- Grayscale listed Aerodrome among its top 20 projects of interest for Q1 2025

- Smart DEX traders are in the distribution phase, but some wallets have recently bought AERO

Grayscale’s latest inclusion of Aerodrome (AERO) in its top 20 for Q1 2025 can be seen as a sign of investor interest. In fact, this listing suggested potential for greater capital inflows, especially as Grayscale’s endorsements often steer market attention.

Historically, such recognition has led to price appreciation in featured assets. Hence, Aerodrome’s visibility could spike, drawing both retail and institutional investors.

Source: Grayscale/X

The spotlight could catalyze further development and partnerships, potentially enhancing returns.

This strategic placement by Grayscale underlined AERO’s promising fundamentals and market potential in the upcoming quarter.

Smart DEX trading and price prediction

Smart DEX traders also capitalized on AERO seeing around 30x gains from its lows to the highs. This sharp accumulation and subsequent sell-off indicated well-timed entries and exits, primarily around these accumulation zones.

At press time, these traders had transitioned into a distribution phase, pointing to a potential fall in buy pressure in the near term.

Source: iCryptoAI

On the contrary, some whales have been consistently distributing AERO, with daily sales ranging between $500k to $7 million.

This high level of distribution contrasts starkly with the optimistic outlook by major players like Grayscale, indicating a divergence in sentiment between large holders and institutional perspectives.

Despite recent purchases by smaller smart money investors, the overwhelming selling pressure from whales could temper short-term price prospects.

