- ADA and SOL’s critical support levels are under stress, and a breakdown could accelerate sell-side pressure.

- As liquidity shifts, only one is poised to take the lead in Q2.

Analysts are divided on Cardano’s [ADA] Q2 outlook. With key support levels under threat, a breakdown could lead to deeper corrections.

However, some argue that ADA has the potential to outperform Solana [SOL] in the coming months.

A deeper analysis of Q1 market structure reinforces this argument—ADA closed the quarter with a 22% drawdown, while SOL suffered a more pronounced 34% retracement.

But can ADA sustain its relative strength and extend its lead in Q2?

Key insights from Q1: A performance recap

A critical assessment of Q1 raises a key question – Did ADA’s relative resilience stem from superior fundamentals, or was its outperformance a result of SOL’s structural weakness?

To decode this divergence, AMBCrypto conducted an in-depth data-driven analysis. The findings highlight a significant contraction in network activity across both chains.

Solana’s daily active addresses have plunged 50% from a post-election peak of over 8 million, while Cardano’s on-chain engagement has weakened, with active addresses declining from an average of 50k to 23.5k.

Source: Artemis Terminal

DeFi metrics further reinforce this downtrend. Solana’s Total Value Locked (TVL), which surged to $14 billion earlier this year, has now compressed to $8.27 billion.

Meanwhile, Cardano’s TVL has undergone a sharp 54% decline, settling at $408.08 million.

However, a granular analysis of the monthly price chart reveals a critical divergence – ADA’s 30% drawdown places it deeper in negative territory compared to SOL, which has contained its losses below 20%.

This supports a clear conclusion – Cardano’s Q1 outperformance was more a result of SOL’s structural fragility than ADA’s intrinsic strength.

Hence, with liquidity cycles shifting, the probability of a market rotation remains high. Will SOL reassert dominance?

ADA vs. SOL: Assessing Q2 prospects

Cardano continues to lag behind Solana’s $62 billion market capitalization, along with its superior user base, DEX volume, and DeFi activity.

However, the probability of another Q1-style retracement for SOL remains elevated, given the lack of capital rotation from Bitcoin. The SOL/BTC pair remains anchored near a two-year low, signaling persistent structural weakness.

