- Coinbase Premium Index rebounded, indicating greater U.S demand for BTC

- However, there seemed to be massive lower liquidity that could constrict BTC in a price range

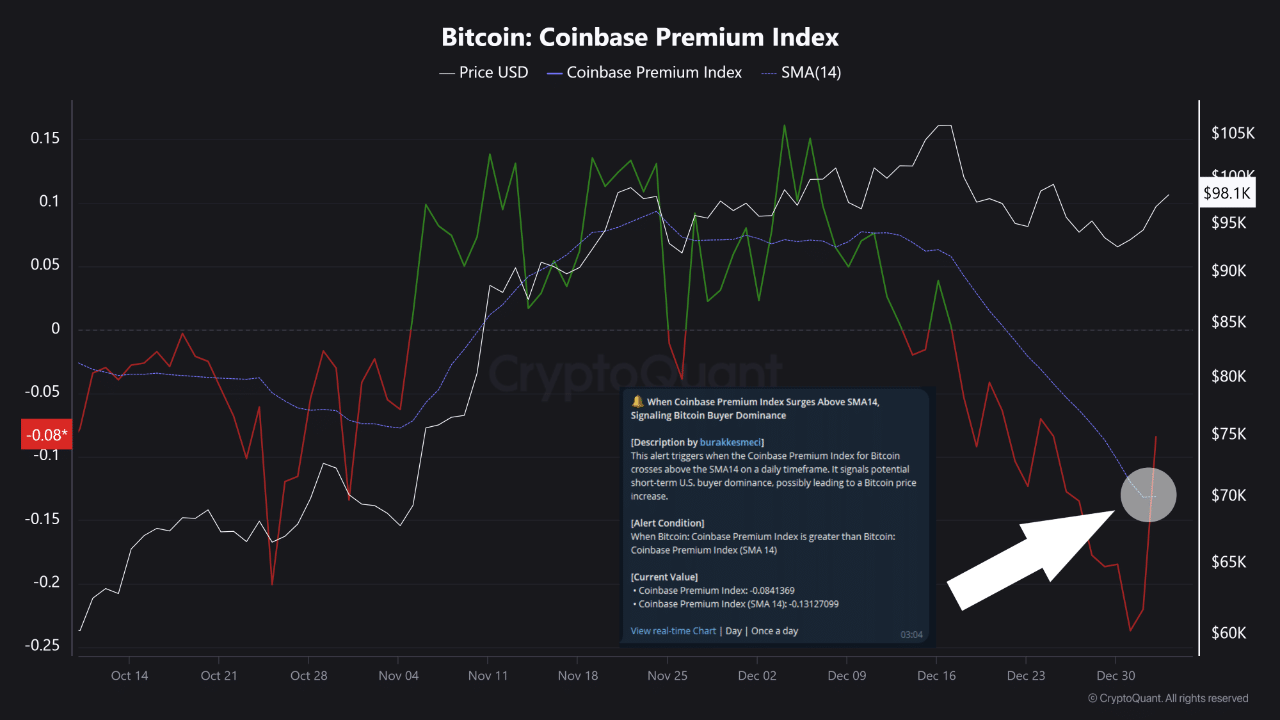

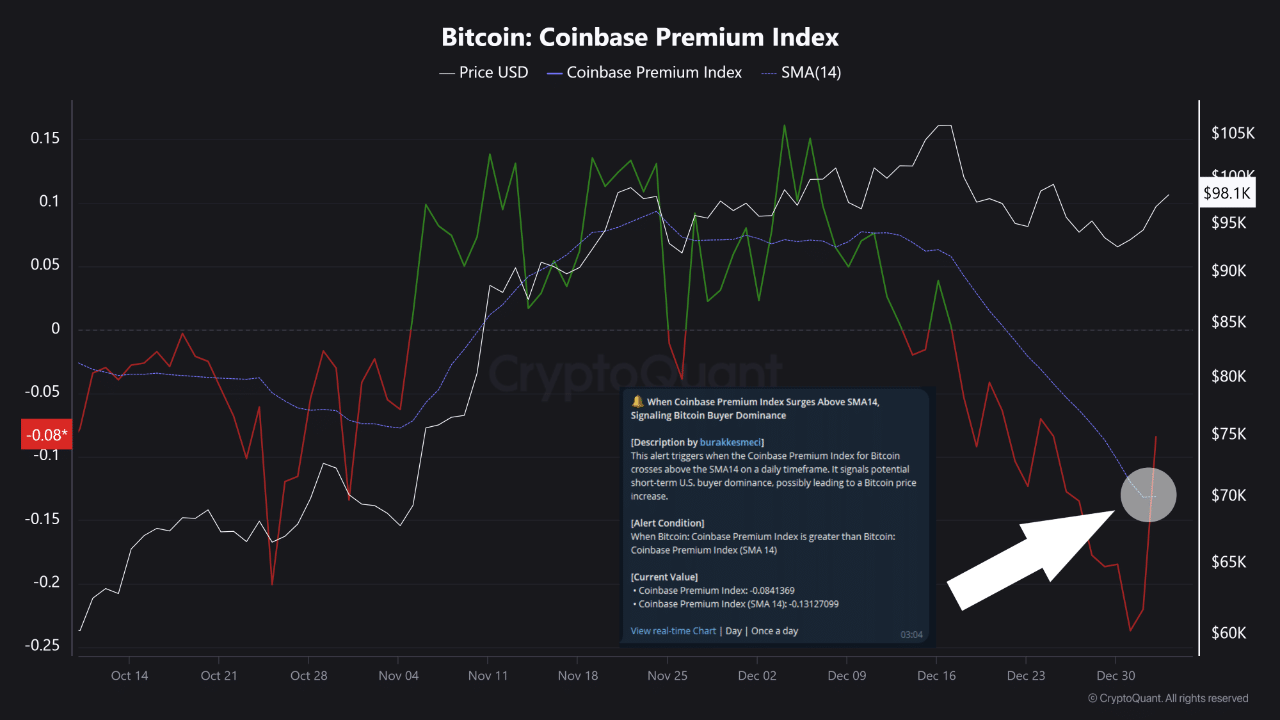

On Friday, 03 January, Bitcoin [BTC] soared to nearly $99k following a rebound in U.S demand, as evidenced by the Coinbase Premium Index. In fact, the index recently dropped to a 12-month low following a risk-off approach by U.S retail and institutional investors during the holiday season.

The index also recently reclaimed the key 14-day Simple Moving Average (SMA) for the first time in nearly a month. According to CryptoQuant analyst Burak Kesmeci, this highlighted greater dominance of U.S buyers in the market.

“When Coinbase Premium Index surges above SMA14, signaling Bitcoin buyer dominance, this event is an early indicator that U.S.-based buyers are regaining dominance in the market.”

