- The long-term risk for Chainlink was low as at press time.

- LINK consolidates in a falling wedge as Smart Money remain bullish.

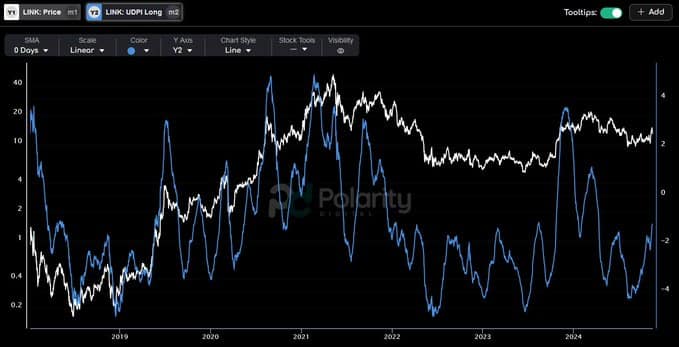

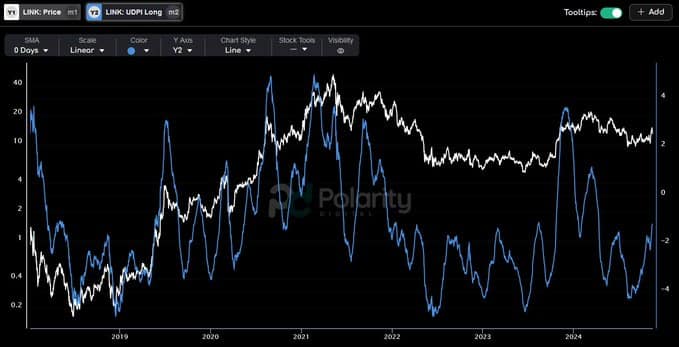

Chainlink [LINK] continued to be one of the top cryptos with its recent UDPI Long reading indicating that LINK was in a period of low risk.

Historically, downturns in the UDPI, often preceded either price stability or increase. In fact, dips in risk around early 2020 and late 2022 corresponded with rallies. This suggested that lower perceived risk led to enhanced buying activity.

These troughs in risk often appear just before substantial price gains, supporting accumulating LINK when the UDPI Long reading is still low.

Source: Polarity DIGITAL

Despite occasional skepticism towards Chainlink, these patterns suggest that it is poised for growth during favorable market cycles.

The historical trend showed that when risk levels subside, LINK’s price tends to rise, aligning with the perspective that alt season could benefit Chainlink.

These low-risk periods are often viewed as optimal times to invest, anticipating potential rallies.

LINK consolidated in a falling wedge

The chart of LINK illustrated a clear falling wedge pattern on the hourly time frame, characterized by converging trendlines enclosing price action.

This technical formation typically suggested a bullish reversal potential once the price breaks out above the upper trendline.

Throughout the observed period, LINK’s price movements have been tightly compressed within this pattern, indicating decreasing volatility and potential accumulation phases.

Source: Trading View

LINK’s price tested the resistance line multiple times, each attempt narrowing the price range and heightening anticipation for a breakout.

Given the pattern and low-risk period, this presents an opportunity for traders to go long or increase holdings in LINK.

The chart suggested that a decisive breakout above the upper trendline, accompanied by increased volume, could trigger a new uptrend.

