- Ethereum’s total netflow experienced a positive shift in the last 24 hours, recording a +3.75k ETH change.

- ETH Whale accumulation often precedes bullish moves, and their 24-hour net buy of $1,020,676 supported this outlook.

Ethereum [ETH] market balance between accumulation and sell-offs determined ETH’s short-term movement, while long-term trends revealed potential breakout opportunities.

In the past 24 hours, whales and smart DEX traders (SDT) emerged as net buyers, signaling accumulation. Whales recorded a buy volume of $6,942,812, exceeding their sell volume of $5,922,136.

SDT mirrored this trend, with a buy volume of $2,803,388 against a sell volume of $1,957,518.

These movements reflected institutional and experienced trader confidence in ETH’s future price.

Source: ICrypto

However, Smart Money (SM) displayed contrasting behavior by selling $1,659,691 compared to a buy volume of $969,774.

Despite this selling pressure, buy-side dominance limited the bearish impact. Over a shorter 6-hour timeframe, all groups showed caution. Whales recorded a net buy of $180,399, SDT posted $84,023, and SM added a smaller net buy of $44,296. These reduced volumes reflected market indecision.

Whale accumulation, often a precursor to bullish moves, was evident with a 24-hour net buy of $1,020,676, reinforcing a positive outlook. SDT’s $845,870 net buy further supported strategic accumulation.

In contrast, SM’s net sell of $689,917 suggested profit-taking but lacked the volume to alter market sentiment. If whale and SDT buying persists, Ethereum could test critical resistance levels. However, an increase in SM selling might indicate the start of a corrective phase.

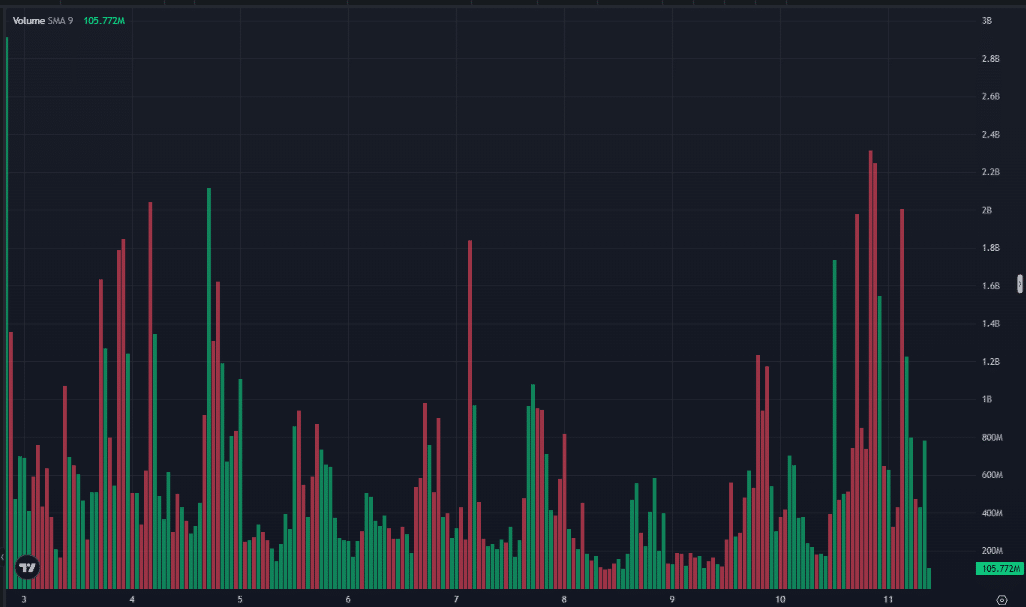

Assessing market momentum

Further, net volume analysis reinforced the bullish sentiment observed in large trader activity. Over 24 hours, whales accumulated a net buy of $1,020,676, reflecting strong positioning.

