- FARTCOIN has defied broader market selling with triple-digit monthly gains.

- As deep pockets realize profits, is the $1 mark in danger?

Fartcoin [FARTCOIN] continues to dominate the weekly top-performers chart. However, its momentum has cooled from triple-digit to double-digit gains. This deceleration suggests that large holders may be realizing profits, especially after the memecoin reclaimed the $0.98 level on the 11th of April.

On-chain data from Lookonchain supports this observation. Over the past two days, whale wallets have offloaded approximately 8.5 million FARTCOIN tokens. At this key supply zone, this would roughly account for $8.33 million in sell-off value.

As Fartcoin approaches the psychologically significant $1 level, these sizable sell-offs could limit the rally, potentially creating strong overhead resistance in the $0.80 — $0.98 range.

But can the memecoin defy broader market odds once again?

A technical and on-chain breakdown

On the monthly timeframe, FARTCOIN has posted a staggering 239.14% gain, positioning it as the top performer.

Consequently, the memecoin has managed to sidestep major drawdowns, suggesting that capital rotation during periods of high-FUD may have funneled liquidity into speculative high-beta plays like FARTCOIN. Hence, giving it a distinct relative strength advantage.

Beyond pure price action, the fundamentals are showing momentum as well. Adoption metrics have exploded, with the number of total addresses rising by 146.20% year-to-date, now totaling 408,377.

Source: Glassnode

Out of these, addresses holding over 10,000 tokens have rebounded to late-March levels, with 5,125 wallets currently in this bracket. Mathematically, this cohort holds a minimum of 51.25 million FARTCOIN tokens.

However, despite the robust metrics, caution is warranted. Whale offloads, coupled with an RSI sitting deep in overbought territory, suggest that the memecoin may be approaching a technical overextension. Too much, too soon, perhaps?

Is FARTCOIN overbought or overvalued? – The key differentiator is…

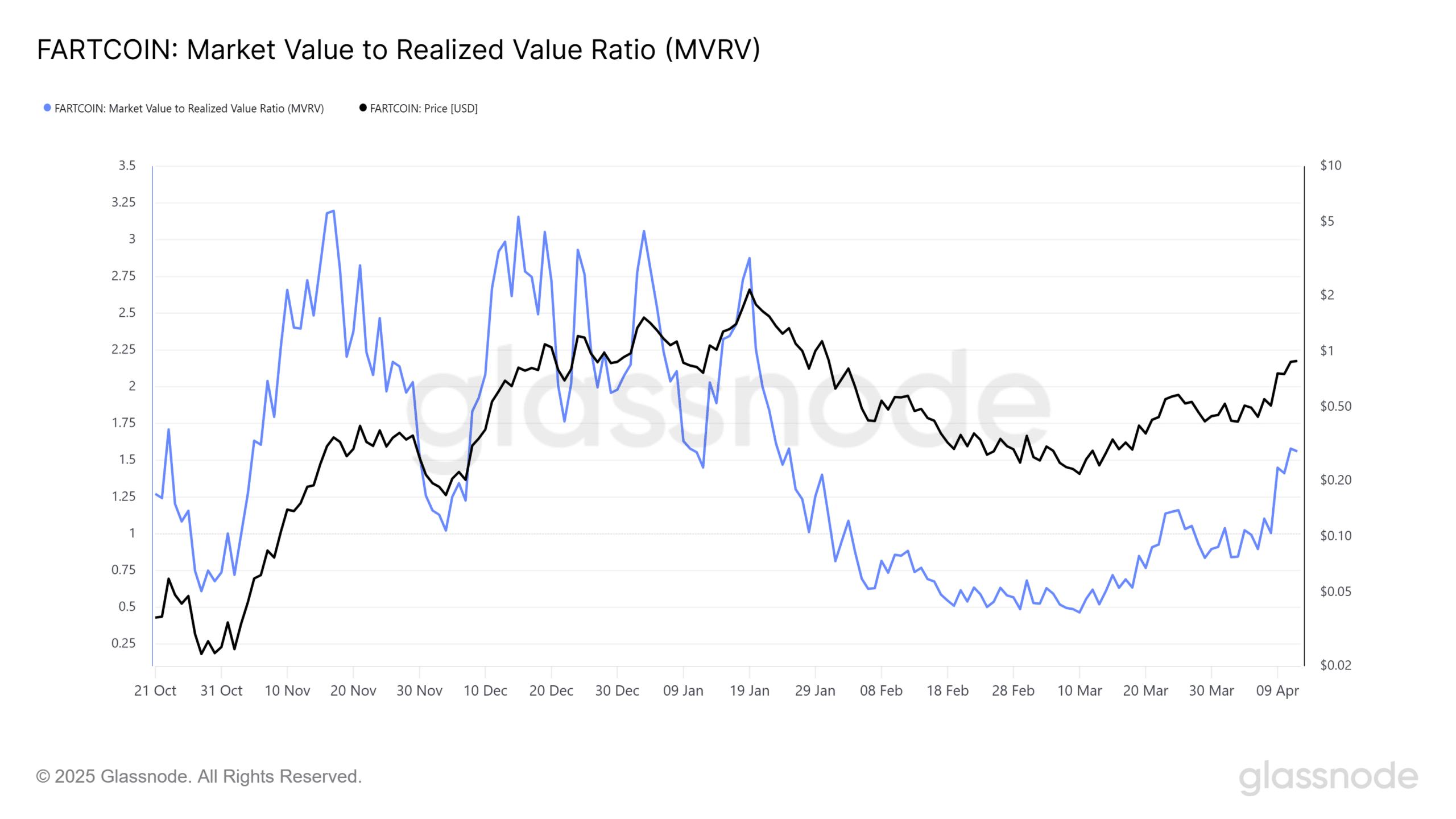

The Market Value to Realized Value ratio (MVRV) compares the current price of a coin to the average price at which it last moved. A ratio above 3.0 often signals overvaluation.

At press time, FARTCOIN’s MVRV ratio stood at 1.50, showing a bullish divergence. Unlike past market tops where the ratio spiked above 3 near $1, this suggests the coin isn’t overvalued yet.

Source: Glassnode

However, while not overvalued, FARTCOIN may face a technical pullback.

The percentage of supply in profit has soared past 85%, a level last seen during the mid-January rally. Coupled with a consistently elevated LTH NUPL in the euphoria phase, the stage is set for potential profit-taking by long-term holders.

Yet, the lack of overvaluation signals that market confidence in FARTCOIN remains robust. This suggests that any pullback would likely be short-lived, with broader upside potential still in play.

Given FARTCOIN’s strong fundamentals, liquidity grabs during periods of high FUD, and an MVRV ratio that doesn’t signal overvaluation, this presents a unique opportunity.

As a result, the $1 mark might be closer than many anticipate.