- Ethereum’s fee drop and growing accumulation may signal the start of a market rebound

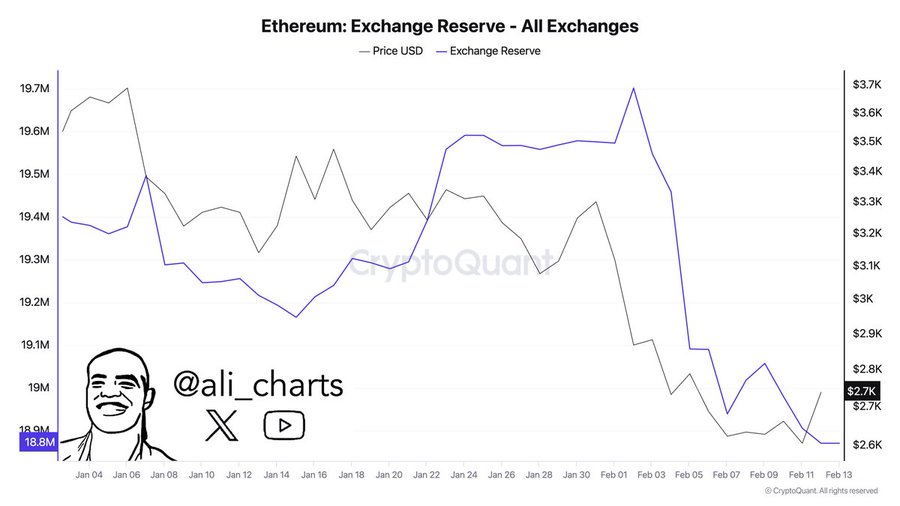

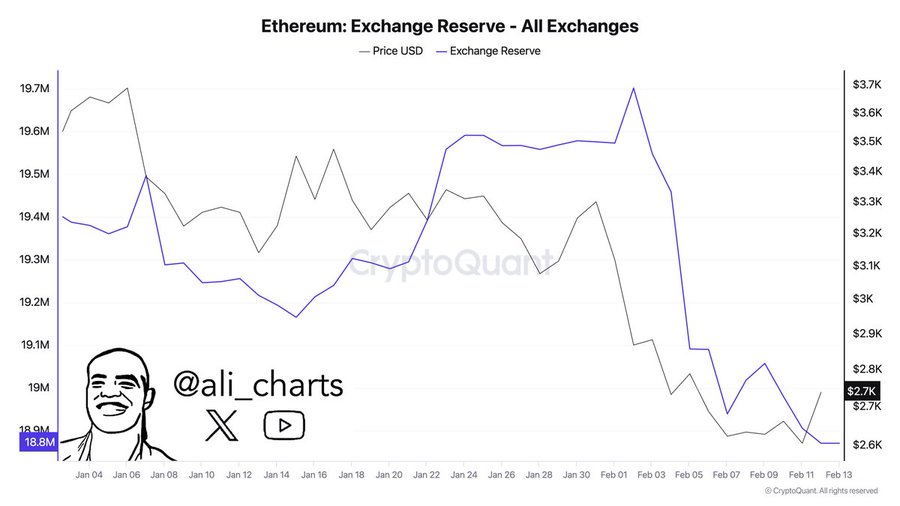

- Decline in ETH exchange reserves hinted at a potential supply squeeze and upcoming price rally

