- Cardano continued to trade within the range and saw consolidation near the range lows.

- The hesitance to bid ADA near the $0.7 support meant the bulls were too weak to force a recovery.

Cardano [ADA] saw whale accumulation a few days ago, but the price did not react positively. The trend of Bitcoin [BTC] has not been bullish in recent days either. This did not help ease the selling pressure on ADA.

Range lows might be defeated

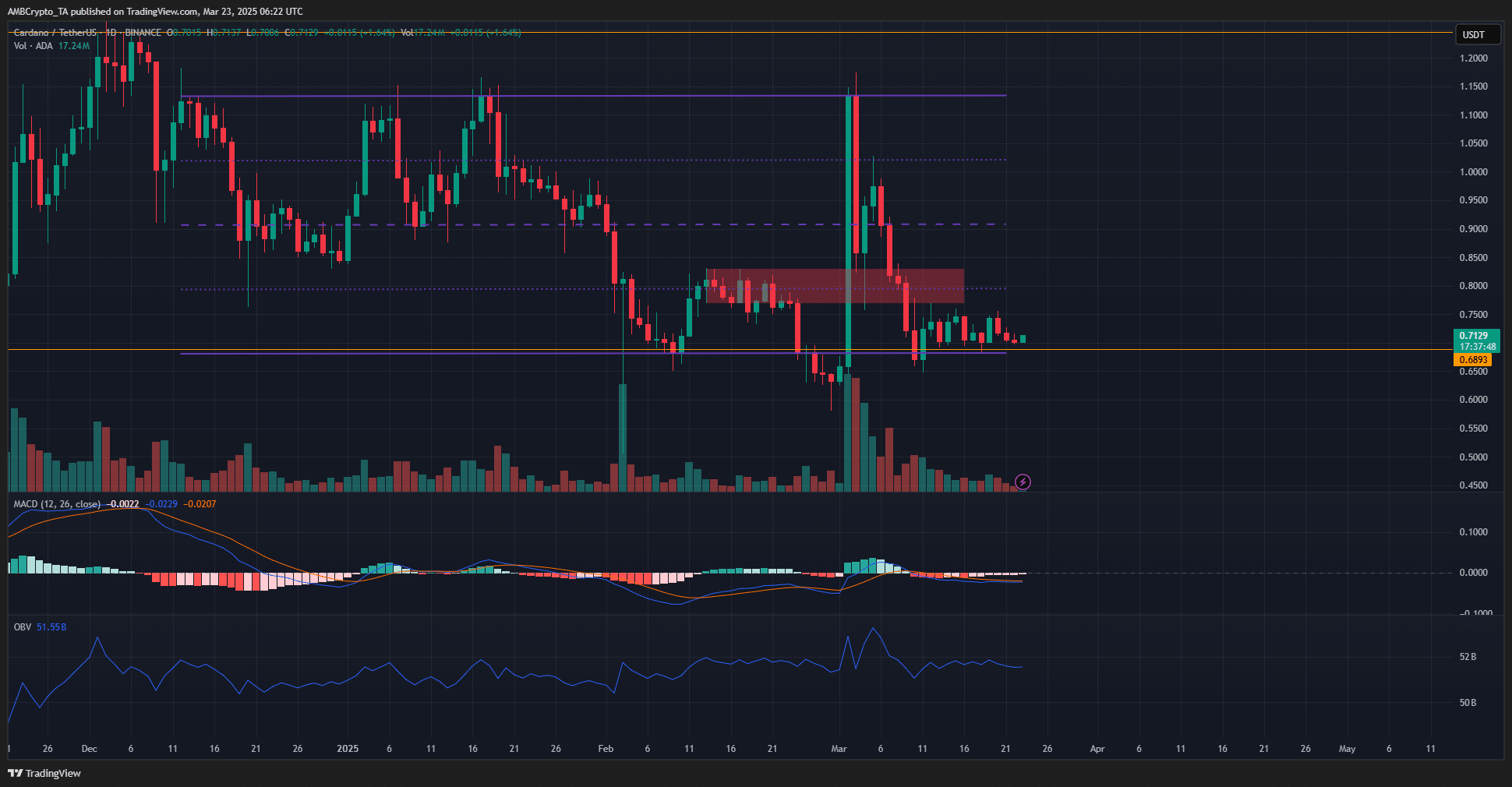

Source: ADA/USDT on TradingView

The strong surge from the range lows to the highs in early March meant that the sub-structure of ADA on the 1-day chart was bullish.

It formed a higher low at $0.67 ten days ago, after the lower low from late February at $0.63.

The swing structure remained bearish, as the $1.13 level has not been breached yet. Hence, the price action outlined the importance of the range (purple).

With ADA near the range lows, a buying opportunity was present. This was highlighted in a report from a week ago.

Little has changed since then. Cardano has traded around the $0.7 level but displayed little momentum. The MACD and signal lines have been closely interwoven in recent days, highlighting the lack of momentum.

