- HNT declined by 79% over the past three months.

- Helium’s daily active addresses and transactions hits a yearly low.

Since hitting a local high of $10 three months ago, Helium [HNT] has traded within a descending channel.

Over this period, it has dropped by 79% to a low of $2.1 recorded over the past day. Since hitting this low, it has made a moderate recovery.

As of this writing, Helium was trading at $2.59, a 14.07% decline in 24 hours. Equally, the altcoin has declined on weekly and monthly charts, dropping by 24.17% and 24.45% respectively.

With the prices declining, the question is what’s driving the current trend. Inasmuch, AMBCrypto’s analysis suggests that declining on-chain activity is a major factor driving the downtrend.

Helium on-chain activity hits yearly low

Over the past months, Helium has experienced significant challenges fundamentally. As such, its on-chain activities have dropped to hit a yearly low.

Source: Artemis

For starters, Helium’s daily active addresses have dropped from 19.1k to a one-year low of $4.9k. Such a massive drop in active addresses suggests low demand for the altcoin and adoption rate.

As such, the network is experiencing a lower usage rate, either as new investors shy away from the network or the old ones close their accounts while others remain dominant.

This reflects strong bearish sentiments in the markets.

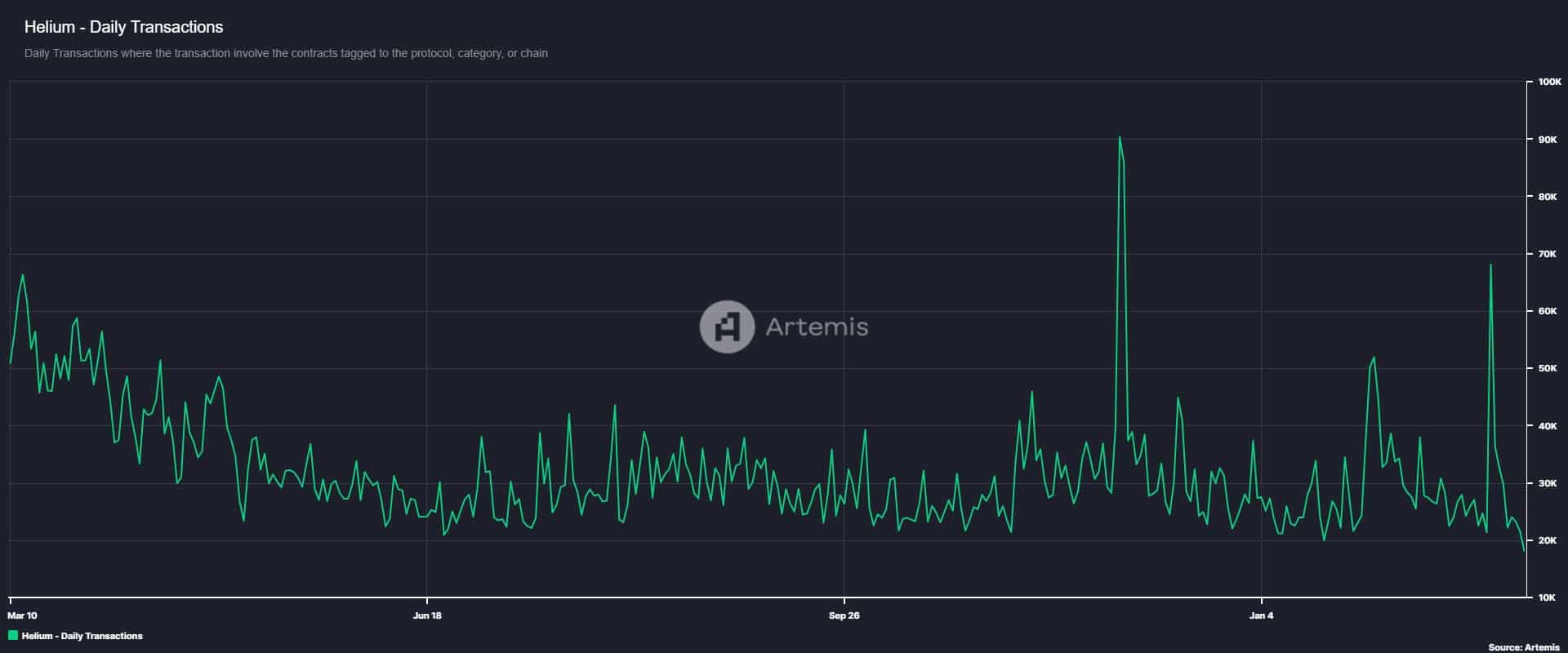

