- Whale exits and a 63.8% drop in large transactions weaken Ethereum’s bullish structure.

- On-chain metrics and rising exchange reserves point to increasing selling pressure and fading demand.

Ethereum [ETH] has seen a significant 63.8% decline in large transactions since February 25, highlighting a steep drop in whale participation. Over the past two weeks, whales have sold over 760,000 ETH, contributing to rising selling pressure across the market.

Additionally, a long-term Ethereum holder recently sold the remaining 2,001 ETH in their portfolio for $3.82 million, after initially accumulating 5,001 ETH at $277 back in 2017.

These sales indicate that large holders are reducing their exposure, possibly in anticipation of further price declines or as part of a strategic shift away from Ethereum.

This decline in whale-driven accumulation weakens Ethereum’s upward momentum. When whales exit, retail investors often struggle to absorb the selling pressure, making the asset more prone to volatility.

As a result, unless demand returns swiftly, Ethereum may face short-term downward pressure. The coming days will be crucial in determining whether the market finds new support levels or experiences a further decline.

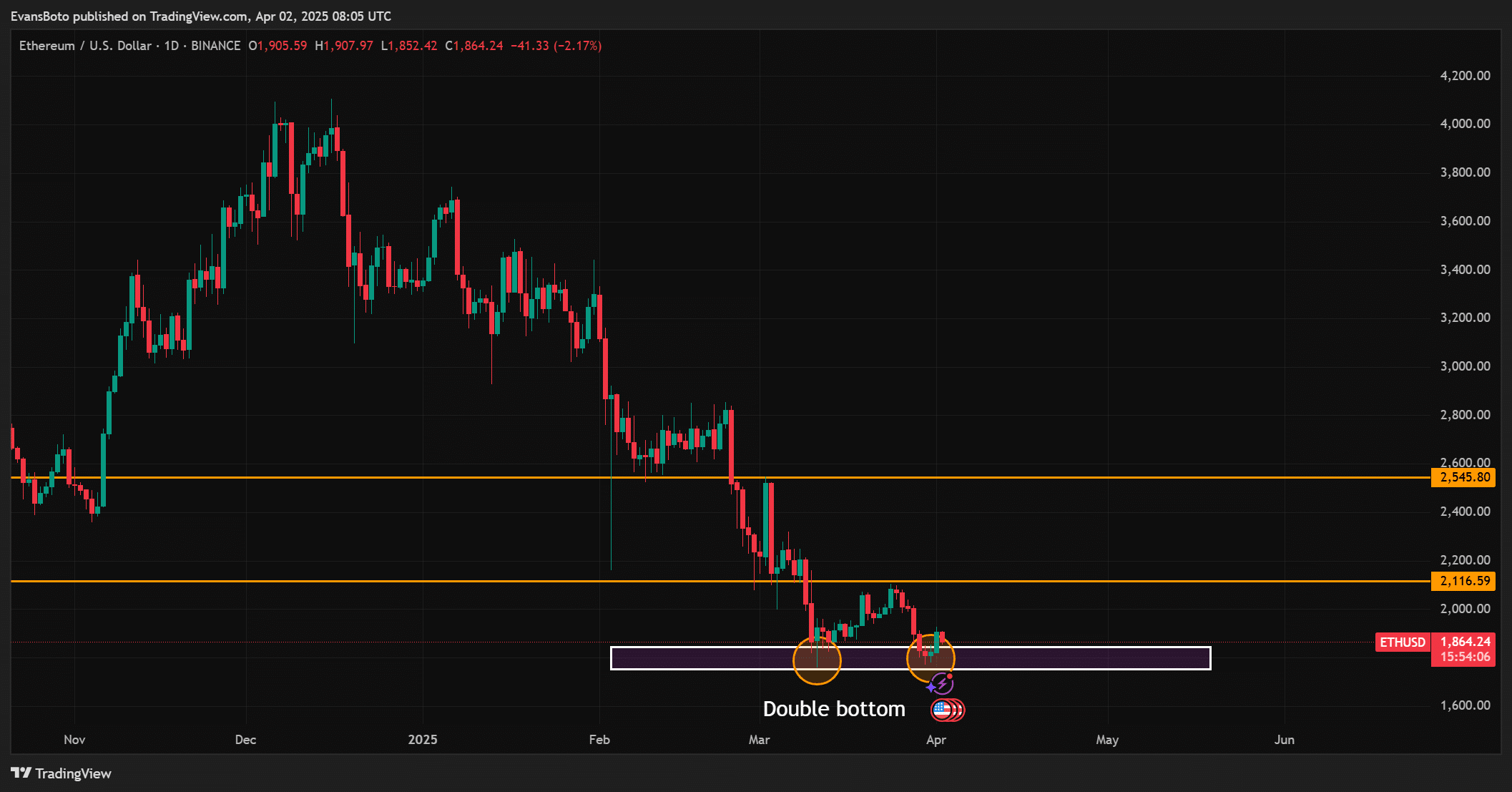

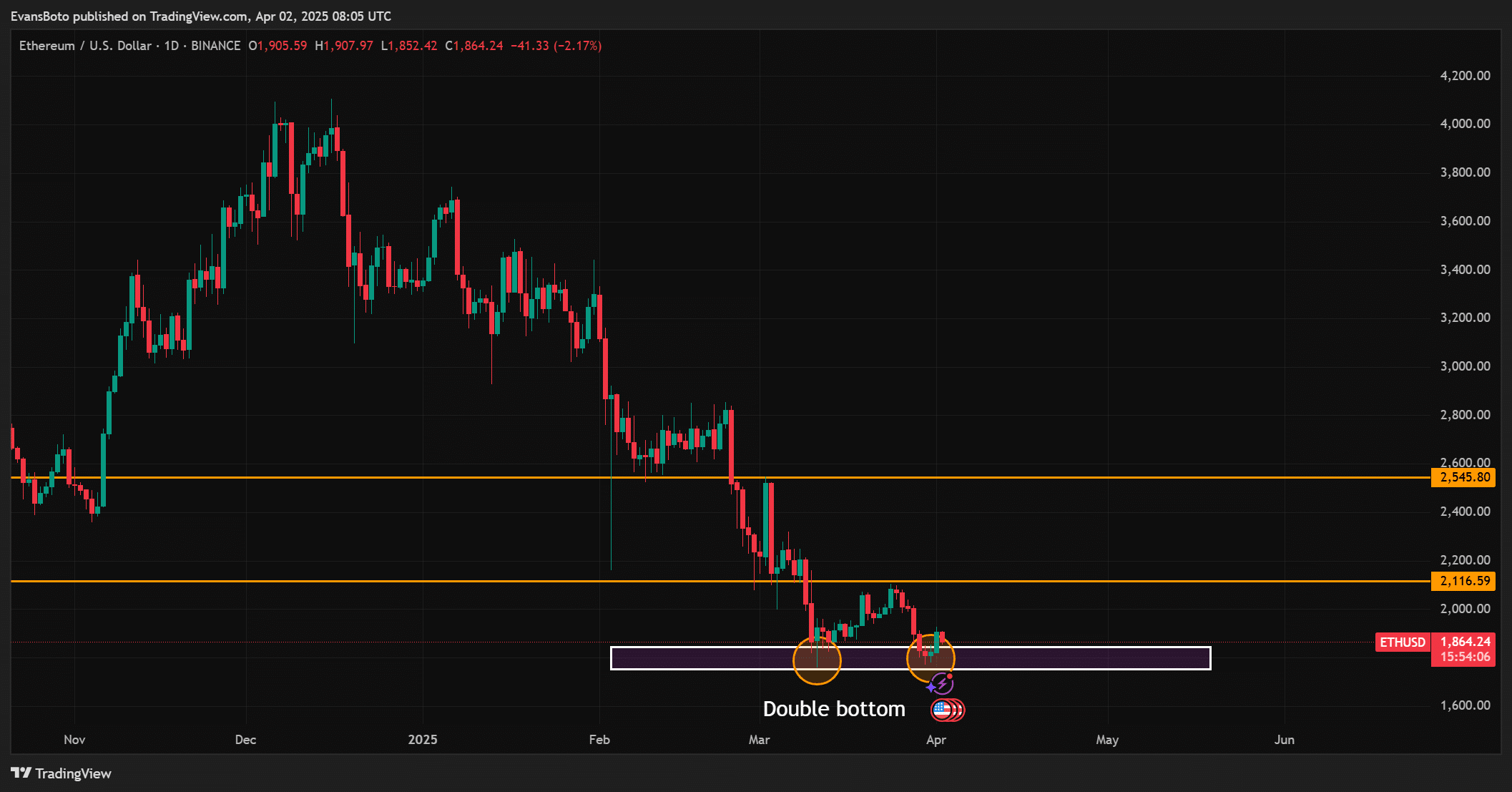

Ethereum forms a double bottom – Can bulls take control?

