- LINK reclaimed its daily trendline as bulls defended $12.25 amid mild upside momentum

- On-chain activity dropped sharply, but fundamentals and reserves hinted at recovery potential

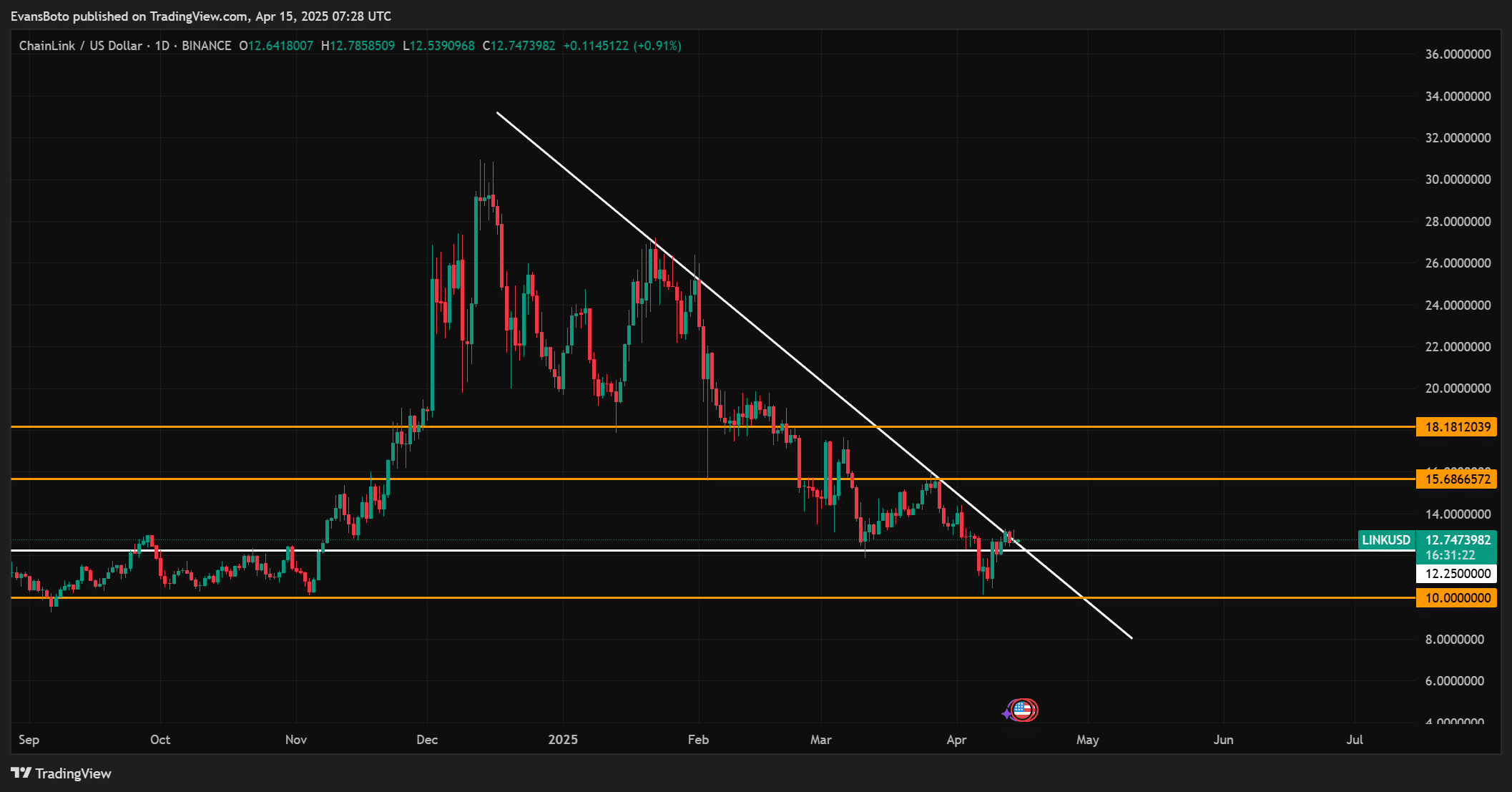

Chainlink [LINK], at the time of writing, was retesting a crucial breakdown zone after breaching a year-long ascending trendline. This seemed to allude to a decisive moment for the altcoin’s short-term direction.

