- ETH has breached critical multi-year support, prompting dormant whales to unwind holdings

- MVRV ratio has flipped negative, historically signaling undervaluation and potential accumulation zones

Ethereum [ETH] is under pressure right now, with long-term holders (LTHs) continuing to offload their holdings. In fact, after three years of dormancy, “another” Ethereum OG has liquidated 7,974 ETH at a price of $1,479, totaling $11.8 million.

Now, while ETH’s daily price dip followed the broader market’s de-risking, its monthly performance revealed a deeper weakness. A steep 17.52% decline seemed to underscore the impact of these large sell-offs, making ETH the weakest high-cap asset.

The catalyst?

Well, ETH breached its multi-year support, recently dipping below $1,500 – A level unseen in two years. In response, dormant whales have been unwinding positions, de-risking, and front-running further downside compression on their profit margins.

According to AMBCrypto, their exit strategy reflects a strategic distribution pattern. These whales are offloading in phases, strategically selling in installments rather than dumping all at once.

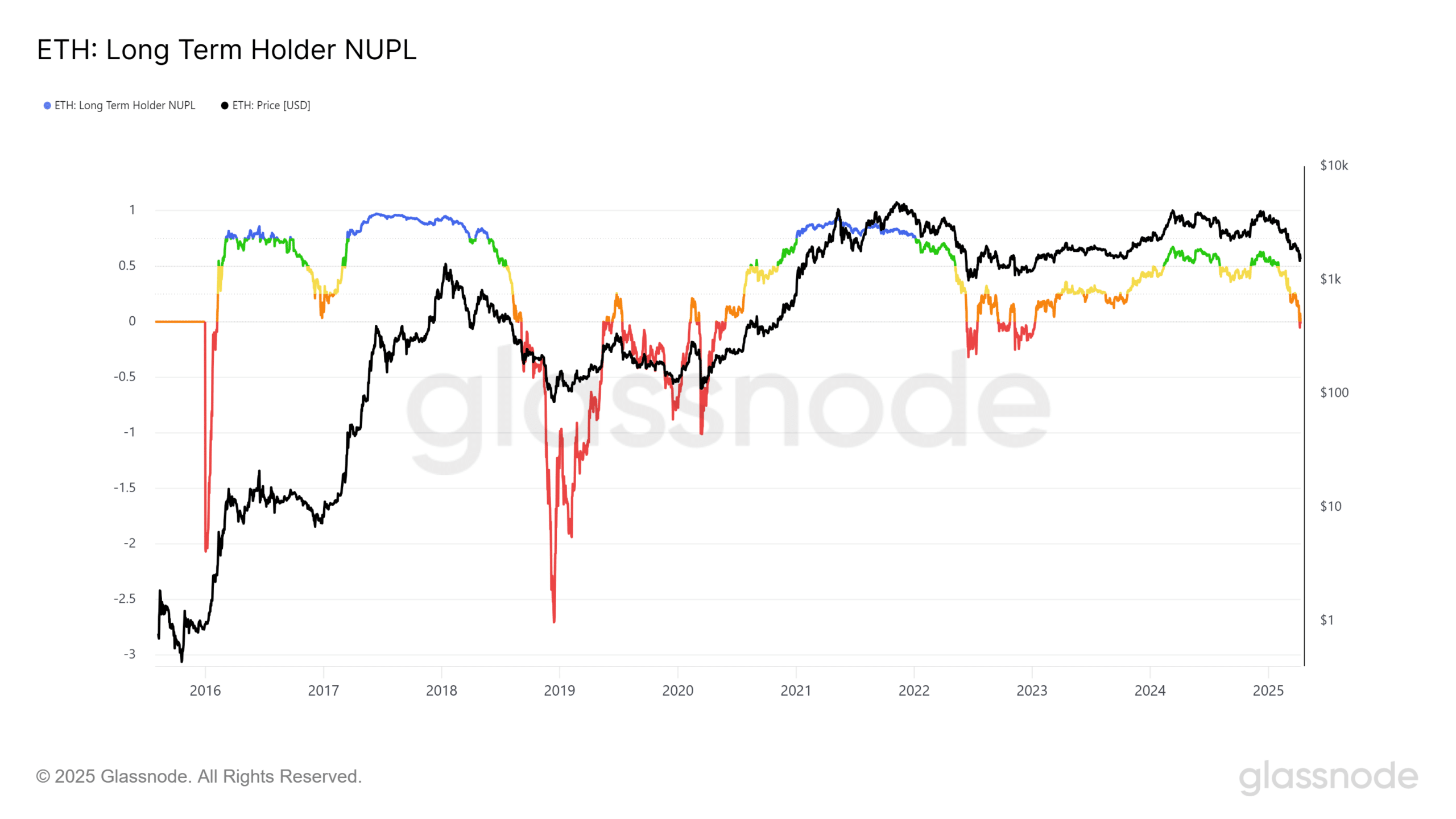

This trend can be evidenced by the chart below.

Source: Glassnode

Ethereum’s LTH NUPL (Net Unrealized Profit and Loss) has entered the red zone for the first time in three years too.

The last occurrence was in 2022 when ETH whales entered capitulation – A brief phase triggered as ETH broke below $1,500 on 10 June.

