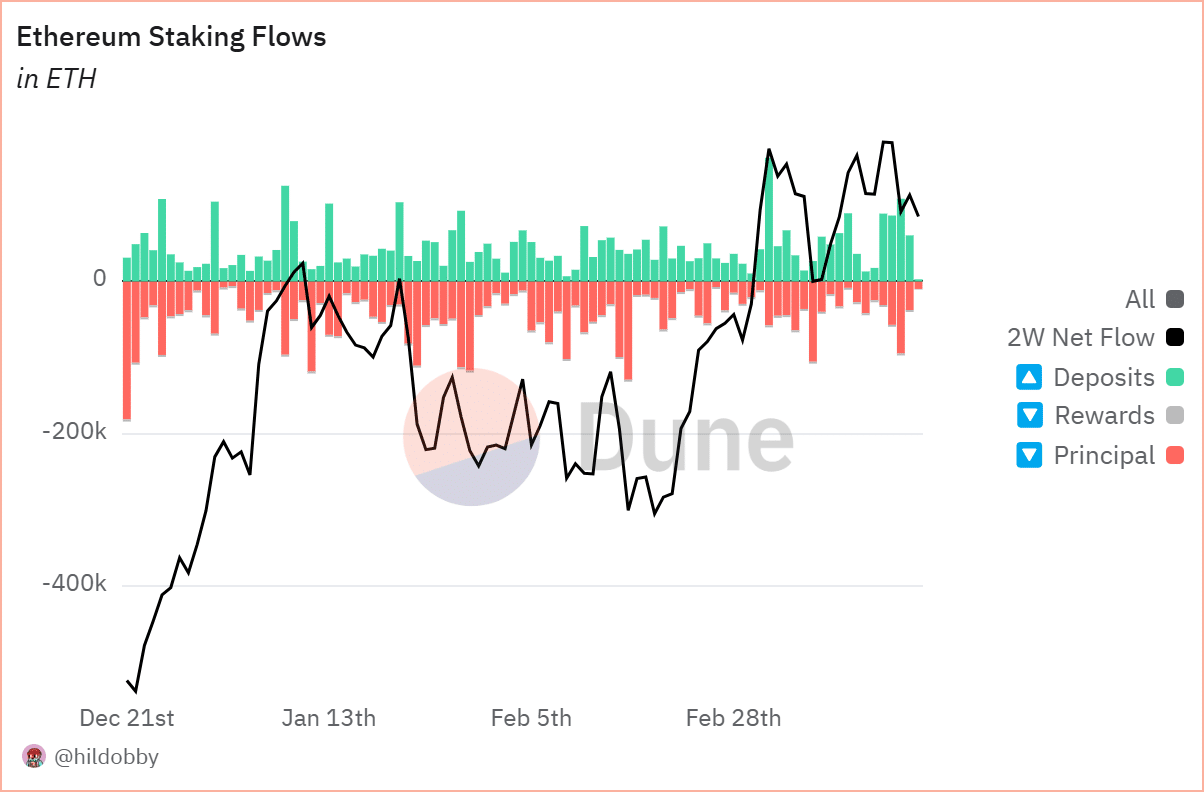

The second chart provides deeper insights into Ethereum staking flows. Over the past few months, staking deposits have outpaced withdrawals, leading to a net positive flow.

Source: DuneAnalytics

The black line representing the two-week net flow showcases an upward trend, indicating growing confidence in Ethereum’s staking ecosystem.

Notably, principal withdrawals (shown in red) have decreased, suggesting that fewer investors are opting to unstake their ETH despite market fluctuations.

This trend signals that long-term holders and institutions are embracing Ethereum staking as a sustainable investment strategy.

Implications for ETH ETFs and investors

The growing emphasis on staking carries significant implications for ETH ETFs and their investors. If approved, staking within ETFs could introduce an additional revenue stream through staking rewards, making ETH ETFs more appealing than traditional spot ETFs.

Institutional investors may favor staked ETH ETFs, as they provide both price exposure and passive income through staking yields.

However, regulatory uncertainty remains a major obstacle, with the SEC historically cautious about crypto-related products, particularly those involving staking.

A favorable decision on NYSE Arca’s proposal could set a precedent, paving the way for more advanced Ethereum-based investment products.