- PENGU soared by 18% post ETF filing following a major shift in market sentiment

- Canary Capital seeks the SEC’s approval for the first PENGU ETF

Since the approval of Ethereum Spot ETFs in 2024, other altcoins have ventured into the space too. In fact, over the last 4 months, especially since the re-election of President Trump, stakeholders have taken the opportunity to file applications for various ETFs with the SEC.

The latest crypto to join this bandwagon is Pudgy Penguins [PENGU].

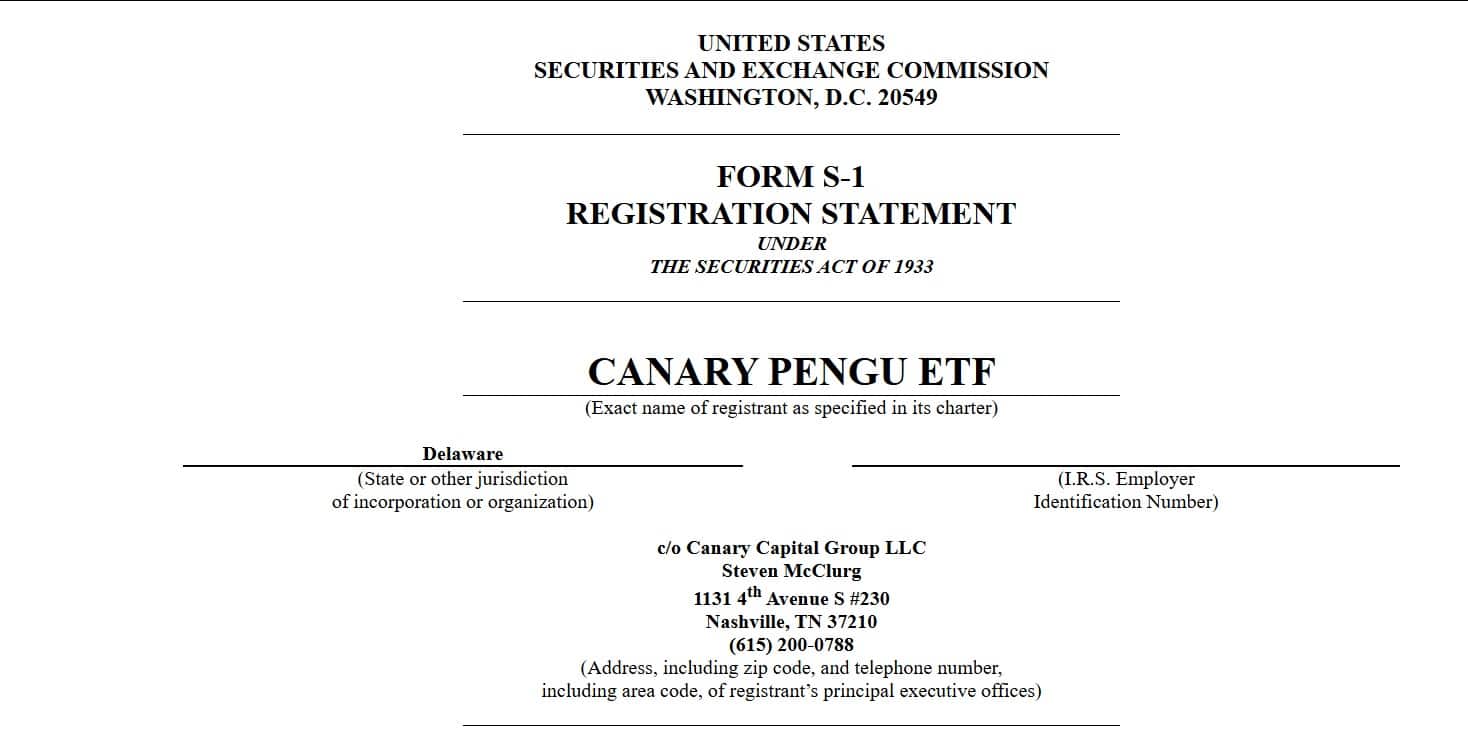

Source: SEC.gov

According to a recent SEC filing, Canary Capital has filed an application with the U.S. Securities and Exchange Commission for a PENGU ETF. This makes it the first filing for a Pengu ETF. A potential approval would mean the first ever memecoin-related ETF too. As per the same, the proposed ETF will facilitate investment in PENGU tokens, as well as Pudgy Penguins NFTs.

