- TON’s ecosystem expansion and Telegram partnership have driven adoption

- Technical metrics and user activity trends hinted at consolidation on the price charts

Toncoin’s [TON] normalized risk metric has been signaling a potential market bottom lately – a level historically associated with price rebounds. In August 2024, TON surged from $5.3 to $6.8 after hitting similar metrics – Proving the reliability of this indicator.

At press time, TON was trading at $5.03 following a 2.14% fall over the last 24 hours. Hence, the question – Can the press time level set the stage for another upward surge on the charts?

TON and Telegram’s partnership drives ecosystem growth

The strategic partnership between TON and Telegram continues to strengthen the blockchain’s position in the market. Telegram’s Mini App ecosystem now exclusively integrates TON, reaching over 950 million monthly users globally.

Additionally, TON Connect, a streamlined wallet connection protocol, is simplifying blockchain transactions for Telegram users, enhancing usability. Therefore, this partnership not only boosts adoption, but also solidifies TON’s role as a key player in blockchain integration.

Privacy coins rally as Ross Ulbricht pardon fuels optimism

The pardon of Ross Ulbricht and the Tornado Cash reversal have sparked fresh interest in privacy-focused cryptocurrencies. As a result, Monero and Dash saw significant momentum. These altcoins weren’t the only ones though as TON gained attention due to its strong focus on privacy-aligned blockchain technologies.

Needless to say, these events have bolstered TON’s position in the privacy coin market.

Therefore, its ecosystem now attracts greater attention from investors and users alike. However, sustained interest will require consistent ecosystem developments and market engagement.

What do the charts reveal about TON?

