- Spot traders took a neutral position in the market, with whale accumulation climbing on the charts too

- Litecoin’s price could reclaim a key consolidation level and see a major move to the upside

Litecoin [LTC] investors have had a challenging past few weeks. In fact, they have accumulated losses of 12.75% over the past week and 36.61% on the monthly charts. However, the tides appear to be changing, with the market’s whales taking over right now. As expected, the entry of whales had a positive impact on the cryptocurrency, with the same up by almost 2% in 24 hours.

Can it climb any higher? Well, according to AMBCrypto’s analysis, LTC could reclaim a key level. This would potentially mark the start of a major rally, with the altcoin reversing its recent losses too.

Spot traders pass the baton to whales

According to IntoTheBlock, spot traders have stopped actively buying and selling the asset, with 0 LTC traded in the last 24 hours.

When such a scenario occurs, it is a sign of exhaustion among buyers and sellers. What this means is that there is no accumulation or distribution of LTC on exchanges. Inflows and outflows balance out too – Indicative of a neutral positon.

Source: IntoTheBlock

While spot traders have adopted a neutral position, whales have recorded high trading volumes, with this cohort sitting on $8.24 billion worth of LTC at press time. These transaction volumes consist of whale buyers and sellers.

The Bull Bear Indicator is a metric that measures whether large buyers or sellers are dominating trading volume. As per the same, the market may be at balance now, with 28 bulls and bears.

Whenever there is balance in the market and the price rises, it means that buyers are in control. They do so by purchasing more LTC while sellers offload their holdings. This is also a sign of whales accumulating the altcoin at a lower price, while increasing their own position sizes.

