- Bitcoin and Ether drop amid U.S. trade tariff announcement, triggering significant market volatility.

- Despite the downturn, Bitcoin held above $90K, with many investors urging to “buy the dip.”

Amid escalating concerns over a potential global trade war, Asian stock markets experienced significant declines.

This followed U.S. President Donald Trump’s announcement of sweeping tariffs on Canada, China, and Mexico. The economic uncertainty sent shockwaves through the markets, affecting cryptocurrencies as well.

Major digital assets, including Bitcoin [BTC] and Ethereum [ETH], witnessed steep drops. BTC briefly fell to a three-week low of $91,441.89, while ETH plummeted by 24%, reaching its lowest value since September.

The downturn continued into the weekend, with Bitcoin slipping further by 7%. The CoinDesk 20 Index, which tracks the top 20 cryptocurrencies, saw a sharp 19% drop.

As investor sentiment weakened, concerns about future stability have risen.

Tariff war sends shockwaves in crypto

In fact, the crypto market has experienced its largest liquidation to date.

Commenting on this, a crypto investor known as ‘The Wolf of All Streets’ pointed out,

“$2B liquidated in 24 hours. That’s a record. More than the Covid dump. More than the FTX collapse. Epic.”

Adding to the fray was another X (formerly Twitter) user who said,

“Be fearful when others are greedy, be greedy when others are fearful.”

However, despite the recent downturn, Bitcoin has managed to hold above the $90K mark. As per CoinMarketCap, BTC was trading at $95,375, at press time, after a 4.36% drop in the past 24 hours.

While some investors, like ‘The Wolf of All Streets,’ expressed cautious optimism about further price dips, emphasizing a reluctance to sell in such an oversold market, the broader crypto community remains hopeful.

Community stays positive amidst massive crypto liquidation

Many are urging others to ‘buy the dip,’ suggesting a positive outlook for Bitcoin’s long-term potential even amidst the current volatility.

Source: Kiwi/X

Echoing similar sentiments was another X user who added,

“I haven’t lost hope in the market yet, I’d say this was just a MASSIVE liquidity sweep, BTC has bounced off a long term support.The whole market is oversold.”

He continued,

“I wouldn’t be surprised if the market continues downwards but we will see a recovery withing the coming week.”

Source: Thread

Recently, Robert Kiyosaki, renowned author of Rich Dad, Poor Dad, described Bitcoin’s recent dip following Trump’s tariffs as a “buying opportunity.”

He sees this market correction as an attractive chance for investors.

However, Kiyosaki also emphasizes that the U.S. fiscal debt remains a far more pressing issue, one that will continue to drive interest in assets like Bitcoin, gold, and silver as safe havens during times of financial uncertainty.

He said,

“Trump tariffs begins: Gold, silver, Bitcoin may crash. Good. Will buy more after prices crash. Real problem is DEBT…which will only get worse. Crashes mean assets are on sale. Time to get richer.”

What lies ahead for Bitcoin?

