- ETH staking flipped from outflows to inflows right after Pectra’s February announcement — not at launch.

- Inflows hint at early institutional alignment with Ethereum’s yield-friendly, validator-focused future post-upgrade.

Ethereum [ETH] enthusiasts had been counting down to the Pectra upgrade, anticipating that its validator-friendly changes would reshape staking dynamics.

But the shift began earlier than expected — not at launch, but from the moment Pectra’s roadmap was announced in mid-February.

A recent report revealed that ETH staking flipped from months of outflows to net inflows almost immediately after the upgrade was announced.

Now that Pectra is officially live, the rebound raises a bigger question: is this just a short-term reaction, or the first signal of growing institutional confidence in Ethereum’s yield and infrastructure story?

Staking timeline

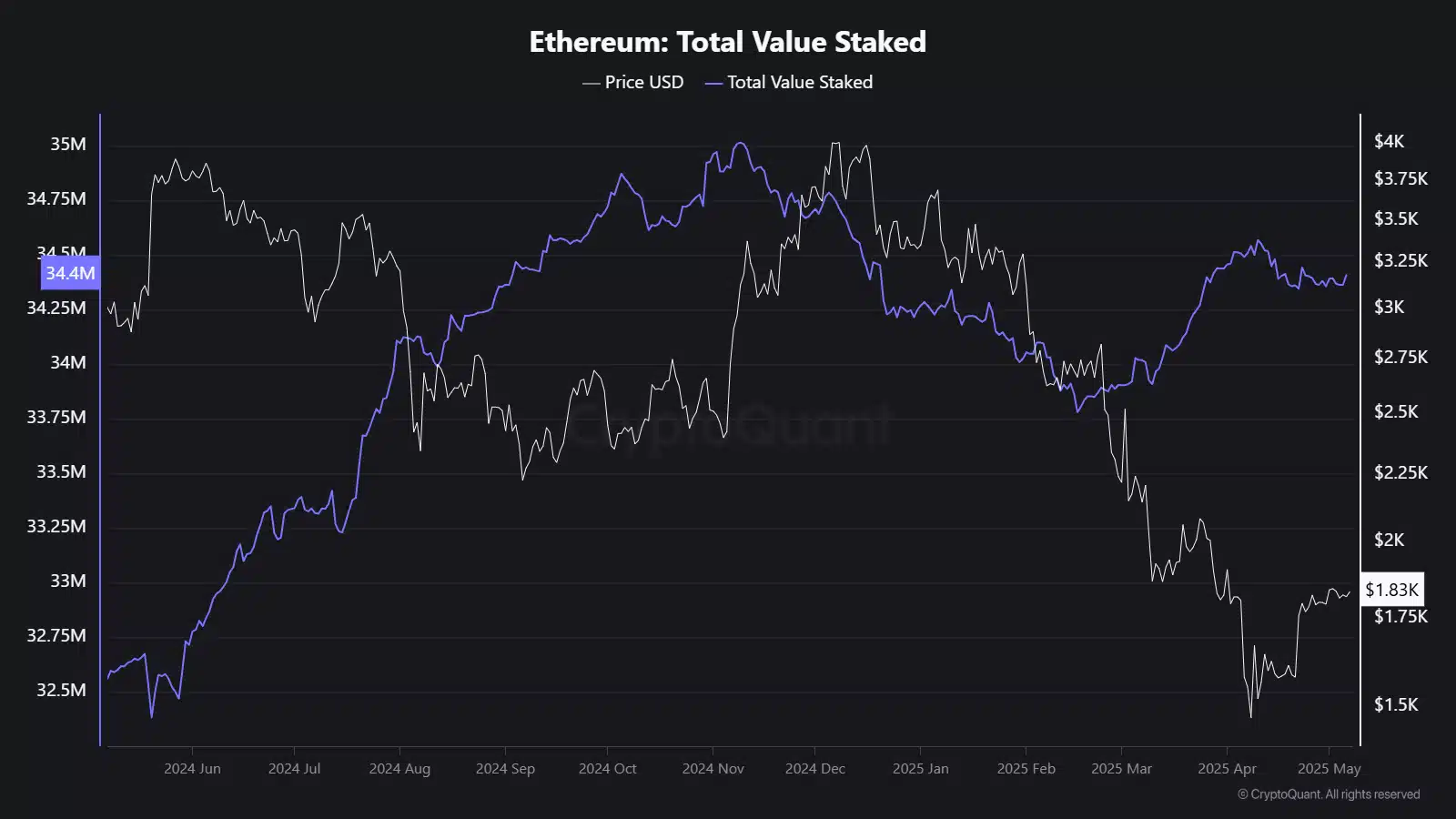

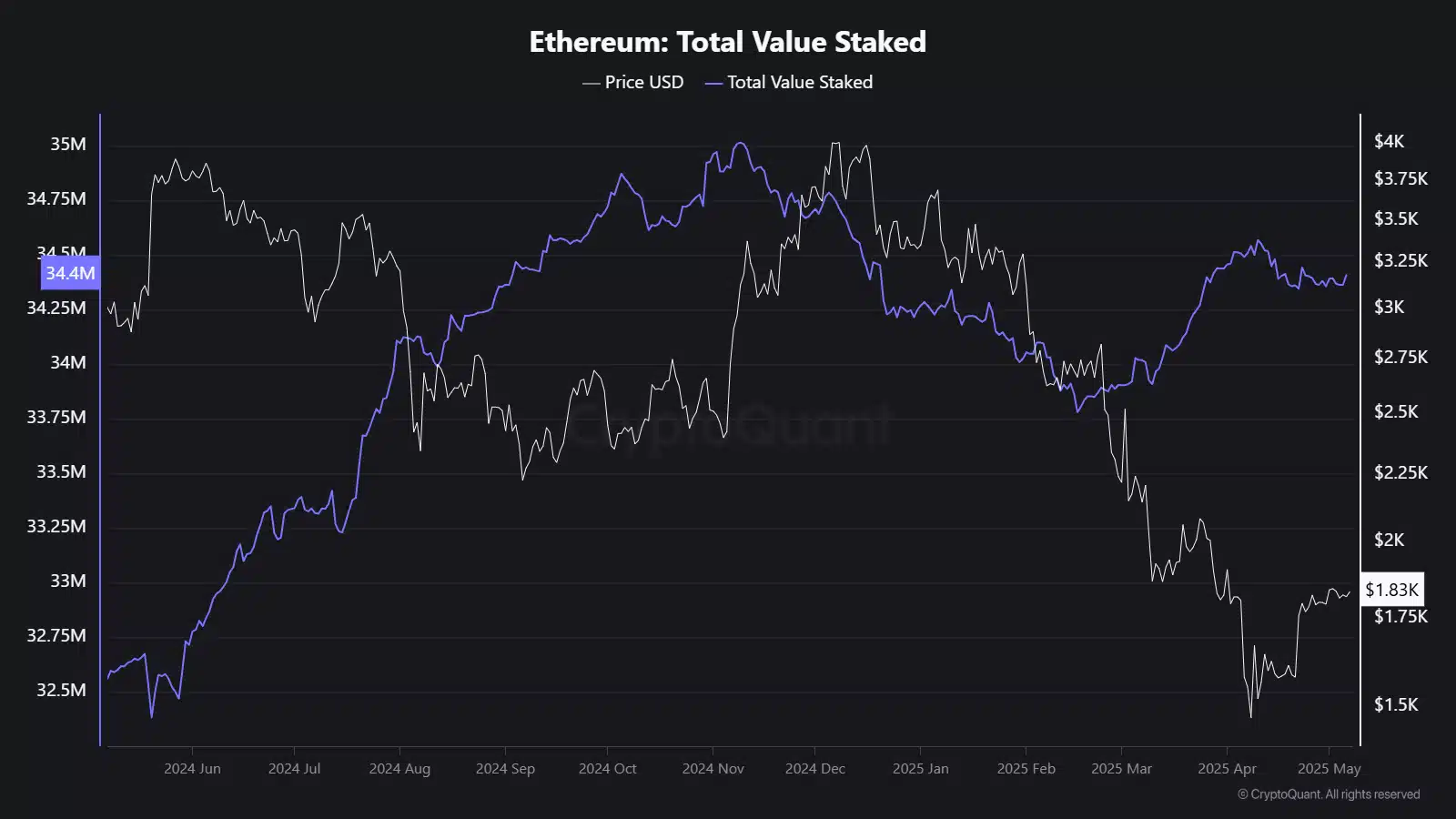

Source: Cryptoquant

From the 16th of November to the 15th of February, staking participation declined notably — from approximately 34.88 million ETH to 33.86 million ETH.

That 1.02 million ETH outflow reflected market jitters, likely stemming from regulatory pressures and the broader risk-off sentiment that dominated Q1.

But the announcement of Pectra around mid-February altered that trend. From the 16th of February to the 16th of May, ETH staking rebounded with a net inflow of 627,000 ETH.

You can’t ignore the timing — Ethereum’s validator-centric upgrades, including EIP-7002’s flexible withdrawal credentials, landed well with the ecosystem and may have reassured more sophisticated stakeholders.

Source: Cryptoquant

Staking inflows could signal growing institutional trust

Staking inflows often mirror behavioral shifts. And Ethereum’s recent trends suggest more than just a retail return.

The restoration of confidence in the staking system points toward a shift, possibly from institutions exploring or preparing for Ethereum’s post-upgrade profile.

Key staking milestones — like the Shanghai and Pectra upgrades — have historically driven ETH flows.

Around each, we’ve seen positioning shift weeks before the technical rollout, showing the market’s forward-looking approach.

With ETFs now in play and staking mechanics becoming more flexible, Ethereum’s design is increasingly friendly to large capital allocators.

The yield narrative

Ethereum’s native yield — through staking — has always been a central narrative. Now, with Pectra in place, that narrative gains credibility and structure.

The reduced operational friction, paired with protocol-level improvements, may attract further inflows.

While current inflow volumes aren’t explosive, they’re directionally important.

A slow but steady climb in staked ETH hints at a maturing market reassessing Ethereum’s yield potential — not just as a retail yield farm, but as a strategic, regulated, and ETF-compatible yield product.