Equally, the proposal also states that the ETF will hold other digital assets such as SOL and ETH to support and facilitate trading and transfer activities. Therefore, if this ETF is approved by the SEC, it will allow investors to track the price and performance of PENGU, without owning the physical assets.

Significantly, a PENGU ETF will offer institutional and other large entities opportunity to invest in the crypto, without the need to use crypto platforms or directly own it. Such exposure could boost the altcoin’s performance and growth.

How other altcoins performed after their ETF filings

In light of the Altcoins’ ETF frenzy, it’s vital to understand how others have performed after ETF filings. This could answer the question – Will Pengu replicate the market trend?

For example – 2 weeks ago, Bitwise filed for Aptos ETF with the SEC. The announcement saw APT spike from $5.05 to $6.54. After hitting these levels on that day, the altcoin’s price retraced to a low of $4.8 on the charts.

Something similar happened to Dogecoin [DOGE] after its filing. On 3 March 2025, Bitwise filled for a Dogecoin ETF with SEC. This saw DOGE’s price soar to a local high of $0.24. Since then, however, the memecoin has seen strong downward pressure, with the crypto priced at $0.16 at press time.

To put it simply, this means that a filing usually causes speculative buying. This, in turn, results in a short-term rally, only for a sell-off to follow.

PENGU’s case study

Like other altcoins, PENGU’s price appreciated after the announcement, climbing from $0.0064 to $0.0076 on the charts. This marked an 18% hike, one resulting in a breakout above its $0.006 resistance.

At the time of writing, however, the memecoin had already retraced to $0.0063.

