- Fantom recorded its highest volume of large transactions since October, leading to a notable price drop in the past 24 hours.

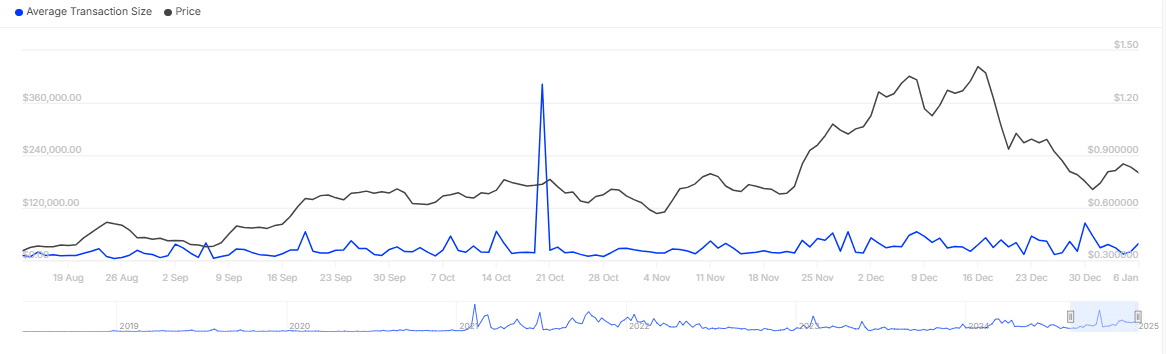

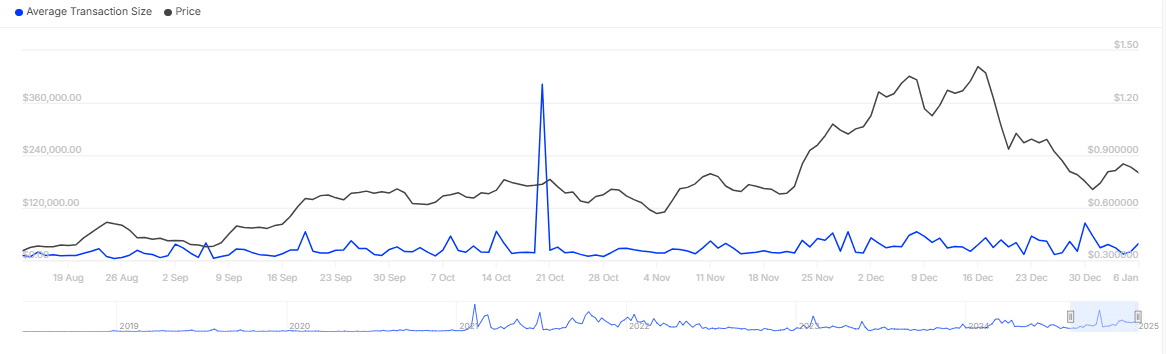

- The average transaction sizes spiked sharply, further intensifying the pressure on exchanges.

Over the last 24 hours, Fantom’s [FTM] price plunged by 3.05%, falling to $0.78, according to CoinMarketCap.

If this trend continues, the asset risks erasing its hard-earned weekly gains while deepening its monthly losses, already exceeding 40%.

This price slide is likely triggered by recent bulk sales from whales, with further declines expected if the selling spree persists.

