- Biggest Gainers: Mantra [OM], Kaspa [KAS], and Sonic [S].

- Biggest Losers: Bitget Token [BGB], Onyxcoin [XCN], and Ethena [ENA].

The cryptocurrency market remains a battleground of volatility, with some tokens soaring to new heights while others face sharp declines.

This week has been no exception, with notable winners riding bullish momentum and struggling assets succumbing to selling pressure.

Here’s a comprehensive breakdown of the biggest gainers and losers over the past seven days.

Biggest winners

Mantra [OM]

MANTRA [OM] continues its impressive rally, securing the top spot for the third consecutive week with a strong 26% gain, as prices surged from $5.90 to $7.54.

The token’s persistent dominance underscores exceptional market strength and growing institutional interest.

The week started with OM consolidating around $5.90, displaying relatively quiet price action until the 14th of February.

However, the 15th of February marked a turning point as prices exploded upward, breaking multiple resistance levels to reach $7.65.

Trading volume surged to 549.34K OM, validating the strength behind this upward move.

Source: TradingView

From a technical standpoint, OM remained well above its 50-day [$5.38] and 200-day [$4.01] moving averages, maintaining a robust bullish structure.

The significant gap between its current price and these averages signaled strong momentum, though some caution is warranted for potential overextension.

OM was stabilizing near $7.54 as of this writing, with a minor -0.57% adjustment as traders absorb recent gains.

Its ability to top the weekly gainer list for three straight weeks is a rarity in the crypto market, highlighting sustained buyer conviction.

Key support stood at $7.00, which could act as a solid foundation for any short-term retracements.

Kaspa [KAS]

Kaspa [KAS] made an impressive recovery this week, rising 25.6% from $0.087 to $0.109. This rebound is particularly significant, considering last week’s price decline.

KAS found initial support at $0.087, leading to a steady climb. A surge on the 11th of February pushed prices to $0.105, establishing a new support zone.

While mid-week volatility saw fluctuations near $0.095, buyers remained in control, maintaining bullish momentum.

At press time, it was consolidating at $0.109, and KAS continues to establish higher lows, reinforcing renewed market confidence.

While some profit-taking at this level is expected, the steady accumulation and strong buying pressure indicate the uptrend might persist.

Sonic [S]

Sonic [S], formerly FTM, posted a 25.3% gain, climbing from $0.41 to $0.51. This well-structured recovery follows recent market turbulence.

The week began with sideways movement near $0.41, before a breakout on the 13th of February propelled Sonic to $0.56 amid strong trading activity.

Although some profit-taking emerged, buyers maintained control of the trend.

As of this writing, it was around $0.51, with support forming at higher levels, Sonic’s momentum appears sustainable.

The measured pace of its advance suggests genuine accumulation rather than speculative surges. If buying interest continues, further upside potential remains in play.

Top 1,000 gainers

Beyond the top performers, the broader market saw notable surges.

Unchain X [UNX] led the top 1,000 tokens with a 387% gain, while TRUST AI [TRT] and STURDY [STRDY] followed closely, posting 384% and 113% gains, respectively.

Biggest losers

Bitget Token [BGB]

Bitget Token [BGB] suffered a 24.3% decline, dropping from $6.45 to $5.05, as selling pressure dominated throughout the week.

The decline accelerated on the 12th of February, breaking key support levels and triggering further sell-offs. Each attempted bounce faced strong resistance, forming a pattern of lower highs and lower lows.

Currently struggling around $5.05, any recovery would require reclaiming $5.50 to stabilize. However, the sustained selling pressure suggests further downside risk.

Onyxcoin [XCN]

Onyxcoin [XCN] was the second-worst performer, dropping 14.6% from $0.026 to $0.023. The privacy-focused token failed to maintain momentum, encountering consistent downward pressure.

A steep decline on the 11th and the 12th of February pushed ONYX to $0.020, before a brief rebound to $0.025. However, the lack of sustained buying interest caused the price to slide back down.

Trading volume remained steady, suggesting a sustained bearish trend rather than panic selling.

The $0.022 support level is now critical—if breached, another wave of selling could occur. Conversely, for any recovery, ONYX must hold above $0.025.

