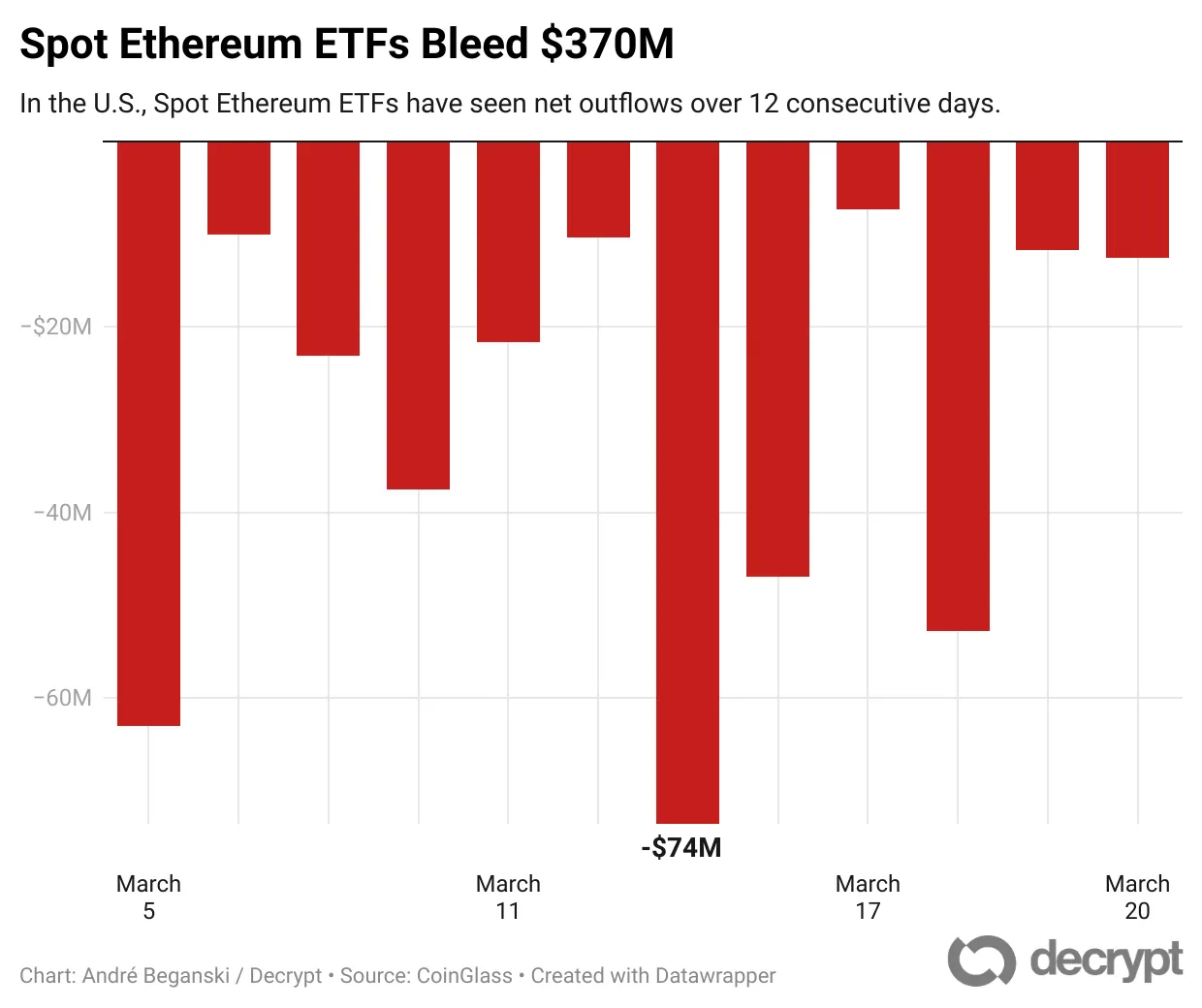

Spot Ethereum exchange-traded funds have shed $370 million in assets over the past 12 trading days, notching their longest losing streak yet, as the price of the underlying asset has struggled.

Among funds, which began trading last year, outflows from the iShares Ethereum Trust (ETHE) and the Grayscale Ethereum Trust (ETHE) totaled $146 million and $106 million, the most over this period, according to crypto data provider CoinGlass.

The outflows have dovetailed with Ethereum’s tumble to its current level of around $1,950 from $2,200 on March 5, according to the crypto data provider CoinGecko. The asset has swooned in recent months amid investors doubts about its speed and efficiency compared to blockchain rivals and a wider fall-off in crypto and other risk-on assets prompted by macroeconomic angst.

Spot Bitcoin ETFs have attracted $660 million this week, regaining a small amount of ground lost in their own recent downturn.

In an interview on Thursday at the Digital Asset Summit in New York, Robert Mitchnick, BlackRock’s head of digital assets, said that the Ethereum ETFs’ lackluster debut came partly because they do not permit staking.

NYSE Arca filed for just that on behalf of Bitwise this week, while Grayscale, 21Shares and Fidelity have also filed for rule changes on their funds to permit staking.

The SEC has acknowledged the NYSE and Grayscale filings, and earlier this month, the Commission met with Coinbase to discuss how certain liquidity risks could be mitigated for spot Ethereum ETFs depending on the amount of ETH withheld from staking.

“A staking yield is a meaningful part of how you can generate investment return in this space,” Mitchnick said.

Staking rewards are issued to Ethereum investors that lock up their capital and participate in the process of validating transactions.

The amount of Ethereum being staked has meanwhile increased to 33.8 million ETH, according to data from testnet block explorer beaconcha.in. That represents a 0.5% increase from the 33.6 million Ethereum staked on March 5, when spot Ethereum ETFs began their recent bleed.

Spot Ethereum funds have generated $2.45 billion in net inflows since their debut last July, with BlackRock’s spot Ethereum ETF garnering $587 million. Analysts consider their launch successful, although their performance is dwarfed by spot Bitcoin ETFs that have received more than $35 billion in net inflows, according to U.K. asset manager Farside Investors.

“This highlights a growing institutional risk appetite for BTC, while ETH’s recovery remains sluggish as investors wait for stronger catalysts,” the crypto research firm BRN said on X (formerly known as Twitter) on Friday.

Edited by James Rubin

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.