In brief

- Bitcoin dropped early Friday amid uncertainty over Trump’s proposed China tariffs, with analysts watching the critical $103,000 support level.

- Short-term holders who bought around $113,000 are selling, while the “Coinbase premium” has turned negative, signaling weakened U.S. demand.

- Broader market pressure from U.S. banking concerns and $1.2 billion in liquidations over 24 hours has pushed crypto’s overall market cap down.

Bitcoin continued to fall early Friday as President Donald Trump waffled on the high tariffs he proposed for China last week.

Heading into the weekend, investors need to watch the $103,000 price level, an analyst told Decrypt.

At the time of writing, Bitcoin is trading for $106,953 and now sits about 11% lower than it was this time last week, and nearly 8% lower than BTC was trading for a month ago, according to crypto price aggregator CoinGecko.

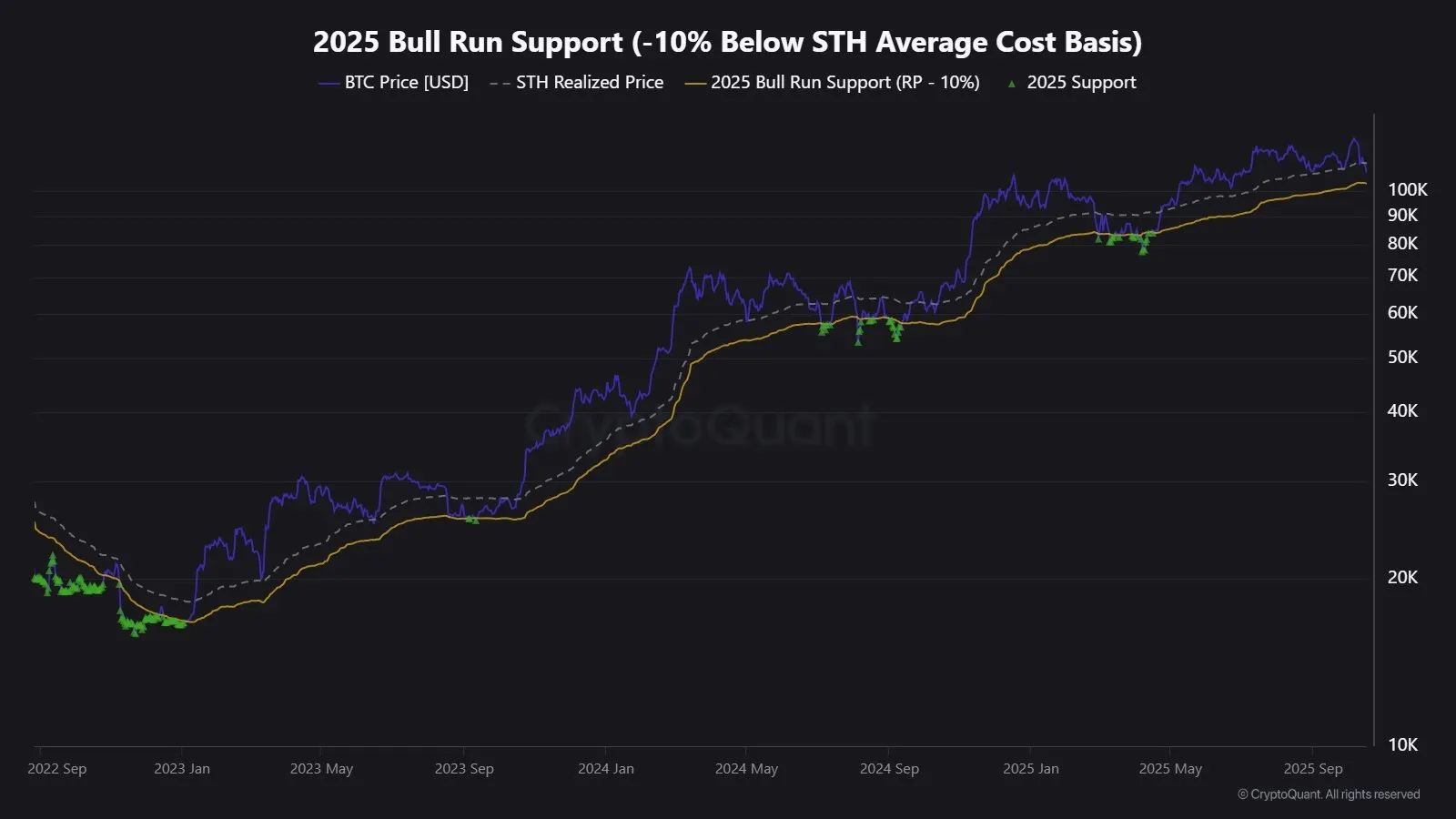

Popular CryptoQuant analyst JA_Maartun told Decrypt the dropping prices spooked short-term holders who bought BTC around $113,000. Short-term holders refers to wallets that have held Bitcoin for less than 155 days.

“The [short-term holders] realized price provided support for an extended period, but finally broke after the fifth test,” he said. “This breakdown has triggered additional selling pressure, compounded by Coinbase, where the premium gap has flipped away.”

To be clear, he’s not blaming Coinbase for Bitcoin’s losses. The “Coinbase premium” refers to Bitcoin’s price on the San Francisco-based exchange being slightly higher than overseas competitors, like Binance.

When that’s the case, it signals strong U.S. demand for Bitcoin. But when it turns negative, as JA_Maartun mentioned, it signals U.S. traders are selling or demand for BTC has weakened.

He said he’s watching the $103,000 level because it’s roughly 10% lower than the short-term holders realized price, and an indicator he said has acted as key support throughout the 2025 bull run.

“If price reaches this area, it will be an important level to monitor,” he said.

Users on Myriad, a prediction market owned by Decrypt parent company DASTAN, think Bitcoin is more likely to sink to $100,000 before it reclaims $120,000. As of Friday morning, 65.8% of users think it’ll fall to the lower level before rebounding.

