Buterin has proposed a new roadmap aimed at enhancing the scalability, finality, and security of Ethereum’s Layer 2 solutions.

Vitalik Buterin’s new roadmap for Ethereum introduces a “2-of-3” model, combining optimistic proofs, zero-knowledge (ZK) proofs, and trusted execution environment (TEE) provers.

Transactions are finalized when two of these proofs agree, reducing reliance on one method and addressing security and fraud concerns.

The proposal targets long-standing Layer 2 scaling issues while preserving Ethereum’s decentralization.

A key feature is the development of “Stage 2 rollups,” which promise faster confirmations, better finality, and increased resilience in semi-trusted environments.

Ethereum’s liquidation concerns

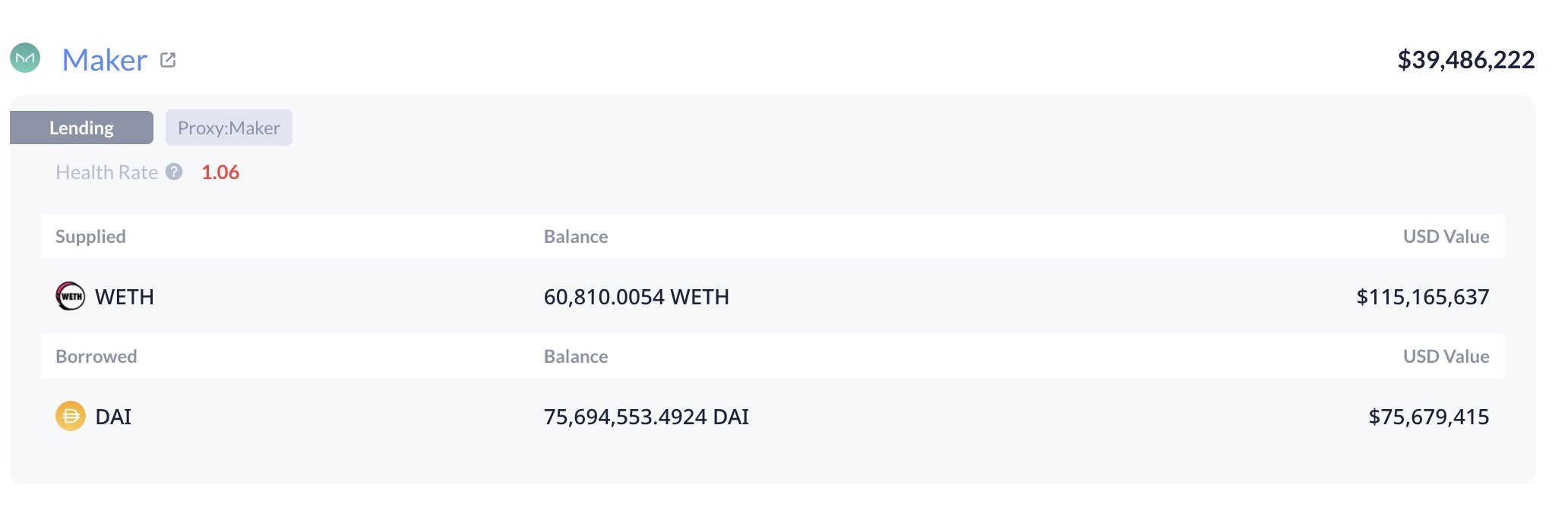

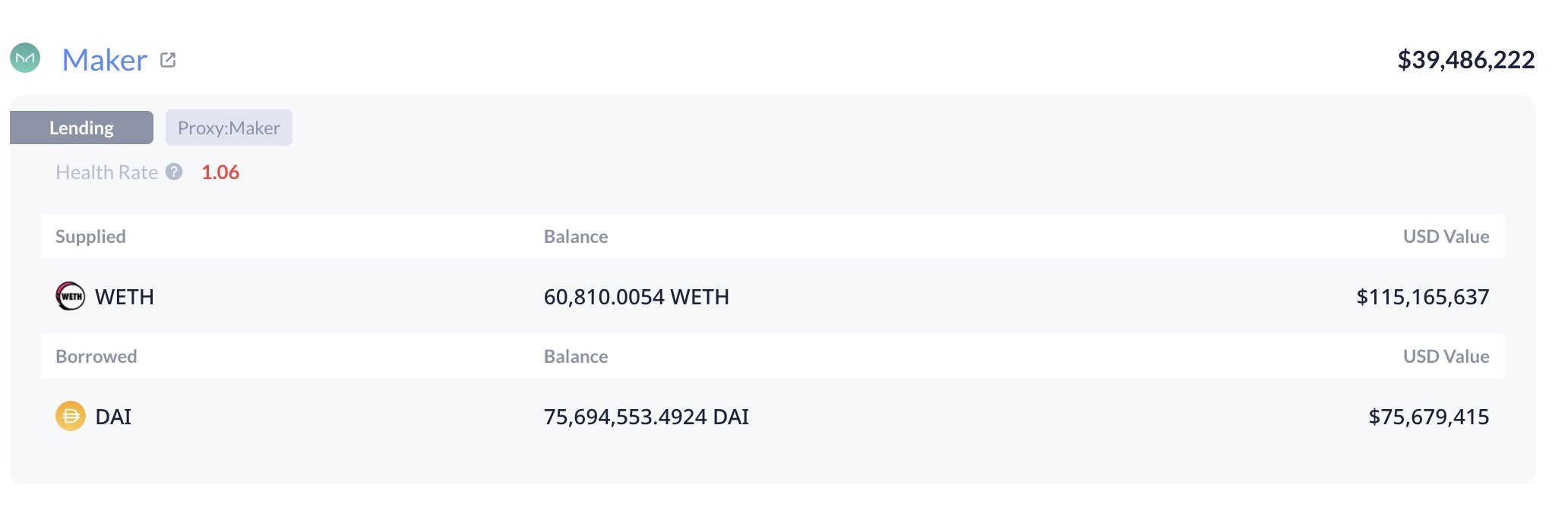

While Ethereum’s Layer 2 innovations focus on improving scalability and security, the broader ecosystem still faces significant financial risks. One such concern is the liquidation risk tied to large ETH holdings on MakerDAO.

Source: X

As the price of ETH fluctuates, the 125,603 ETH (approximately $238M) held by two major whales on Maker is at risk of liquidation.

With the health rate dropping to 1.07 and critical liquidation prices at $1,805 and $1,787, a further decline in ETH’s price could trigger forced liquidations, potentially impacting market stability.