Whales sell in high volumes

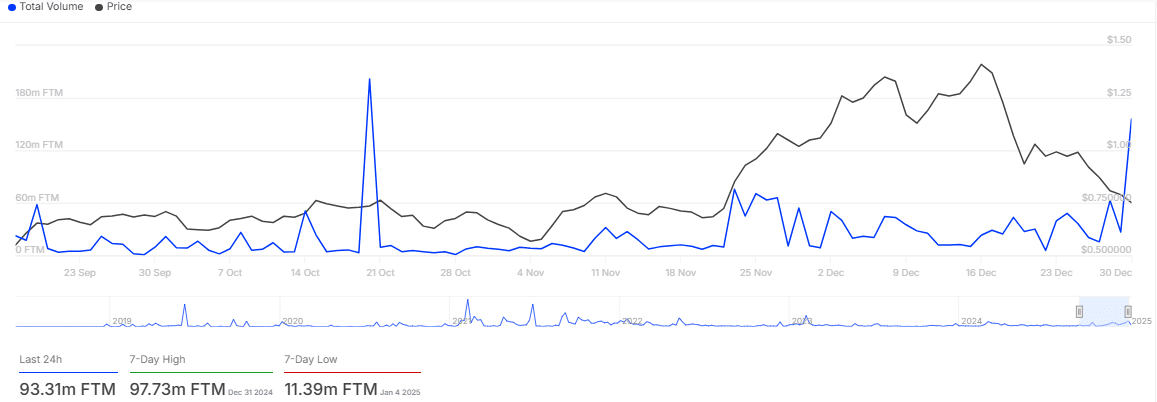

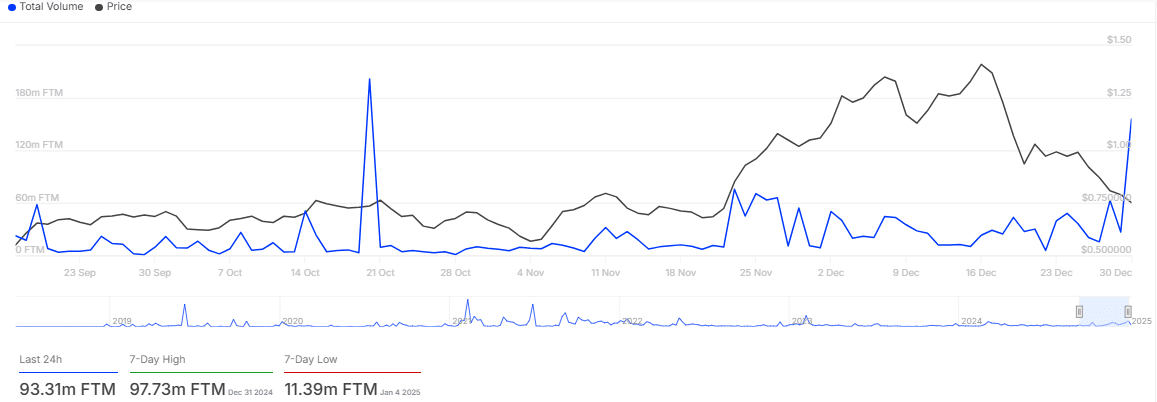

Data from IntoTheBlock revealed a significant increase in activity among large traders, commonly referred to as whales, for FTM over the past 24 hours.

During this period, 184 whale transactions were recorded, amounting to 93.31 million FTM, valued at $74.8 million. Such a surge in activity often indicates that major market participants are either buying or selling the asset.

Source: IntoTheBlock

However, when a volume spike coincides with a price decline similar case of FTM, it suggests that the majority of large transactions involve selling.

To support this observation, AMBCrypto analyzed additional market metrics, discovering that a bearish sentiment is dominating the market.

Large FTM holders grow wary

Data from IntoTheBlock reveals a widening gap between bullish and bearish sentiment among large FTM holders.

Over the past seven days, the Bull vs. Bear metric showed that FTM had 139 bullish addresses compared to 148 bearish ones, indicating a shift toward bearish dominance.

These addresses collectively hold at least 1% of FTM’s total supply, and recent activity suggests selling pressure is increasing.

Additionally, the average transaction size rose sharply in the past 24 hours, reaching approximately $38,500 at press time, with the seven-day average climbing to $32,000.

This points to substantial amounts likely being sold in each transaction.

Source: IntoTheBlock

As bearish sentiment among whales continued to grow and transaction sizes remained high, FTM’s price began facing additional downward pressure from retailer traders.