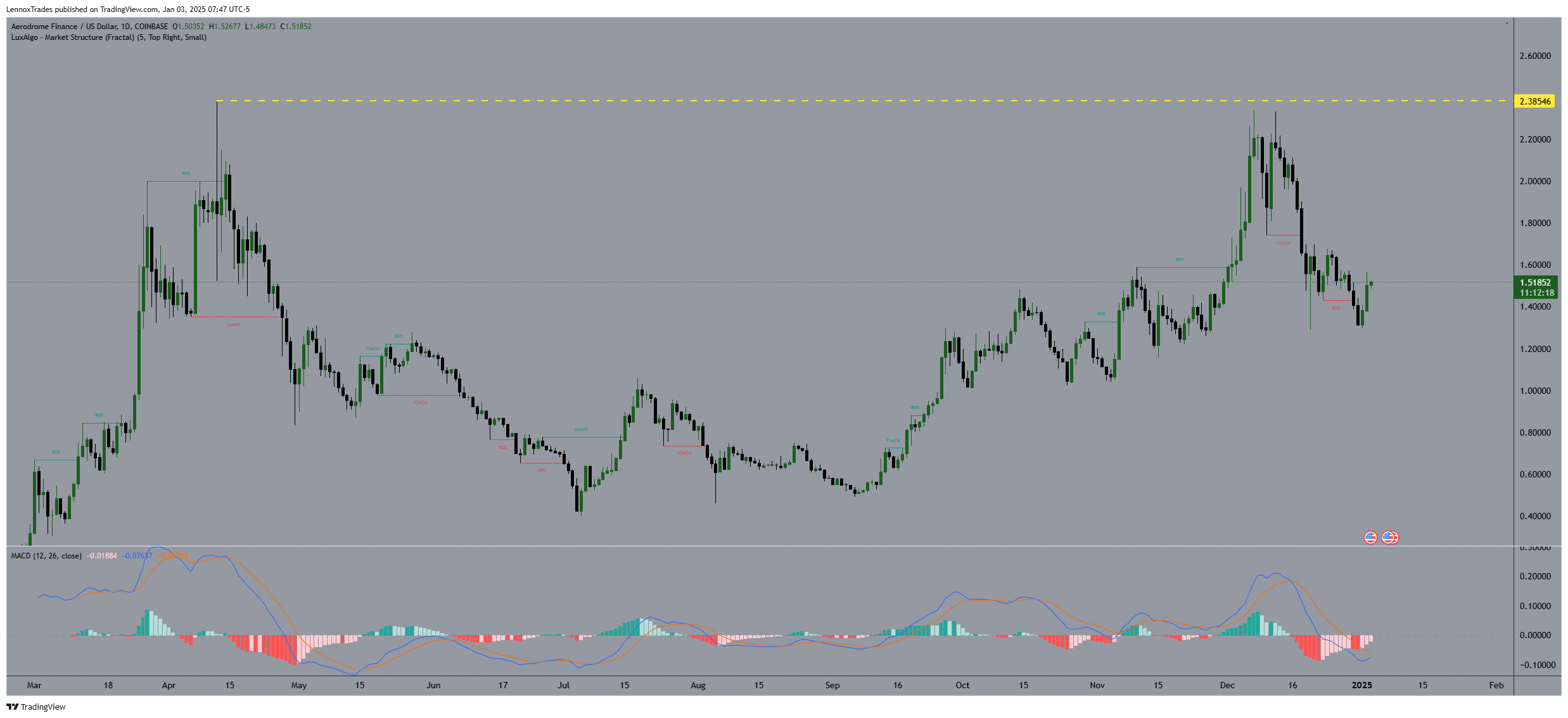

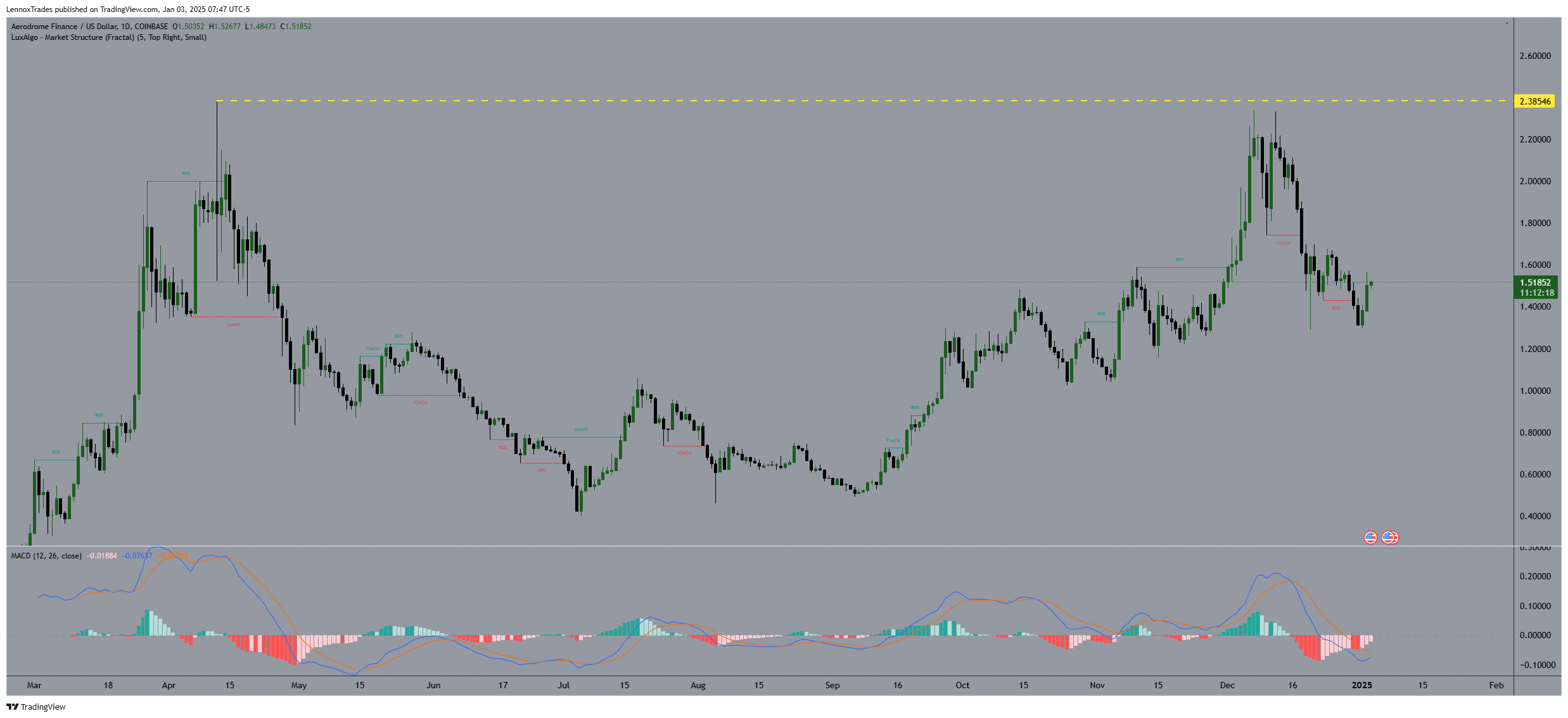

AERO’s price, previously at $2.38, faced a downturn, pushing the price to a more volatile zone marked by frequent buy and sell signals – Indicating mixed sentiment among traders.

In fact, LuxAlgo’s market structure pointed to a break – Alluding to potential for both upward momentum and significant resistance.

Source: Trading View

This inflection could set the stage for AERO to challenge its previous high, offering an entry point for traders keen on leveraging these shifts. As a result, AERO’s future price movements could exceed the ATH of $2.38.

AERO’s TVL, profitability, and active addresses

Finally, Aerodrome also projected financial health with a TVL of $1.409 billion and a market cap of $1.117 billion. Its daily volume peaked at $54.03 million, with $339.06 million in annualized revenue – A sign of robust trading activity and revenue generation within its ecosystem.