“Now that Bitcoin has broken the recent $110K-$108K consolidation range to the downside, we are watching $100K as the next support level,” Julio Morena, head of research at CryptoQuant, told Decrypt. “This level represents the traders’ on-chain realized price lower band, which has acted as the last price support during this bull cycle.”

He added that Bitcoin staying above $100,000—and in the six-figure range—marks “an important psychological support level.”

For now, though, there are signs that trade tensions are starting to ease.

“It’s not sustainable,” Trump said during an interview with Fox Business, referring to the 100% tariff rate he proposed on China last week. “But that’s what the number is, it’s probably not, you know, it could stand, but they forced me to do that.”

Trump confirmed during the interview that he plans to meet with Chinese President Xi Jinping in South Korea later this month.

The tariffs rate he proposed last week led to the liquidation of more than $19 billion worth of crypto contracts. But even as trade trouble fades, there’s growing concern over credit risk among U.S. regional banks.

JP Morgan CEO Jamie Dimon hinted during an earnings call this week that the bankruptcies of two auto firms—and hundreds of millions of dollars’ worth of bad loans tied to them—is an indicator that there’ll be more failures.

“I probably shouldn’t say this, but when you see one cockroach, there are probably more,” he said on Tuesday.

The resulting unease among traders has painted equities and crypto markets red. Major stock market indices opened the day in the red, with the Nasdaq still down as of this writing, and the global crypto market capitalization has contracted, falling 2.8% to $3.66 trillion as of Friday morning.

“We’re seeing concurrent pressure from U.S. banking concerns, BOJ rate hike signals, and a cascading wave of liquidations that has wiped out over $1.2 billion in leveraged positions in the last 24 hours alone,” Marcin Kazmierczak, co-founder of crypto oracle provider RedStone told Decrypt.

He said he’s particularly concerned about institutional pullback.

“What’s particularly notable is the synchronized institutional selling. None of 12 Bitcoin ETFs posted net inflows yesterday,” Kazmierczak added. “The market is testing critical support levels. That said, this is still within normal volatility.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.