Retail sentiment turns bearish

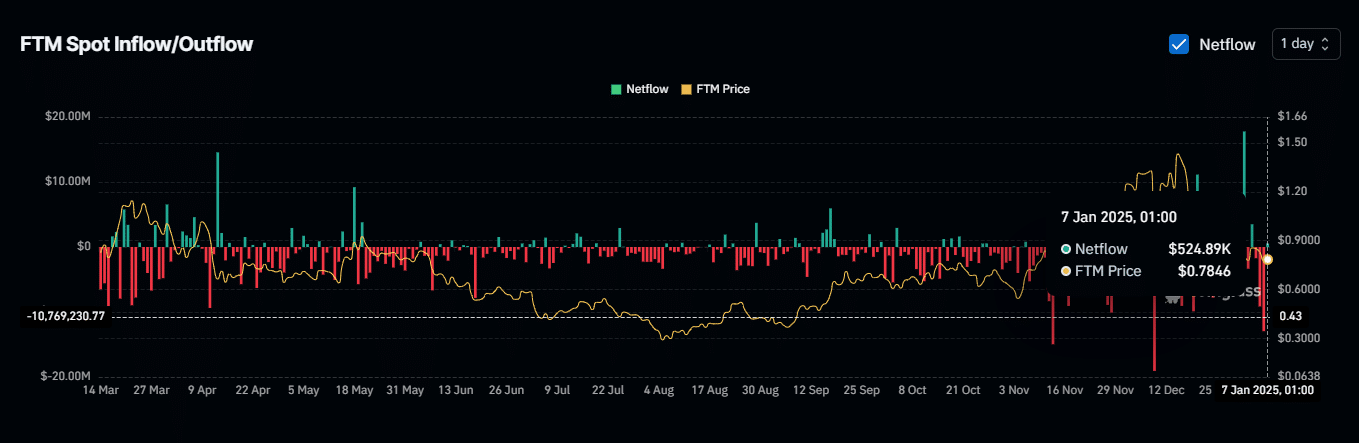

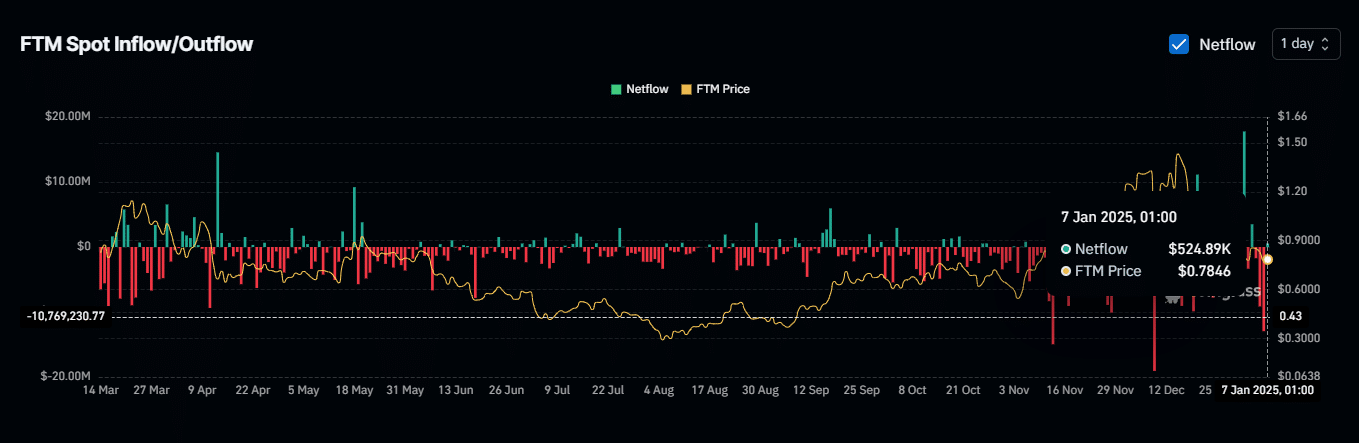

Retail traders in the market are showing increased bearish sentiment, with both spot and derivative participants engaging in selling activity.

Spot traders have gradually started transferring FTM to exchanges, with $497,370 worth of the asset added to exchange wallets on the 7th of January.

This trend suggests the likelihood of more inflows throughout the day, as traders prepare to sell.

Source: Coinglass

When assets move from wallets to exchanges and the exchange netflow turns positive, it typically indicates rising selling pressure and an increase in the available supply of FTM on exchanges.

Derivative traders are mirroring this bearish sentiment. Open Interest has been declining steadily, dropping by 7.34% to $92.62 million in the past 24 hours.

Read Fantom’s [FTM] Price Prediction 2025–2026

Such a decline often signals that market participants are closing contracts, showing a loss of confidence as bearish sentiment takes hold.

With most key metrics pointing toward a bearish outlook, there is a strong possibility that FTM may experience further declines in the near term.