SDT followed with a net buy of $845,870, while SM registered a net sell of $689,917. The net volume balance favored buyers, strengthening ETH’s short-term outlook.

Source: Coinglass

Shorter-term trends indicate reduced market aggression. Over the past six hours, whales recorded a net buy of $180,399, SM contributed $44,296, and SDT achieved $84,023.

These figures reflect cautious trading behavior, as participants await stronger signals before making larger commitments.

Historically, extended net buying has driven ETH to higher price targets. However, intensified selling pressure could lead to a pullback.

Tracking sustained net buying is essential to confirm a bullish continuation, while increasing net selling may signal profit-taking or potential downside risk.

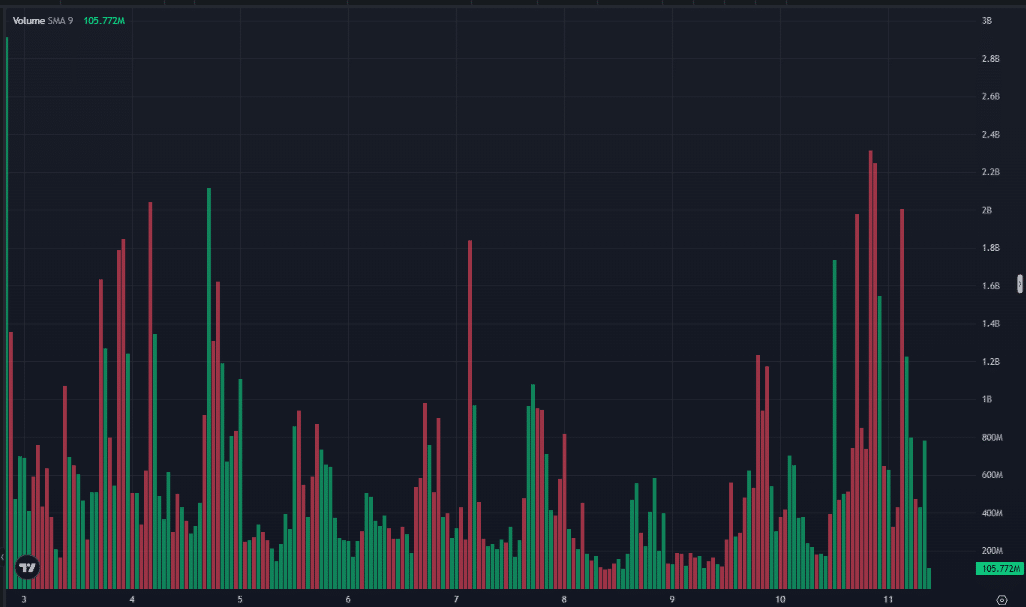

ETH market implications

ETH total netflow experienced a positive shift in the last 24 hours, recording a +3.75k ETH change. However, broader trends revealed a complex picture.

Over the past three months, netflows averaged -430.58k ETH, signaling persistent outflows. March 10, 2025, saw netflows dip to -215.42k ETH before rebounding.

The 7-day netflow change showed a promising +239.52k ETH, while the 30-day figure stood at -99.69k ETH, indicating lingering outflows.

Source: IntoTheBlock

Netflows for ETH declined from December 2024 to January 2025, bottoming at -350k ETH. February saw a recovery, reaching a peak of +150k ETH, followed by increased volatility.

Recent data shows a low of -250k ETH on the 20th of February 2025, and a high of +200k ETH on March 5, 2025. The latest 24-hour uptick indicates short-term accumulation.

If 7-day netflows remain positive, ETH could continue its upward trend. However, the 30-day downtrend suggests broader profit-taking risks. Sustained inflows may support further price gains, while renewed outflows could cause price weakness.

ETH’s market outlook hinges on the interplay between whale accumulation, smart money activity, and liquidity changes.

Over the past 24 hours, whales and SDT were net buyers, reinforcing bullish sentiment, while SM’s selling pressure had minimal impact.