- Bitcoin short-term holders were still selling their coins at a high profit suggesting a correction could be in play.

- However, Funding Rate, Premium and OI fractal for 2024 suggested that BTC could hit a peak of $160k if it rebounds.

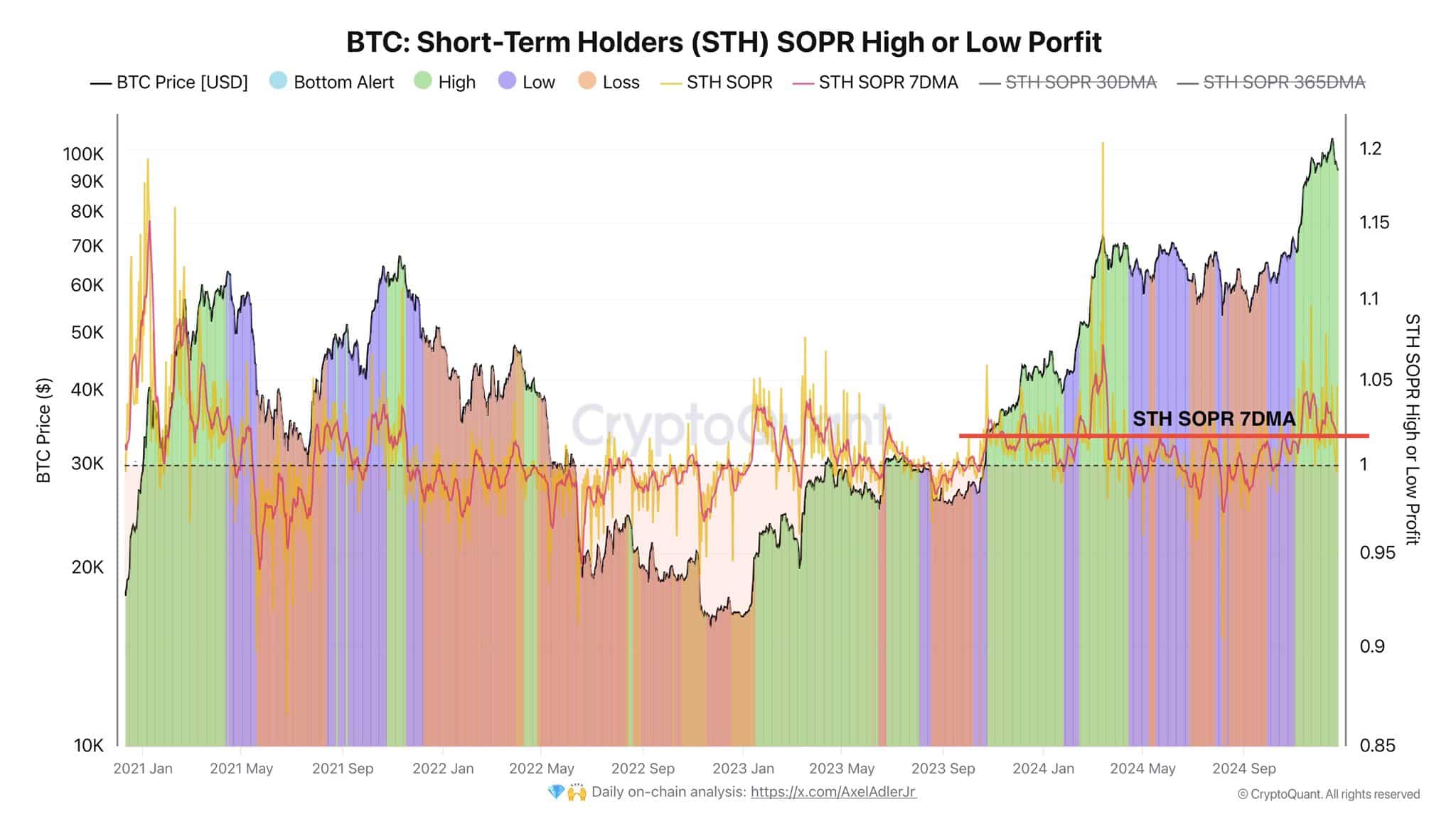

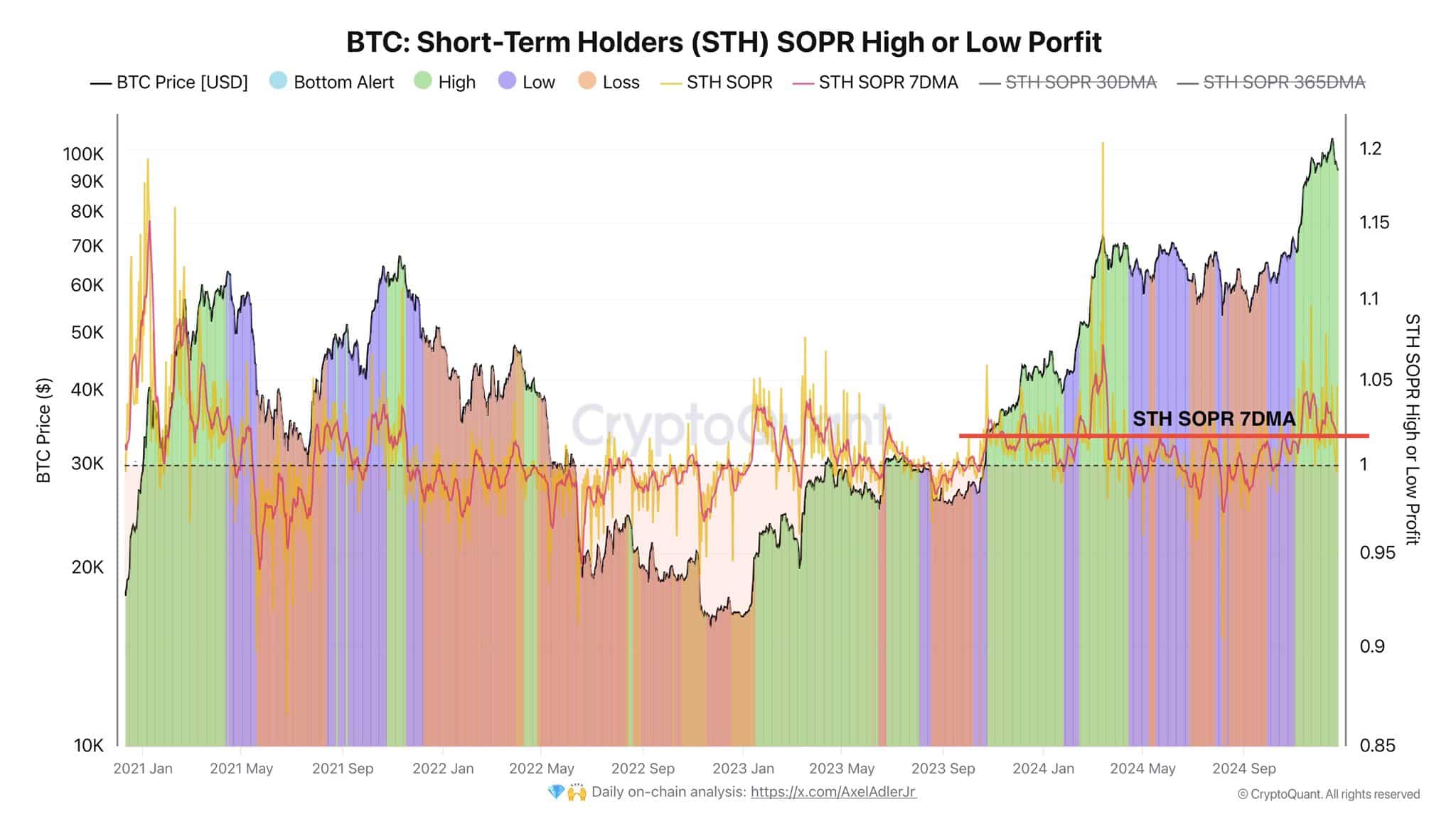

The values of Spent Output Profit Ratio (SOPR) for Bitcoin [BTC] short-term holders (STH) were high indicating that STHs were selling at a profit, often aligning with price highs.

However, if SOPR dipped below 1, this reflected selling at a loss, usually corresponding to price corrections or declines in the market.

This consistent profit-taking by short-term holders could predict potential adjustments. If demand were to wane while profit-taking remained high, price could face downward pressure, leading to corrections.

Source: CryptoQuant

Conversely, if SOPR values indicated losses and continued to decline, it could signal reduced selling pressure, allowing Bitcoin to find stability or support levels, potentially around $90K.

Thus STHs influenced the market’s short-term direction based on their profit or loss realization.

