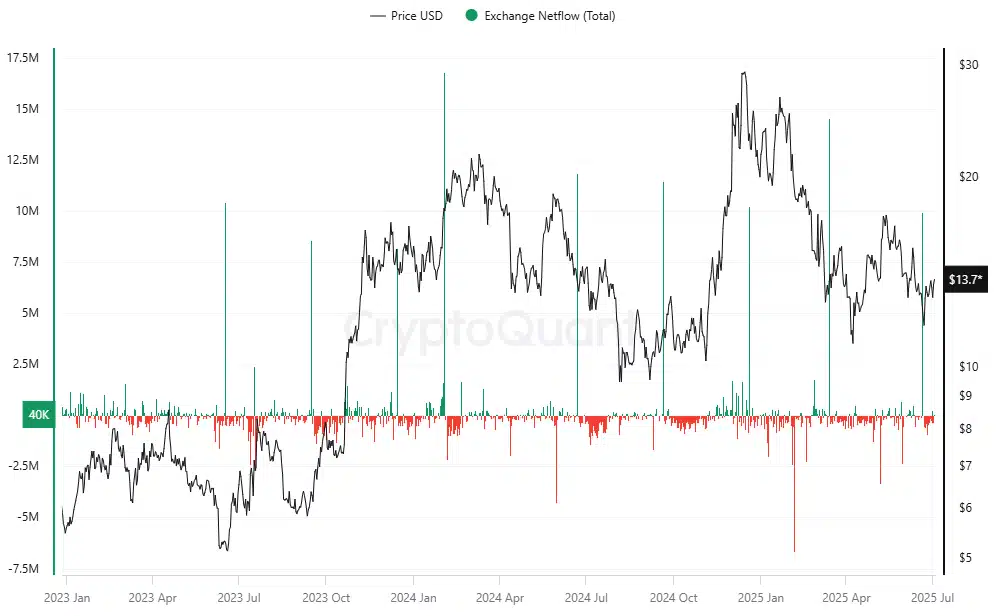

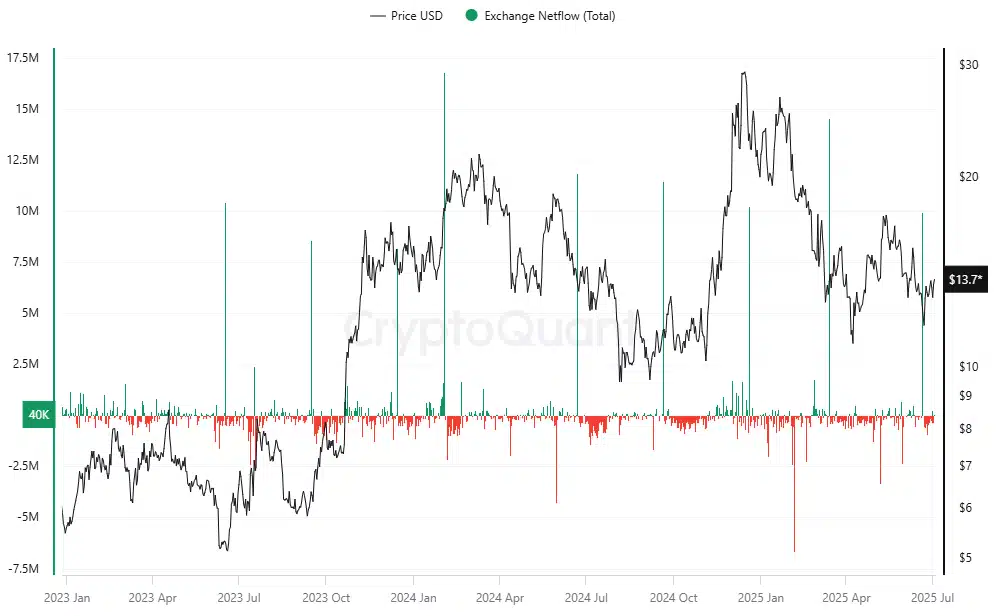

For the past several months, Chainlink has seen a sustained pattern of negative exchange netflows – Roughly 100,000 LINK per week. This is evidence of steady accumulation by large holders.

Source: Cryptoquant

The data, highlighted by CryptoQuant, also showed that this trend has persisted for a while. Even now when the price has been rangebound in a narrow band between $12 and $15.

Source: Cryptoquant

Brief spikes in deposits, such as the $5 million LINK inflows in March 2025, stand out as anomalies driven likely by retail panic or short-term profit-taking.

Whale accumulation has intensified too, with exchange withdrawals spiking in late 2024 and remaining elevated – A clear strategy to absorb retail sell pressure without moving the price. Neutral leverage has kept volatility low, enabling a quiet supply squeeze that’s driven LINK reserves down 40% YTD.

Still, retail apathy has kept the price capped below $15.

