- Hyperliquid NFTs remained resilient despite HYPE’s 18% drop, but adoption was niche.

- Slow bridging to EVM limits liquidity, raising questions about long-term NFT market potential.

Hyperliquid’s [HYPE] value may have taken an 18% hit this week, but the NFT market tied to the protocol seems unfazed — or perhaps just uninterested.

With only 1.5% of users bridging to the Ethereum Virtual Machine (EVM) ecosystem, adoption remains sluggish.

Despite early-stage projects like Hypers and Mechacats showing potential, it’s too soon to tell if they’ll ride the wave — or sink with it.

HYPE’s 18% drop, NFT quietly soldiering through

Hyperliquid’s native token, HYPE, has faced a sharp decline, dropping 18% in value.

Source: Coinmarketcap

Despite this downturn, NFTs associated with the protocol, including Hypers and Mechacats, appear largely unaffected. Unlike the token’s price volatility, these collections continue to trade steadily.

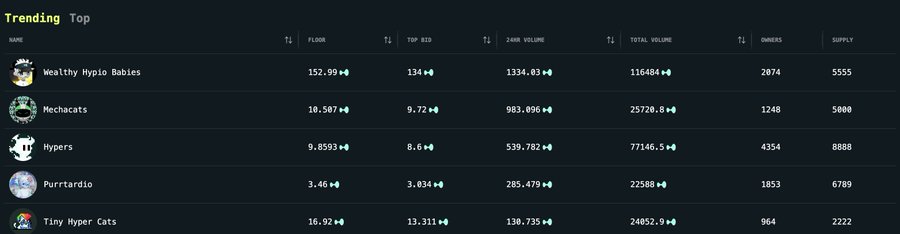

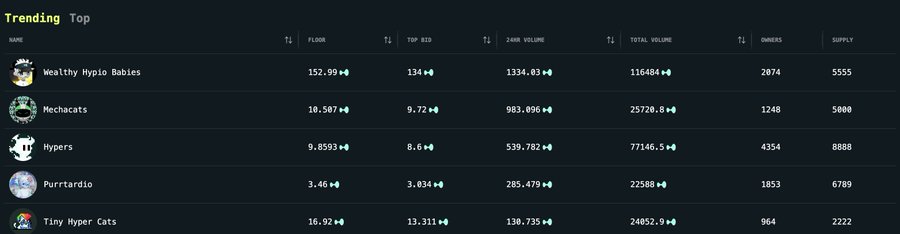

Floor prices for these NFTs remain intact, with Hypers at 9.85 and Mechacats at 10.50, suggesting a degree of resilience. However, the lack of immediate price movement doesn’t necessarily indicate long-term strength.

With only 1.5% of users bridging to EVM, adoption remains slow, limiting liquidity and potential demand.

Traders eyeing these projects must weigh the risks: while early adoption could be lucrative, the ecosystem’s lack of deep engagement presents challenges.

For now, Hyperliquid NFTs appear to be holding firm, but whether they thrive depends on broader user participation.

Hypers and Mechacats; Why NFT adoption remains niche

Hypers and Mechacats stand out as two of the leading NFT projects tied to Hyperliquid, yet adoption remains niche.

Source: X

Hypers, with a total volume of 77,146, and Mechacats, at 25,720, are among the most actively traded collections. However, liquidity constraints limit their growth potential.

The small fraction of users bridging to EVM means that demand is primarily speculative rather than driven by utility.

Additionally, NFT adoption in the broader crypto market has slowed, with many traders focusing on fungible tokens rather than non-fungible assets.

Without deeper integration into Hyperliquid’s ecosystem or additional incentives for users to bridge, these projects risk stagnation. But the issue stays:

If the user base isn’t growing at a meaningful pace, demand for NFTs will struggle to gain momentum beyond the current niche investors.

The road ahead

For Hyperliquid’s NFT ecosystem to flourish, broader adoption is critical.

A key challenge remains bridging more users to EVM — without this, liquidity will remain scarce, limiting price appreciation for collections like Hypers and Mechacats.

Incentives, whether through staking, governance perks, or unique integrations within Hyperliquid’s ecosystem, could drive participation.

Additionally, partnerships with existing NFT marketplaces could expose these projects to a wider audience.

The overall market sentiment toward NFTs will also play a role; if the sector experiences a resurgence, Hyperliquid’s digital assets could see renewed interest.

However, if the ecosystem fails to expand, current investors may face diminishing returns.

For now, Hyperliquid NFTs remain a speculative play with potential — one that hinges on broader user engagement and strategic development within the protocol.