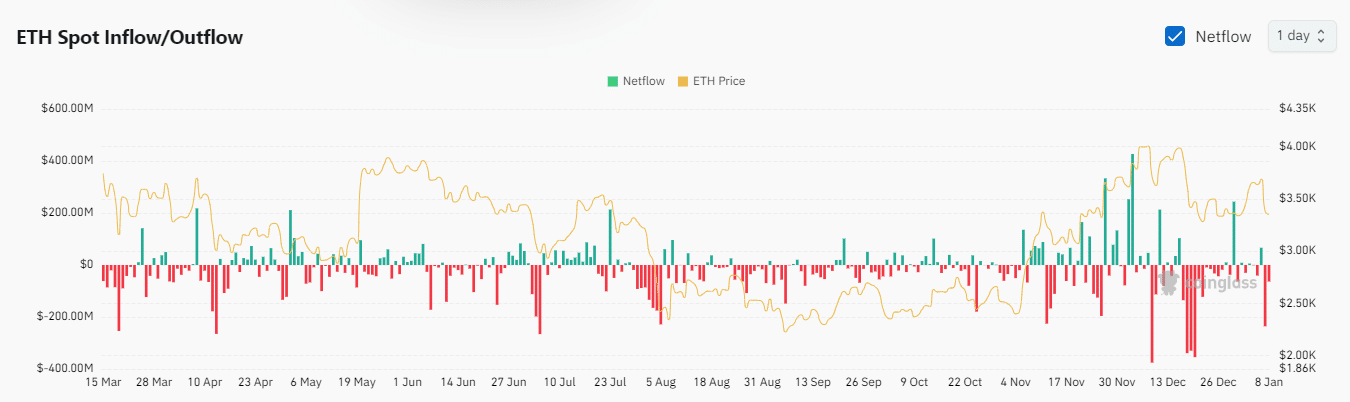

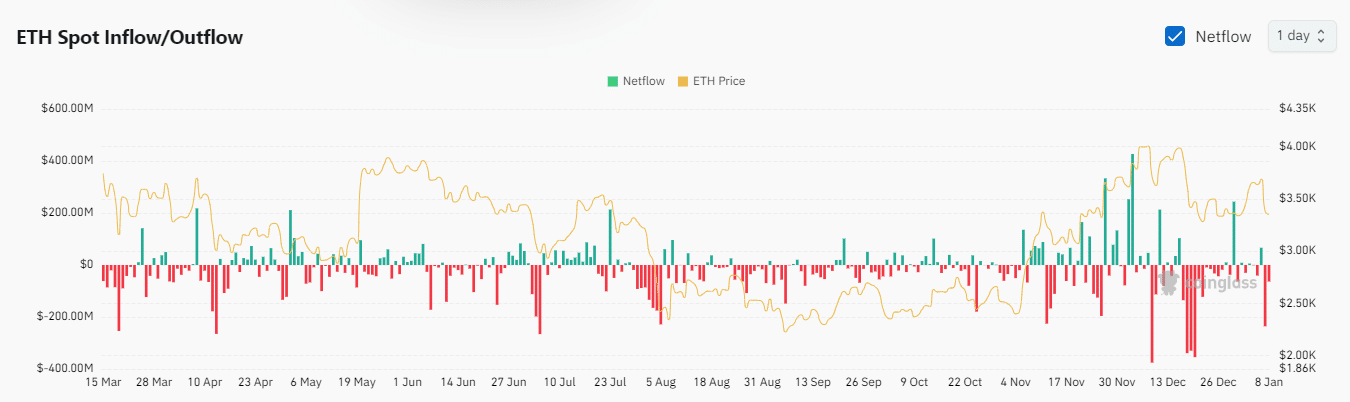

- Spot flows, including ETFs, turned negative, wiping out recent gains.

- Why a short term leverage shakedown played out recently and what’s next as whales make a comeback.

An unexpected wave of sell pressure has wiped out the recent gains that Ethereum [ETH] achieved in its first few days of January.

There were multiple reasons behind the sell pressure, including a leverage shake-down and spot outflows, among others.

ETH spot ETF outflows were arguably the most noteworthy sign of sell pressure. It had initially kicked off this week with $128.7 million worth of inflows on the 6th of January, building on the inflows from the 3rd of January.

This may have created a false sense of relief, and resulted in a FUD-filled selloff after ETFs pivoted on the 7th of January.

In contrast, Bitcoin ETFs were still positive in the last 24 hours despite the opposite outcome on ETH’s side. This was a reflection of the dominance situation.

