- Fartcoin trading volume surged by $96.8 million after a whale move.

- A whale offloaded $4.7 million worth of Fartcoin after two months of inactivity.

On a daily time frame, Fartcoin [FARTCOIN] has experienced a massive surge in its trading volume as whale activity spiked. According to EyeOnChain, whales are diving into a Fartcoin frenzy with big purchases.

Naturally, this reflected mounting interest—and possibly, brewing volatility. Often, a rise in Trading Volume points to either buying or selling pressure.

Looking at whale activity, large entities are making major moves.

First, over the past two hours, a whale has spent $2 million to buy 1.81 million Fartcoin tokens. After the purchase, the whale sat on a 1.81% profit.

While this whale made a purchase, another whale offloaded $4.7 million worth of Fartcoin, as reported by Arkham Intelligence.

As per the on-chain tracker, this whale acquired $2.4 million worth of Fartcoin at $0.2 and $0.3 two months ago.

Before the latest sale activity, the whale was holding $10.4 million in Fartcoin and now, after selling, holds $5.57 million worth of the memecoin.

This uptick in whale activity shows that whales are increasingly active and engaging with Fartcoin on both the buy and sell side. Despite the surge in selling activity from whales, buyers are outweighing sellers.

Source: Coinglass

This positive order imbalance is evidenced by a negative Spot Netflow. This metric has held within negative territory over the past four days.

At press time, spot netflow sat at -$715.6k, reflecting a higher buying pressure with exchange outflows outpacing inflows. These buyers have pushed the RSI to almost overbought territory.

At press time, Fartcoin’s RSI hovered at 64, slipping slightly from 69. The downturn suggests buyer fatigue could soon set in.

With rising whale activity, the question is whether Fartcoin can hold for a strong upward movement.

Are buyers exhausted?

According to AMBCrypto’s analysis, the market sentiments are shifting from bullish to bearish.

As such, Fartcoin’s Weighted Sentiment has turned negative again after holding positive for three consecutive days. A drop here reflects growing concerns among investors as they anticipate a potential correction.

Source: Santiment

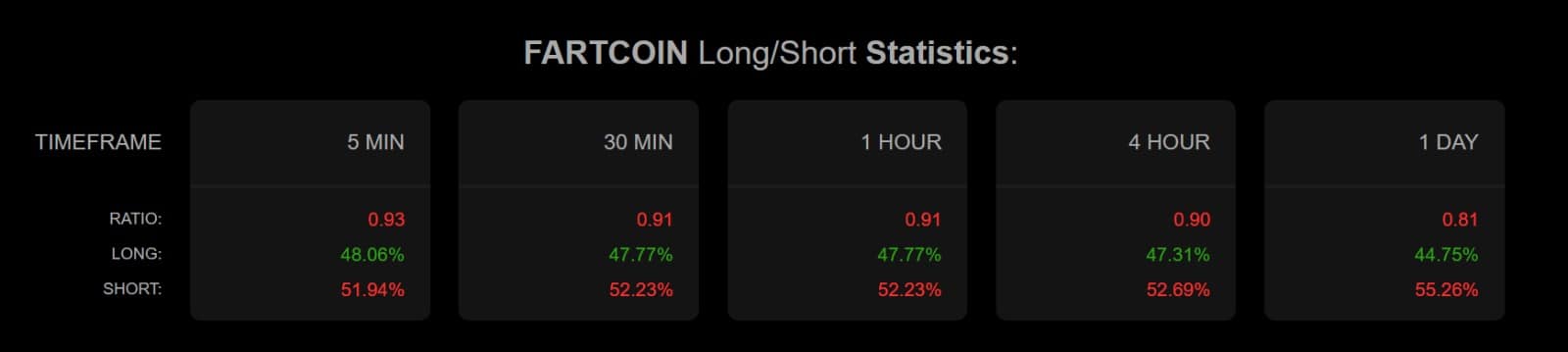

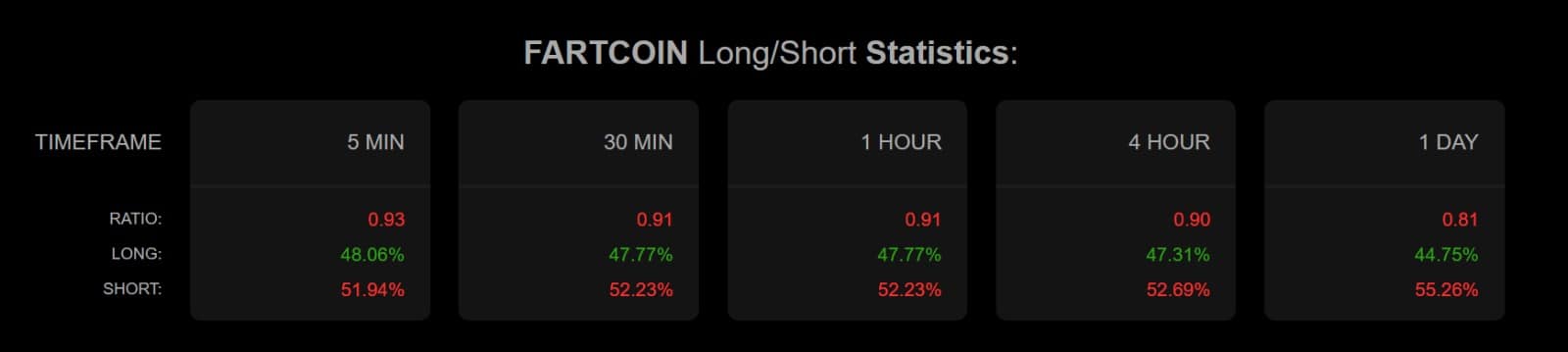

The shift is even more evident among Long/Short position holders. As of this writing, short positions have overtaken longs, with 55.26% of traders betting against the price. Only 44% remain on the long side.

When shorts dominate, it suggests that most investors are bearish and expect prices to decline in the near term.

Therefore, it’s safe to say that most investors entering the market are mostly shorting Fartcoin as they see an eventual decline.

Source: Coinalyze

With Trading Volume rising while bearish sentiments are rising, it indicates looming volatility in the market.

As such, bears are attempting to retake the market as whales start to offload. If the bears have their way, Fartcoin will drop to $1.03.

A failure to hold this level will see a drop below $1. However, if whales increase buying pressure and avert this bearishness, the memecoin could reclaim $1.2.