- BSC now leads in raw block output, clocking 115,200 blocks/day, 8x more than Ethereum’s projected volume

- Does this performance gap reflect deeper on-chain traction too?

As blockchain use cases rapidly expand into mainstream finance, Layer-1 chains are tightening their protocols to stake their claim as the next Web3 powerhouse.

In fact, BNB Chain [BSC] isn’t waiting around. While Ethereum [ETH] devs debate block time reductions, the Maxwell upgrade has already slashed BSC’s block time from 1.5s to 0.75s.

This move aims to boost speed, user experience, and throughput across the network. But does this bold step give BNB Chain a real edge over Ethereum?

BNB chain doubles down on speed with Maxwell upgrade

As AMBCrypto flagged, Ethereum is deliberating a block time reduction from 12 seconds to 6 seconds as part of the upcoming Glamsterdam upgrade, expected in 2026.

Meanwhile, BNB Chain has already taken action. Its Maxwell upgrade has slashed block time from 1.5 seconds to 0.75 seconds.

Statistically, lower block time translates to higher block frequency. With Maxwell in place, BSC now produces roughly 4,800 blocks per hour, or 115,200 per day.

Even if Ethereum implements the 6-second slot time, it would generate only 14,400 blocks per day. That means BSC is on pace to produce nearly 8x more blocks daily, giving it a significant edge in transaction throughput and settlement speed.

However, speed alone doesn’t guarantee network dominance. So, does this architectural divergence translate into measurable gains in BSC’s on-chain activity, DeFi liquidity flows, and price momentum?

Can performance gains drive BSC’s ecosystem impact?

At the time of writing, on-chain numbers seemed to suggest that BSC’s speed boost might actually be paying off. It’s seeing 2.04 million active addresses, nearly five times more than Ethereum’s 411,000 – A clear sign of broader user activity.

The DEX volume backed it up too – $7.38 billion on BSC in just 24 hours, compared to $1.44 billion on Ethereum. That kind of liquidity flow means BSC’s faster block times are helping fuel real usage across DeFi.

