- Solana’s breakout appeared to be more than justified as it reclaimed dominance across key metrics

- Resurgence came on the heels of a swift rebound from recent market FUD

Solana [SOL] made a significant move this week, surging by over 20% to hit $130. This upward momentum placed SOL ahead of many high-cap cryptocurrencies, swiftly recovering from the recent FUD that gripped the market.

Notably, Solana’s relative strength against Ethereum [ETH] became increasingly clear, with the SOL/ETH pair breaching its early-February resistance.

Supporting this outperformance, Solana’s DeFi revenue surpassed Ethereum’s all-time cumulative total, with $2.56 billion in lifetime fees compared to ETH’s $2.27 billion.

All in all, with soaring revenues, a surging SOL/ETH ratio, and unmatched transaction throughput, Solana’s breakout might be well-earned. But, can the bulls seize the moment?

Solana’s Q1 struggles – A look back

Solana ended Q1 with a drawdown of over 30%, underperforming most large-cap peers. In fact, the weakness wasn’t limited to its price action alone, it extended to structural metrics as well.

Notably, SOL forfeited its $100 billion market cap threshold, slipping behind Binance Coin [BNB] to become the sixth-largest crypto asset.

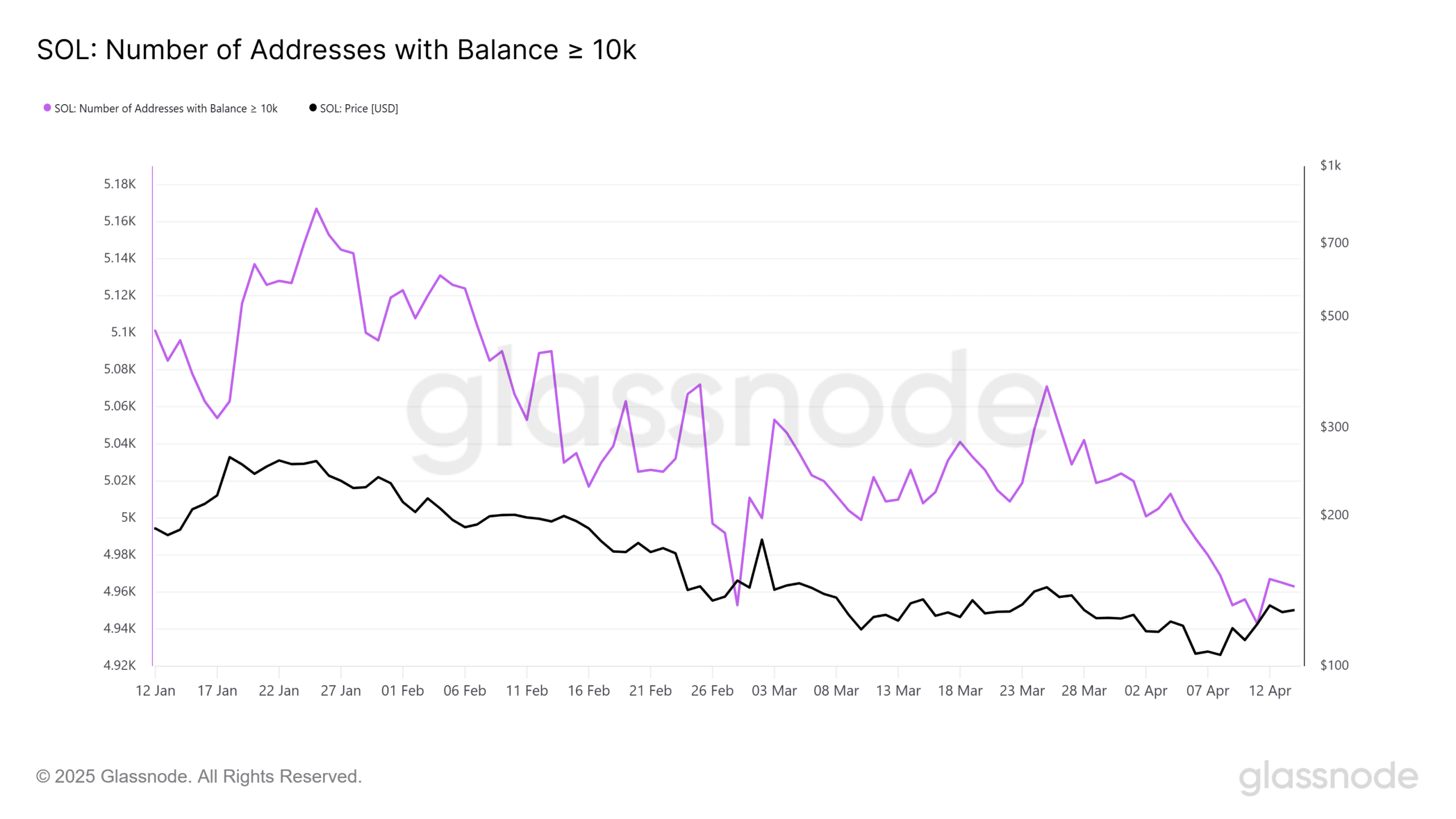

Furthermore, on-chain flows showed millions of SOL tokens being unstaked, triggering a supply overhang. This coincided with an aggressive whale distribution patterns, tipping the balance decisively towards sell-side dominance.

