- Hyperliquid whales who control significant funds in the market have opened more short positions

- Institutional investors, on the other hand, have continued to buy Bitcoin

Bitcoin [BTC], after gaining by 1.59% last week, took a different route over the last 24 hours. In fact, the aforementioned period saw the crypto lose almost 3% of its value.

This is worth looking at, especially since AMBCrypto’s analysis revealed that this decline could extend itself as Hyperliquid whales took control of the derivatives market with a negative net BTC position. This raises an important question though – Can institutional investors regain ground and reverse the downturn?

Hyperliquid whales bet on a major drop

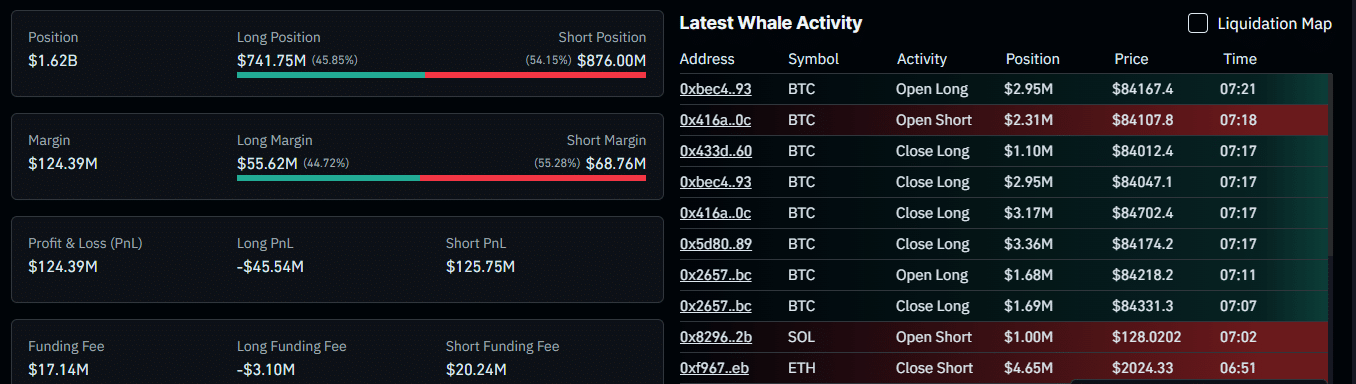

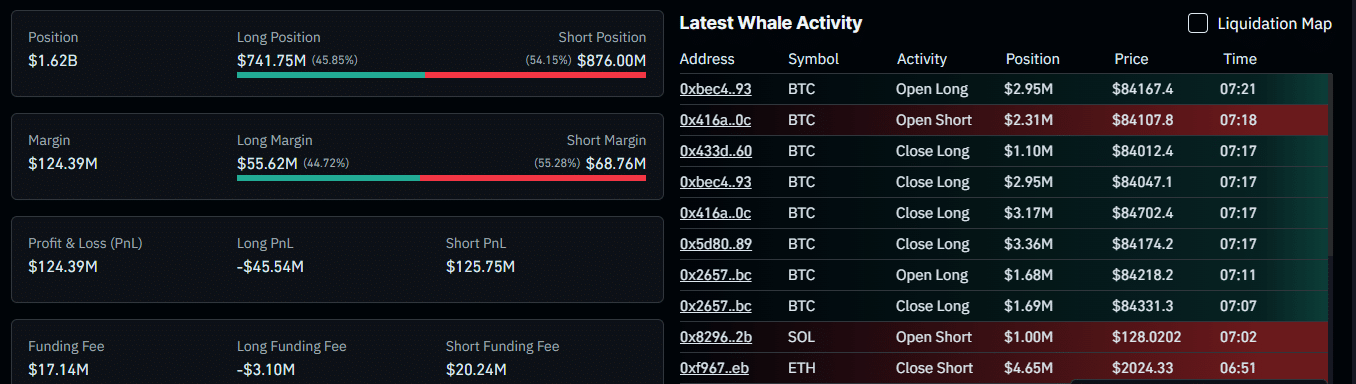

According to Coinglass, there has been a surge in derivative positions on Hyperliquid – A platform that monitors large traders’ positions – with figures for the same climbing to $1.62 billion.

Interestingly, short positions seemed to account for 54.15% of these open positions, worth $876 million. Typically, when market data reveals activity skewed in favor of the bears, it might hint at a lack of interest from top market participants. This could potentially lead to a major market decline on the charts.

Source: Coinglass

Further data revealed that traders who placed opposing bets—long trades—are at a loss now. At the time of writing, long profit and loss (PnL) was down by $45.5 million, while short traders gained $125.75 million within this period.

To put it simply, this suggested that selling has been more profitable – Something that may have influenced Bitcoin’s decline in the last 24 hours. AMBCrypto also found that institutional players are actively buying, likely for the long term.