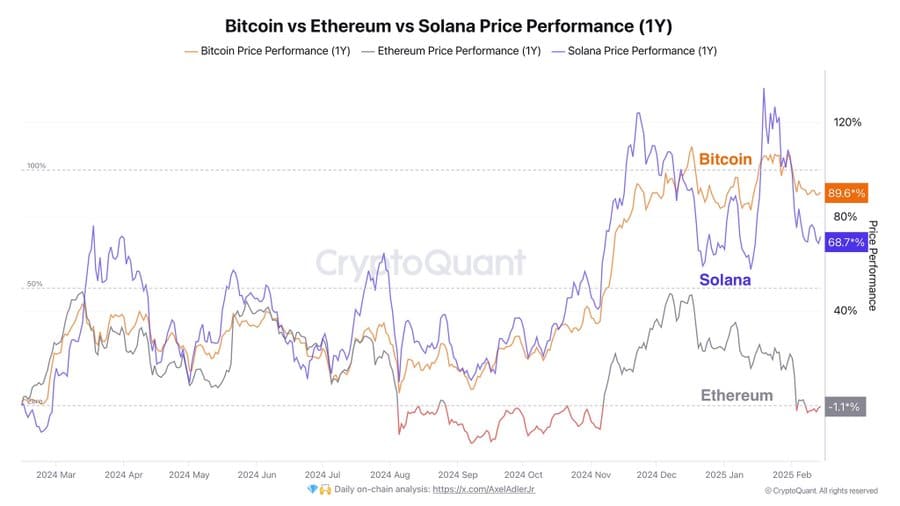

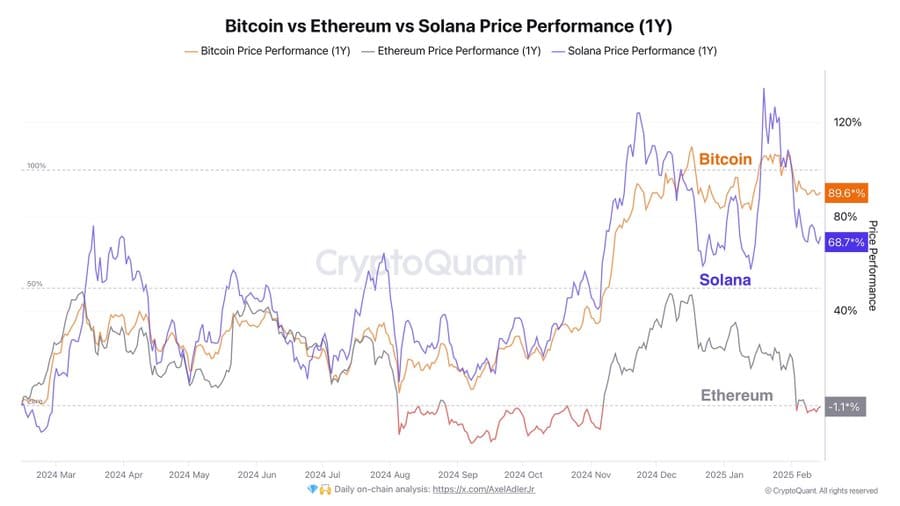

Ethereum [ETH] has underperformed, compared to its peers for over a year. However, new on-chain data might be pointing towards a potential shift. While ETH is down 1.1% year-over-year, Bitcoin [BTC] and Solana [SOL] have posted massive gains.

Now, two key developments – plunging transaction fees and accelerating accumulation – may be signs of growing investor confidence.

Could this signal the start of an Ethereum resurgence?

How lower fees affect network activity and adoption

Ethereum’s transaction fees have dropped by over 70% this week, with total daily fees now at $7.5 million, down from $23 million just weeks prior. This decline follows a recent increase in the gas limit, which effectively expands block capacity and reduces congestion.

Historically, lower fees have correlated with higher network usage. During previous fee declines in 2021 and mid-2023, for instance, daily active addresses and transaction counts surged.

If this pattern holds, Ethereum could see a renewed uptick in on-chain activity. However, what’s crucial is whether this uptick in activity translates into sustained demand rather than short-term speculative surges.

Does the sharp decline in ETH exchange reserves signal a supply squeeze?

Ethereum exchange reserves have fallen sharply, from 19.7 million ETH in early January to 18.8 million ETH in just 10 days.

Such a sharp decline is a sign that investors are moving assets to self-custody, reducing the immediate supply available for selling.

Source: X

Historically, such sharp drawdowns have often preceded price rallies. The last similar exchange reserve decline occurred in Q4 2023, which was followed by a 35% price surge over the following two months.

If this price trend continues, Ethereum could face a supply squeeze. Particularly if demand rebounds alongside lower fees.