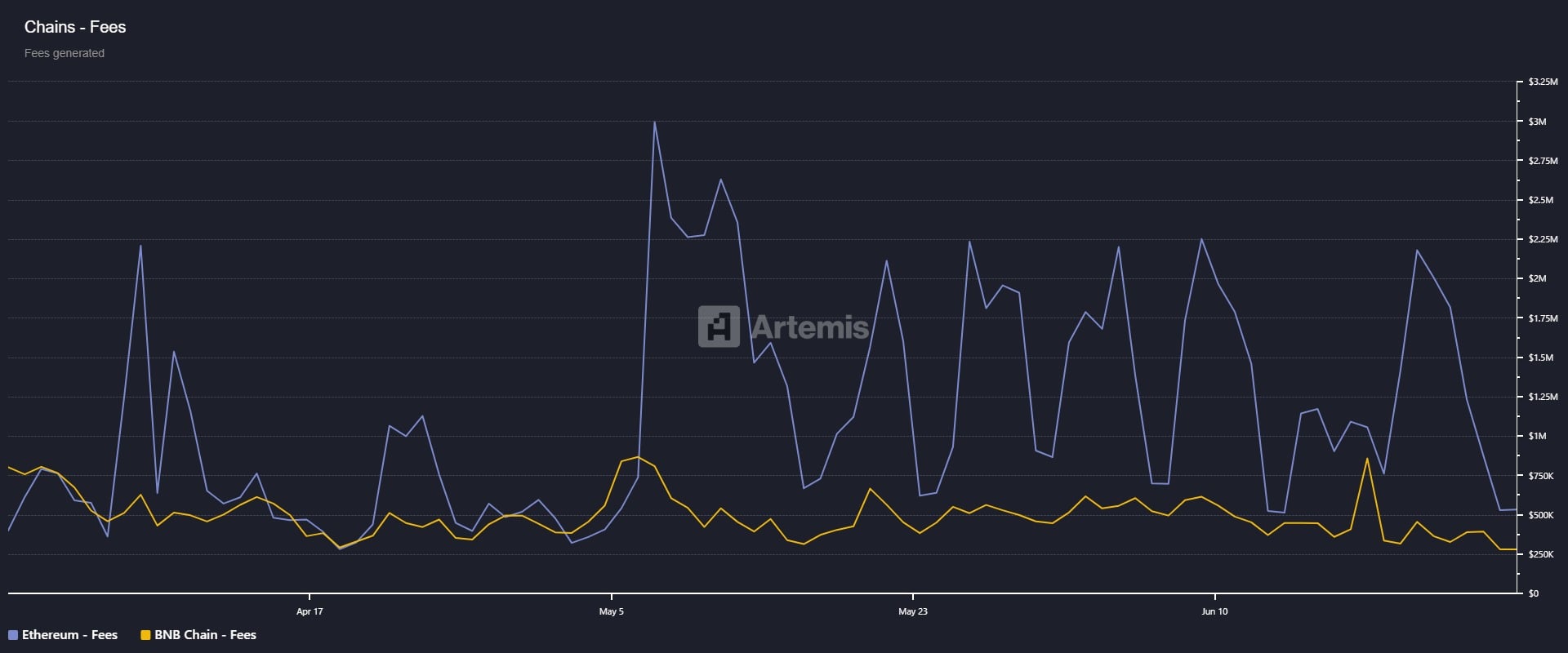

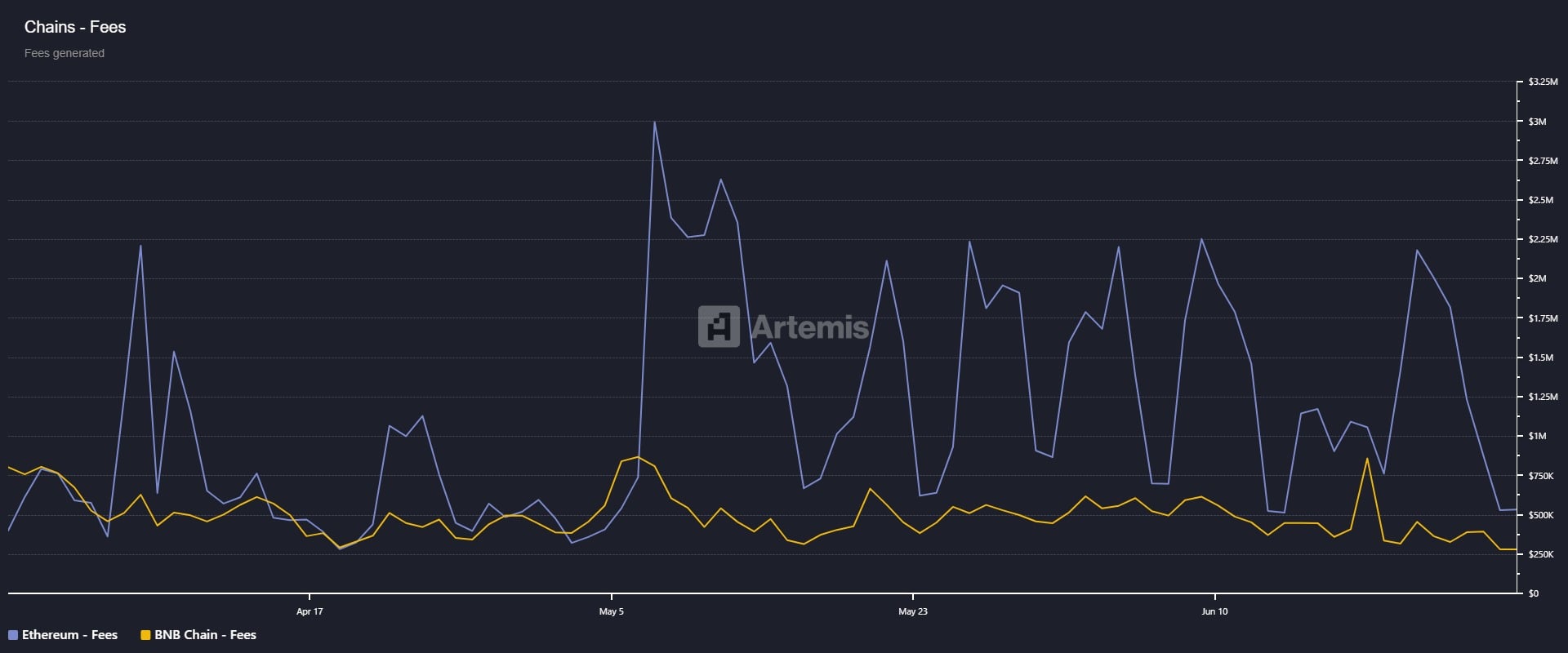

And yet, BSC still lags behind Ethereum in total value locked (TVL) and protocol revenue. This implies that while BSC excels in user activity, Ethereum continues to attract deeper capital and higher-value DeFi interactions.

Source: Artemis Terminal

The divergence alludes to a structural difference too – BSC is optimized for scale and speed, whereas Ethereum remains the primary venue for capital-intensive, yield-bearing protocols.

In essence, one chain is moving faster, while the other is still holding more value. That means while the Maxwell upgrade may drive higher engagement, it still operates well below Ethereum’s dominance in TVL and fee capture.

If Ethereum’s Glamsterdam upgrade successfully improves block times without compromising decentralization, it could neutralize BSC’s speed advantage. In turn, tightening the race for DeFi relevance.