Ethena [ENA]

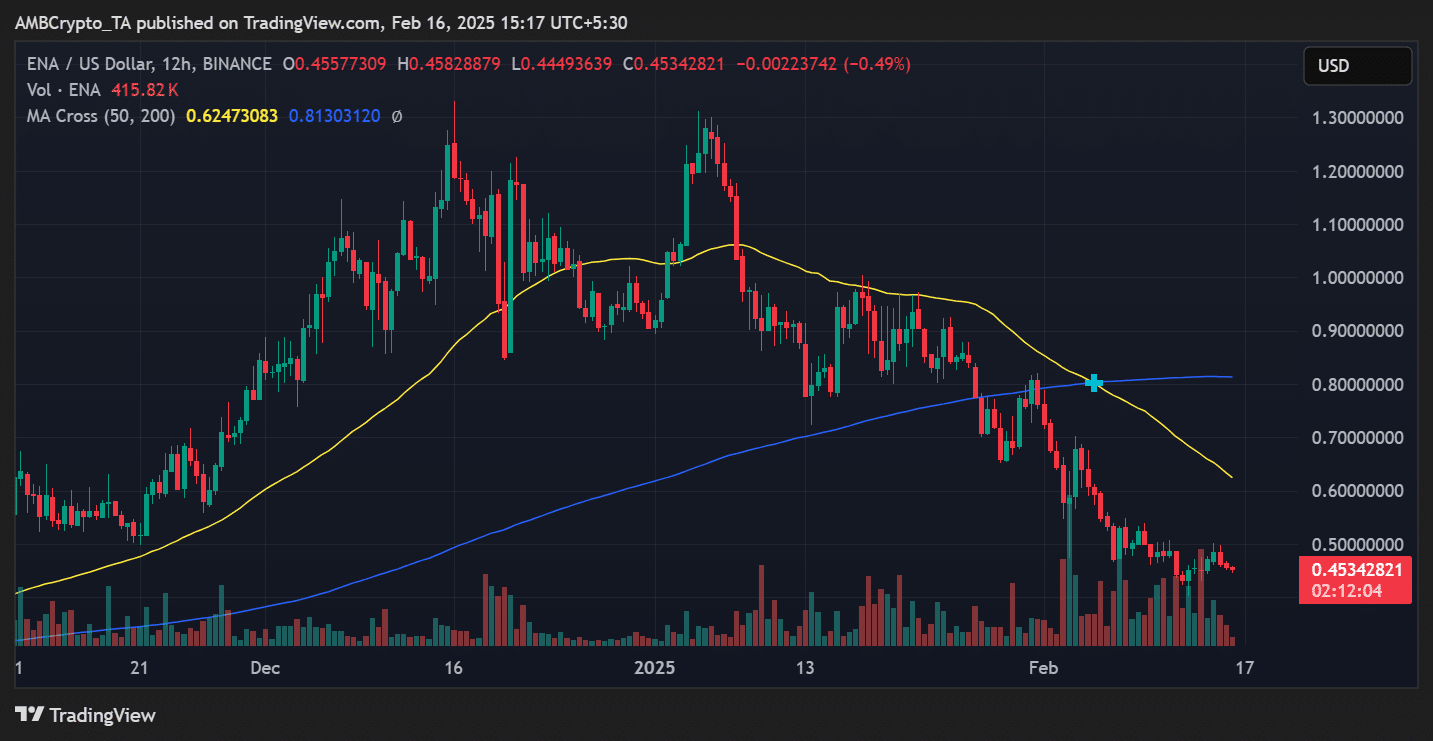

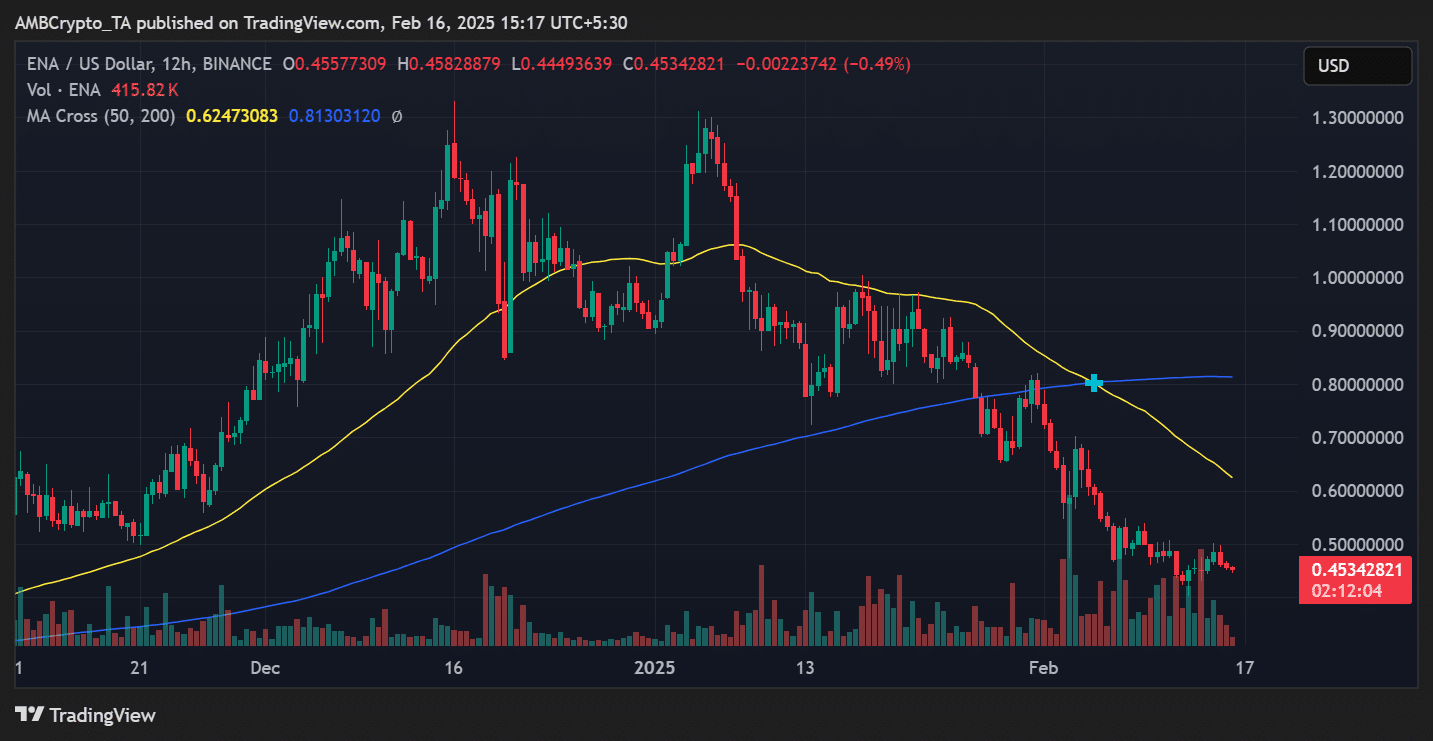

Ethena [ENA] emerged as this week’s third-biggest crypto loser, recording a sharp 11% decline from $0.50 to $0.45.

The protocol’s native token faced intense selling pressure, particularly following its recent attempts to stabilize above the crucial $0.48 mark.

The weekly price action revealed a concerning technical setup, with ENA’s chart forming a series of lower highs and lower lows.

The most significant breakdown occurred on the 12th of February, when the token plunged to $0.42, marking the week’s lowest point. Though buyers stepped in to initiate a recovery, the bounce proved short-lived.

A deeper look at the technical indicators showed the 50-day moving average crossing below the 200-day MA, forming a bearish crossover that typically signals sustained downward momentum.

Trading volume has remained notably elevated during the decline, suggesting strong conviction behind the selling pressure.

Source: TradingView

While ENA managed to stage a brief recovery midweek, climbing back to $0.48 on the 14th of February, the token failed to hold these gains.

Sellers quickly regained control, pushing the price back down to the current $0.45 level. The consistent rejection at higher prices points to significant overhead resistance.

The $0.44 level emerges as a critical support zone for traders eyeing potential entry points. A break below could trigger another wave of selling, potentially testing the recent lows.

Conversely, bulls need to reclaim and hold above $0.48 to indicate any meaningful trend reversal.

Top 1,000 losers

In the broader market, TEST [TST] led the declines with a 78% drop, followed by 360noscope420balzeit [MLG] and Vine [VINE], which fell 53% and 50%, respectively.

Conclusion

Here’s the weekly recap of the biggest gainers and losers. It’s crucial to bear in mind the volatile nature of the market, where prices can shift rapidly.

Thus, doing your own research [DYOR] before making investment decisions is best.