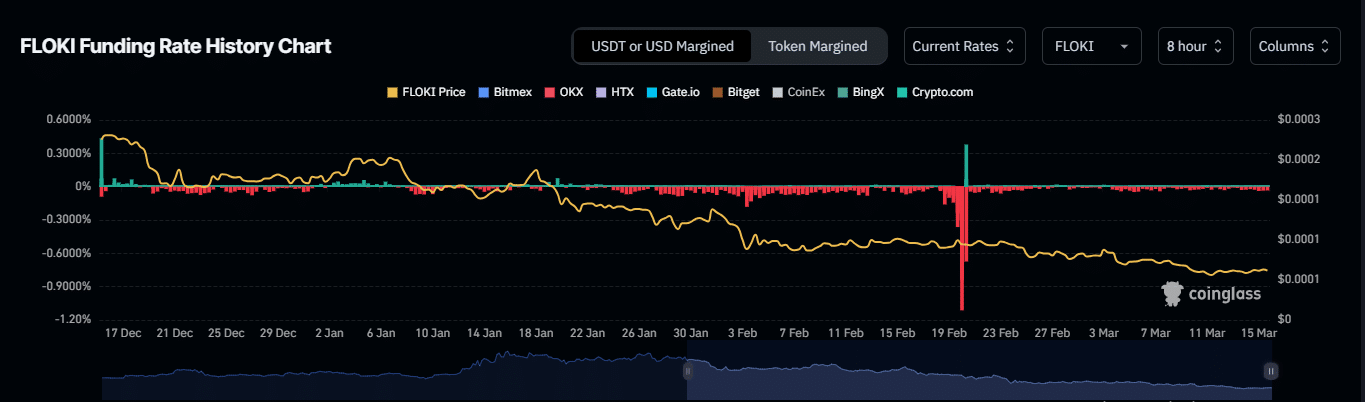

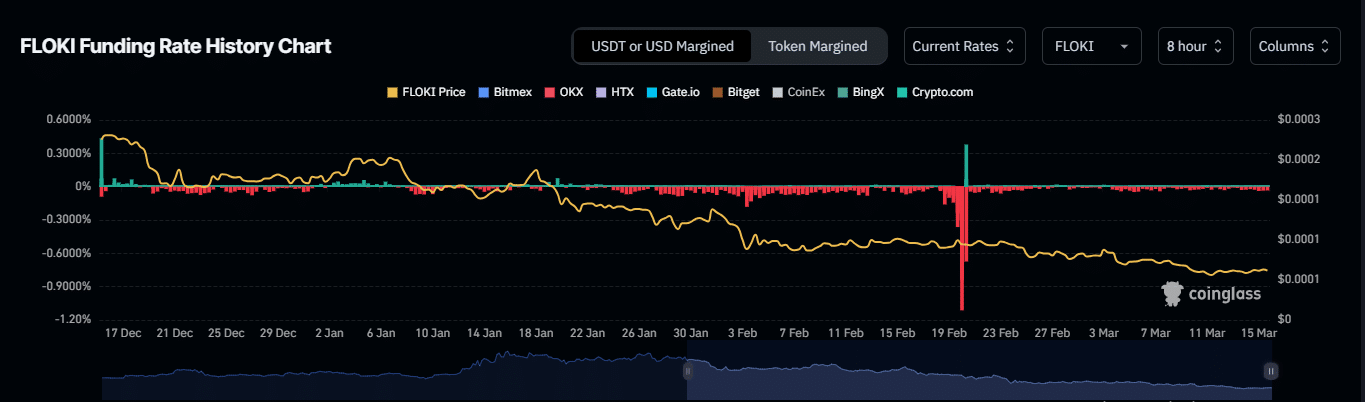

Source: Coinglass

Derivative traders have also played a notable role in Litecoin’s recent price movement. In fact, most of these traders are bullish, as indicated by the positive funding rate of 0.0063%.

A positive funding rate means the market favors long contract holders (buyers) who pay a periodic premium fee.

Alongside the rising funding rate is the growing taker buy-sell ratio, which measures whether derivative trading volume is dominated by buyers or sellers. At the time of writing, the ratio stood at 1:1. All while the Open Interest grew by 8.66% to hit $10.80 million on the charts.

Hence, it’s also worth analyzing the potential price impact IF a major bull run does begin.

