- dogwifhat rallied 18.56% to a three-week high of $0.9558, then retraced to $0.94 at press time.

- WIF buyers stepped in to accumulate over 72 million tokens over the past 48 hours.

dogwifhat [WIF] soared 18.56% to hit a local high of $0.9558 before slightly retracing to $0.94 by the time of writing.

Over the same period, the memecoin followed suit, hiking by 159% to $603.7 million at press time, reflecting strong on-chain activity. But, is this the start of sustained gains or a mere technical bounce?

dogwifhat buyers make a strong comeback

Before the recent price rebound, sellers had total control of the market, with selling volume consistently outpacing buyers. But over the past day, the power dynamics in the market shifted dramatically.

At press time, Coinalyze reported that dogwifhat saw 9.44 million in buy volume compared to 8.88 million sell volume, signalling a strong shift in market dynamics.

Source: Coinalyze

Similarly, the same pattern emerged the previous day, with the memecoin recording 63 million in Buy Volume relative to 61 million in Sell Volume.

As a result, the market recorded two consecutive days of a positive delta of 2.3 million and 563k, respectively.

Such a strong hike in buying pressure typically reflects growing demand with fresh capital flowing into the market.

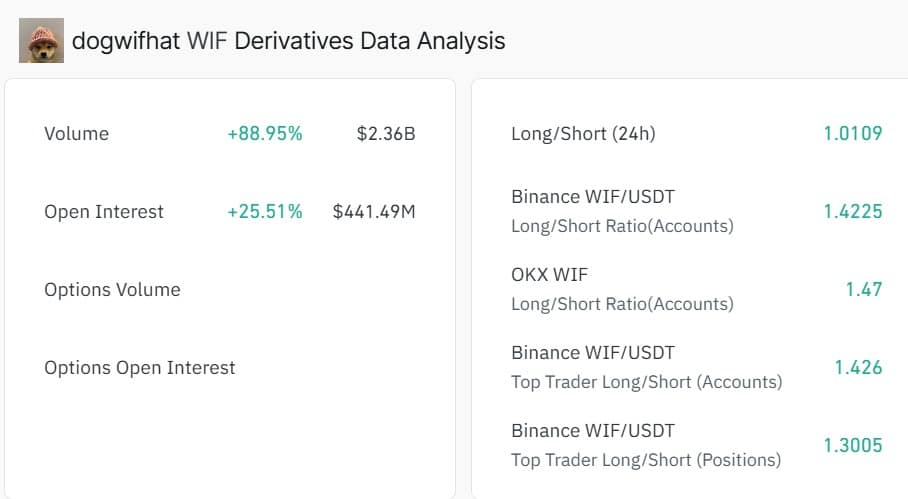

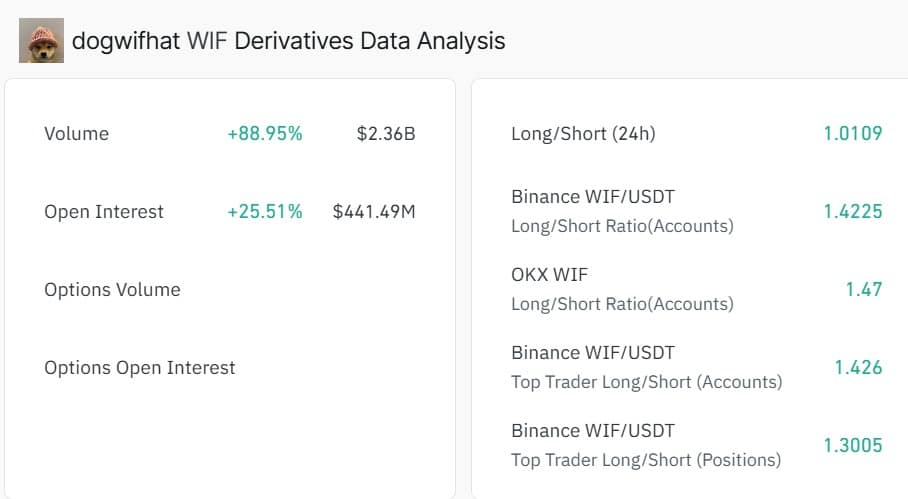

Futures are not left behind

Significantly, when we look at the Derivatives Market, we see that these buyers rushed into the market to position themselves strategically, awaiting the next move.

Source: CoinGlass

According to Coinglass data, dogwifhat’s Open Interest (OI) surged 25.51% to $441.49 million, while derivatives volume hiked 88.9% to $2.3 billion at press time.

Historically, a rising OI alongside rising prices reflects strong capital inflow as investors pursue the trend shift. Thus, this positioning amidst an uptrend signals bullish conviction.

Source: Santiment

In fact, this bullishness in the futures is further validated by a positive Funding Rate, indicating investors are mostly going long.

Profit takers step in

As prices surged, so did the appetite to realize profit among holders and speculative investors. dogwifhat surged to a 3-week high, creating a profit-taking window for holders who have been underwater.

Source: CoinGlass

Thus, looking at the memecoin’s Netflow, investors are aggressively cashing out. As such, this metric has surged, recording a positive value for two consecutive days.

As of this writing, Netflow was $2.52 million, reflecting massive selling activity across all market participants despite the price upswing.

Can WIF hold these gains to flip $1?

According to AMBCrypto’s analysis, dogwifhat surged as buyers returned to the market amid wider crypto market recovery.

As a result, at press time, the memecoin’s Stochastic RSI surged to 86 after making a bullish crossover, signalling a strong upward momentum and its continuation potential.

Source: Tradingview

In the same line, the Relative Strength Index (RSI) climbed to 55, entering bullish territory and signaling growing buyer strength.

With investors actively accumulating and momentum building, dogwifhat (WIF) appears poised for further gains.

If buying pressure continues, WIF could complete a breakout, flip the $1.00 resistance into support, and target $1.20.

However, the uptrend faces a risk: profit-taking. If sellers begin offloading in significant numbers, bullish momentum could weaken, leading to a potential pullback toward the $0.84 support level.