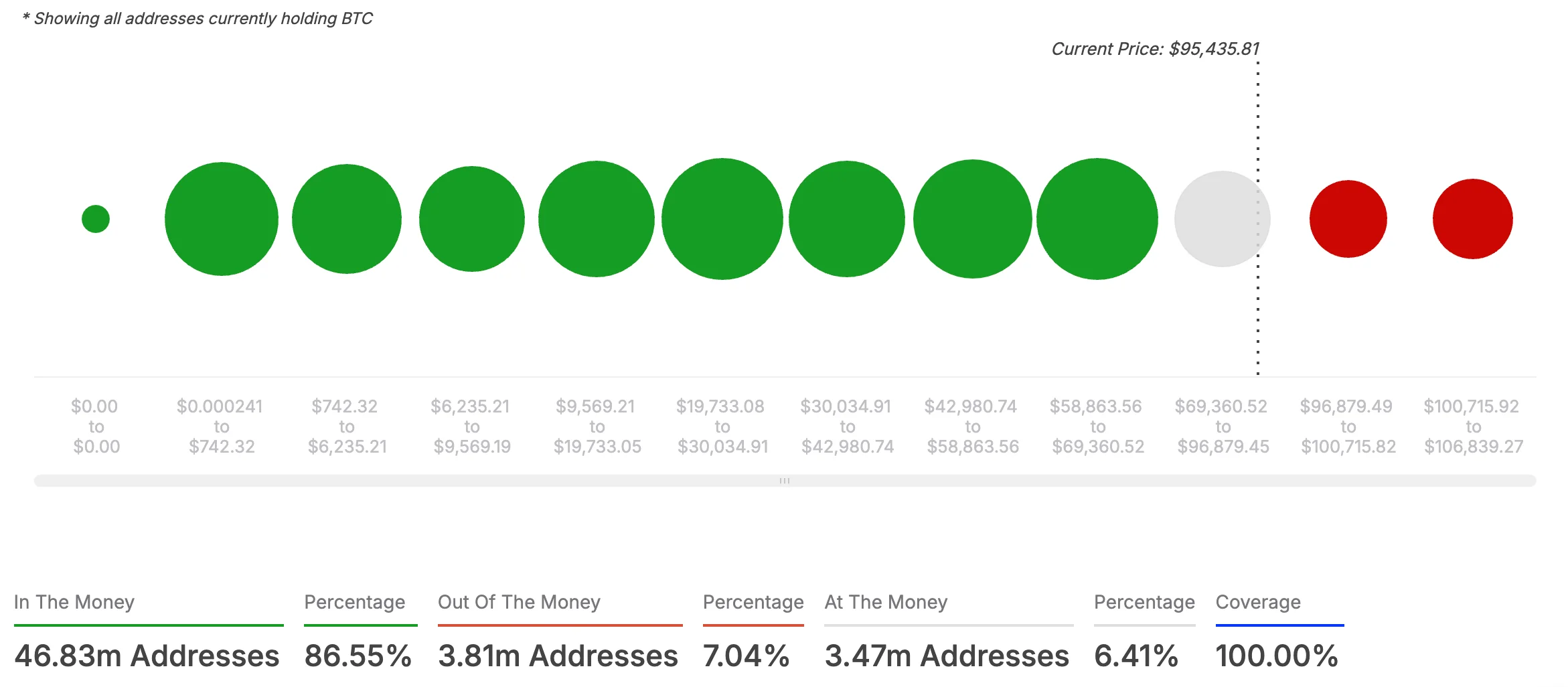

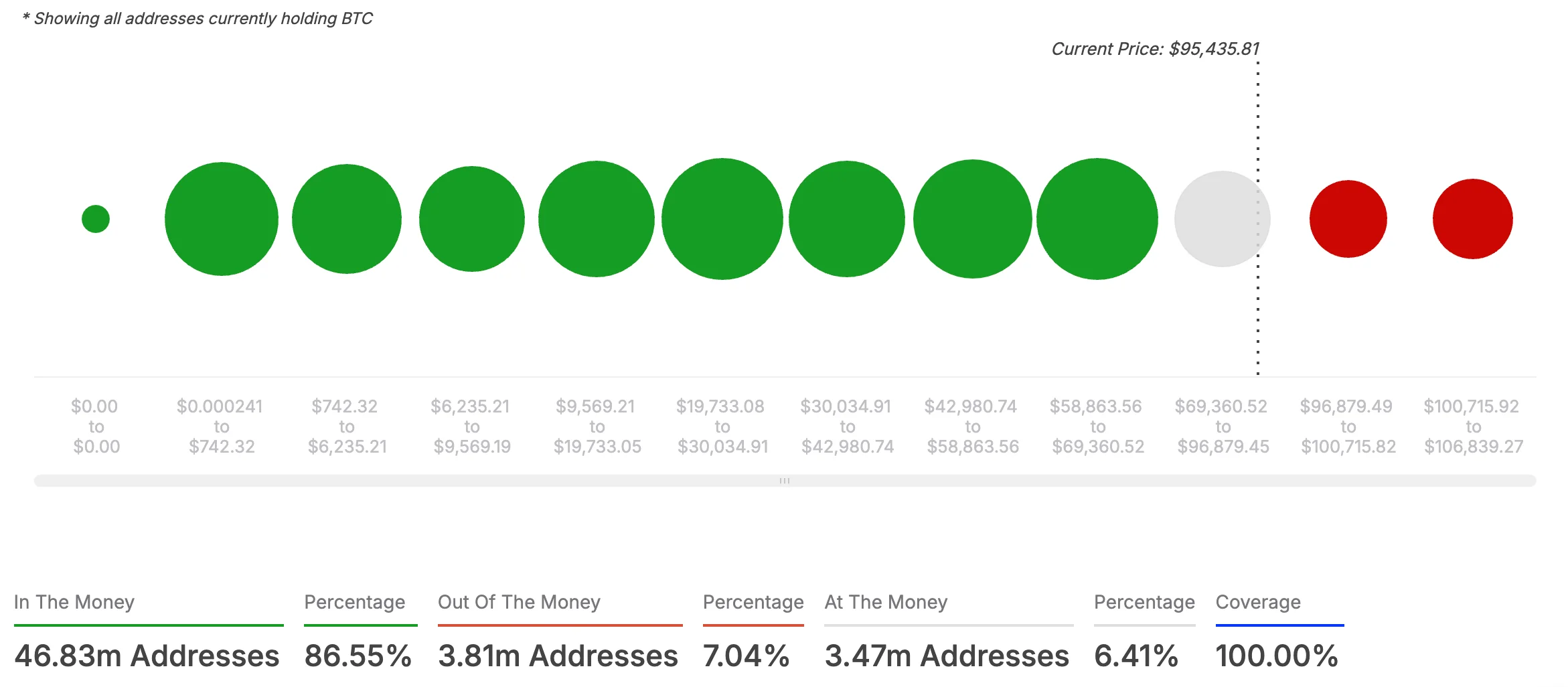

Additionally, recent data from AMBCrypto, based on IntoTheBlock’s insights, reveals a largely positive sentiment in the Bitcoin market.

A significant 86.55% of Bitcoin holders are currently “in the money,” holding tokens valued above their purchase price, which signals optimism and potential for a price surge.

In contrast, only 7.04% of holders are “out of the money,” with their tokens valued lower than their original purchase price.

Source: IntoTheBlock

This disparity reflects growing bullish sentiment in the cryptocurrency community, despite external pressures like rising trade tensions and market volatility.

When comparing recent events to major market crashes in cryptocurrency history, the liquidation figures during the FTX collapse in November 2022 are particularly notable.

In that instance, the market saw over $2.8 billion in liquidations within 24 hours, surpassing even the $1 billion liquidations during the COVID-19 market downturn in March 2020. This highlights the severity of market reactions to significant events.

It also serves to underline the resilience of the crypto market, with many investors continuing to see Bitcoin and other digital assets as long-term opportunities despite the ongoing volatility.