At the time of writing, Ethereum was trading at $1,863.12, reflecting a 0.53% daily increase.

The price action suggests a potential double bottom near the $1,800 support zone, signaling that bulls may be making a recovery attempt.

However, Ethereum’s price remains below crucial resistance levels at $2,116.59 and $2,545.80, which are essential to reclaim for confirming a bullish reversal. Without breaking above these levels, the current rebound may prove short-lived.

While the structure of this bounce shows some optimism, the overall trend remains cautious.

Recent whale exits and low market participation significantly dampen the likelihood of a sustained breakout. As a result, the $1,800 support level becomes a critical threshold; if breached, it could lead to accelerated selling.

To prevent further declines, bulls must act decisively and with strength.

Source: TradingView

Liquidation data shows resistance ahead for ETH bulls

The 24-hour liquidation heatmap on Binance showed significant liquidation activity between the $1,900 and $1,950 range. This indicates a high concentration of leveraged traders being forced out of their positions, creating short-term resistance.

Ethereum has struggled to maintain levels above this range, highlighting a lack of buyer confidence. To regain upward momentum, ETH needs to build stronger bullish support and break through this zone.

If the price continues to stall below these levels, bears could seize control. Strong liquidation walls often act as barriers, trapping price action within a sideways trading range.

Source: Coinglass

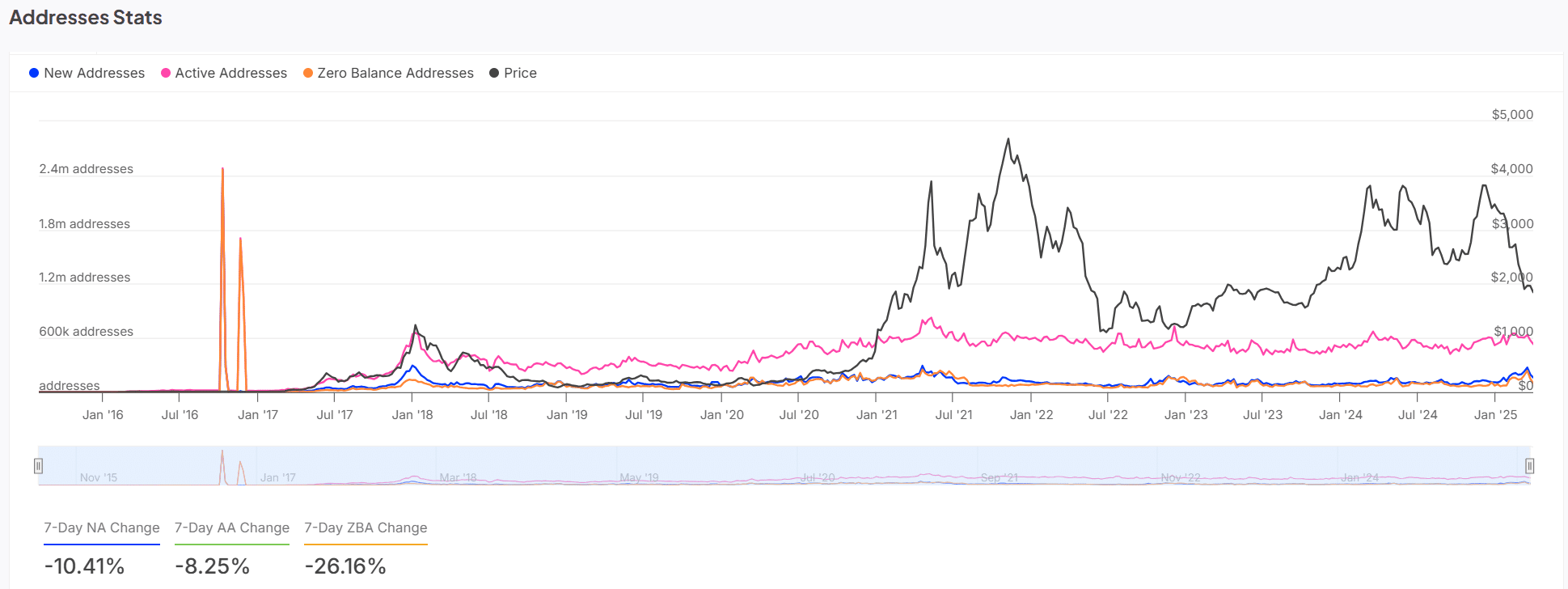

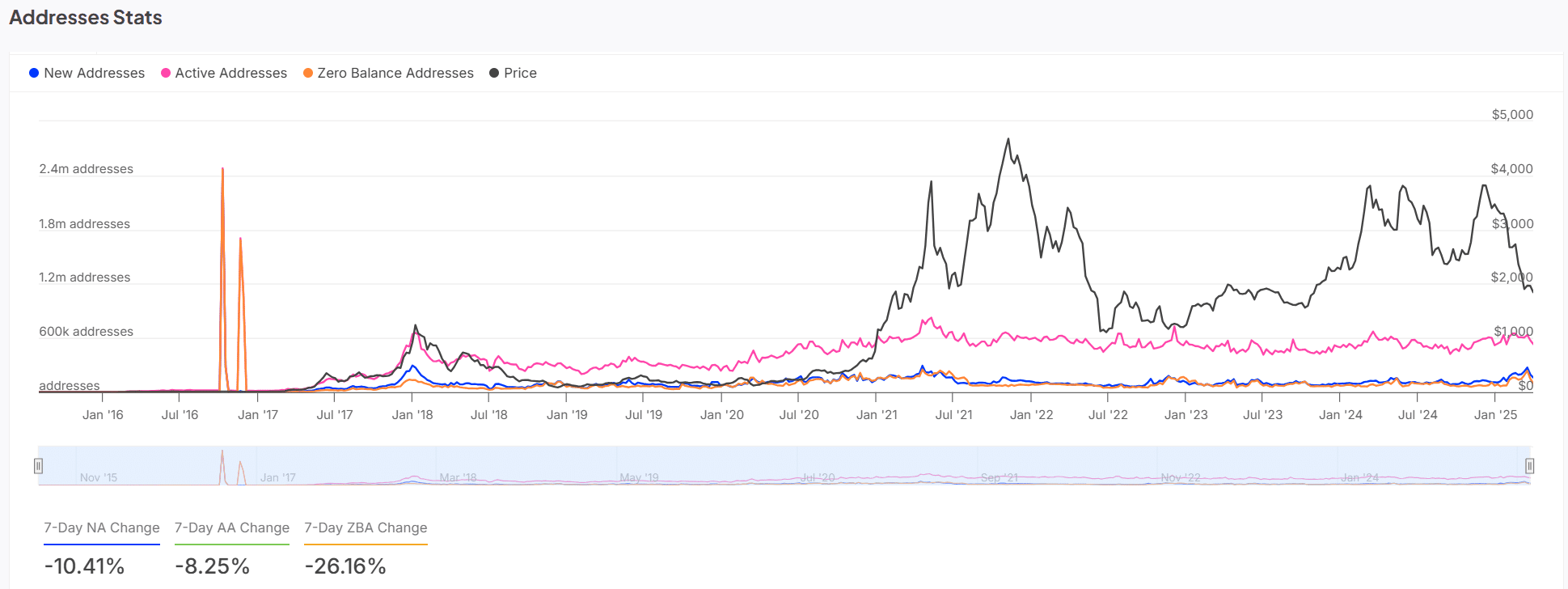

Address stats show declining network demand

Ethereum’s on-chain metrics reveal a decline in user activity. Over the past week, new addresses decreased by 10.41%, and active addresses dropped by 8.25%. Simultaneously, zero-balance addresses increased by 26.16%, signaling a rise in wallet abandonment.

These trends indicate a pullback by both new and existing users, highlighting a contraction in network participation. This decline reflects weakening demand fundamentals.

As fewer users transact or hold Ethereum, market stability weakens further. Consequently, low user engagement could amplify bearish pressure in the coming weeks.

