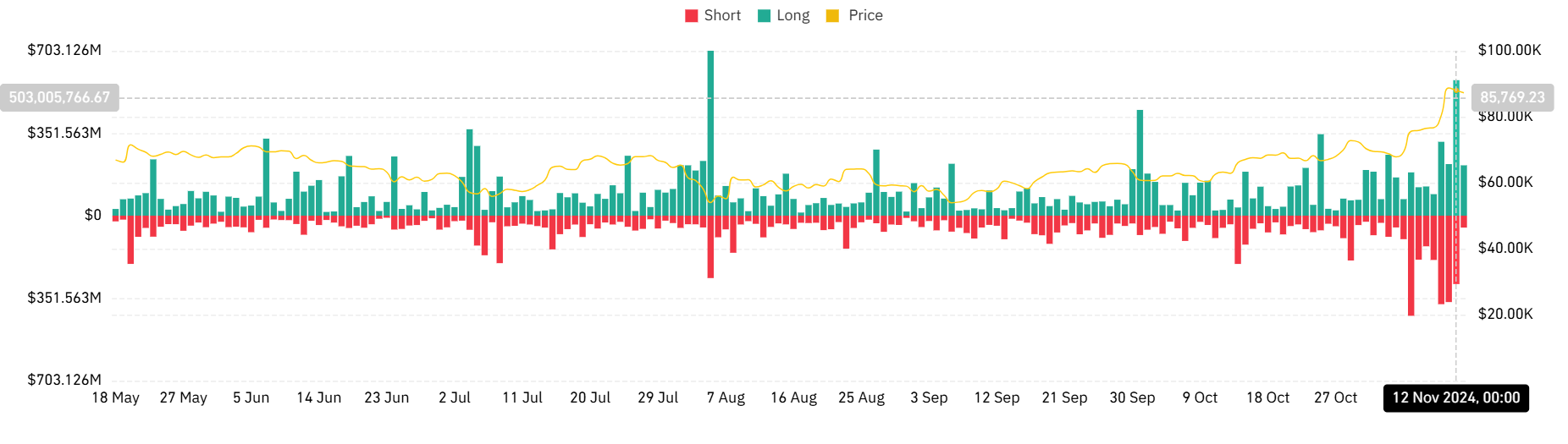

- Long and short positions saw a spike in liquidation volume in the last trading session.

- Bitcoin contributed over $500 million to the liquidation.

The cryptocurrency market has recently witnessed significant liquidation activity, with Bitcoin [BTC] at the forefront of these movements.

As traders navigate volatile price swings, the liquidation of long and short positions offers crucial insights into the market’s current state. The latest data reveals the leverage and risk in the crypto ecosystem.

Longs, shorts hit notable levels

According to the liquidation chart on Coinglass, over $503 million in liquidations have been recorded recently, highlighting the impact of Bitcoin’s rapid price movements.

Also, AMBCrypto’s analysis of the total liquidation showed that it surged to nearly $870 million in the last trading session.

Source: Coinglass

This trend illustrated the precarious balance of leverage in the market, where traders betting on continued upward momentum were caught off guard by sudden price corrections.

Conversely, the rise in short liquidations suggested that Bitcoin’s recent rally forced bears to cover positions as assets broke past key resistance levels.