Consequently, ETH fell to $883 on the charts within the next 30 days.

With Ethereum once again teetering on this critical support, the probability of a full-scale capitulation event is rising. Is this $11.8 million dormant whale sell-off just the first domino to fall?

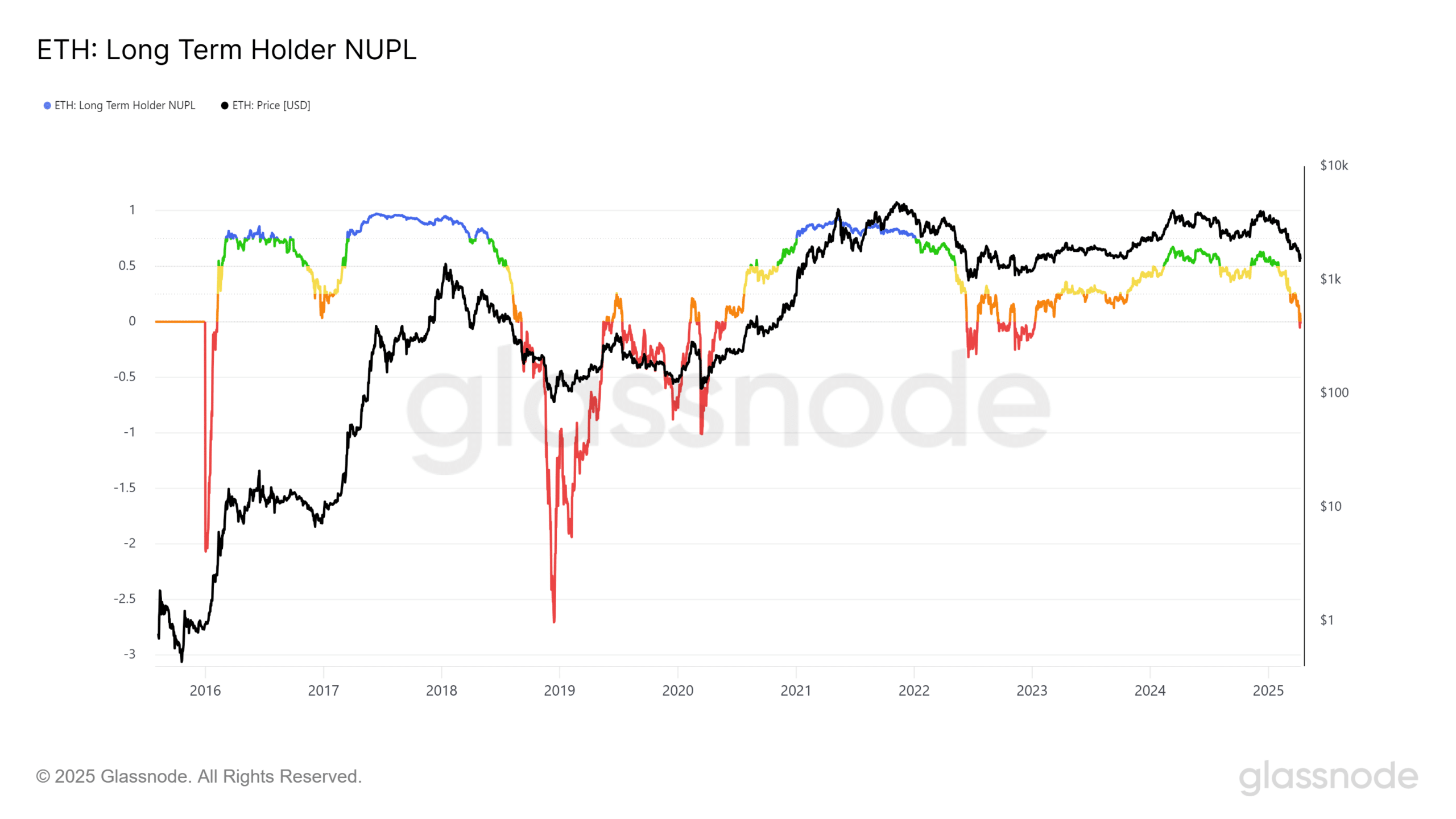

On-chain metric flashes undervaluation

At the time of writing, Ethereum’s Market Value to Realized Value (MVRV) ratio was 0.76. This meant its press time market price of $1,549 was trading at 76% of its aggregate realized value. Simply said, ETH was trading at a 24% discount relative to the average acquisition price of all coins.

This suggested that on average, ETH holders are underwater. Historically, such undervaluation zones have preceded strong recoveries.

Even in 2022, a month-long consolidation in July saw ETH rally by 85% to $2,020 by 13 August.

Source: Glassnode

However, market FUD remains a major variable this time. In April alone, Ethereum reserves saw net inflows of approximately 2 million ETH across spot exchanges, underscoring investor reluctance to buy the dip.

Without a reversal in this accumulation trend, Ethereum remains vulnerable to deeper corrections below $1,400. Especially as dormant whales continue to unwind their positions.

In fact, with long-term holders de-risking and market liquidity fragile, Ethereum’s structure is now mirroring its 2022 breakdown. This raises the risk of another capitulation event on the charts.