Source: CryptoQuant

Bitcoin ETFs log $908M daily inflows

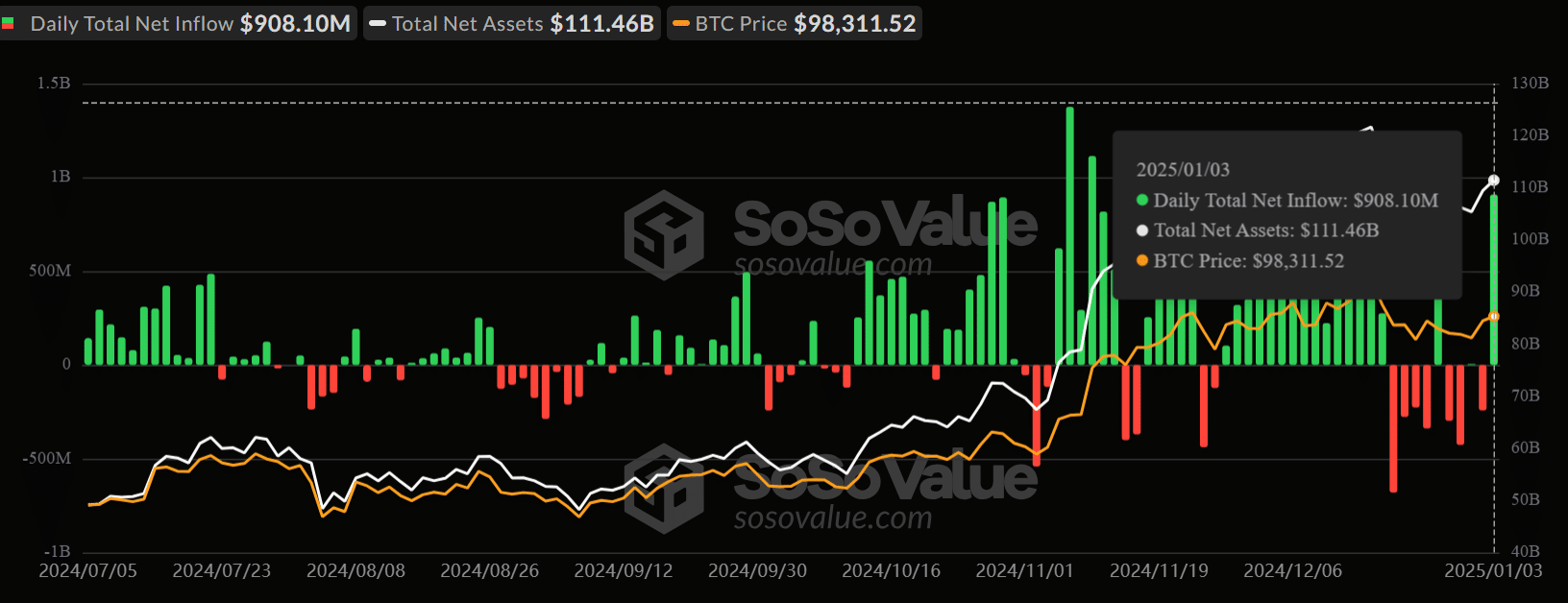

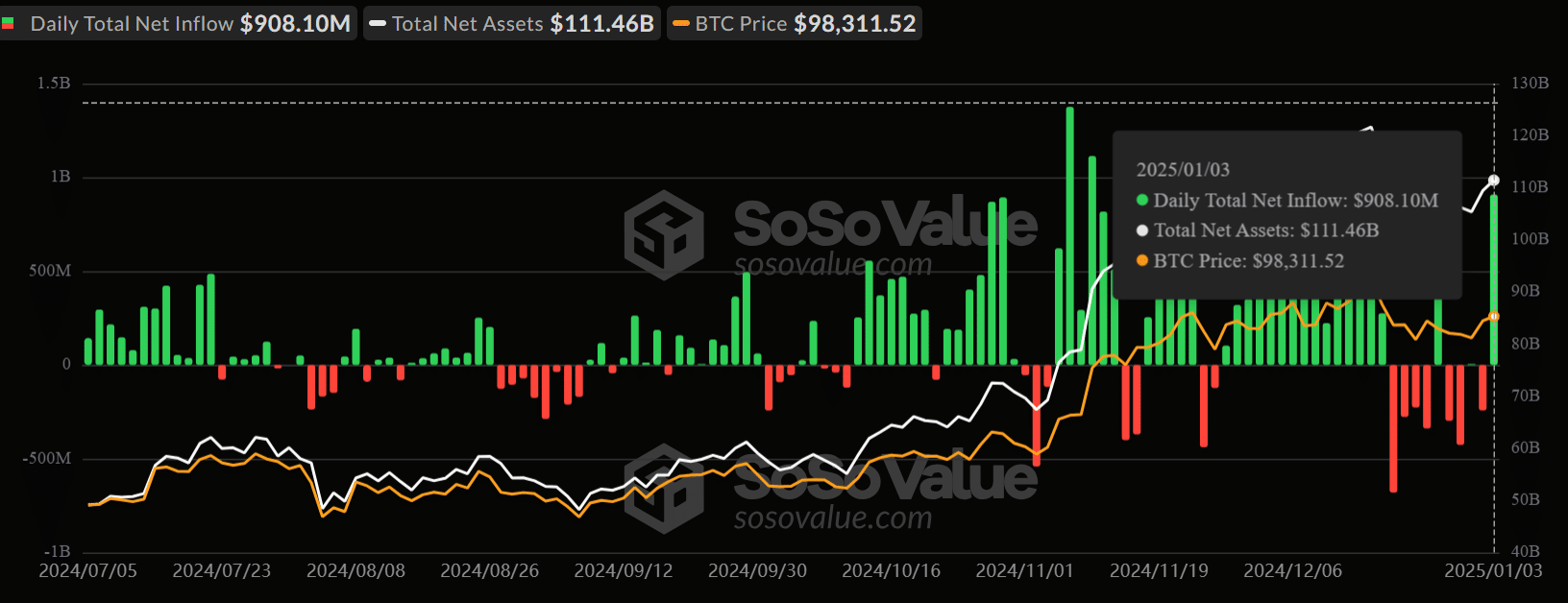

The trend was also evident across the U.S BTC ETFs complex. They raked in $908M in daily net inflows on Friday, marking a monthly high.

