- Sui Foundation backs Cetus with a loan to enable full user reimbursement post $223M hack.

- Nasdaq files for Sui ETF, signaling institutional confidence and potential retail revival.

The Cetus protocol is at the center of ongoing headlines following a devastating exploit that led to a $223 million loss.

Sui Foundation and its recovery plan

In a swift move to stabilize the situation and restore user trust, the Sui Foundation has stepped in with a secured loan to support full user reimbursement.

This financial backing, combined with Cetus’ treasury, is part of a broader recovery framework designed to address the breach’s fallout.

The foundation’s aid specifically targets losses stemming from assets bridged off the Sui network.

The post noted,

“Using our cash and token treasuries, we are now in a position to fully cover the stolen assets currently off-chain if the locked funds are recovered through the upcoming community vote. This includes a critical loan from the Sui Foundation, making a 100% recovery for all affected users possible.”

Community reactions

Reacting to the steps taken, an X user said,

“finally some good news for memecoins on sui!.”

Echoing a similar sentiment, Samuel Xeus, Founder of The Nirvana Academy, added,

Source: Samuel Xeus/X

Can a community vote really unlock millions?

Thus, as Cetus positions for a full recovery, the final step now hinges on a community vote to unlock additional funds and ensure affected users are made whole.

A pivotal community vote, launched on the 27th of May, will determine whether a protocol upgrade can proceed without requiring the hacker’s signature to reclaim frozen assets.

If the proposal is approved, the retrieved funds will be transferred to a 4-of-6 multisig wallet overseen by Cetus, OtterSec, and the Sui Foundation.

In this governance process, SUI holders play a key role by delegating their stake to validators casting votes of “yes,” “no,” or “abstain,” with the Foundation’s own stake deliberately excluded to maintain impartiality.

For the upgrade to pass, over 50% of the total stake must participate, and a majority must support the change.

Meanwhile, Sui has also announced a $10 million security initiative focused on audits, bug bounty programs, and tooling improvements, marking a strong commitment to safeguarding its ecosystem and fostering greater collective responsibility.

Impact on Cetus and Sui price action

Following the announcement of the Sui Foundation’s recovery loan, CETUS witnessed a notable price jump of 23.94%, climbing to $0.1602, while SUI also gained 6.55%, trading at $3.72 at press time.