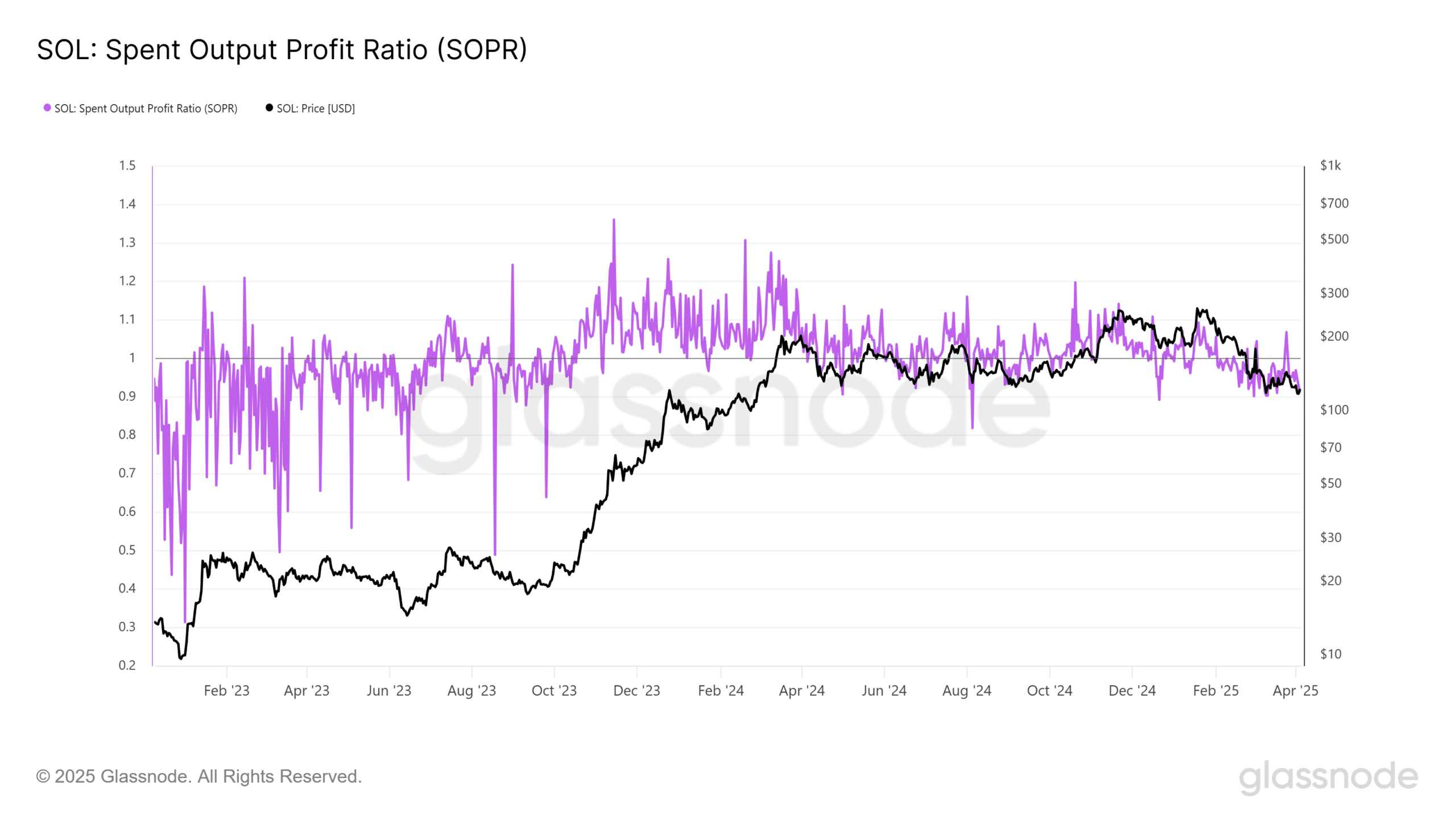

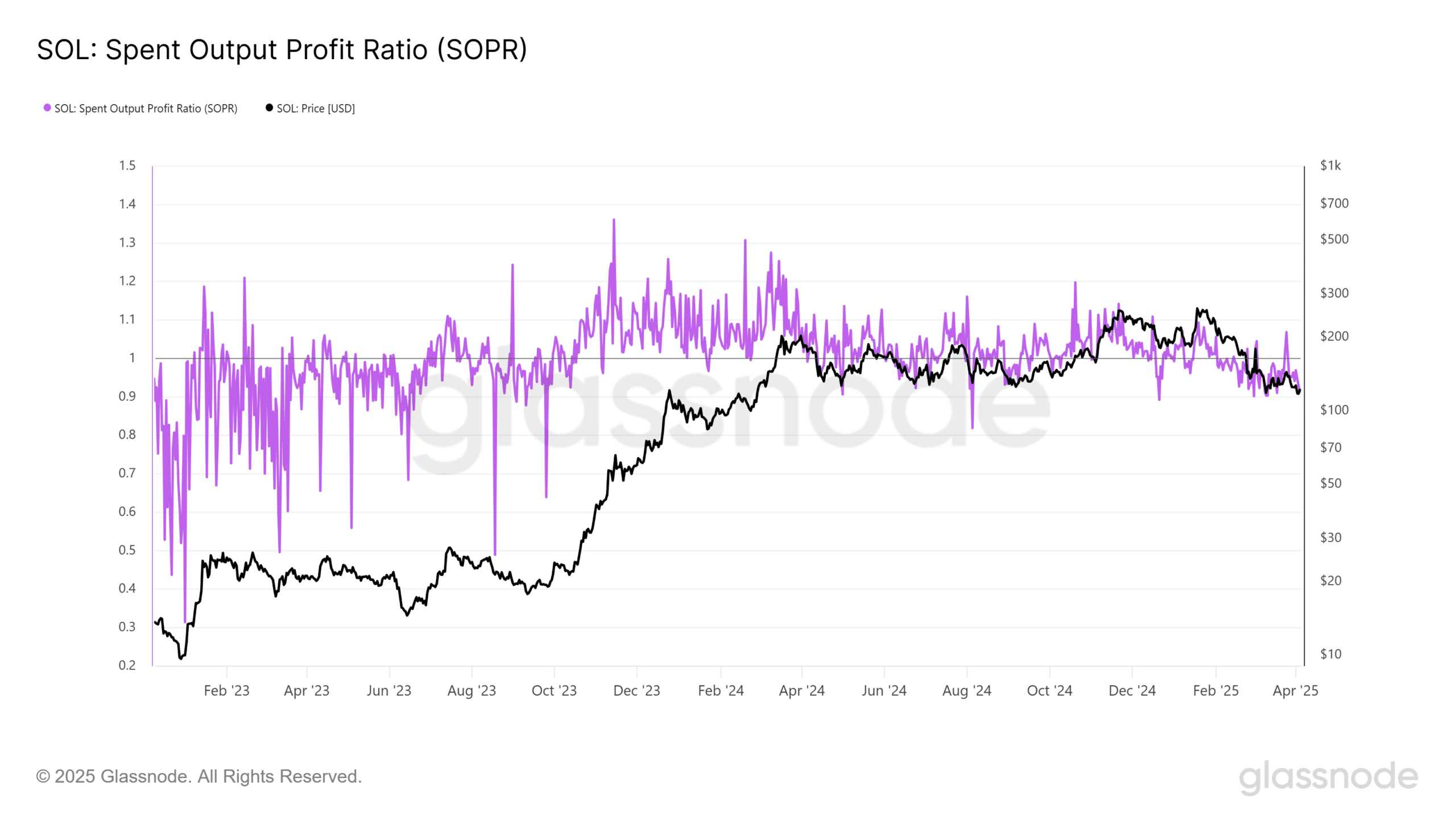

If these conditions do not reverse, ADA could maintain its relative lead in Q2, not by strong demand but by SOL’s continued susceptibility to sell-side pressure, as evidenced by its SOPR remaining below 1.

Source: Glassnode

A SOPR below 1 for Solana signals that investors are realizing losses, highlighting ongoing capitulation.

When combined with stagnant network growth and weak buyer absorption, this creates a challenging environment for SOL, making it difficult to reclaim key resistance levels.

Conversely, ADA exhibits stronger relative positioning for capital inflows, as reflected in the ADA/BTC pair’s three-day streak of sustained accumulation.

Unless liquidity dynamics shift in SOL’s favor, ADA appears primed to extend its Q1 outperformance, leveraging Solana’s structural vulnerabilities.