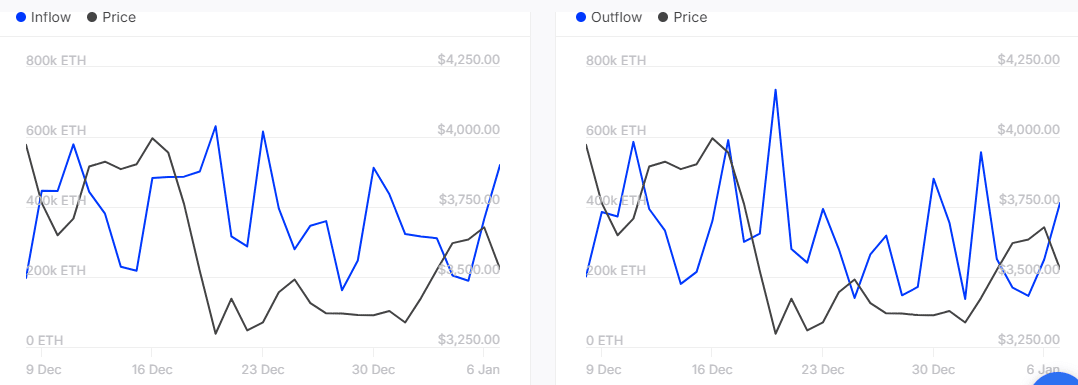

ETH ETF outflows amounted to $86.8 million on the 7th of January. This was consistent with the total negative spot flows observed on exchanges during the same period. Outflows peaked at $235.66 million on this date.