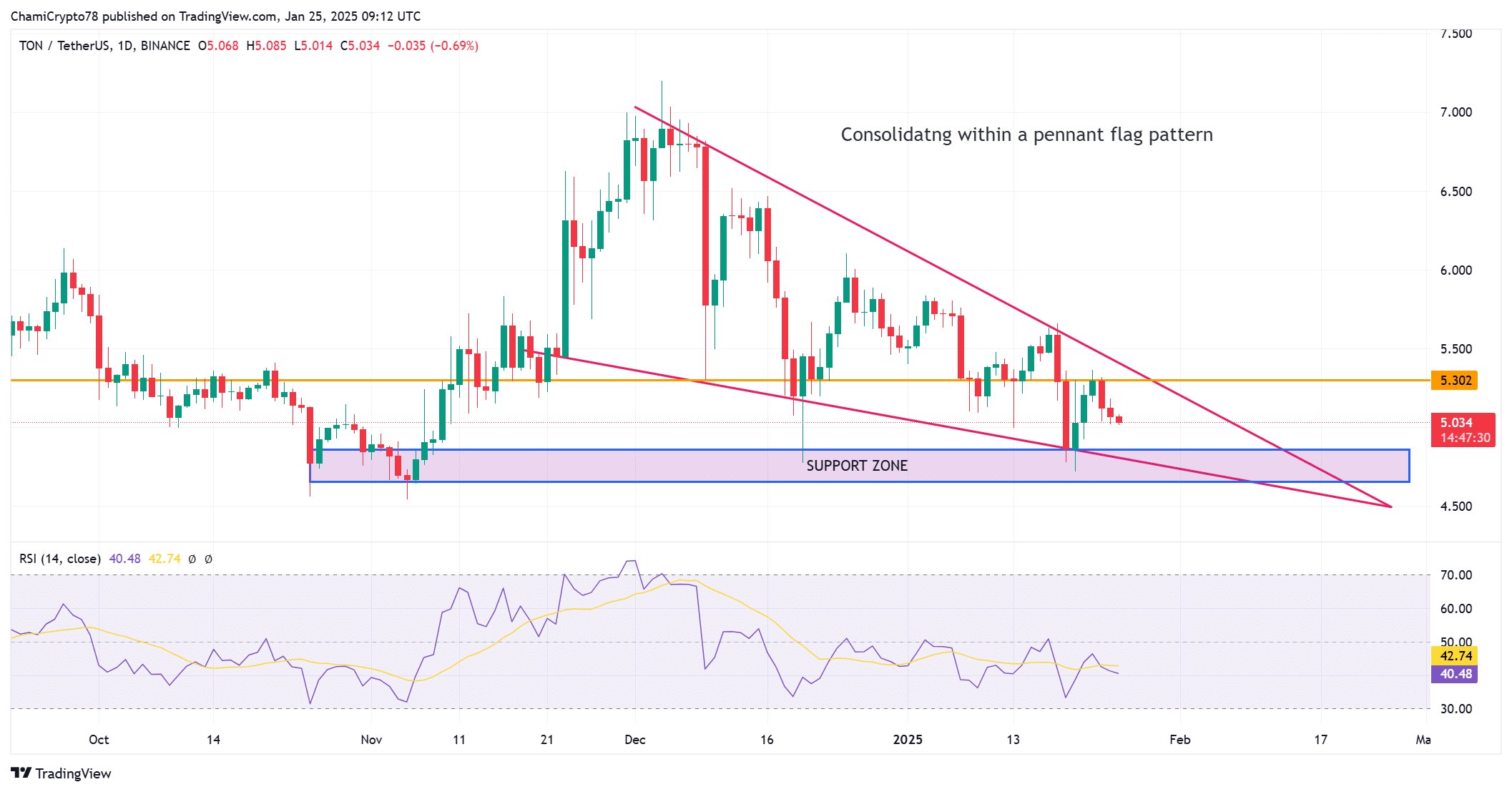

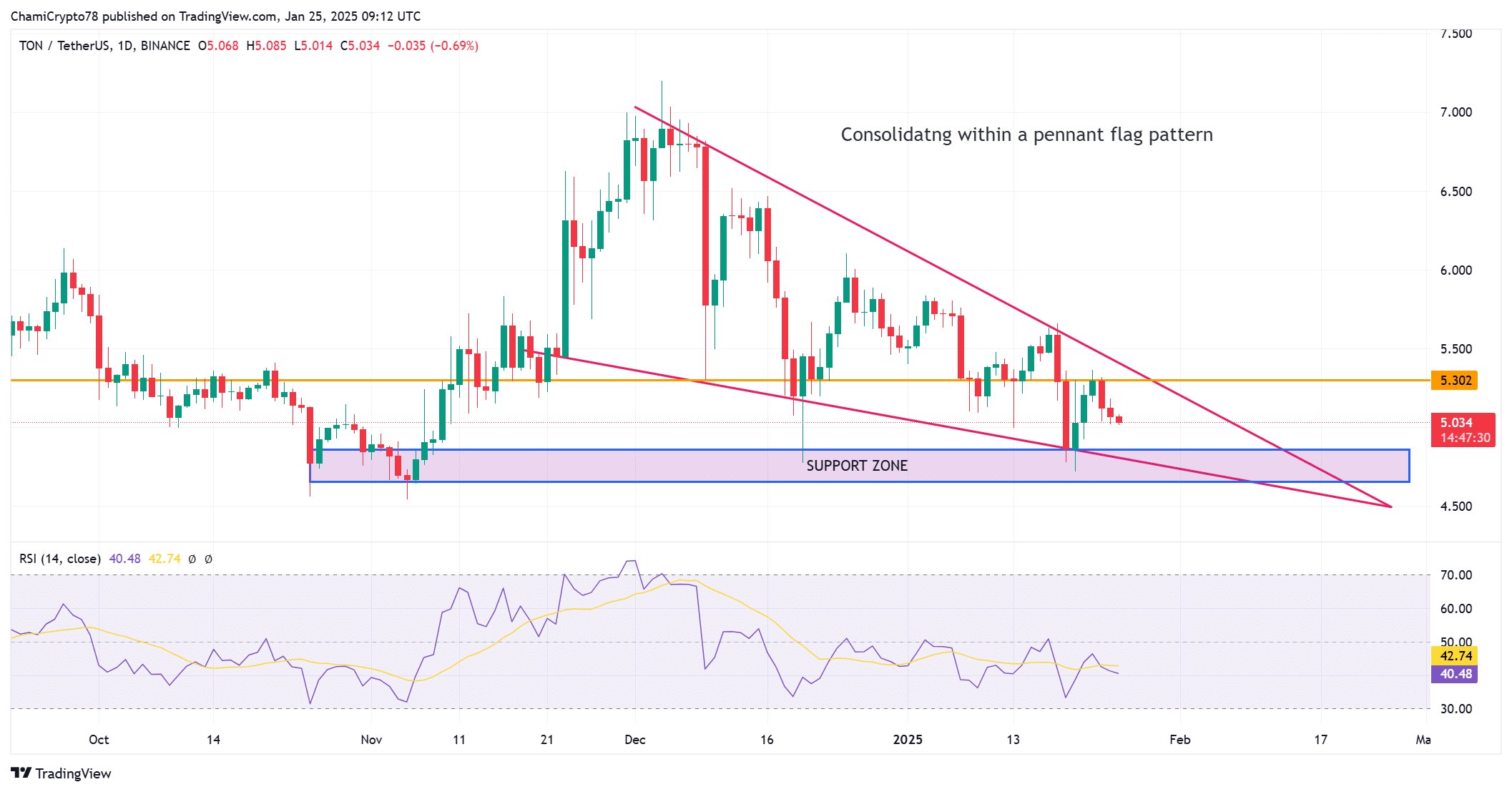

At press time, TON’s price action highlighted consolidation within a pennant flag pattern – Indicating the potential for a breakout. The support level was found at $4.50, while resistance lay near $5.30 – A critical level for traders to watch.

Additionally, the RSI was neutral, reflecting indecision among market participants. If a breakout occurs above $5.30, historical data suggests Toncoin could rally towards $6 on the charts.

