- Global liquidity is on the rise, hitting recent highs as investors transfer capital to foreign markets.

- Bitcoin is the biggest winner as investors turn to BTC amidst market turmoil.

Despite the ravaging impact of Donald Trump’s policies on global markets, global liquidity has surged to hit new levels, according to Alpha Extract.

The rise in market liquidity has seen Bitcoin [BTC] continue to rise on its price charts despite the market turmoil. The recent spike means the markets are nearing September 2024 levels, just before Bitcoin rallied to $100k.

Source: Alpha Extract

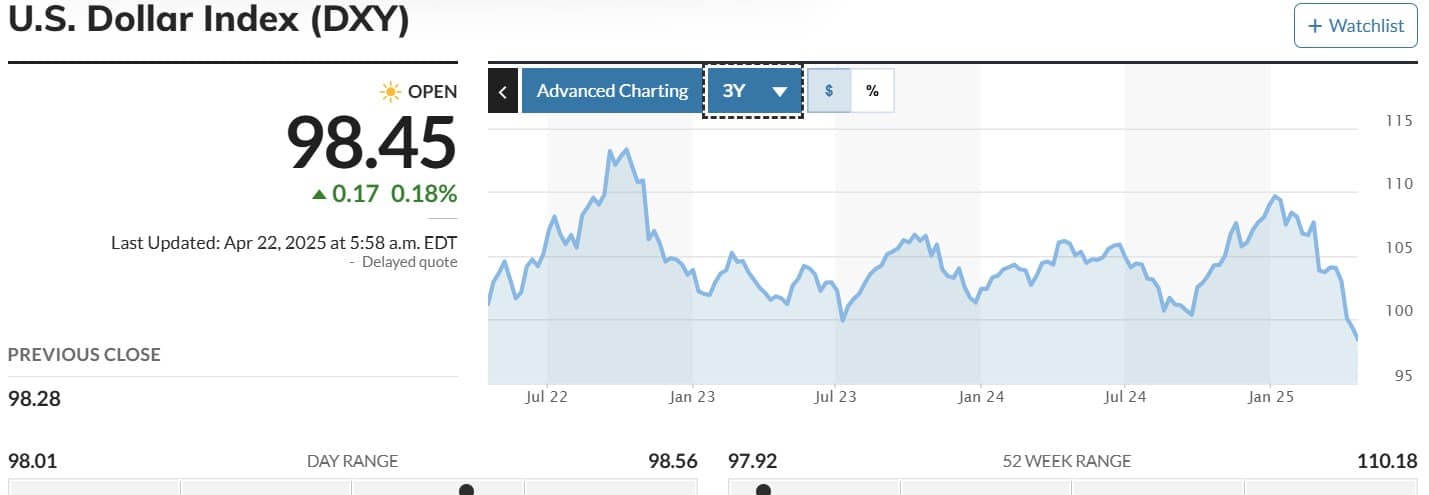

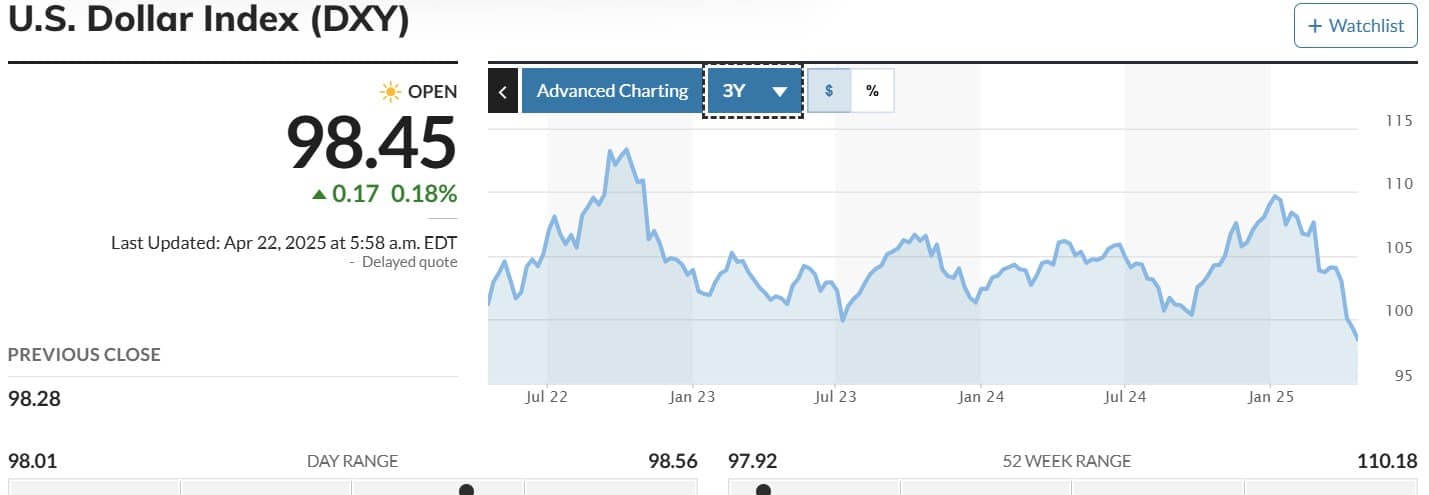

The U.S. Dollar Index (DXY) is in a strong downtrend, having breached a two-year range and fallen to its lowest levels since March 2022. This decline suggests that global markets are stabilizing and liquidity is increasing.

As DXY drops, major capital appears to be flowing out of the U.S. into foreign markets, indicating a preference for better investment conditions.

Capital tends to move where it is well treated, and currently, the U.S. market is struggling to retain it.

Source: MarketWatch

Is this the golden moment for BTC?

When global liquidity rises, Bitcoin tends to follow capital flows, often leading to price increases over time. This week, the Global Liquidity Index surged by $4.175 trillion, marking a 3.31% increase.

Simultaneously, Bitcoin’s price jumped from $78K to $88K, showing the positive impact of increased capital inflow into global markets.

Investors are returning to accumulate BTC, with U.S. institutional buyers re-entering the market.

The Coinbase premium index turned positive after three days in the negative, signaling institutional interest in Bitcoin amid market uncertainty.

Source: CryptoQuant

The Korean Premium Index remained in positive territory, further confirming strong investor interest in Bitcoin.

With both Korean and U.S. investors turning to BTC, it suggests that major players view Bitcoin as a haven amid extreme market volatility.

As uncertainty grows, Bitcoin is being perceived as a reliable store of value, positioning it for significant opportunity in the current market landscape.

Source: CryptoQuant

Among store-of-value assets, only Gold has outperformed Bitcoin. Currently, BTC is holding above SPX, NDQ, and NLT, highlighting its growing strength against equities.

Bitcoin’s comparative rolling performance suggests strong favorability, indicating further growth potential if market turmoil continues due to U.S. policy uncertainties.

Source: Checkonchain

Simply put, as global liquidity increases, Bitcoin stands to benefit significantly, emerging as a reliable store of value alongside gold.

Amidst uncertainty in traditional finance, investors are increasingly turning to BTC, setting the stage for further growth.

If BTC’s favorability persists, it could reclaim $90K and potentially rally to $100K.

However, if the FED intervenes to address the impact of Trump-era policies, financial markets may stabilize, leading to a BTC pullback to $85K.