In fact, even BlackRock’s IBIT, which began the year with outflows, saw $253M in inflows on Friday.

Source: Soso Value

Fidelity’s FBTC led the demand with $357M and Ark Invest’s ARKB came in third with $222M inflows. Collectively, this indicated that institutional demand was back and aided BTC’s steady push to $98.9k.

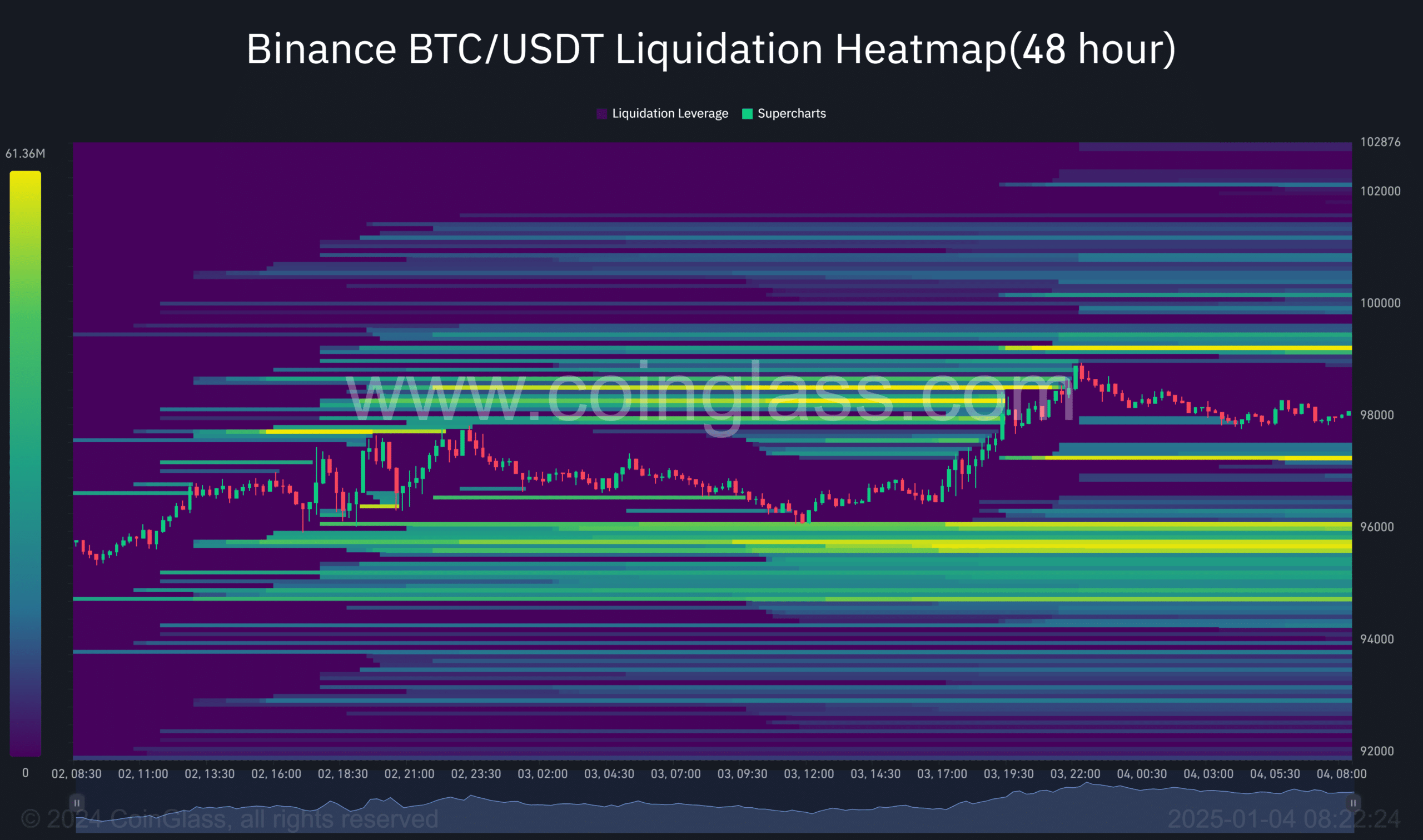

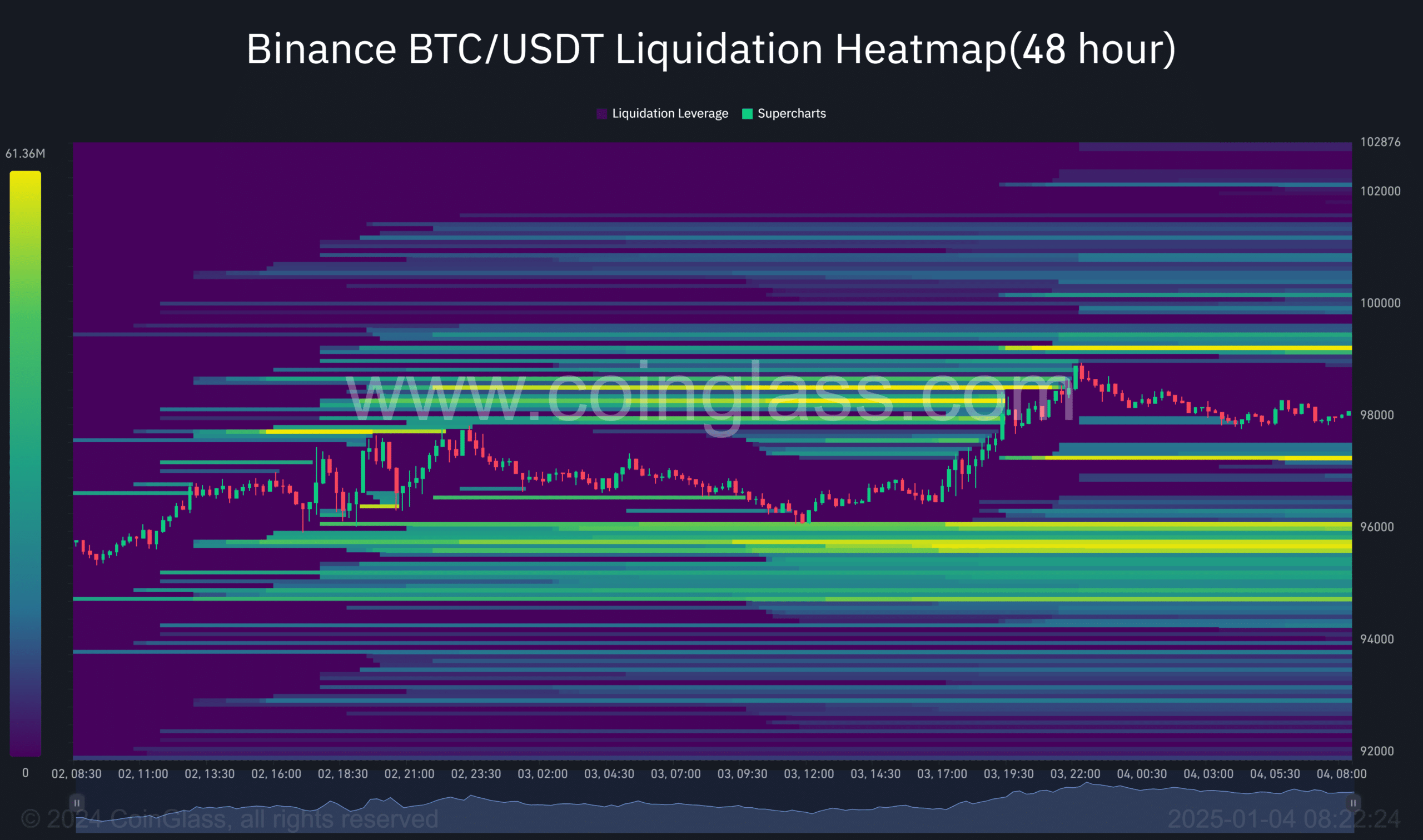

Besides, the extended recovery was driven by a liquidity hunt as a huge pile of short positions was located at the $98k-level earlier in the week. Now, the upside liquidity is located between $99k and $100k.

Similarly, lower liquidity levels (bright yellow zones) seemed to be located at $97.2k, $96k, and $95k.

Source: Coinglass

Given that more liquidity seemed to be concentrated on the lower side of the price action at press time, a drop towards $97K-$95K can’t be overruled.

Read Bitcoin [BTC] Price Prediction 2025-2026

Put differently, the liquidation heatmap suggested that BTC could enter a price range between $96k and $100k in the short term.

However, it remains to be seen whether strong BTC ETF demand will trigger a bullish breakout above $100k.