Source: TradingView

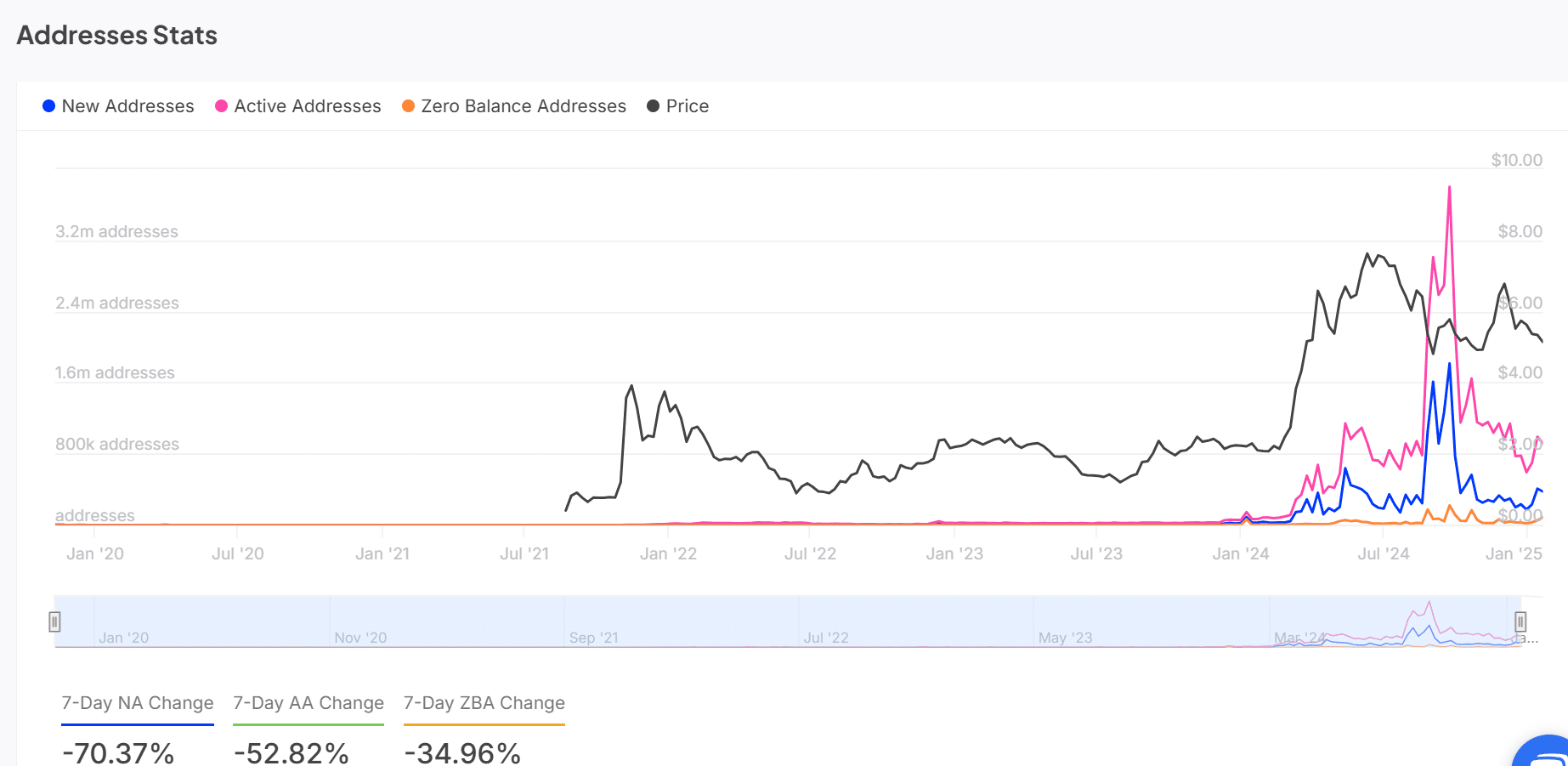

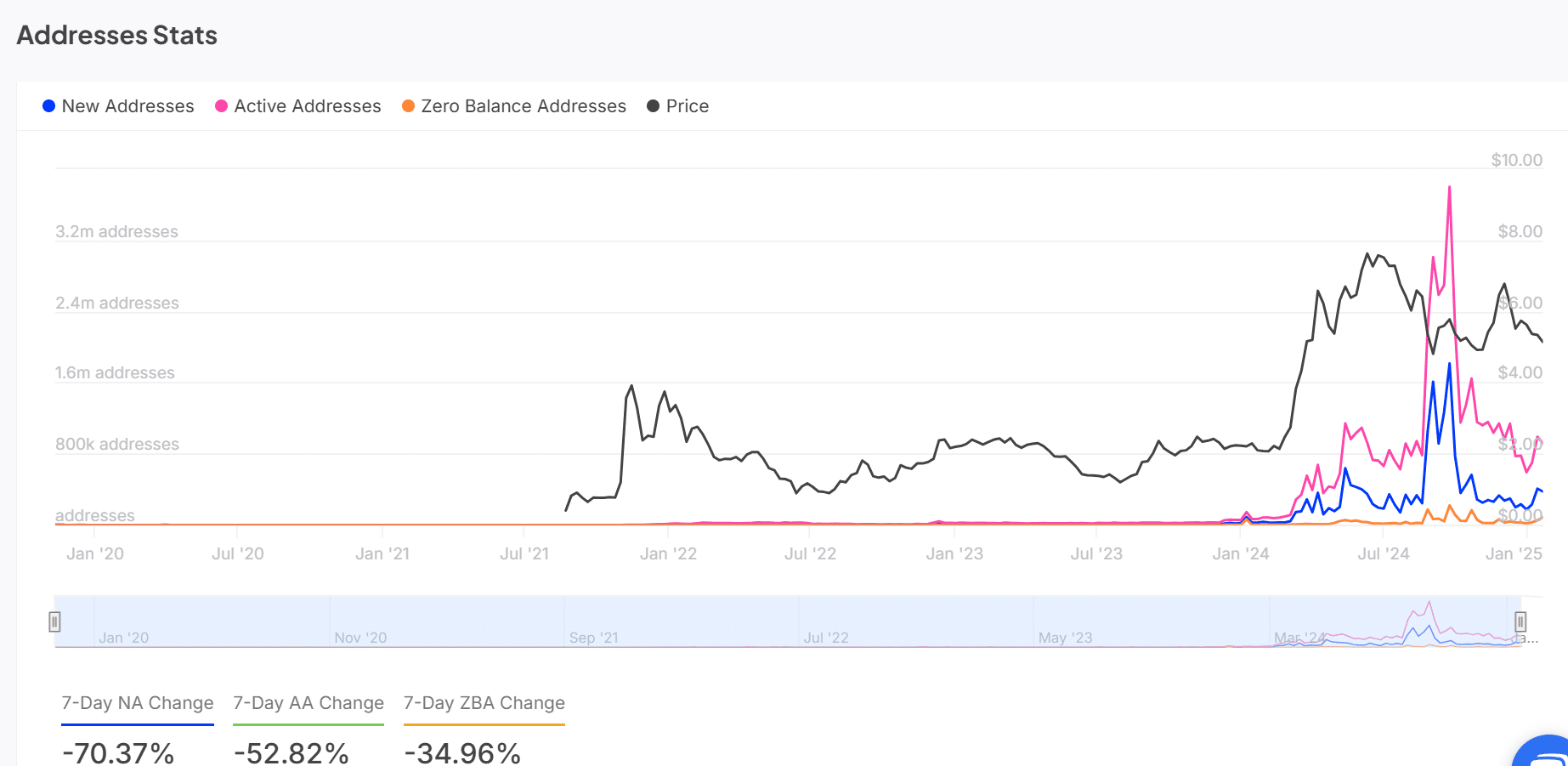

TON user activity and address stats suggest consolidation

On-chain activity for Toncoin [TON] highlighted a 52.82% drop in active addresses and a 70.37% decline in new addresses over the past week. However, Telegram’s ecosystem integration could reverse this trend by attracting more users in the near term.

Additionally, the decline in zero-balance addresses alluded to some consolidation, which could support price stability. Therefore, the ecosystem’s current lull may provide a strong base for future activity and growth.