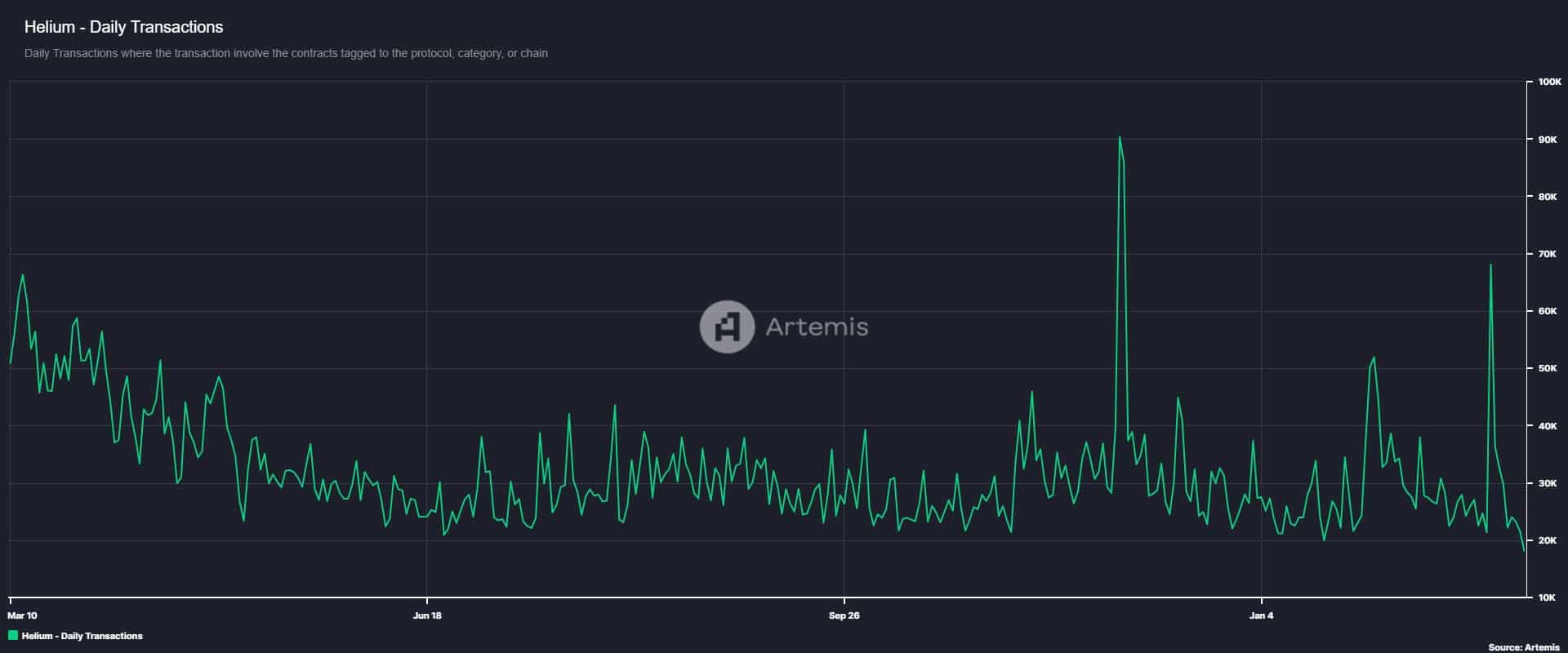

Source: Artemis

This reduced demand for the HNT is further confirmed by declining daily transactions, which have also reached a yearly low of 18k.

This dip means few traders are interacting with the network, which usually happens during market downturns as investors take a risk-off approach.

Source: Artemis

Finally, the past 24 hours saw the altcoins market cap drop to a yearly low, further validating reduced demand.

With lower demand for the altcoin, it means less capital inflow as investors are not buying which results in a lower market cap especially as prices also decline.

The massive dip in on-chain activity positions Helium in a risky place where it could drop even further.

What’s next for HNT?

With HNT hitting a yearly low of $2.1 over the past day, the altcoin shows significant challenges it’s facing. Therefore, with this dip, as sellers dominate the market, we could see more losses on HNT.

The past day saw a bearish crossover on RSI validating the previous bearish crossover on Stoch, thus confirming the potential for a trend continuation.

Source: Tradingview

If this trend continues HNT will drop below $2 for the first time since November 2023.

However, if buyers take the recent dip as an opportunity to accumulate, we could see the altcoin’s move upwards thus reclaiming $3.4 meaning it has reached a bottom.