- Dogecoin has been trading at 7-year channel support, historically a high-probability reversal zone

- Funding rate patterns suggested whales added long exposure during sharp sell-offs

Dogecoin [DOGE] was trading at $0.1739 on 02 April, before the full impact of ‘Liberation Day’ tariffs pulled it down by another 2% on the charts.

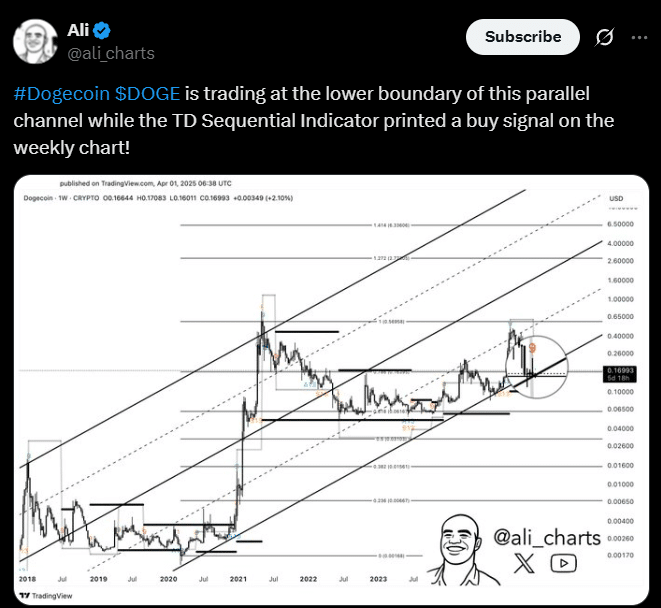

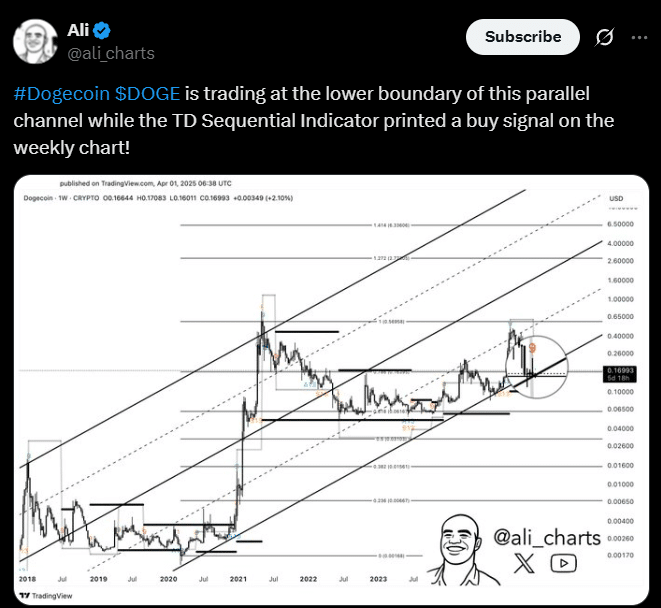

In fact, the memecoin is now sitting directly on a technical support that has held on for seven years. This long-term boundary, formed by a rising parallel channel, has defined the memecoin’s price action since 2018.

According to Ali Martinez, the latest TD Sequential indicator on the weekly chart just issued a buy signal. Historically, this pattern has preceded major price reversals in crypto markets.

Source: X

Double trouble or double signal?

In fact, the buy trigger appeared at the same time as DOGE tested the lower line of its channel. Naturally, it creates a high-probability setup, where two independent signals align.

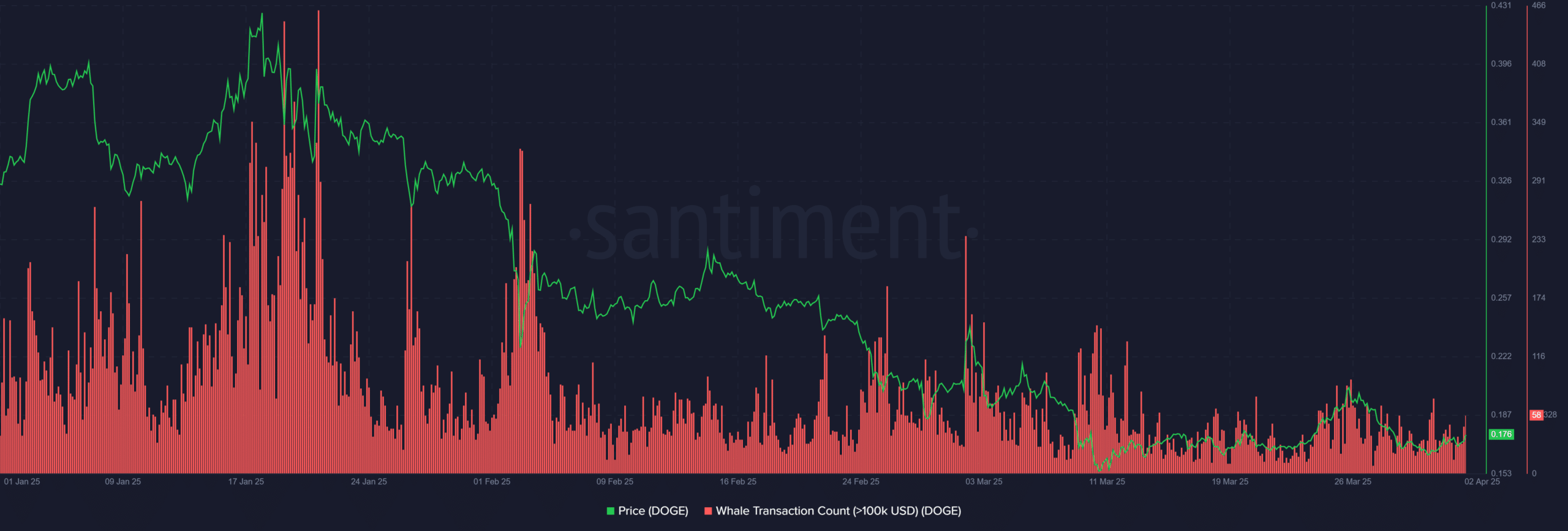

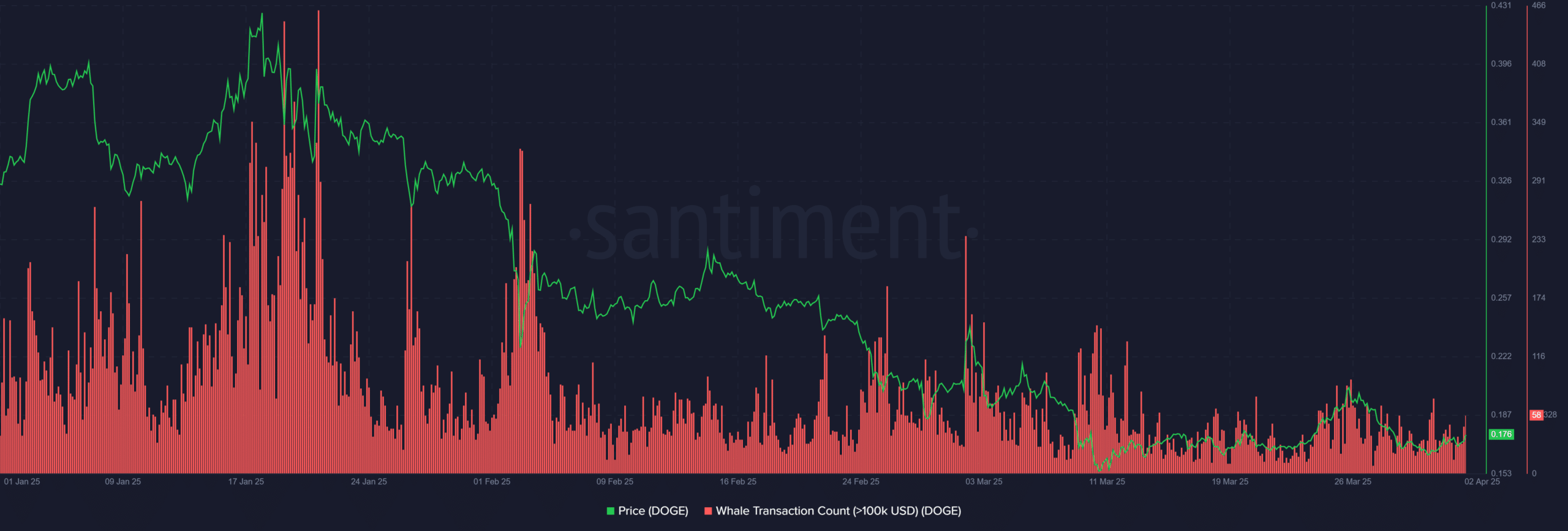

On-chain activity seemed to support this technical view too.

Source: Santiment

Between 11 and 25 March, whales acquired 220 million Dogecoin — A net inflow that represented 0.17% of total circulating supply.

This accumulation occurred while DOGE rose from $0.15 to $0.19 – A 26% gain. It happened as the asset reached the same channel support that has sparked previous rallies.

The holdings tracked in the chart reflect wallets containing 1M–10M DOGE. Activity in these brackets surged throughout the month.

Dogecoin funding rates whisper before the storm

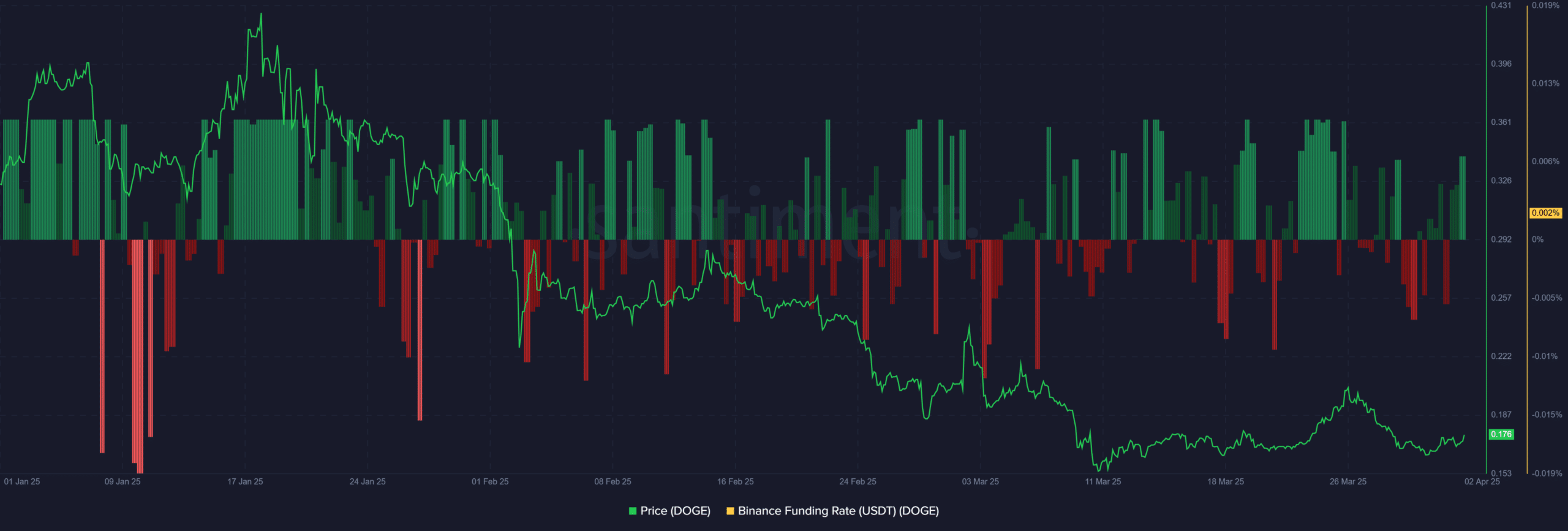

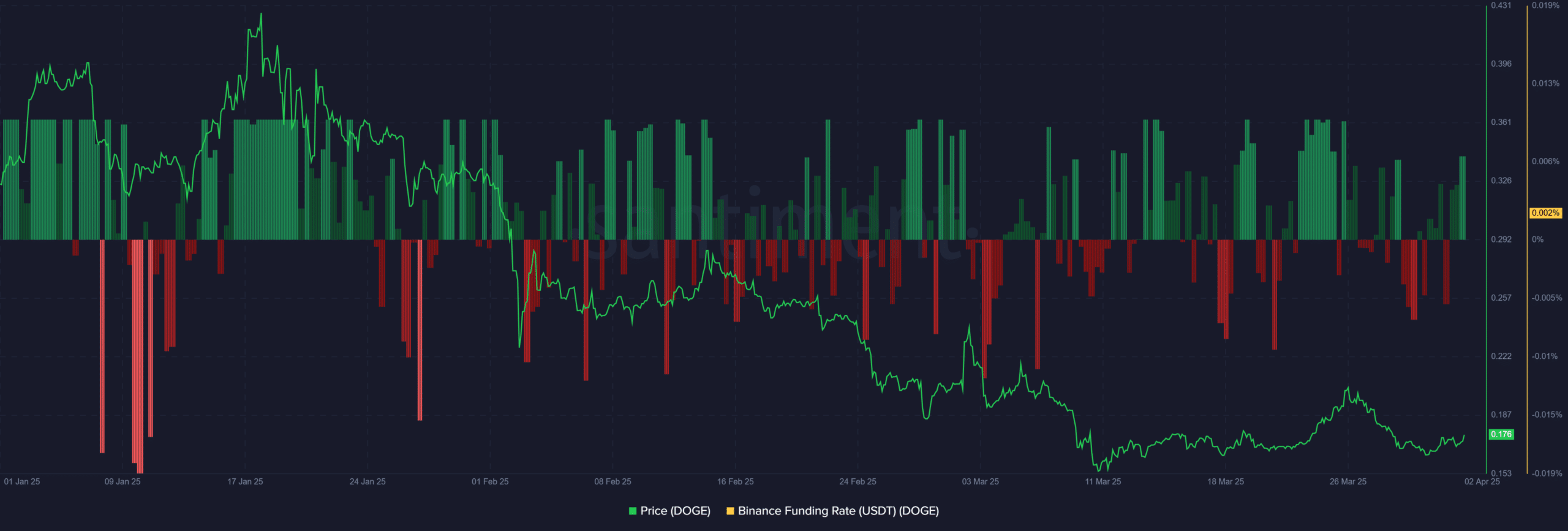

Moreover, funding rates turned positive near that low, marking a possible inflection.

Source: Santiment

The chart data also revealed a strong inverse relationship between funding rates and price trends. In January and March, for instance, spikes in negative funding aligned with sharp declines in DOGE.

Conversely, positive funding periods saw temporary price stabilizations.

Despite these fluctuations, however, positive funding rates occurred more frequently than negative ones. This hinted at underlying long interest from larger traders throughout the downturn.

History rhymes, but doesn’t repeat — Will it this time?

Looking forward, if historical behavior repeats itself, DOGE could target the channel midpoint — Estimated at around $0.65. That would reflect a gain of approximately 270% from its press time price.

However, if DOGE fails to hold the $0.16 support, prior patterns would highlight the risk of a 26% to 44% drawdown.

These downside projections are based on previous “death cross” scenarios that triggered breakdowns from similar positions.