Source: IntoTheBlock

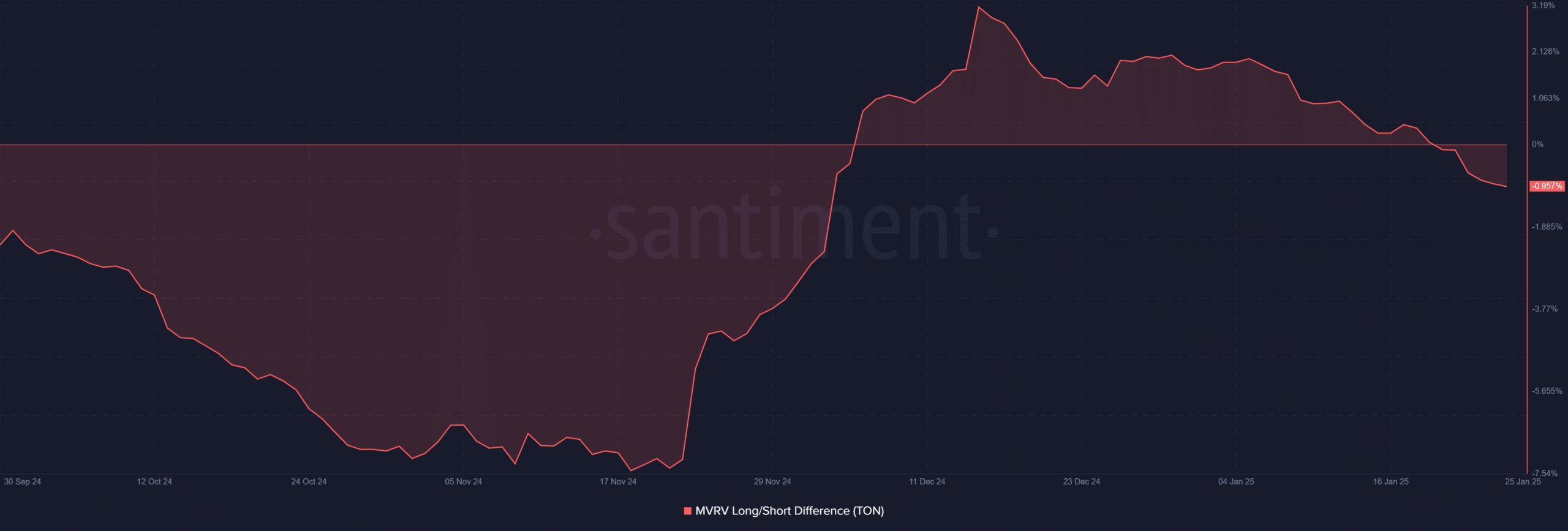

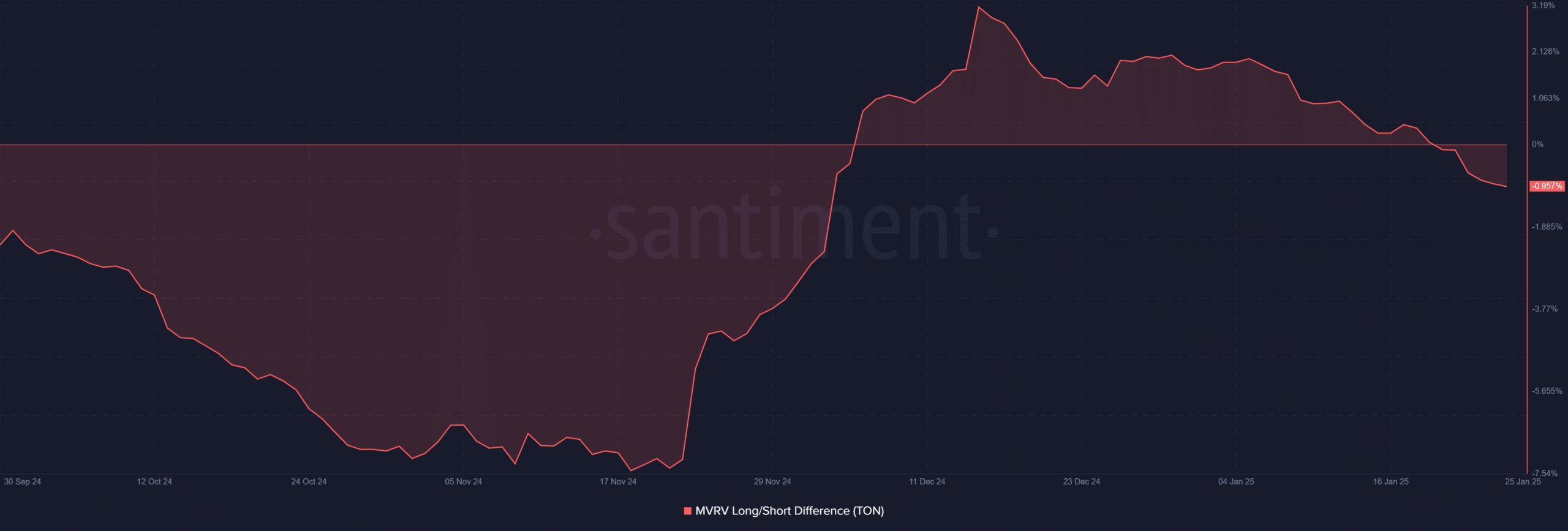

MVRV ratio indicates potential for recovery

At press time, the MVRV long/short ratio stood at -0.95% – A sign of negative sentiment among long-term holders. Historically, such levels have coincided with market bottoms, often leading to a price recovery.

This seemed to be consistent with the normalized risk metric signal, further hinting that a reversal may be imminent. Additionally, the combination of these metrics reinforced the possibility of Toncoin approaching the $6-mark soon.

Source: Santiment

Read Toncoin’s [TON] Price Prediction 2025-26

Toncoin is well-positioned for a rally, driven by ecosystem growth, privacy coin momentum, and favorable technical signals.

While risks remain, the combination of metrics and recent developments suggests TON could soon break out of its current consolidation phase. Is the next price target of $6 within reach? All signs suggest that it very well might be.