Source: Coinglass

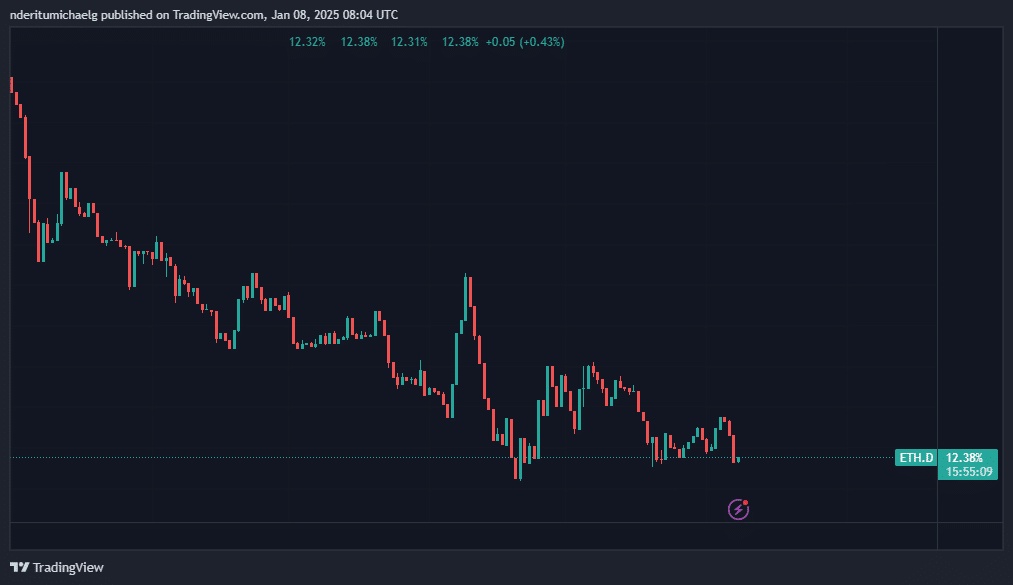

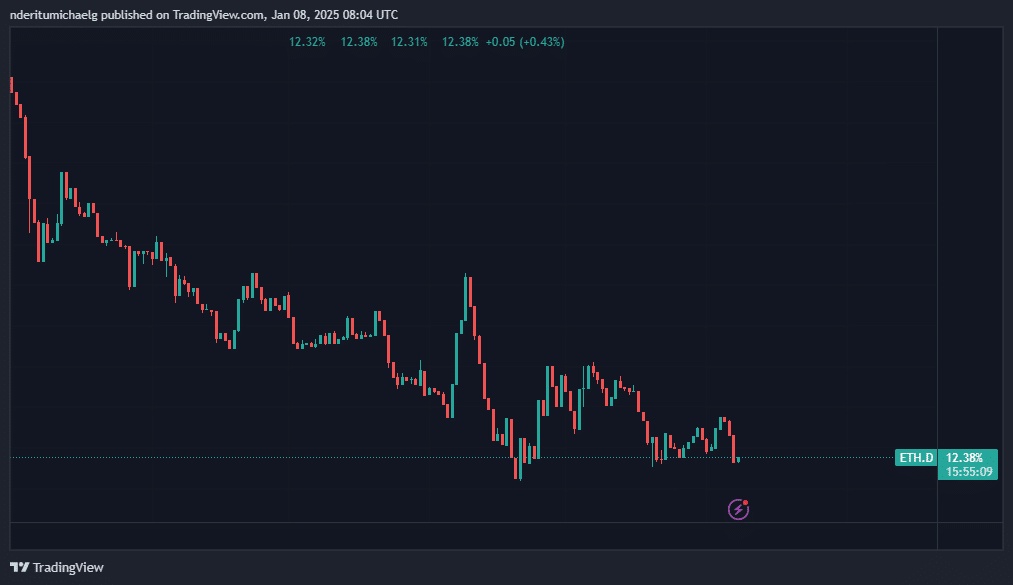

ETH dominance dips, but could be ready to pivot

The recent sell pressure hammered down on ETH dominance, which previously rallied as high as 12.87% during the weekend. However, the latest turn of events sent it as low as 12.32%.

ETH might attempt another crack at higher dominance from its current level. This because the same zone previously demonstrated support.

Source: TradingView

The same ETH dominance support also aligns with the support retest on ETH price action. But is the latest pullback over, or will price dip even lower?

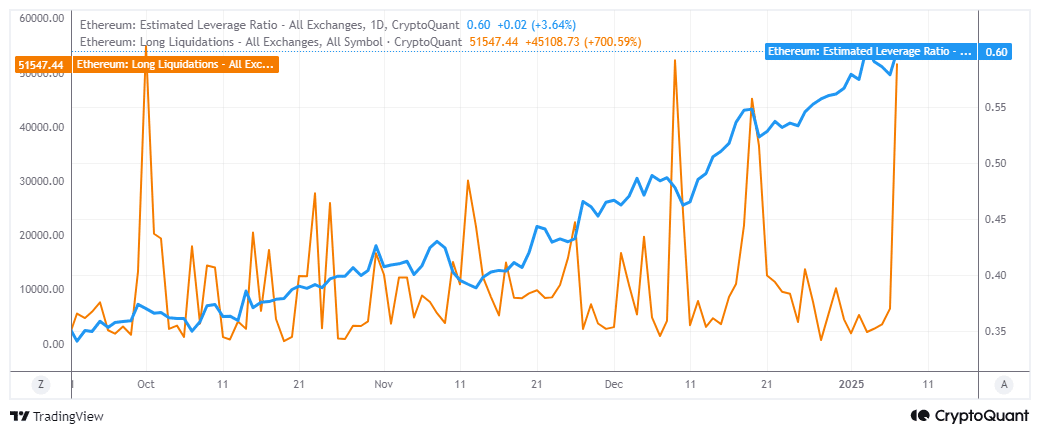

Leveraged long liquidations likely had a hand in the latest wave of sell pressure observed in the last two days.

Appetite for leverage has been on the rise over the last few months. Long liquidations were up by over 700% since the 3rd of January.

Source: CryptoQuant

More than $173 million worth of liquidations were observed in the last 24 hours. This suggests that the latest rally in the first week of January may have been a set-up for a leverage shakedown.

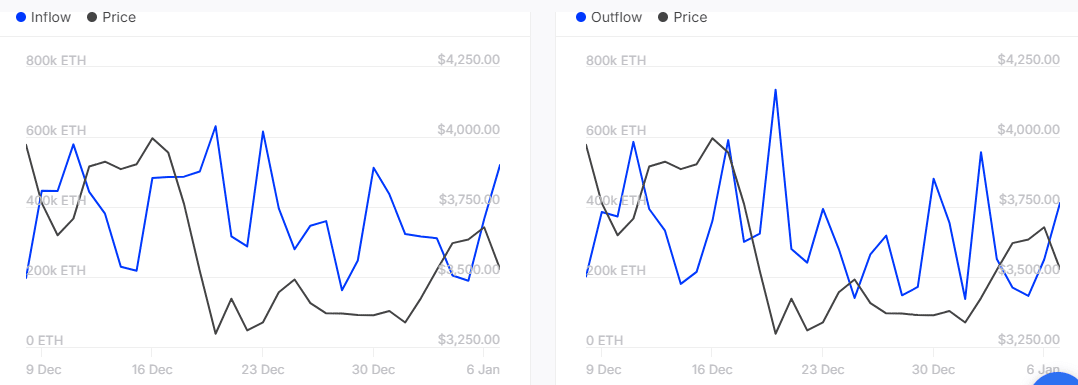

Will ETH bounce back in the second half of the week? This is plausible because of one major observation that may offer insights into the next move. Whales have been selling since the start of January.

Read Ethereum’s [ETH] Price Prediction 2025–2026

However, recent data reveals that they have been accumulating during the latest dip.

Source: IntoTheBlock

ETH whales accumulated 519,620 ETH on the 7th of January while outflows were lower at 411,300 ETH on the same day. This confirmed that whales have been buying the dip and could potentially aid in a mid-week recovery.