High leverage concentrations

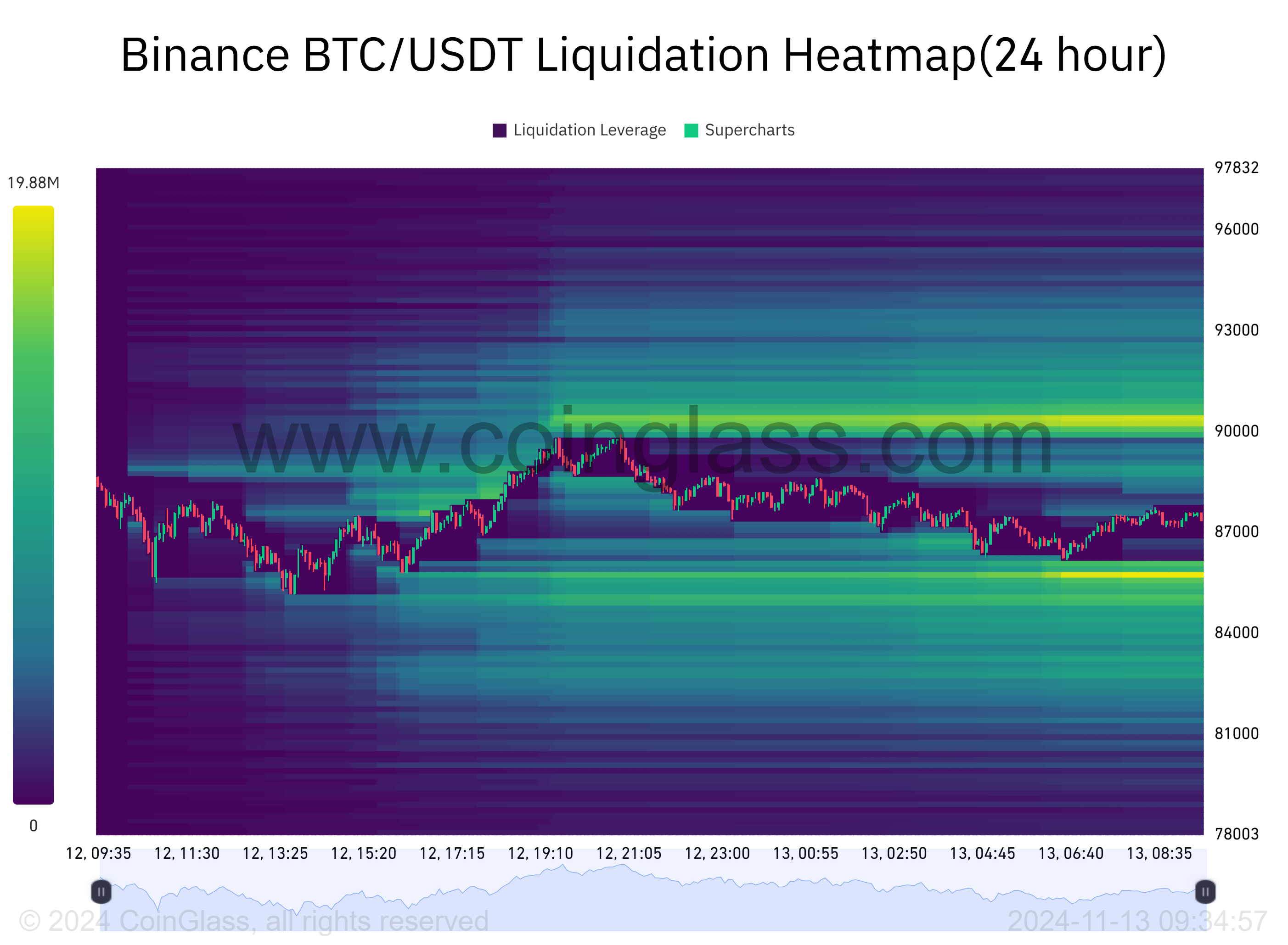

The Binance BTC/USDT Liquidation Heatmap provided additional context, showcasing areas of concentrated liquidation activity.

The heatmap highlighted liquidation clusters between $84,000 and $88,000, with darker zones representing higher leverage and more significant liquidations.

This concentration around Bitcoin’s psychological resistance levels underscored the intensity of speculative trading in the market.

Source: Coinglass

The yellow line on the chart indicated Bitcoin’s price nearing $85,769, correlating with the long and short liquidations surge.

Notably, long-position liquidation dominated the market as Bitcoin’s price retraced from recent highs, triggering stop-loss orders and margin calls.

Interestingly, the liquidation heatmap reveals that leverage traders have placed significant bets near current price levels, creating both opportunities and risks.

While these zones can act as liquidity pools to propel price action, they also signal potential market fragility if liquidations cascade further.

Market implications

The spike in crypto liquidations, particularly on major exchanges like Binance, reflected the broader market’s heightened volatility.

With Bitcoin continuing to trade near all-time highs, liquidation data highlighted both the enthusiasm and vulnerability of market participants.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As the market moves, traders will closely watch key price levels and liquidation data to gauge the next directional move.

While liquidations can exacerbate short-term price swings, they also provide opportunities for market stabilization and new trends to emerge.