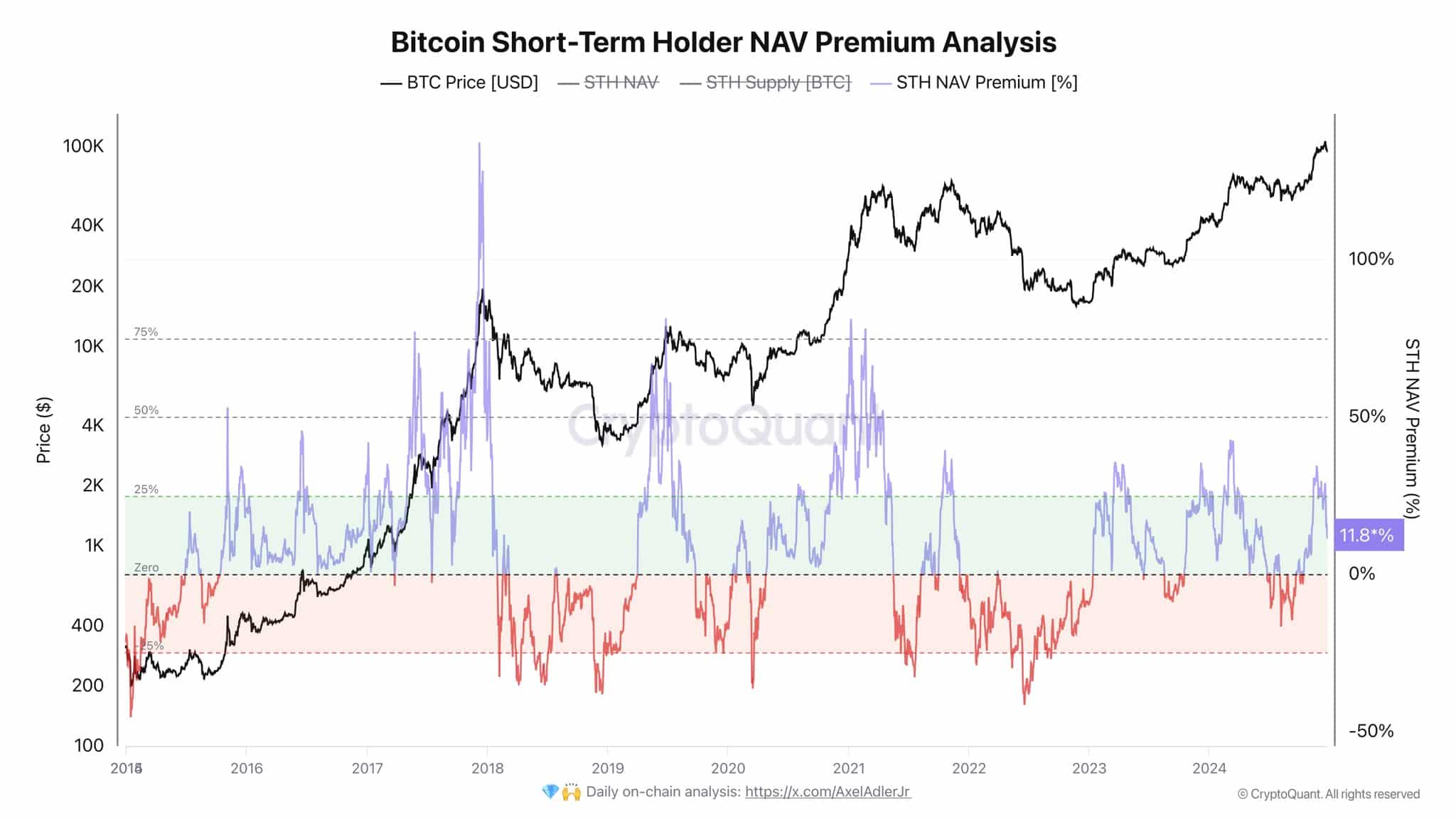

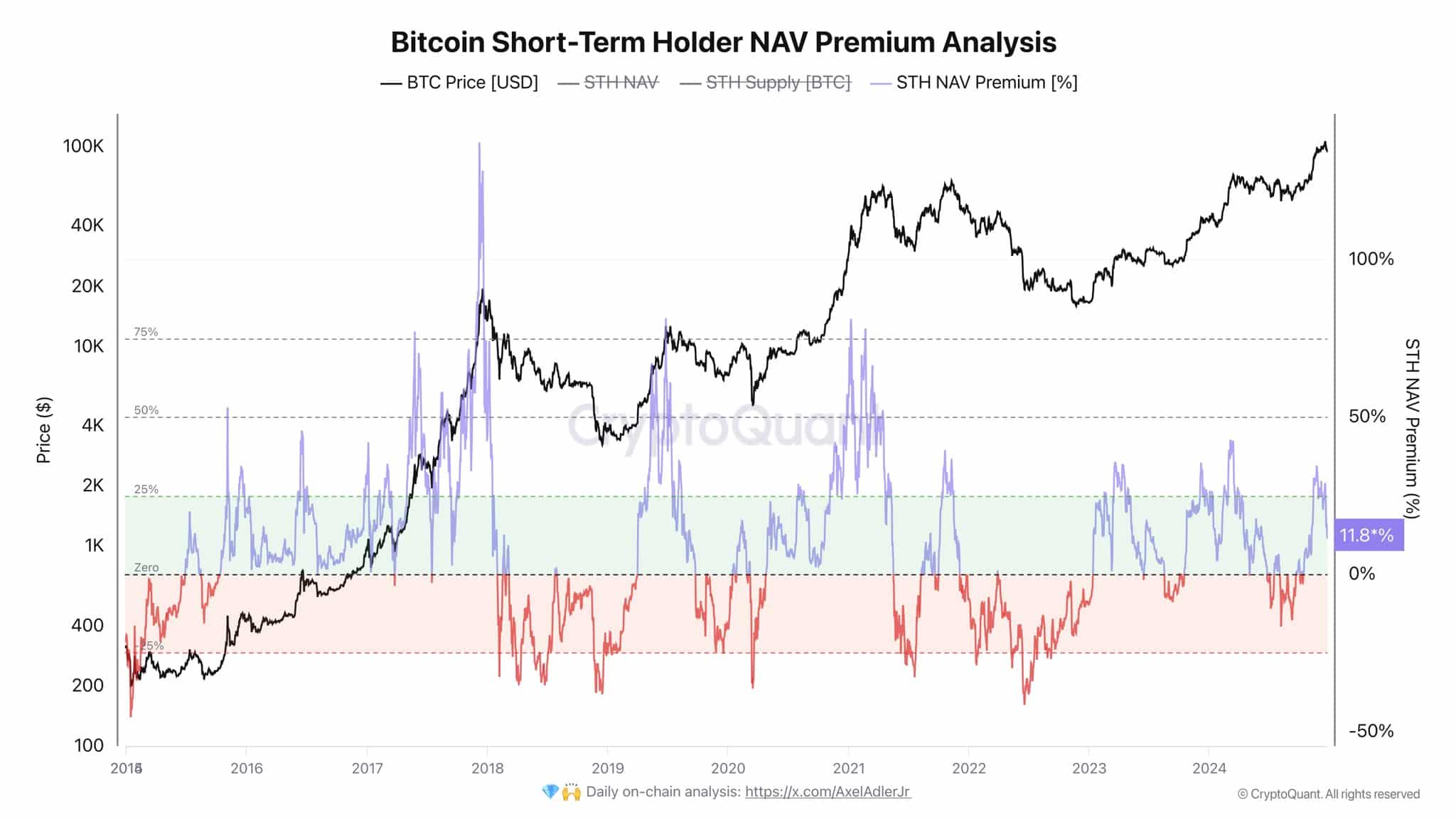

NAV premium for STHs and MACD signals

Additionally, STH NAV Premium dropped to 11.8% from levels above 30% further supporting the anticipated price correction.

Previously, when the STH NAV premium approached zero, a slowdown in selling activity was evident.

This meant holders tended to retain their assets, expecting improved market conditions. The repetitive trend where the NAV Premium dipped towards zero, coincided with reduced volatility.

Source: CryptoQuant

As per current value, there’s potential for a decrease in selling pressure if it drops below zero, which could support BTC’s price if the trend follows historical patterns.

This scenario noted periods where price stabilizes or increases, following dips below zero of STH NAV.

Also, the MACD showed bearish crossovers at high levels, historically correlating with price corrections. Previously, such crossovers led to about 30% declines in Bitcoin’s price.

Bitcoin’s price peaked near historical resistance levels, aligning with the bearish signals. This suggested that if BTC follows previous patterns, another considerable correction could be impending.

Source: Trading View

This meant BTC could below the $90K levels at the fourth target, following current bearish crossover.

Bitcoin’s Funding Rate, Premium and OI

However, Bitcoin’s Open Interest (OI) appeared to be retracing to a supportive trendline, suggesting potential stabilization or a rebound in its price.

This movement echoed previous correction pattern, which, if repeated, could propel Bitcoin’s price toward the $160K mark in Q1 of 2025.

The Funding Rate, Premium, and OI were historically similar to those seen during the earlier correction.

Source: X

Read Bitcoin (BTC) Price Prediction 2024-25

Notably, the Realized Profit/Loss Ratio and the STH Realized Price, currently at $86K, hinted at key levels where sentiment could shift, potentially dampening further corrections and reinforcing the trajectory toward $160K.

This analytical perspective, grounded in historical patterns and current on-chain metrics, provided a cautiously optimistic outlook for BTC’s near-term movement.