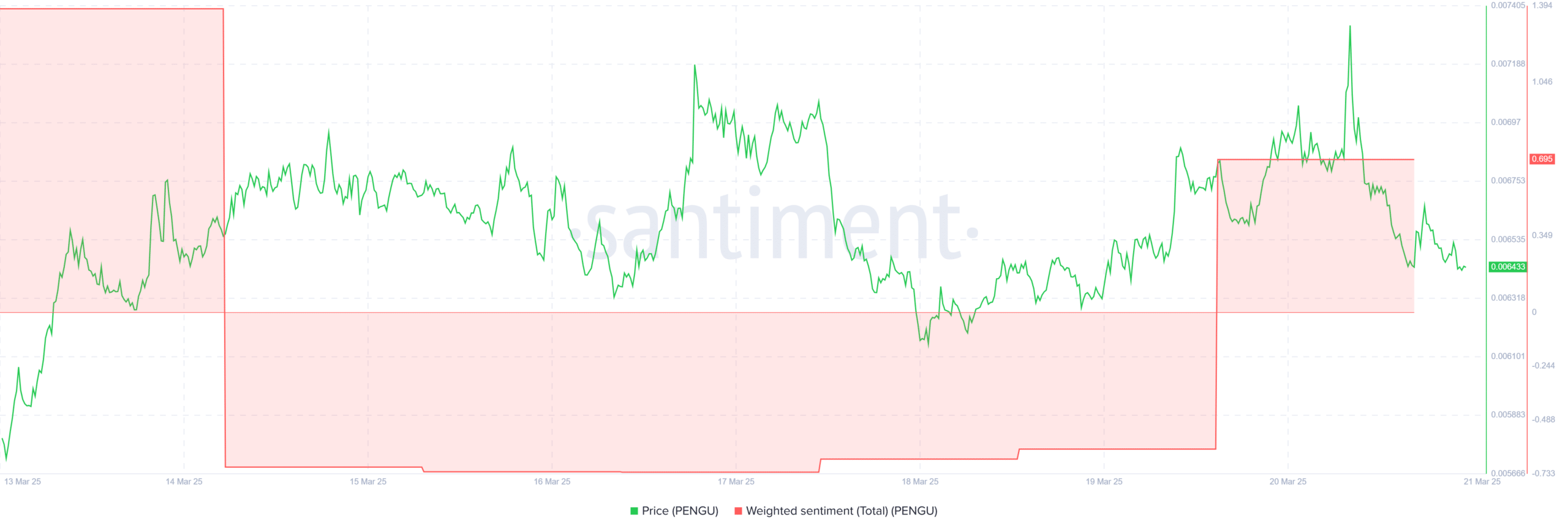

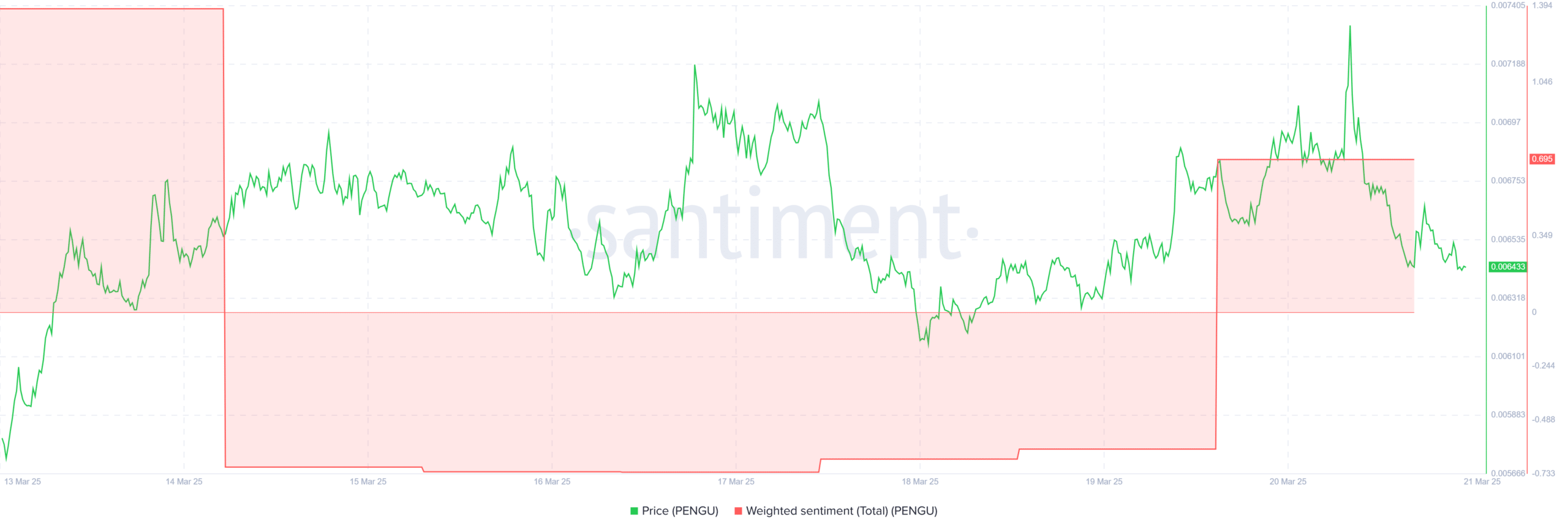

Source: Santiment

Despite the retracement seen on the daily charts, the altcoin has seen strong bullish sentiment build up. This bullishness was evidenced by the fact that weighted sentiment turned positive for the first time in 6 days.

Such a shift in sentiment implies that investors have a positive favorability for the memecoin. Usually, positive sentiments attract other investors in the market, thus boosting an asset’s demand.