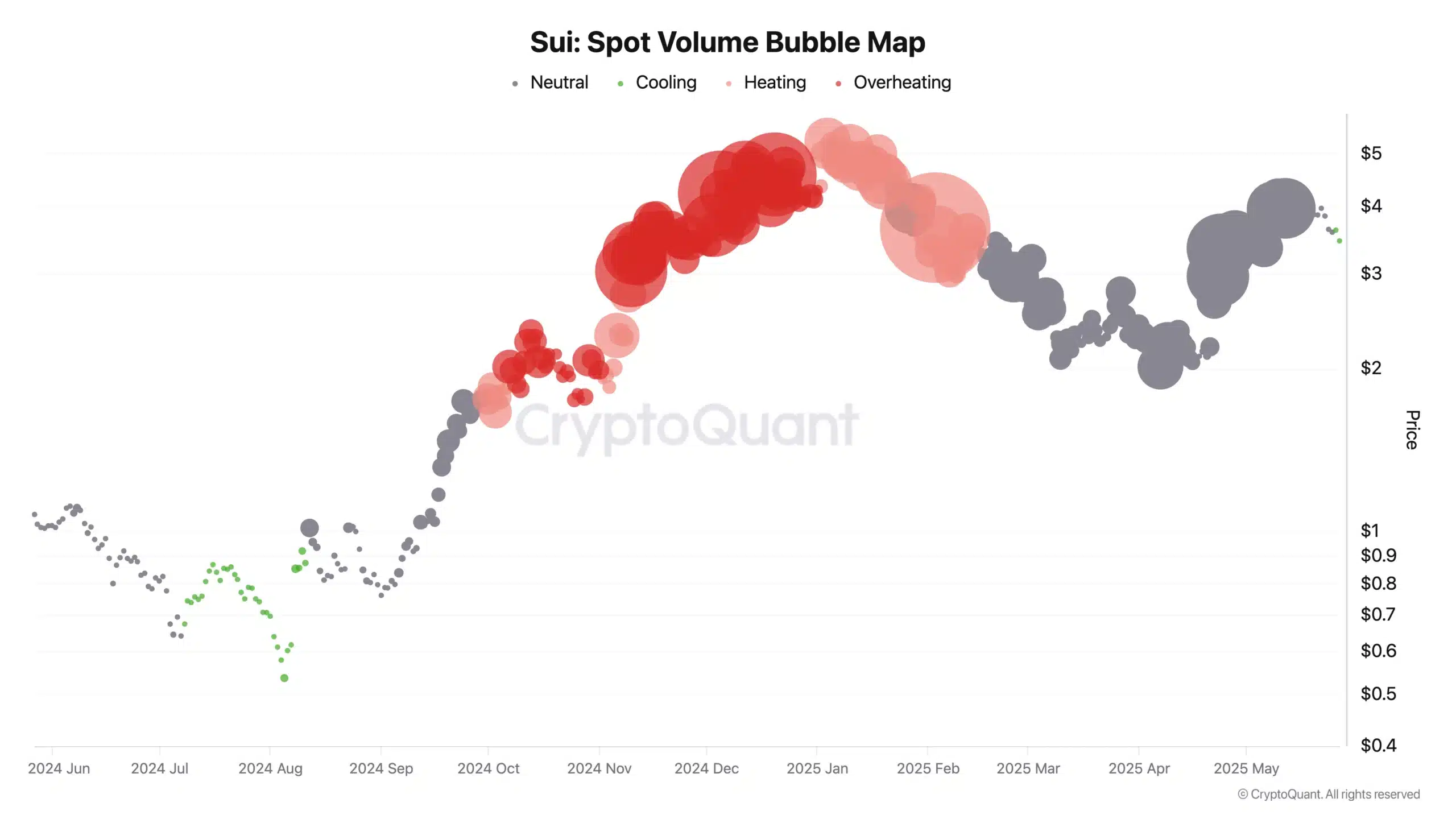

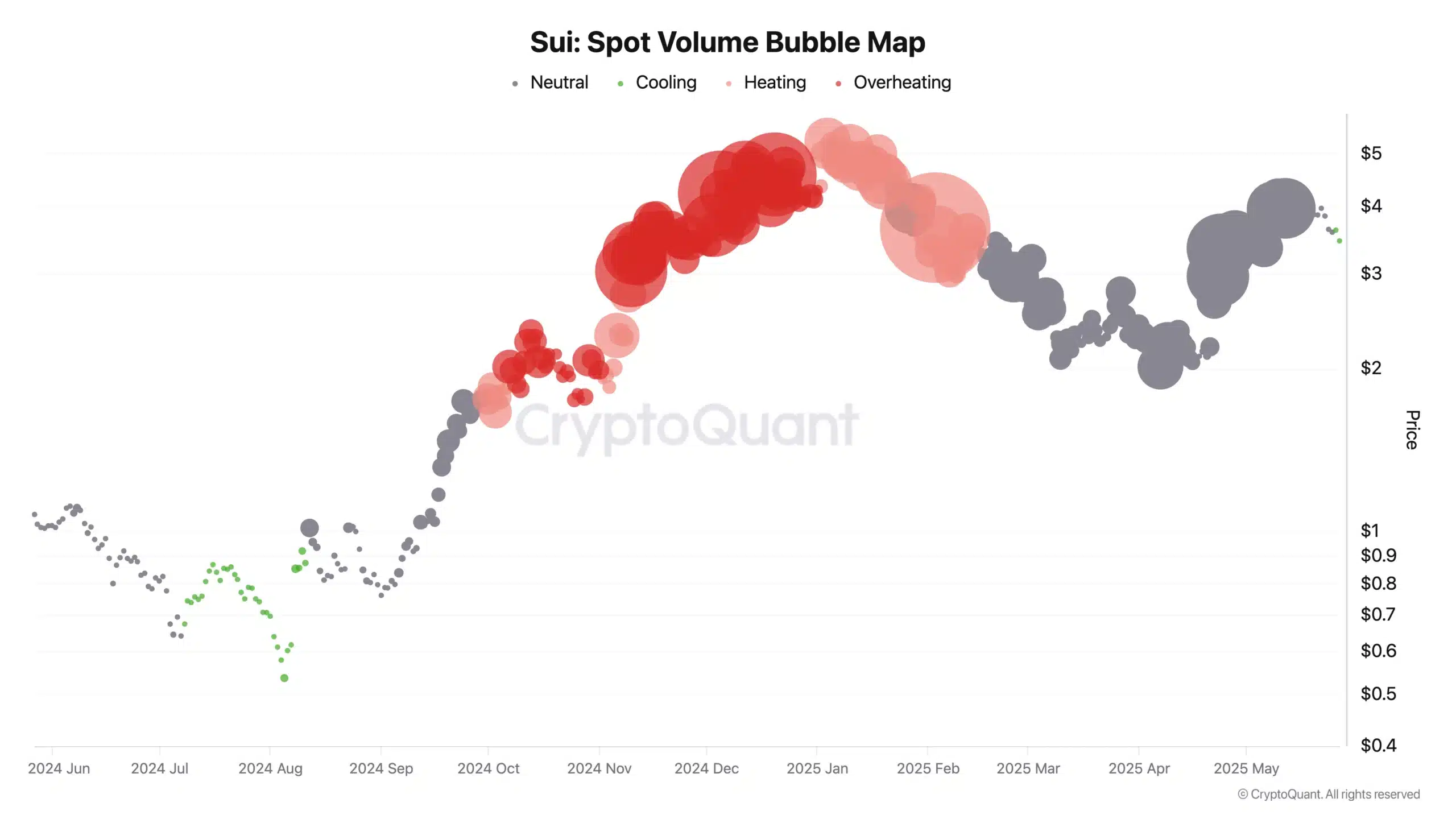

Despite this bullish price action, deeper analysis revealed a lack of significant retail participation, indicating that SUI’s rally might still be in its early stages.

Insights from CryptoQuant’s spot volume bubble map showed a decrease in trading volume across exchanges.

But with increased overheated signals in the market typically associated with imminent corrections, there may be room for further upside before facing a pullback.

Source: CryptoQuant

Optimism persists

Adding to the momentum, Nasdaq’s recent filing for 21Shares to launch a spot Sui ETF in the U.S. signals growing institutional interest in the network.

As the SEC begins its review, this development could catalyze broader retail engagement and strengthen market confidence.

Coupled with ongoing recovery efforts and security enhancements, such initiatives may not only offset the damage caused by the Cetus exploit but also position Sui for long-term growth and resilience.