In fact, despite a momentary rebound, the $12.25-level has emerged as a key battleground for bulls aiming to regain dominance. If this support fails to hold, downside targets at $10 and $7.50 may come into focus.

On the technical front, LINK recently broke above a descending trendline on the daily chart – Hinting at a potential shift in trend. However, momentum was weak, and the price could still flirt with the key support area.

At press time, LINK was trading at $12.67 following gains of 0.41% in the last 24 hours. Bulls must maintain pressure above $12.25 to confirm a sustainable reversal.

Source: TradingView

New partnerships and declining reserves – Will fundamentals spark a recovery?

Chainlink recently announced a strategic collaboration with Pi Network, aiming to enhance decentralized applications through real-time data integration. This move strengthens Chainlink’s smart contract capabilities and could serve as a long-term bullish driver.

However, the market reaction has been muted so far, indicating that traders may be focused more on technical structure than fundamentals in the short term.

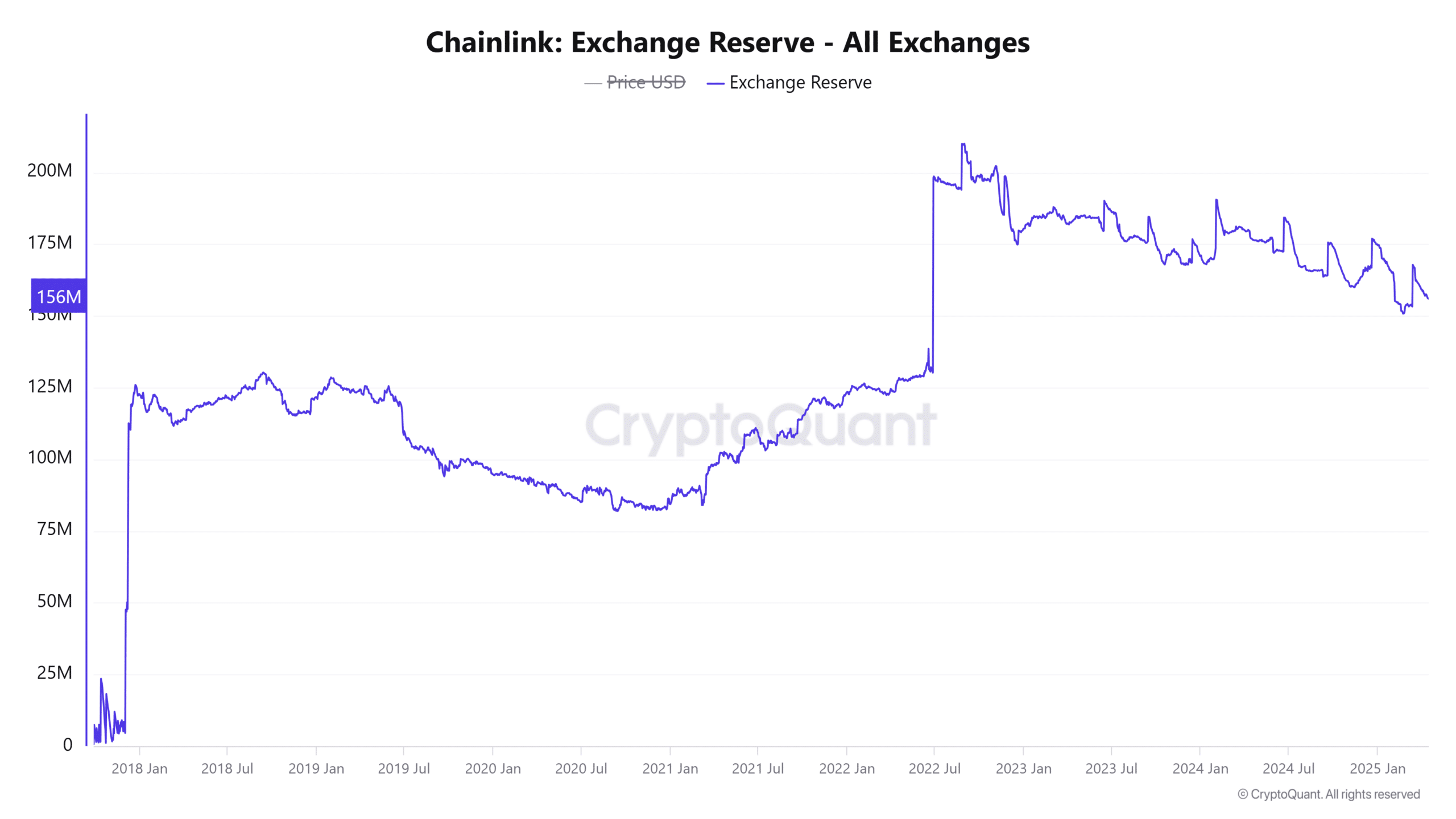

Meanwhile, exchange reserve data revealed a 0.2% drop over the last 24 hours, with total LINK on exchanges now at 156 million. This fall in exchange-held supply hinted at declining sell-side pressure, often seen during accumulation phases. If sustained, this trend could support higher prices, especially if demand begins to rise.