Source: Glassnode

In short, Q1 marked a period of sustained structural unwinding for SOL, with bearish liquidity dynamics overpowering any signs of bullish absorption.

A trend reversal is now critical to validate the patience of both short and long-term holders (HODLers) who navigated through this high-volatility FUD cycle.

Solana’s on-chain dynamics, with Total Value Locked (TVL) spiking to an April high of $8.54 billion, seemed to hint at a potential turning point at press time.

Months-long patience finally about to pay off?

With Solana reclaiming its earlier dominance across both technical and on-chain fronts, speculation is mounting around a potential breakout. While the setup might be increasingly constructive, a decisive move still requires validation.

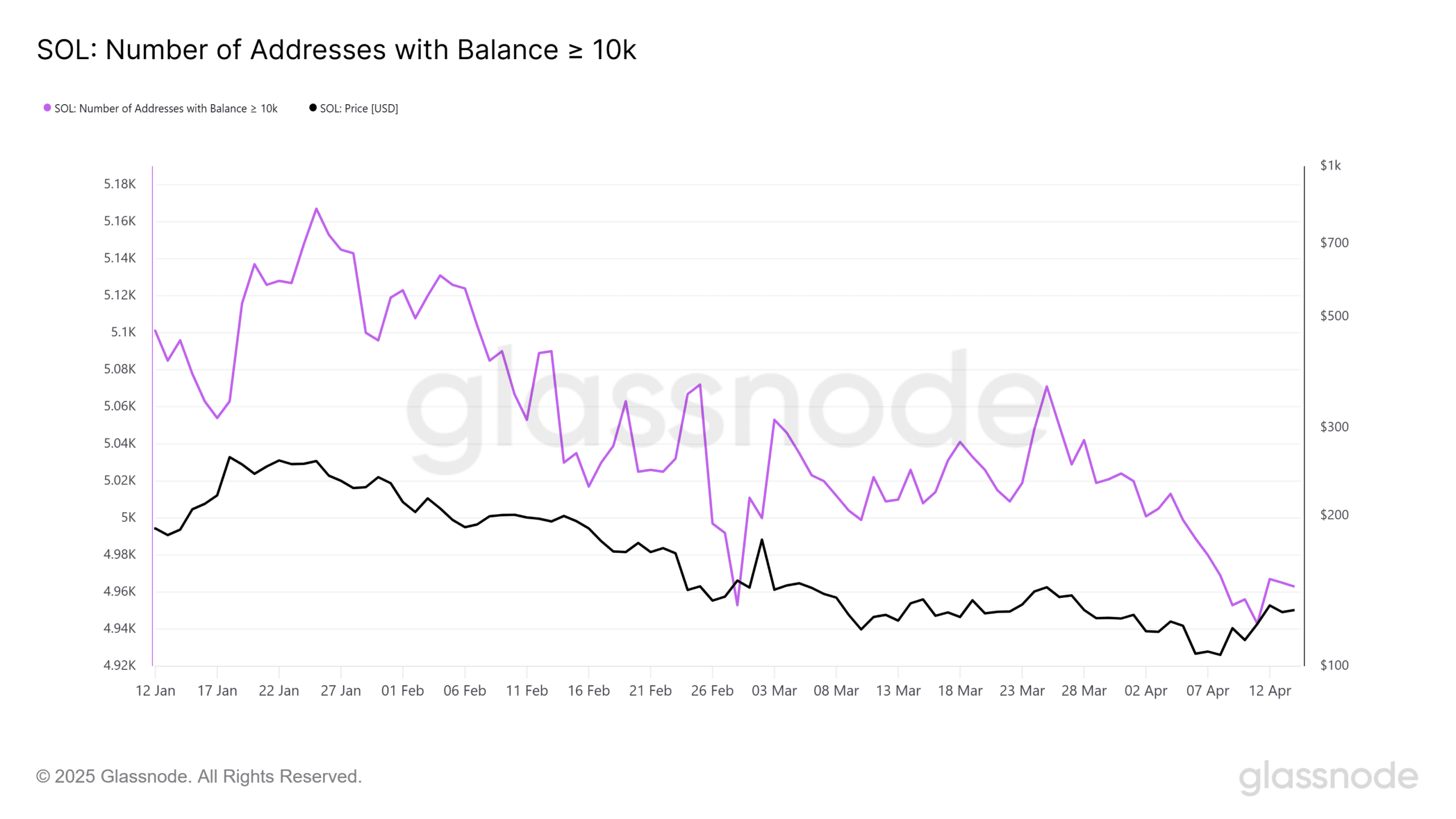

Notably, Solana’s HODLer Net Position Change flipped firmly into positive territory. This indicated sustained net inflows into long-term wallets.

In fact, the press time market trend marked the longest accumulation streak in over six months – Reflecting rising conviction in Solana’s macro narrative.

Source: Glassnode

Historically, such structural accumulation phases have aligned with cyclical bottoms, often preceding impulse rallies. However, unlike previous cycles, the divergence between long-term accumulation and retail dormancy has been notable.

Specifically, new address creation declined to a six-month low. This reflected subdued grassroots participation.

In effect, Solana may be undergoing a phase of structural reaccumulation, with the near-term price action likely to remain range-bound. Until retail activation resumes.

Until then, long-term holders will continue to shoulder the weight of market inertia – with their patience likely to face further tests.