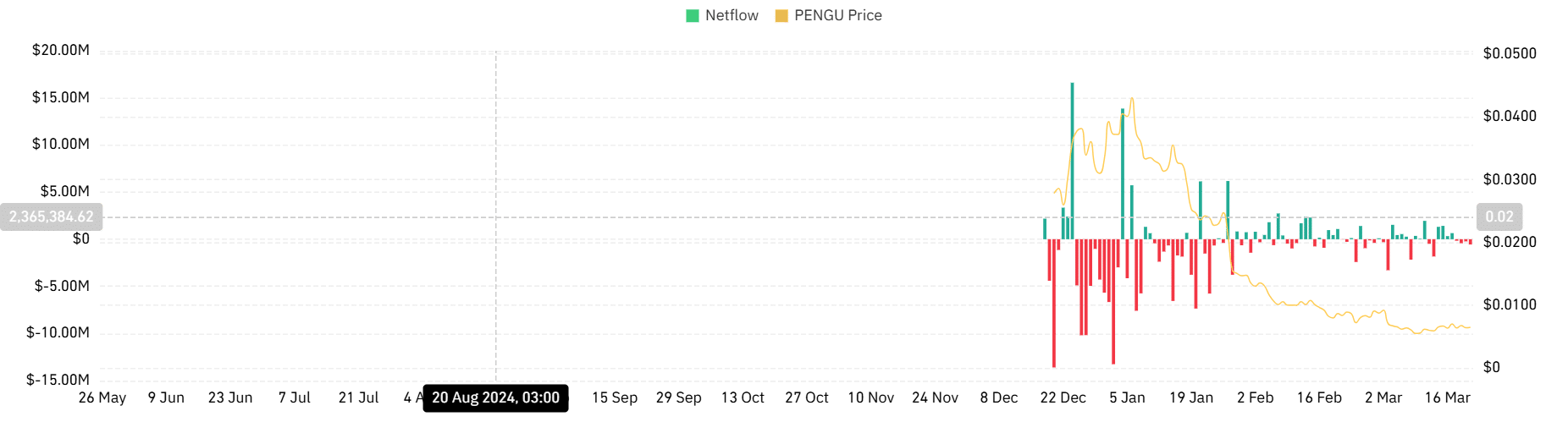

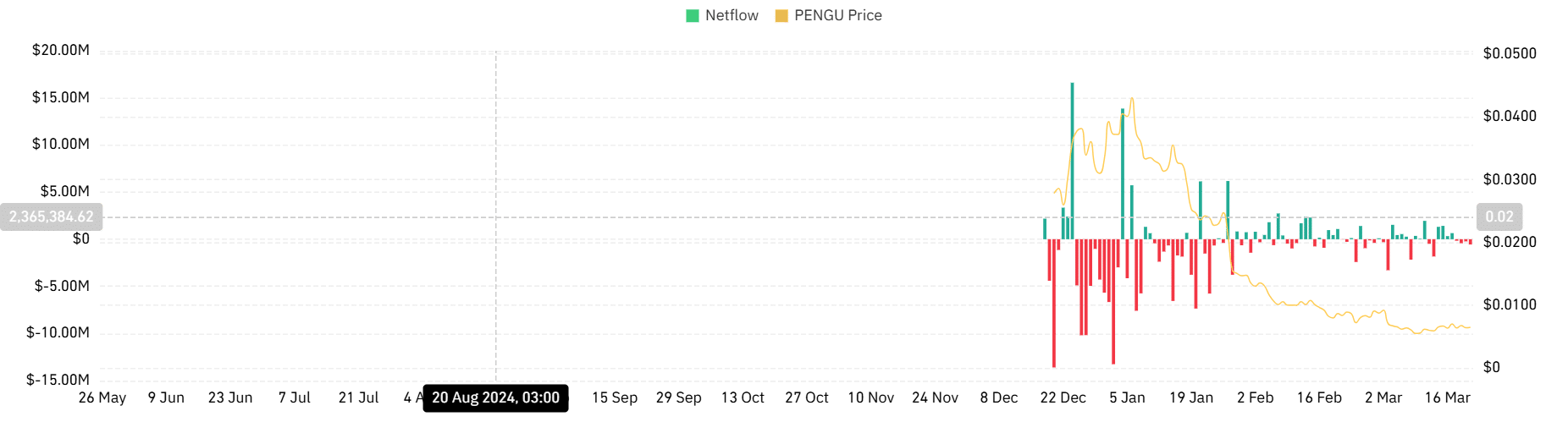

Source: Coinglass

Finally, PENGU’s spot netflows reached their highest negative level of -$557.9k for the first time in 8 days. This suggested that investors have entered the market to accumulate the memecoin following the ETF’s filling. A higher negative netflow suggests there are more accumulating addresses than selling ones.

Such a positive order imbalance results in higher prices if demand holds.

With market sentiment turning positive, PENGU may be well positioned for a recovery if the conditions hold. If that happens, we could see PENGU reclaim $0.007 and move towards $0.008. However, there is also the possibility that the altcoin could drop to $0.0059.