Source: CryptoQuant

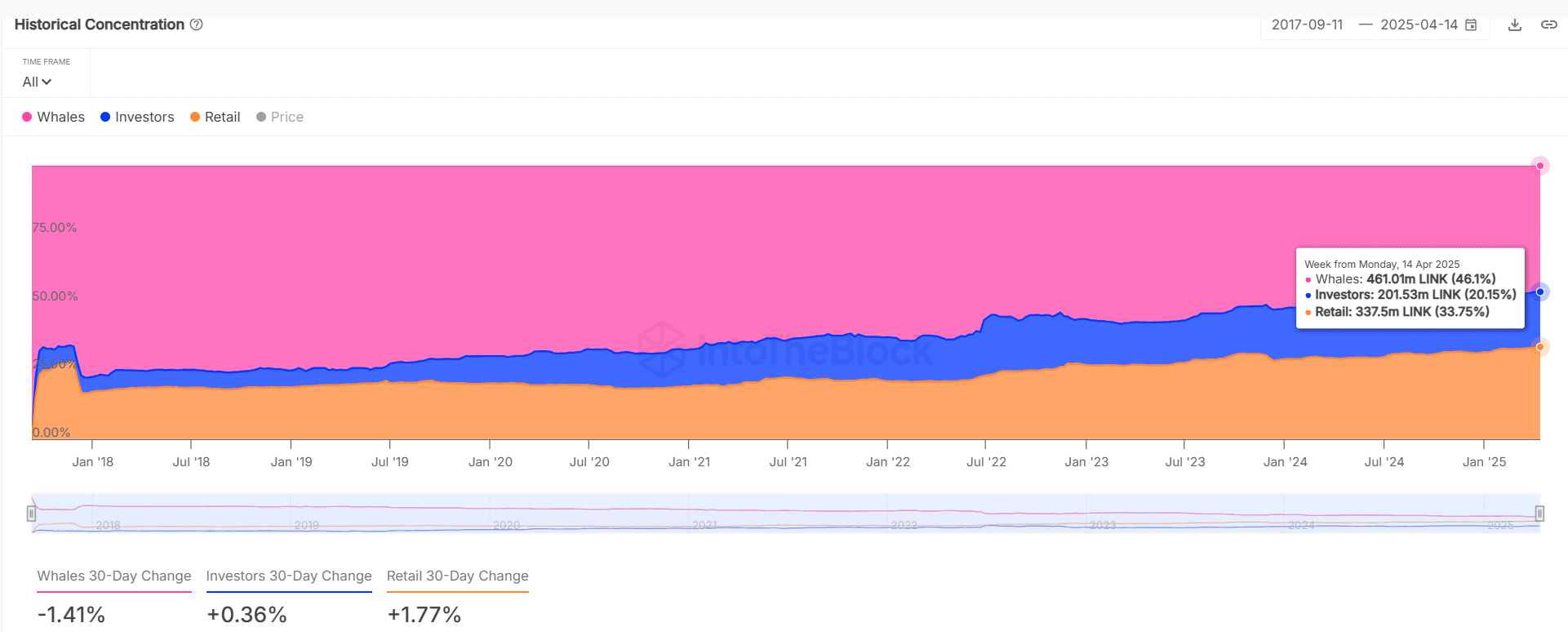

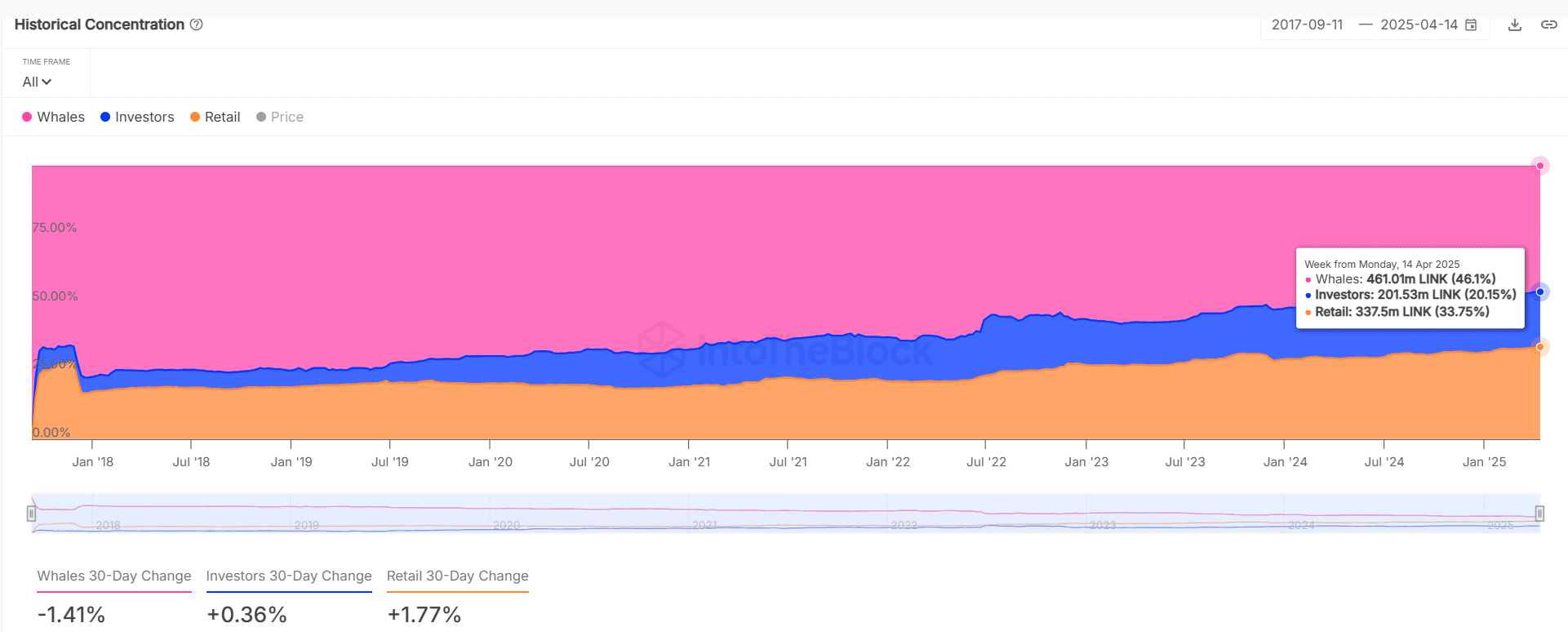

What does investor behaviour suggest?

Right now, whales control 46.1% of LINK’s supply. However, their holdings dropped by 1.41% over the past month.

Retail participation, on the other hand, climbed by 1.77% and their investor holdings increased marginally by 0.36%. This redistribution could point to growing interest from smaller market participants, despite slight whale outflows.

Source: IntoTheBlock

On the contrary, address activity suggested that traders are still on the sidelines. New addresses dropped by 44.25%, active addresses by 49.5%, and zero-balance addresses by 56.62% over the past week.

This slowdown in network activity could limit LINK’s upside potential in the short term. Unless volume and participation return across the market.

Conclusion

Chainlink’s current setup reflects a market in limbo – Caught between promising structural shifts and declining on-chain engagement. The $12.25-level remains the most immediate line of defense for bulls, supported by lower exchange reserves and positive developments like the Pi Network partnership.

However, fading user activity and a fall in whale involvement introduce caution. A decisive bounce above press time levels could spark momentum, but failure to hold may drag LINK into deeper correction territory.