Source: IntoTheBlock

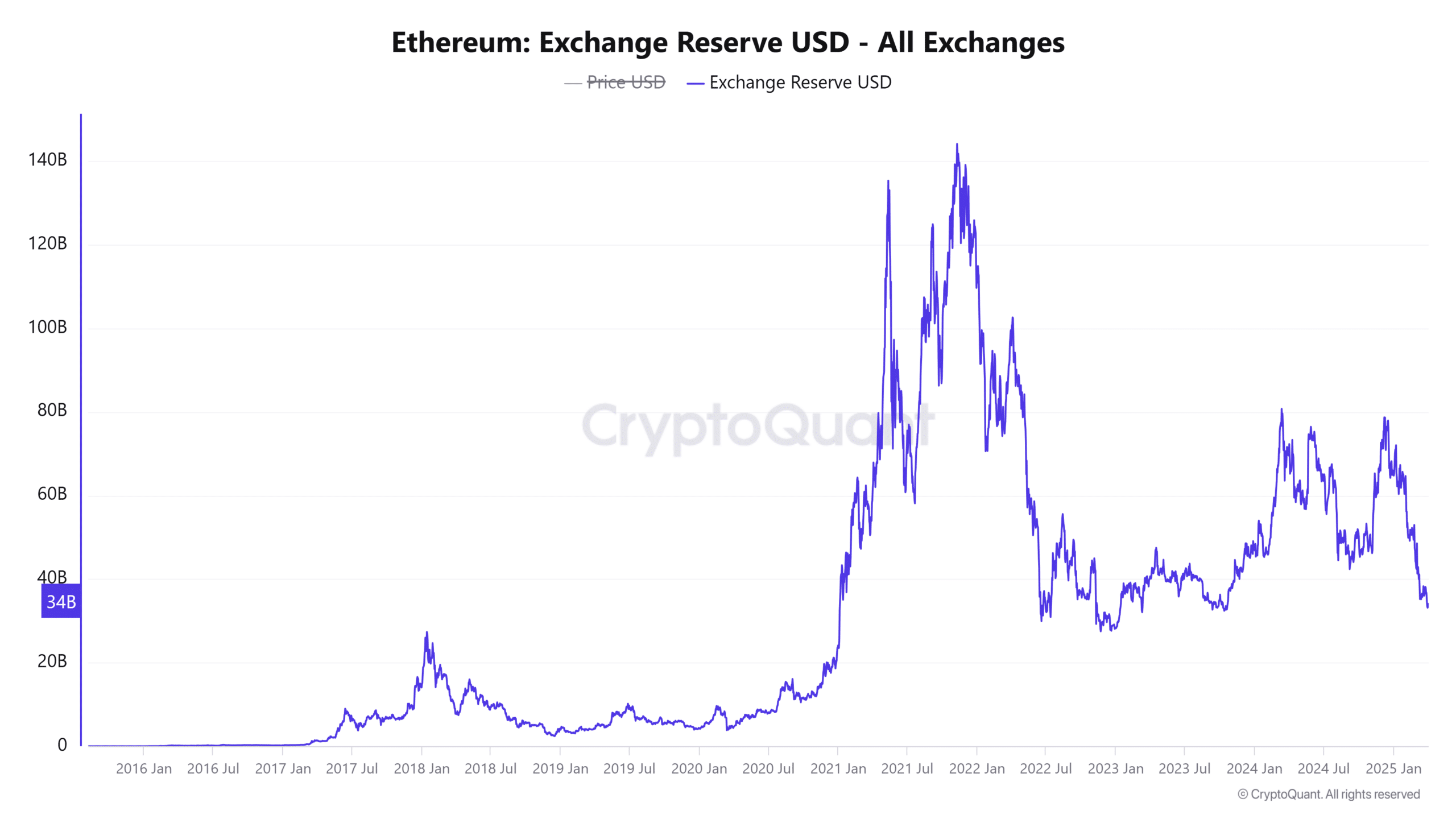

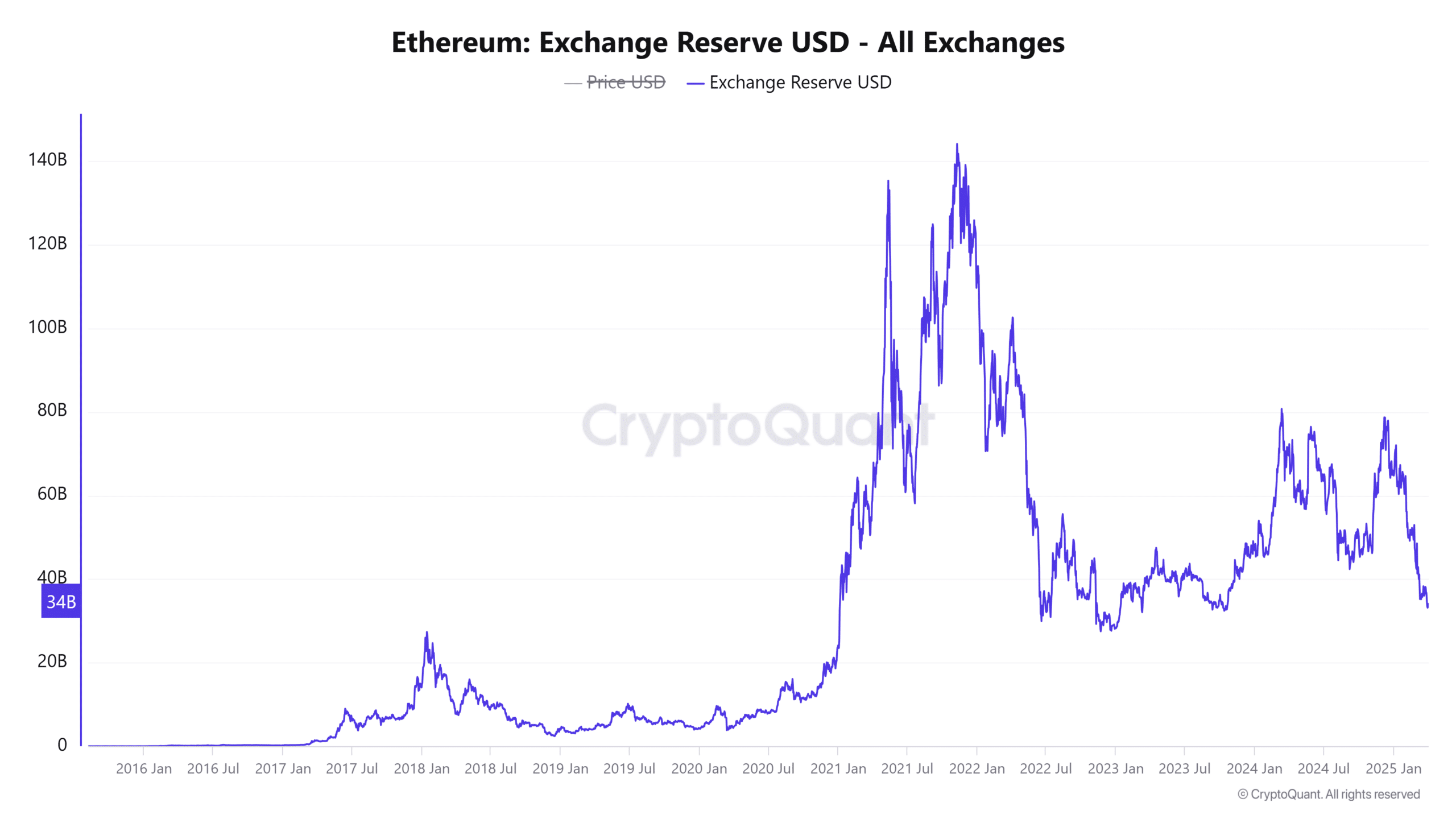

Ethereum exchange reserves climb as sell pressure increases

The total value of Ethereum held on exchanges has increased to $33.98 billion, up by 0.77% over the past 24 hours. Rising exchange reserves often indicate that more investors are preparing to sell rather than hold.

This behavior aligns with the wave of whale exits and reduced on-chain activity. Therefore, elevated reserves suggest that further downside pressure could emerge if demand does not pick up.

Sellers currently dominate the sentiment, and until this trend shifts, price action may continue to face resistance.

Source: CryptoQuant

What next for ETH

Ethereum appears to be headed for a short-term correction. A 63.8% decrease in whale transactions, a 0.77% rise in exchange reserves, and a 26.16% uptick in zero-balance addresses all indicate weakening demand and heightened selling pressure.

While the formation of a double bottom pattern hints at the possibility of a rebound, the absence of strong buying momentum increases the likelihood of a further decline.