The OBV also failed to climb higher. Hence, accumulation was not underway based on the buying volume. Despite being a good buying opportunity, ADA remained in consolidation and was not ready for a breakout yet.

A move past the local resistance zone (red) at $0.8 would be an encouraging sign of an upcoming breakout.

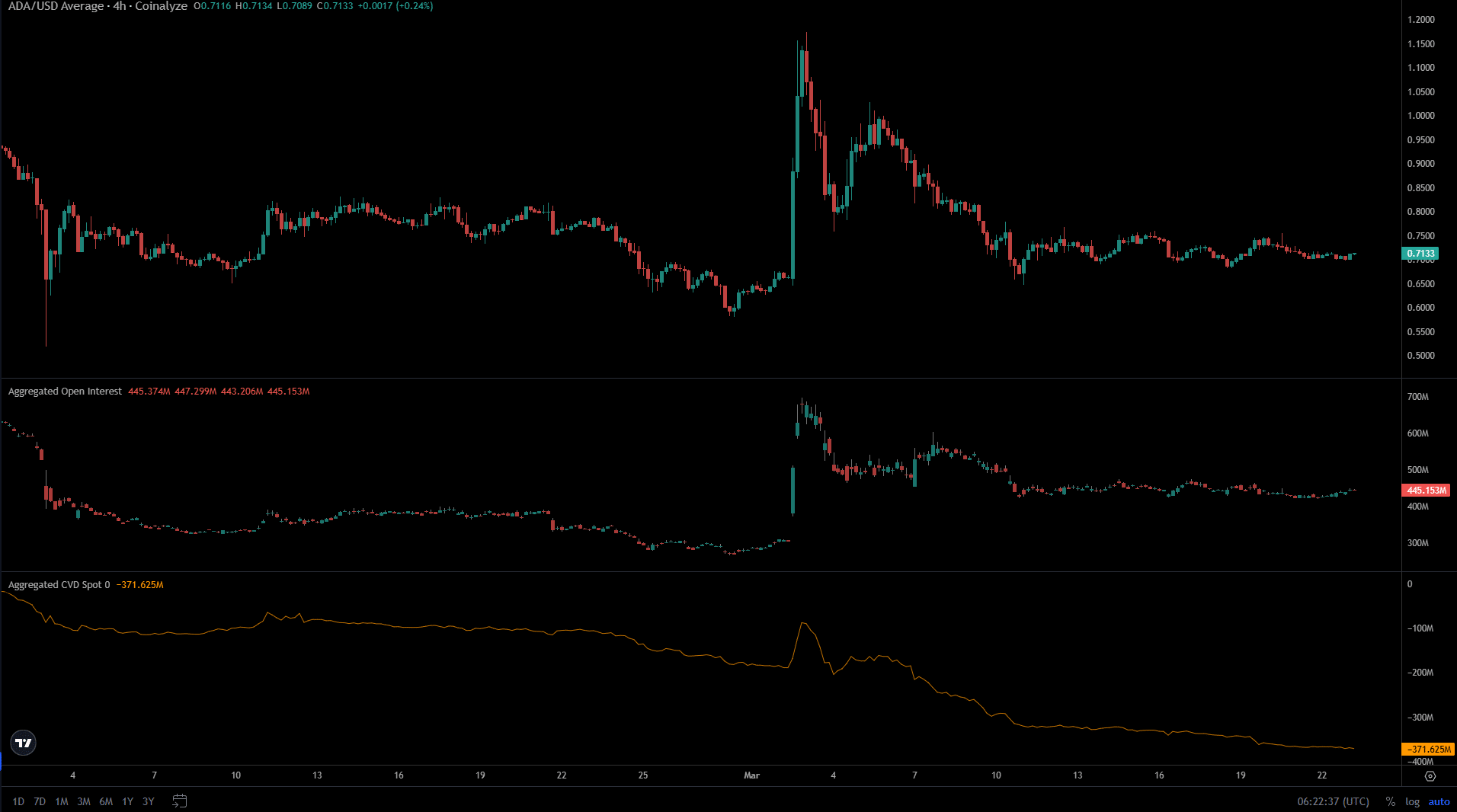

Data from Coinalyze showed that the Open Interest has remained around $400m-$450m over the past three weeks. The lack of rising OI meant that speculators preferred to remain sidelined.

This was due to a lack of bullish conviction in the token.

This lack of faith was further illustrated by the falling spot CVD. The indicator showed that selling pressure has been strong in the first half of the month.

Over the past ten days, the sell volume has dwindled but remained stronger than the buying volume.

Overall, it appeared that Cardano might struggle to recover and move beyond the $0.8 resistance. The lack of bidding in the spot and derivatives markets was a sign of bearish sentiment.

Unless BTC can climb higher and shift this sentiment around, ADA might be on course to fall below the range lows.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion