- Whale activity raised speculation about WIF’s potential reversal amid declining market performance.

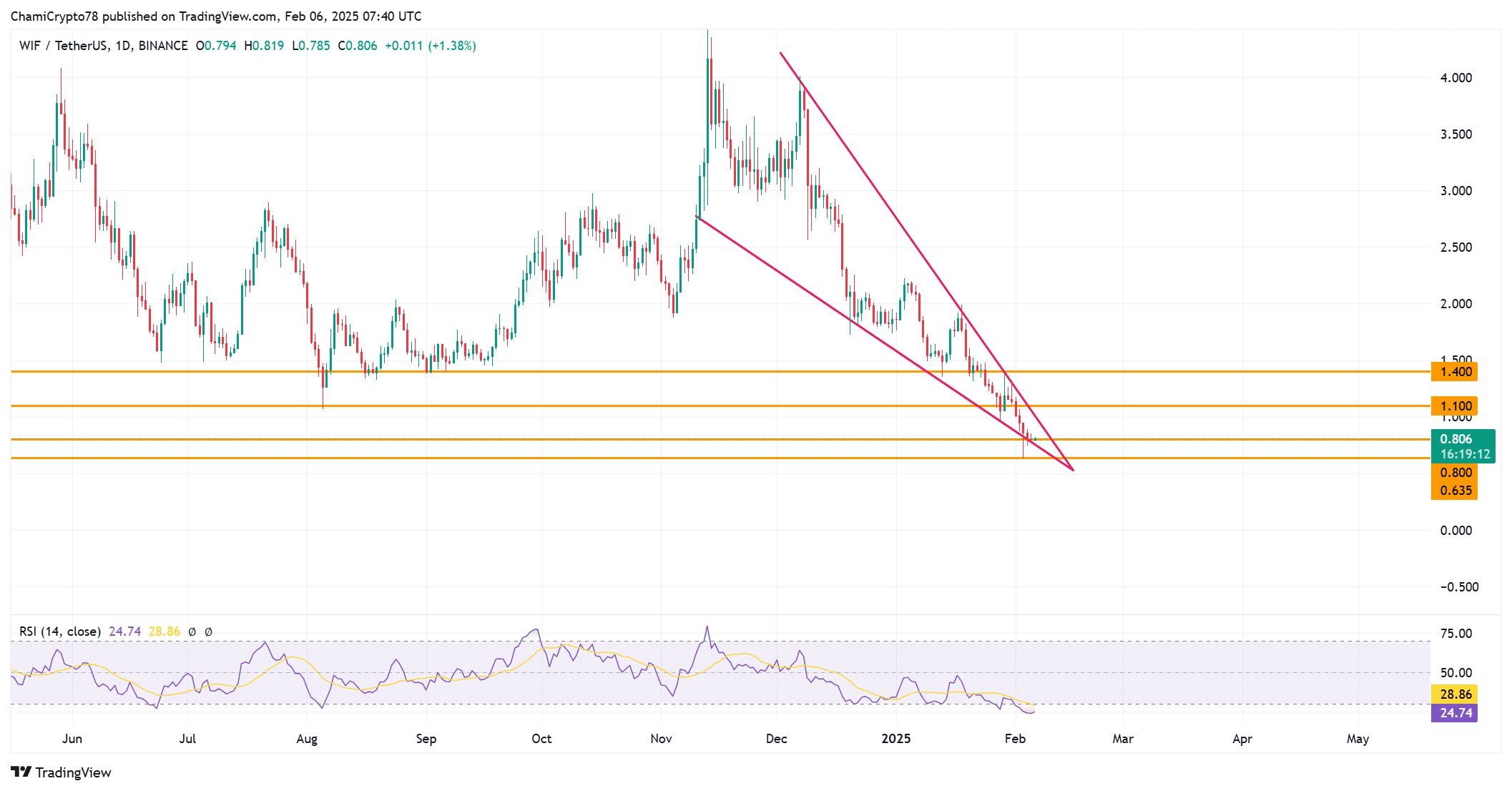

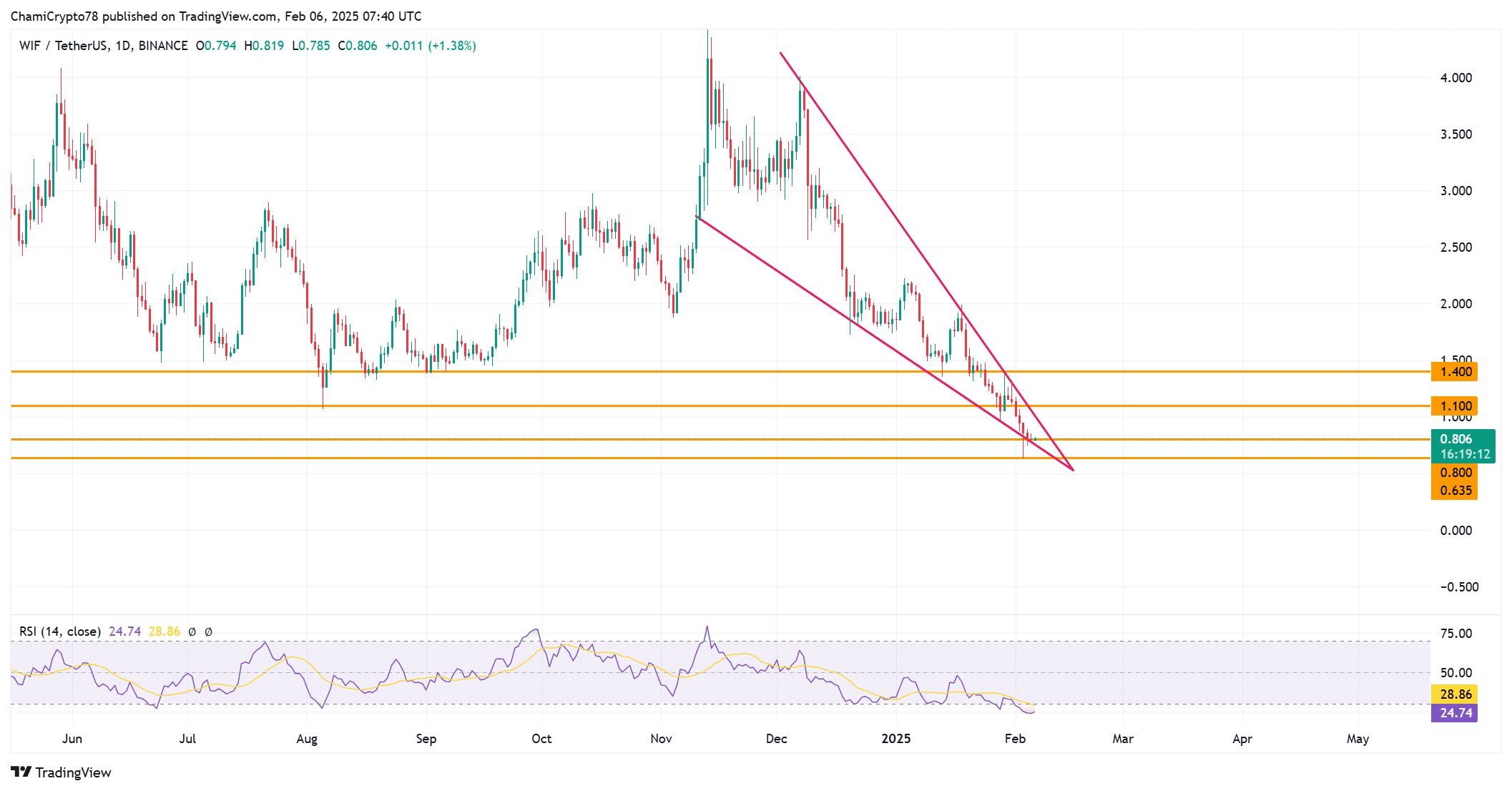

- WIF was consolidating in a bullish pennant while testing crucial support levels at $0.80.

A wallet dormant for two years moved 6.5 million WIF, worth $5.21 million, from Binance, sparking speculation about its impact on the dogwifhat [WIF] market.

This unexpected whale activity has raised questions about whether it marks the beginning of a significant market shift or is just a temporary event.

Traders are now closely watching WIF’s price action to determine the next direction for the token. Could this sudden movement indicate a larger market shift, or is it just a one-off event?

Testing key support levels

WIF has plunged into oversold territory, currently testing the critical $0.80 support level. After losing the $1.40 mark, the price saw a sharp decline, extending as low as $0.64.

The Relative Strength Index (RSI) indicates that the token remains oversold, which suggests a potential for a reversal. However, a true price recovery will require WIF to reclaim the $1.10 resistance level.

At the time of writing, the token was consolidating within a bullish pennant flag pattern, often seen before a breakout, but the market’s next moves will depend on whether the support holds at $0.80.

Source: TradingView

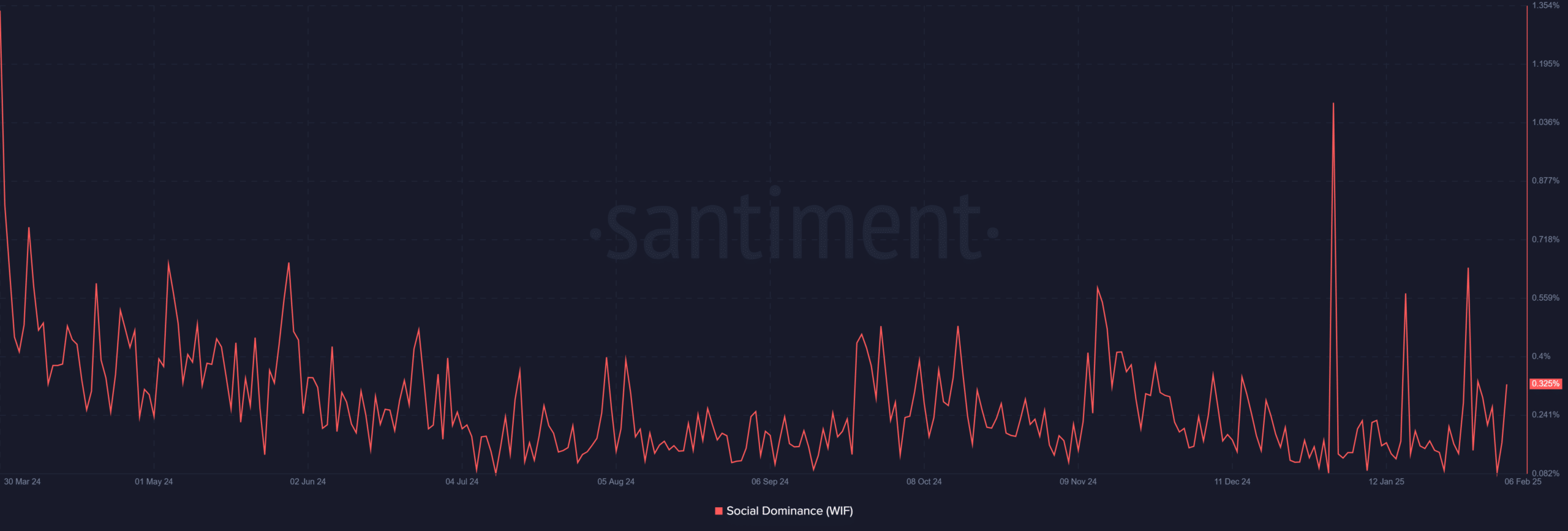

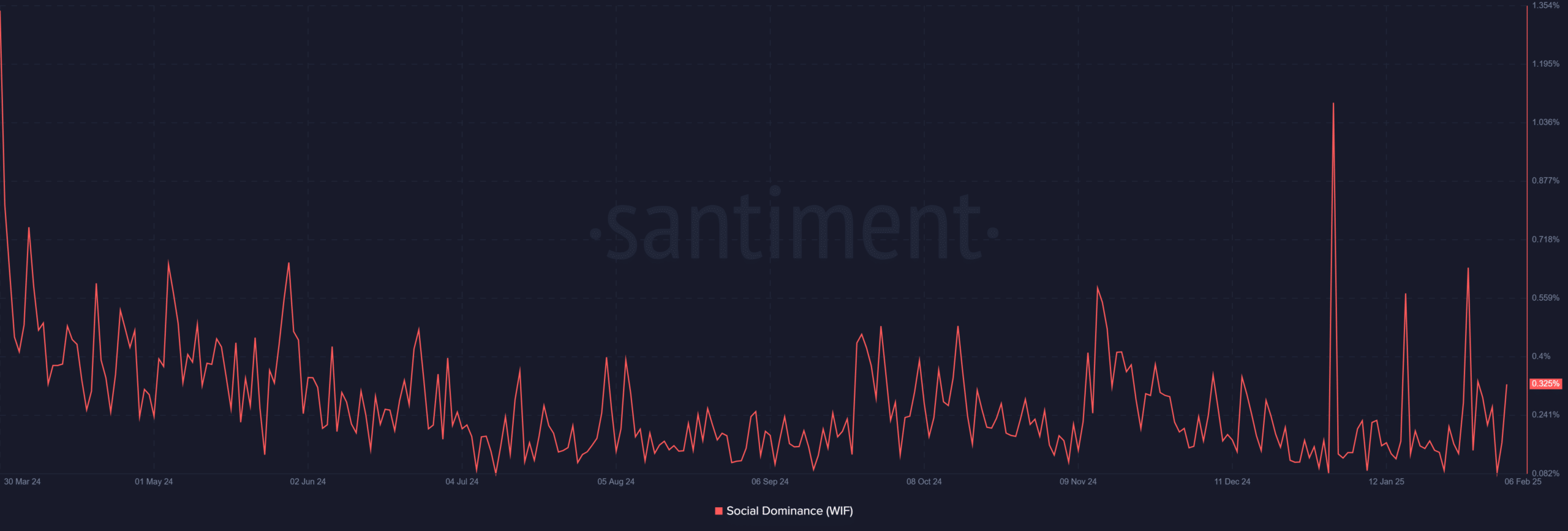

Social dominance: Rising steadily after a dip

Social dominance for WIF has been rising steadily after reaching lower levels. This increase in social mentions indicates a growing interest from retail investors, which could provide a boost to the token’s price.

However, while the rise in social dominance can correlate with price movements, it is uncertain whether this attention will translate into sustained buying pressure.

Traders will need to watch if this increase in mentions leads to real market momentum or fades away as quickly as it surges.

Source: Santiment

Bullish indicators amid the downtrend

The Stochastic RSI shows signs of bullish divergence, hinting at a potential reversal. This technical indicator suggests that WIF might be preparing for a bounce, although it will require further confirmation.

Additionally, the Moving Averages (MA) cross between the 9-period and 21-period MA provides a mixed signal.

While the MA indicates some recovery, the market needs to see consistent price action above $0.80 to confirm a reversal.

Source: TradingView

Liquidations and Open Interest reflect caution

Market sentiment for WIF remains largely bearish. The token has seen over $1.78 million in total liquidations, with the majority coming from short positions. Additionally, Open Interest (OI) has decreased by 5.79%, signaling reduced trader enthusiasm.

This cooling of interest reflects market uncertainty and caution, as traders remain hesitant to take strong positions either way.

Source: Coinglass

WIF faces crucial test for recovery

WIF is at a crucial moment. While the whale activity and technical signals show potential for a reversal, reclaiming key resistance levels will be essential.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

Social dominance and the Stoch RSI indicate some promise, but the overall market sentiment remains cautious.

Traders will need to closely monitor price action in the coming days to see whether WIF can mount a recovery or continue its downward trend.