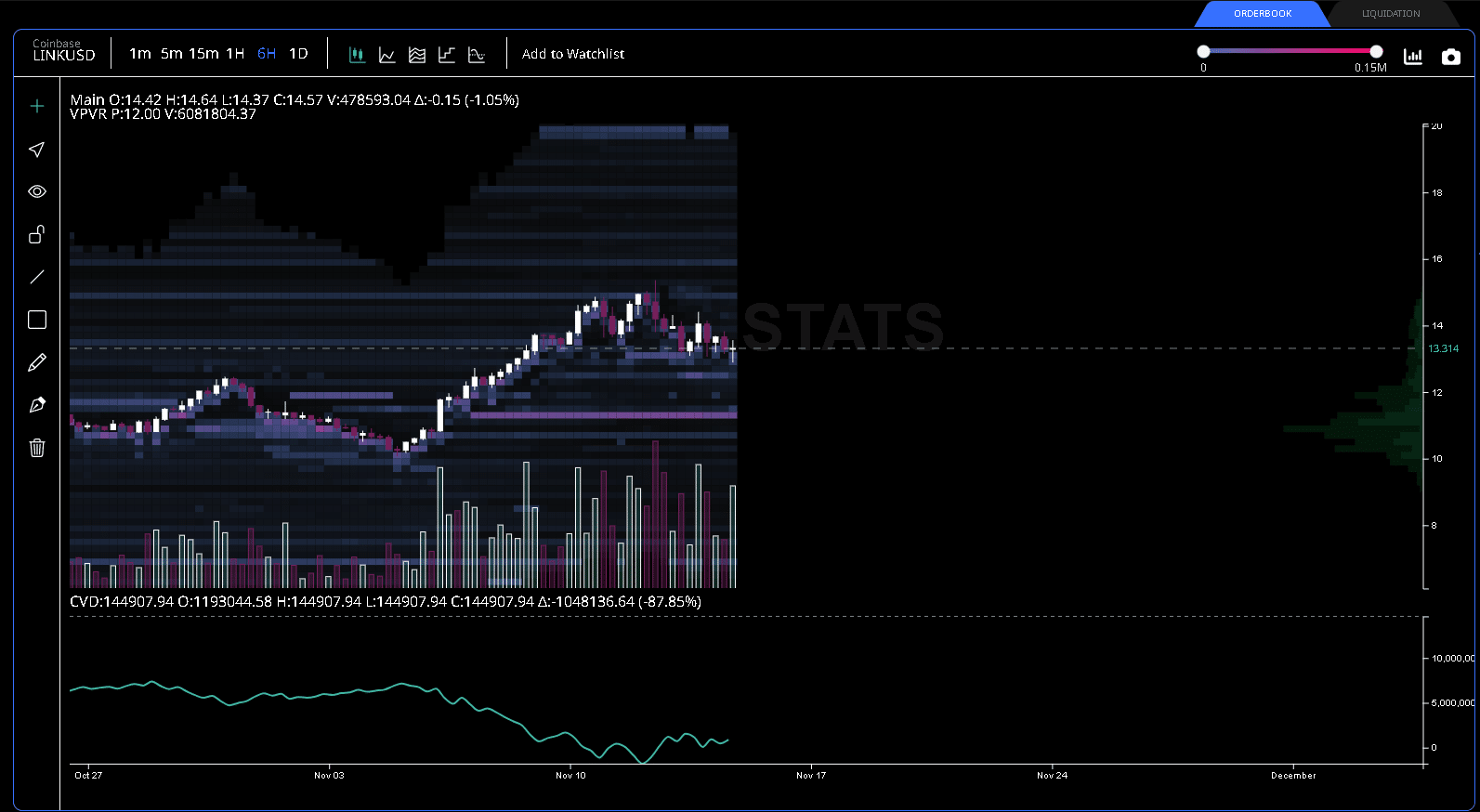

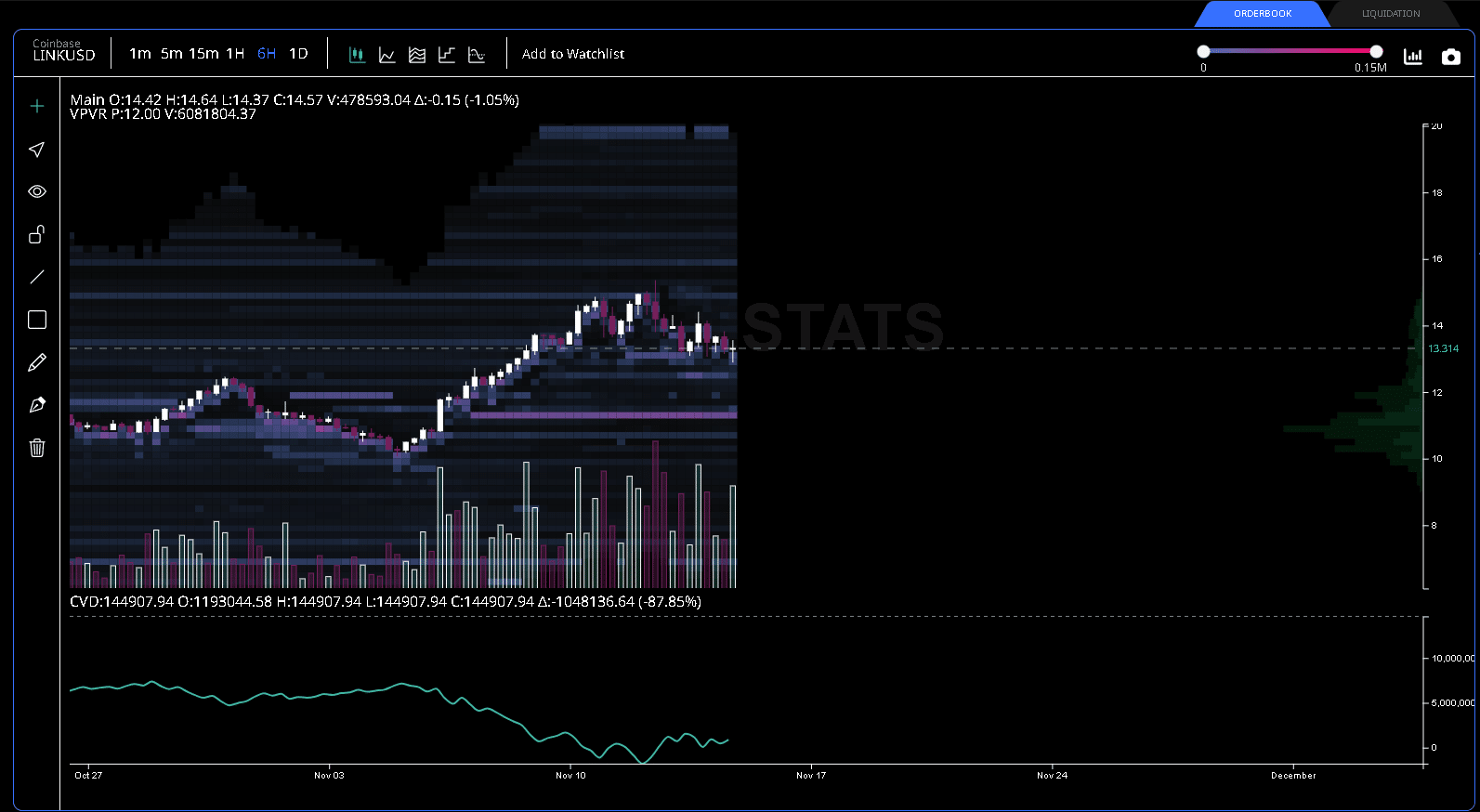

Volume and sentiment

Chainlink’s Volume Profile Visible Range (VPVR) and Cumulative Volume Delta (CVD), revealed critical insights into market dynamics.

VPVR indicated rise trading activity at various price levels, with a pronounced peak around $13.00. This peak in trading volume suggested a strong interest level, potentially acting as a pivot for future price movements.

CVD showed an overall increase this week, indicating higher buying pressure than selling. This suggested accumulation by traders anticipating future price increases.

Considering the bullish sentiment from ‘Smart Money’—institutional or informed investors who outperform the general crowd—alongside a bearish retail crowd sentiment, it presents a typical contrarian opportunity.

Is your portfolio green? Check out the LINK Profit Calculator

The current sentiment divergence, with Smart Money bullish as Market Prophit noted, supports the idea of taking a long position on LINK.

This strategy, often profitable, especially when retail sentiment remained bearish. This indicated that the majority might be missing out on underlying bullish signals captured by informed investors.