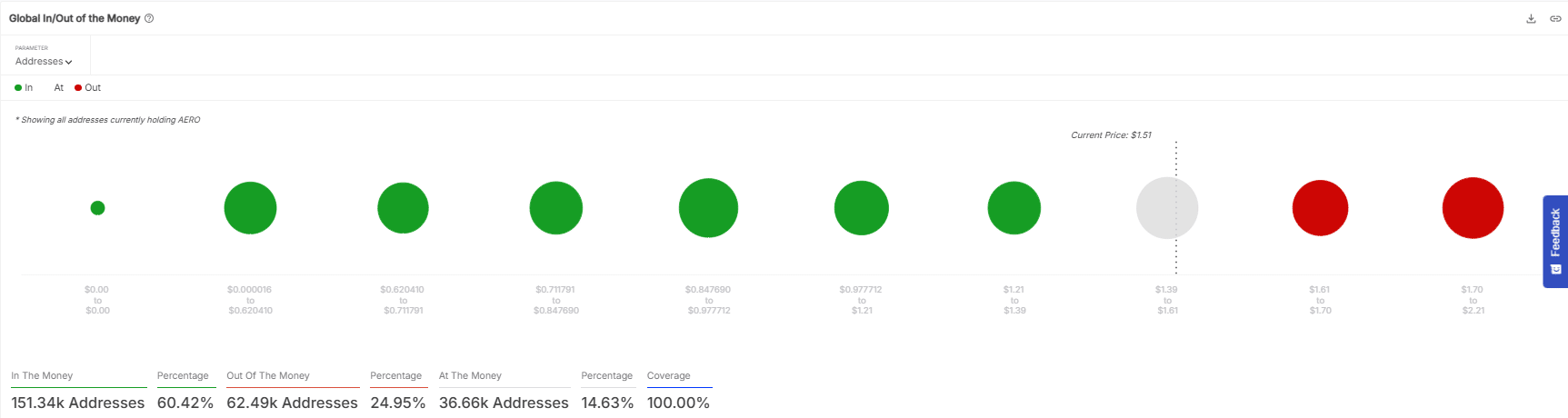

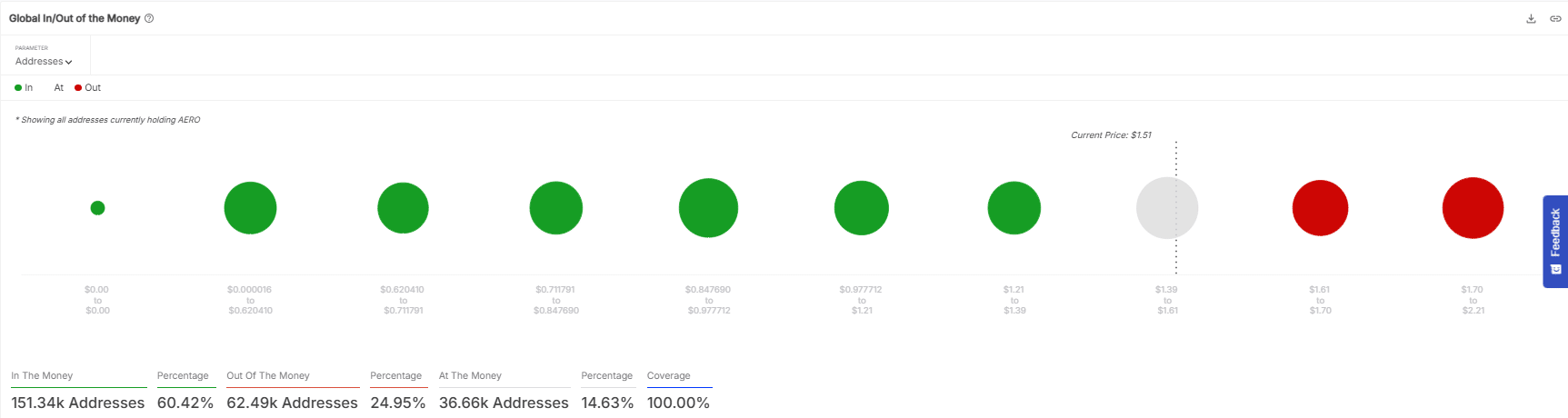

On the charts, 60.42% of AERO holders were ‘in the money.’ This meant that their holding price was below the press time market price of $1.51, pointing to potential selling pressure.

Source: IntoTheBlock

Conversely, 24.95% were ‘out of the money’ and may hold for higher prices, while 14.63% were ‘at the money,’ indicating a possible decision point for buying or selling based on short-term price movements.

The daily active addresses for the tracked asset declined by 29.10% too, indicating a fall in user engagement as per IntoTheBlock. On the contrary, new addresses grew by 6.47%, suggesting some fresh interest. Zero balance addresses also climbed by 13.89% to highlight some section of users exiting their positions.