Ethereum price outlook

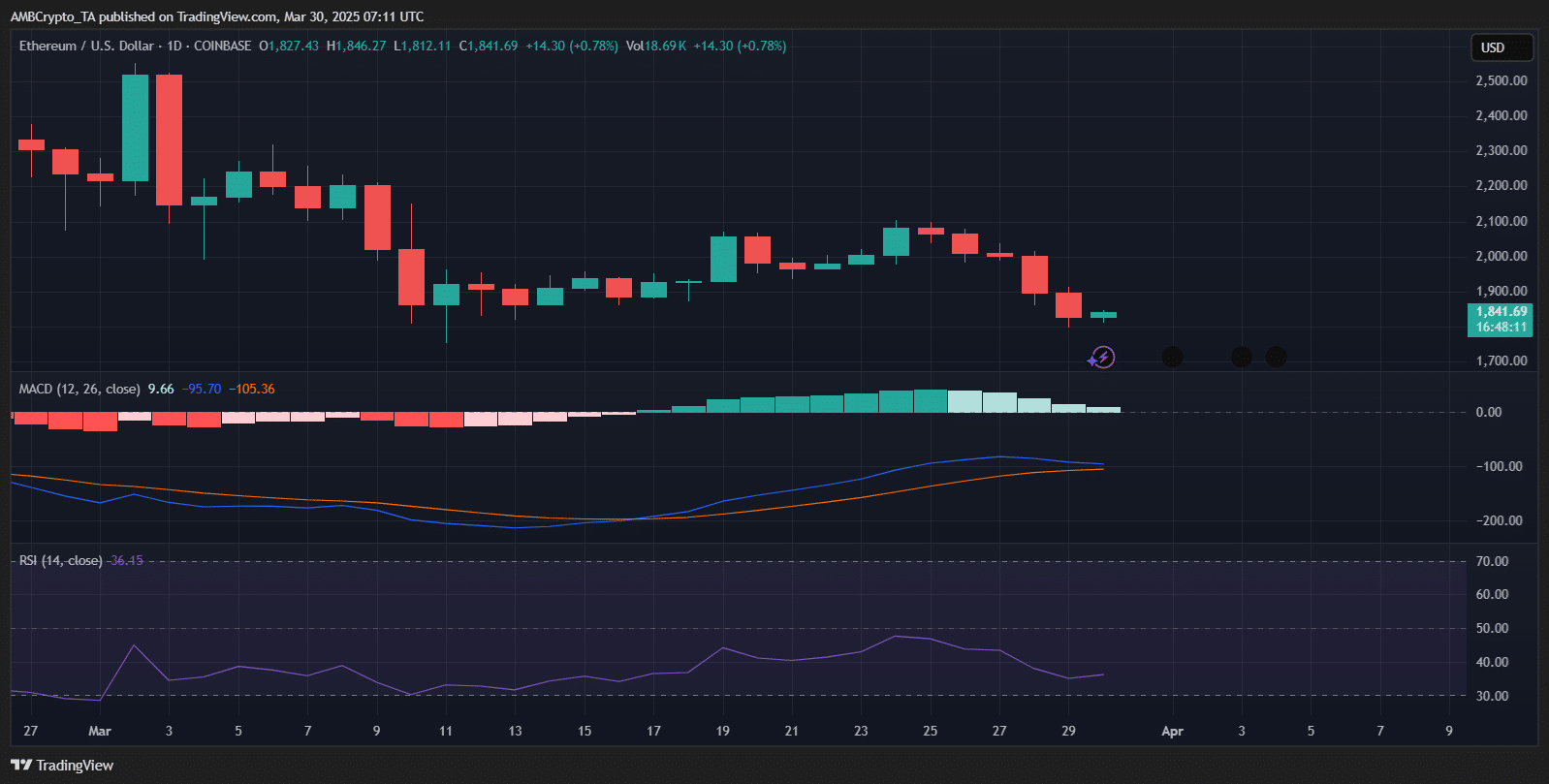

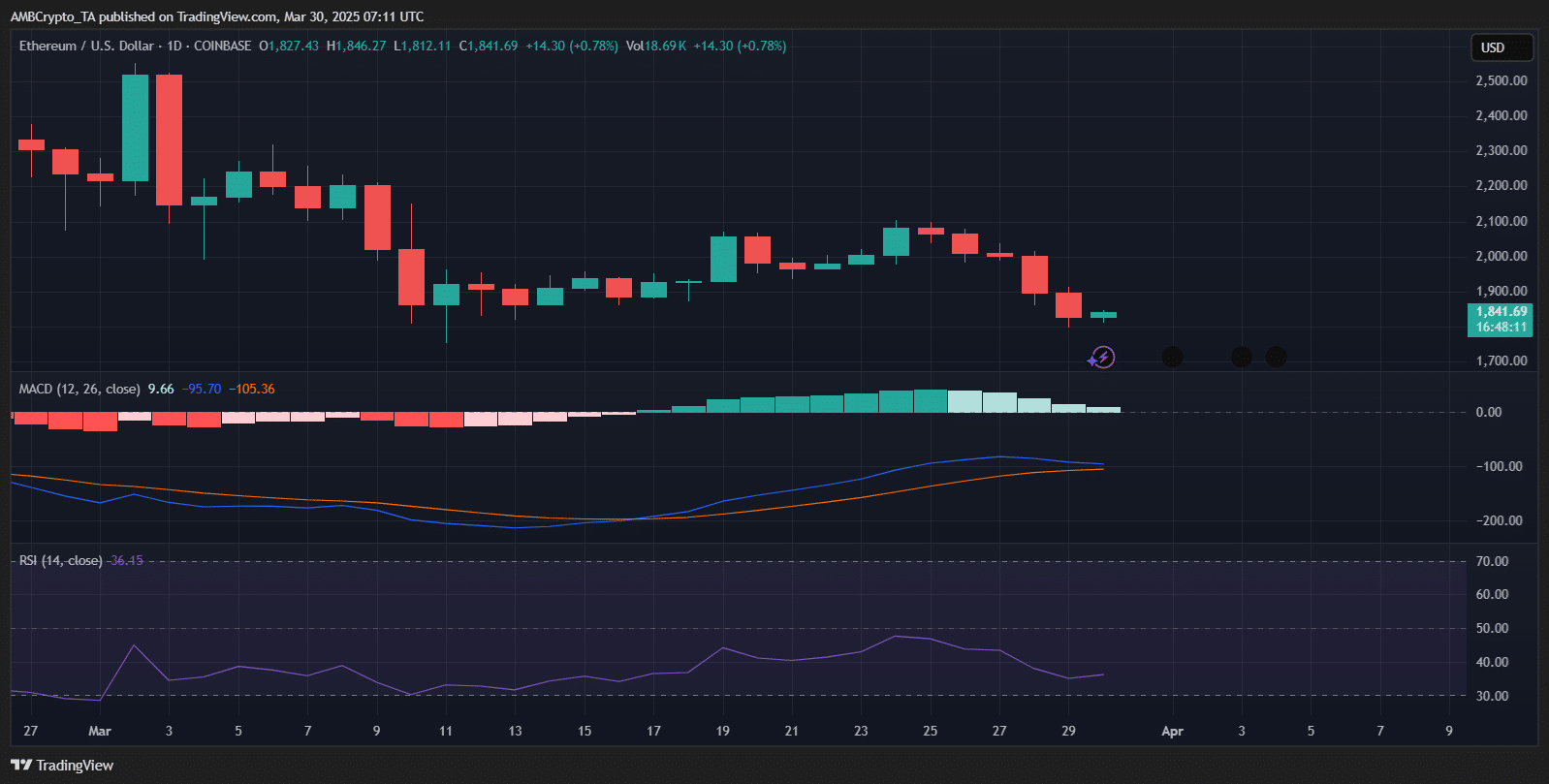

The Ethereum daily chart shows a slight recovery after an 8% drop in the last week, trading at $1,841.69 at press time.

The MACD indicator remains bearish, with the line below the signal line, suggesting ongoing selling pressure. The RSI at 36.45 indicated oversold conditions, hinting at a potential reversal if buying volume increases.

Source: TradingView

The recent price action shows a consolidation phase after a sharp decline, with support likely around $1,750-$1,700. If bullish momentum builds, resistance is expected near $1,900-$2,000.

The overall trend remains uncertain, with further downside possible unless a strong buying push materializes.