Key Takeaways

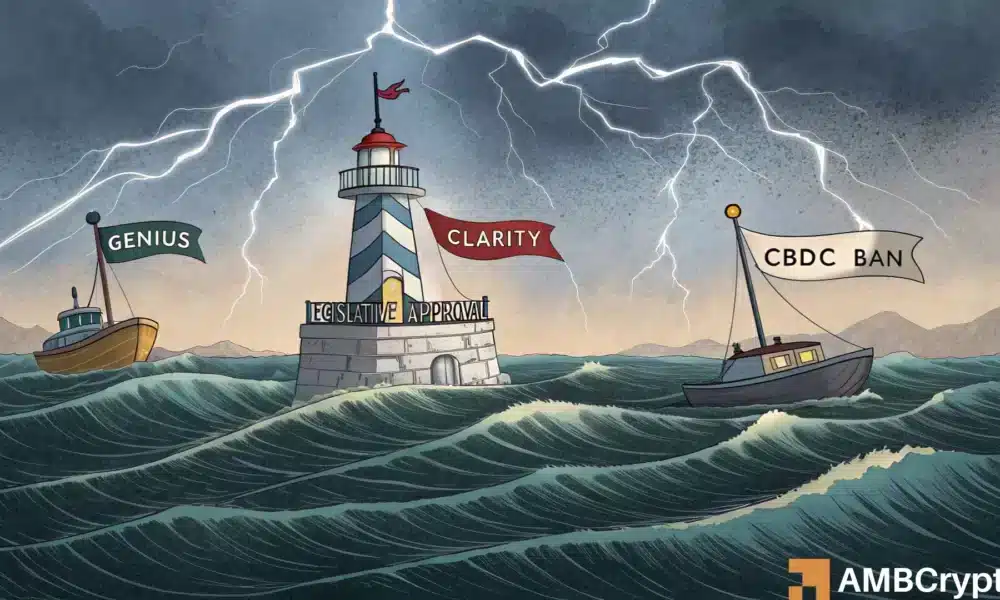

House Republicans blocked a procedural vote to consider two crypto bills on the House floor, dealing a setback to pro-crypto President Trump and the GOP’s efforts.

It’s crypto week in Washington, but things are already off to a rocky start. House conservatives tanked a procedural floor vote on the afternoon of the 15th of July.

The vote was to advance the three crypto bills, as well as the 2026 Defense spending measure. The final vote was 196-223, with Democrats and GOP hardliners voting against advancing the legislation.

The Republicans who voted against said they wanted the legislation to be packaged together with two other crypto bills for consideration this week.

These included a market structure bill and a bill that would ban central bank digital currency (CBDC). Rep. Marjorie Taylor Greene (R-Ga.) told reporters,

“President Trump wrote an executive order on January 23rd, specifically on exactly what the GENIUS Act is about. Except, they (the Senate) did not include what was in his executive order, which was a ban on central bank digital currency.”

The Senate had left this “extremely important” detail out. Moreover, she stated that Speaker Mike Johnson would not allow the House to vote on amendments to the legislation.

The House leadership has tentative plans to hold another vote later in the day.

However, it is still unclear if the second vote would be for identical bills or whether House Republican leaders would amend the packages to satisfy the first vote’s defectors.

Context on the crypto bills and the market reaction

The crypto industry could yet notch a major win this week if the House can pass the crypto bills that would set up a regulatory framework.

The first is the stablecoin bill known as the GENIUS Act. It is aimed at regulating stablecoins, specifically their issuance and exchange. The bill sets rules for issuers, aiming to protect consumers from a digital bank run.

The bigger prize was the CLARITY Act.

This would determine whether an asset is a security and overseen by the U.S. Securities and Exchange Commission, or if it’s a commodity and overseen by the Commodity Futures Trading Commission (CFTC).

The third bill in limbo was the proposal to prevent the Federal Reserve from creating a CBDC.

This legislative snag has affected crypto stocks. Shares of the Circle Internet Group, issuer of the stablecoin USD Coin [USDC], fell by 4.58% on the 15th of July.

Coinbase, the largest U.S.-based crypto exchange, saw its shares fall 1.5% for the day. However, it had just made its all-time high at $394 on the 14th of July.