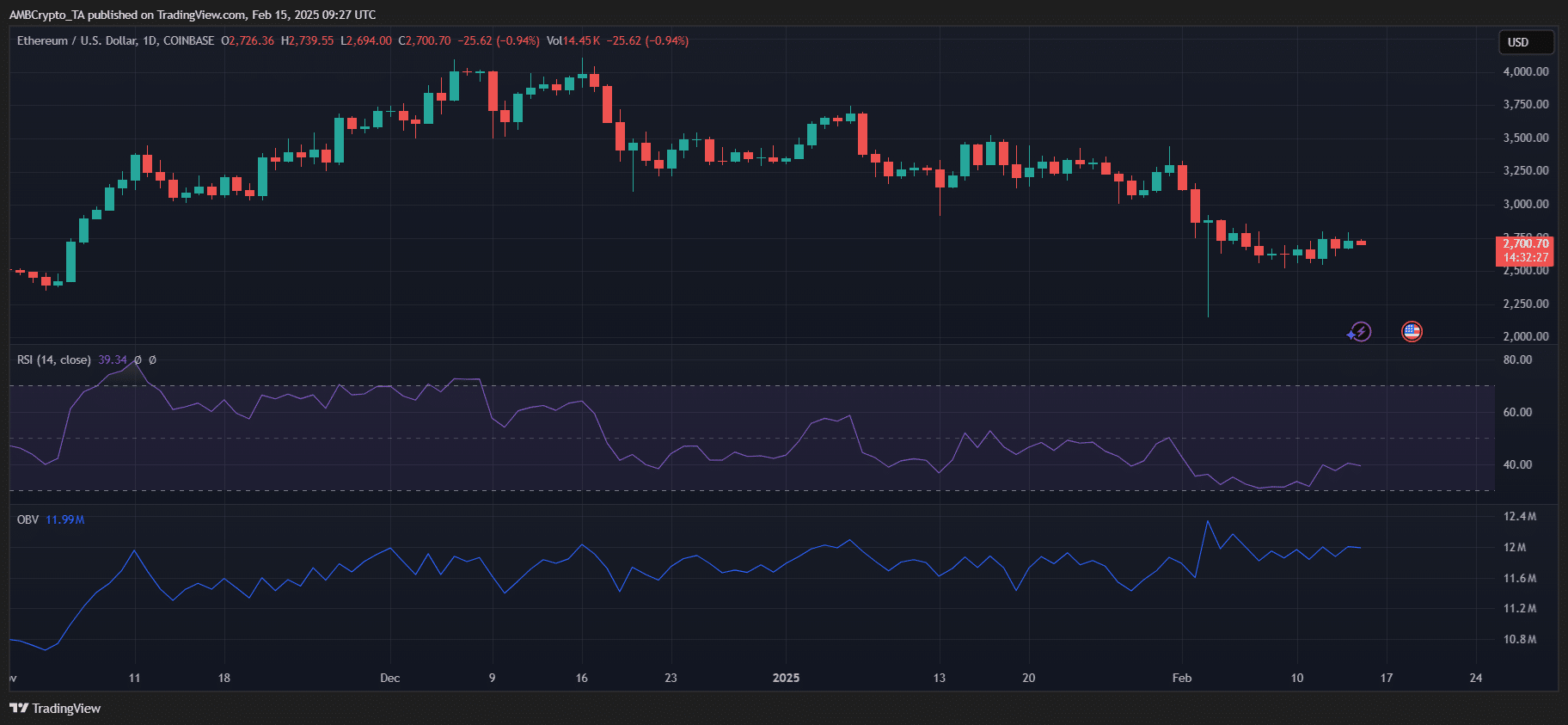

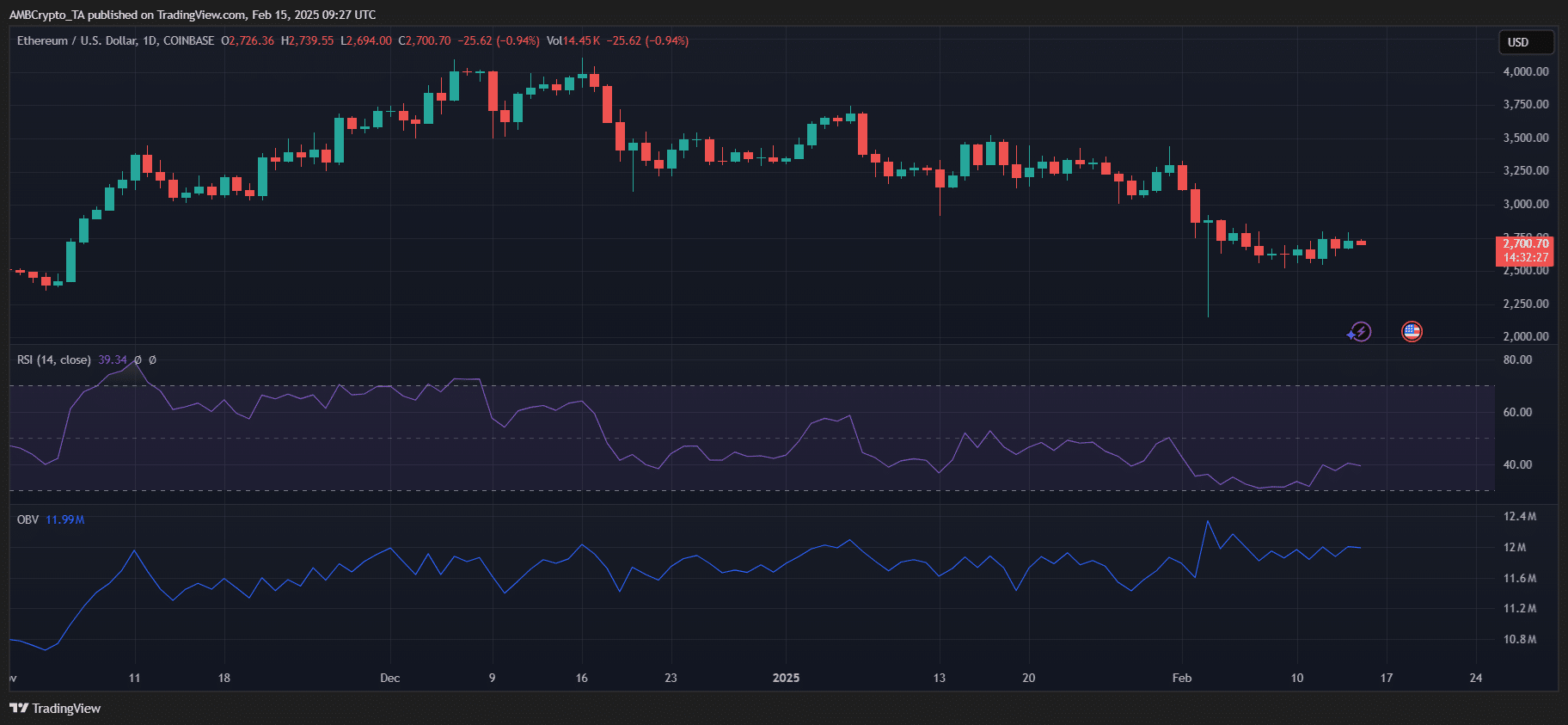

Technical indicators show lack of bullish momentum

Source: X

Despite improving on-chain metrics, however, at press time, Ethereum was still down 1.1% YoY. It was lagging behind Bitcoin (+89.6%) and Solana (+68.7%).

Source: TradingView

Recent data also highlighted a strong resistance around $2,800, with ETH struggling to break above it despite rising accumulation. The RSI sat at 39.34, indicating that while Ethereum may be near oversold conditions, it is yet to gain bullish momentum.

Additionally, the OBV showed a lack of strong buying pressure – A sign that while supply has been tightening, demand is yet to surge.

For ETH to break out, it needs a decisive push past the $2,800-$2,900 range backed by increasing volume. If this fails, a retest of $2,500 will remain a possibility before any sustained upside.