Retail stalls despite Chainlink’s expanding utility

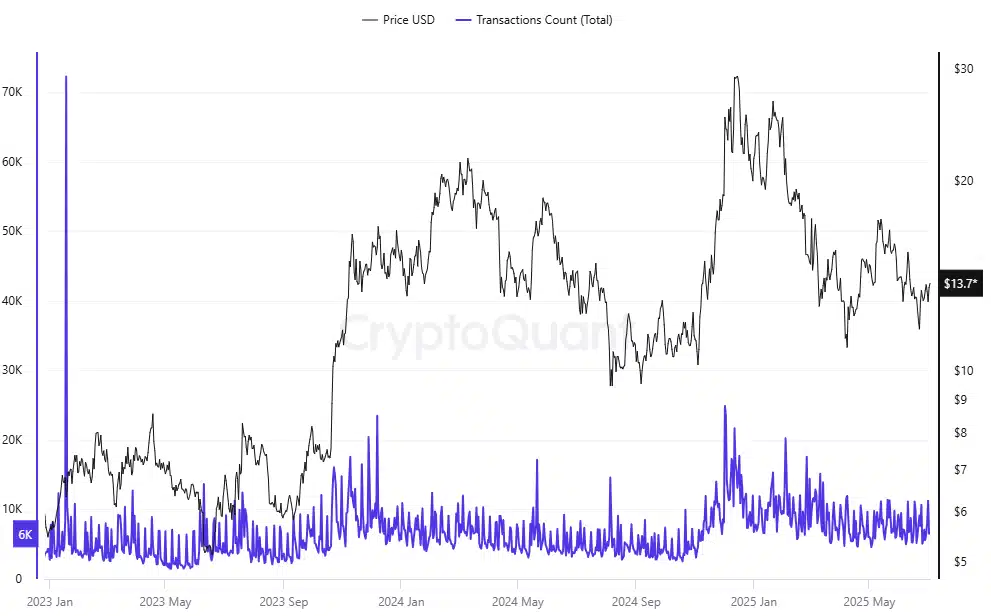

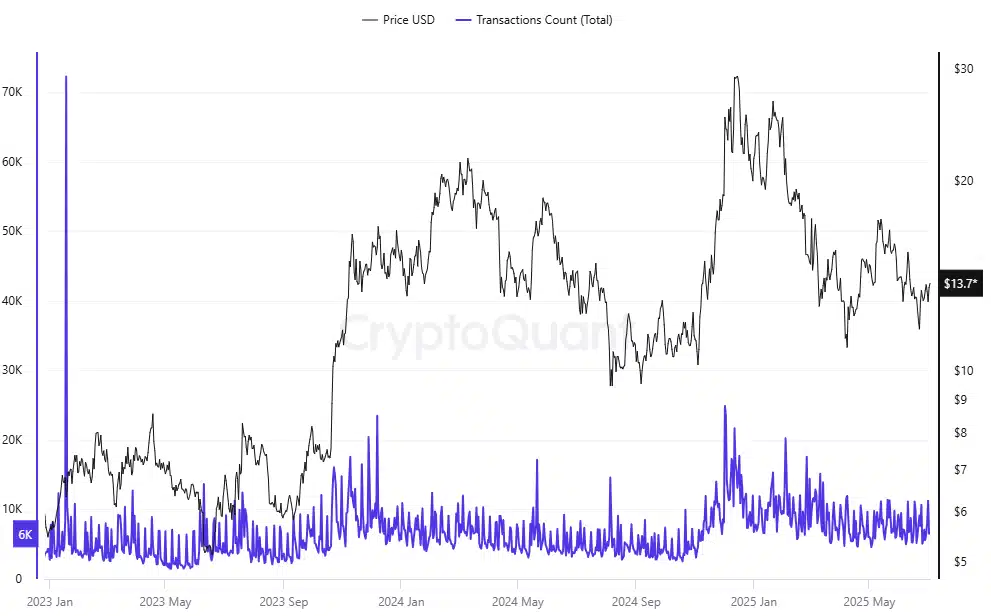

While whales have been quietly accumulating, retail participants have been largely uninterested. In fact, at the time of writing, daily active addresses hovered between 28,000 and 32,000, while transaction counts were stagnant around 9,000 per day.

Source: CryptoQuant

Source: CryptoQuant

Even during Chainlink’s Q4 2024 uptick in ecosystem utility and minor price rally, retail activity barely budged. The charts revealed no meaningful follow-through, suggesting that retail traders may be either fatigued or unconvinced by prevailing price levels.

Setup eyes breakout, but market needs a nudge

LINK held just above the $13-mark at press time, maintaining a fragile grip on a key support at $12.

Bollinger Bands tightened too, hinting at a volatility squeeze, while the RSI hovered near neutral at 49 – Neither overbought nor oversold. The MACD also underlined a tentative bullish crossover, but momentum seemed to be weak on the charts.

Source: TradingView

According to analyst Ali Martinez, holding above $12 could open the door to a breakout towards $18-$20. For now, price action remains sluggish. A trigger, likely from retail or a macro push, may be required.