Reclaiming the consolidation path

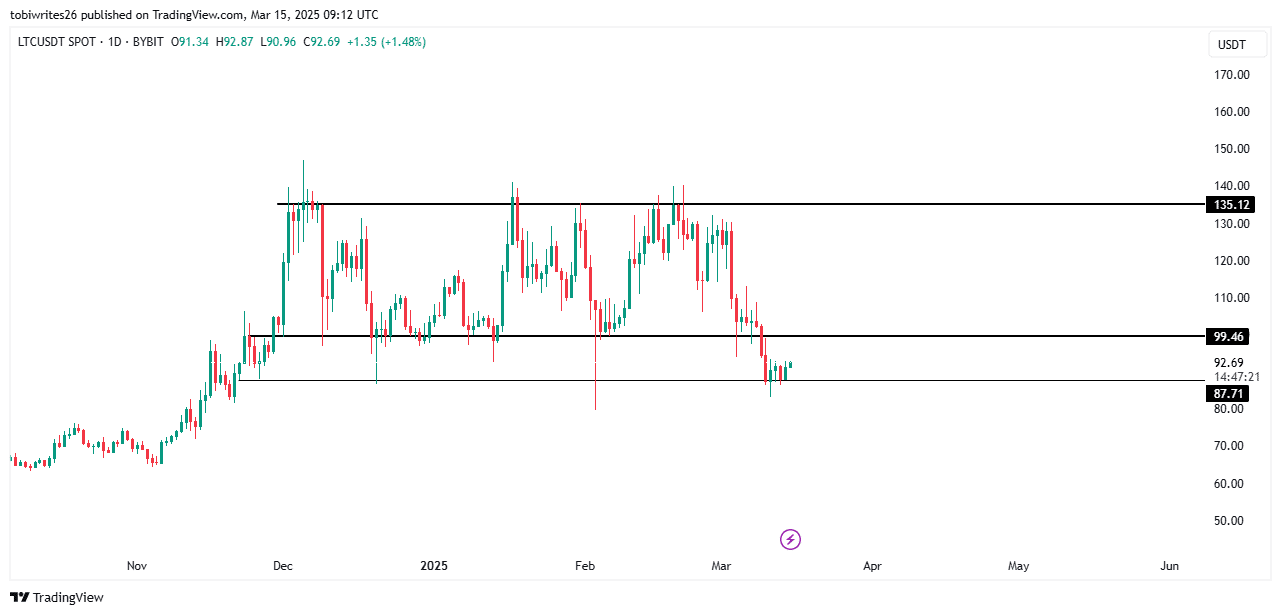

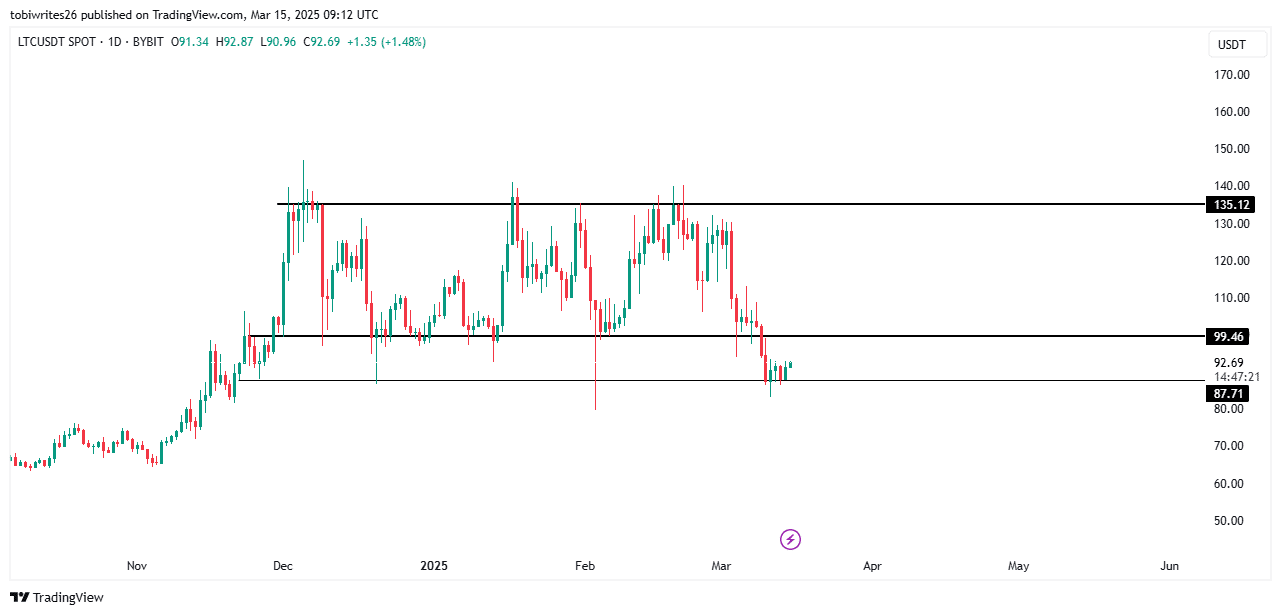

Litecoin’s recent gains correlated with the price bouncing off a support level at $87.71, potentially reflecting strong buying pressure that aided its two-day consecutive uptrend.

Source: TradingView

If the bullish trend continues, LTC could reclaim the support level of the consolidation channel it previously breached at $99.46. This would indicate that the drop below this level was merely a stop hunt, and the price can continue rallying north.

If the altcoin hits this new support level at $99.46, the price could surge to the peak of the channel at $135. If momentum remains strong at this level, Litecoin might continue its upward trajectory.