Institutional investors keep accumulating

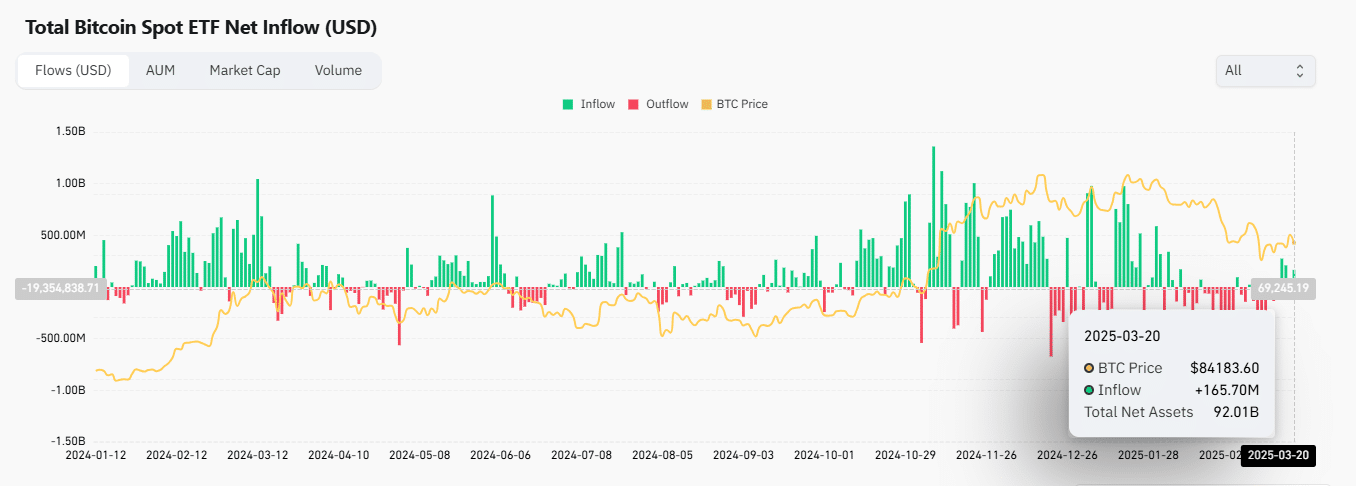

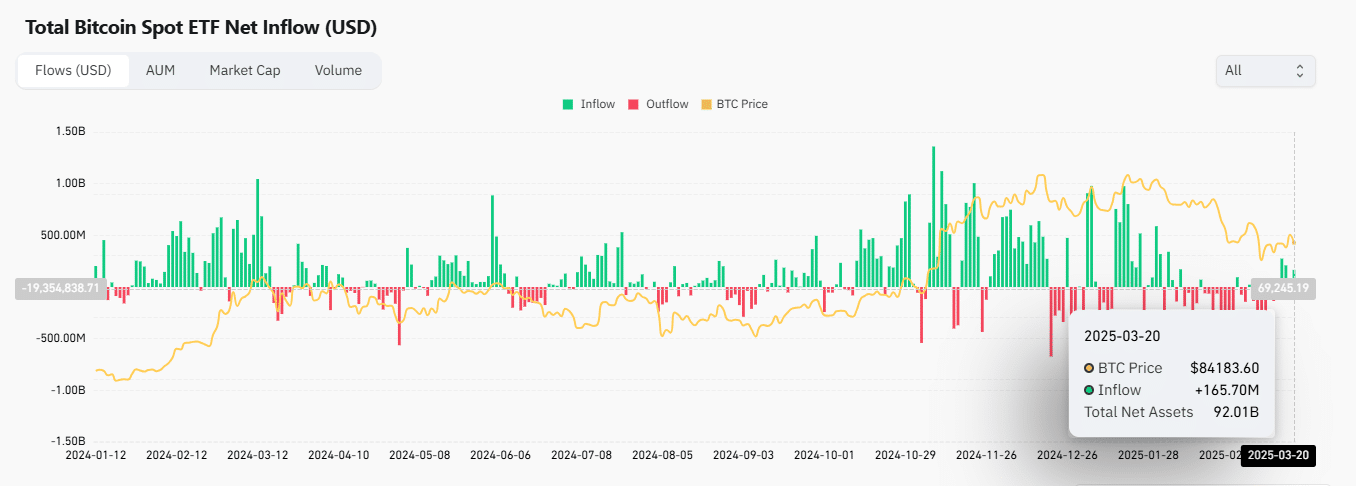

While whales on Hyperliquid are predominantly selling, institutional investors have been actively purchasing Bitcoin. This can be evidenced by the netflows tracking inflows and outflows.

According to the same, investors purchased a total of $165.7 million worth of BTC over the last 24 hours. Such a significant amount is a sign of high level of interest in Bitcoin.

Source: Coinglass

The Fund Market Premium, another key metric comparing Bitcoin prices on institutional investment platforms to the broader spot market, showed buying activity from these platforms. At the time of writing, the metric sat above the neutral level of 0.

AMBCrypto also found that this institutional buying sentiment seemed to be in line with long-term holders’ decisions to accumulate. The movement of their assets in the past seven days has notably declined, with a Binary CDD (Coin Days Destroyed) reading of 0.285.

Here, Binary CDD tracks long-term holders’ activity based on a scale from 1 to 0. The closer it is to 0, like in the present case, the more buying and holding activities are going on. This is a sign that these investors are regaining a bullish outlook across the market.

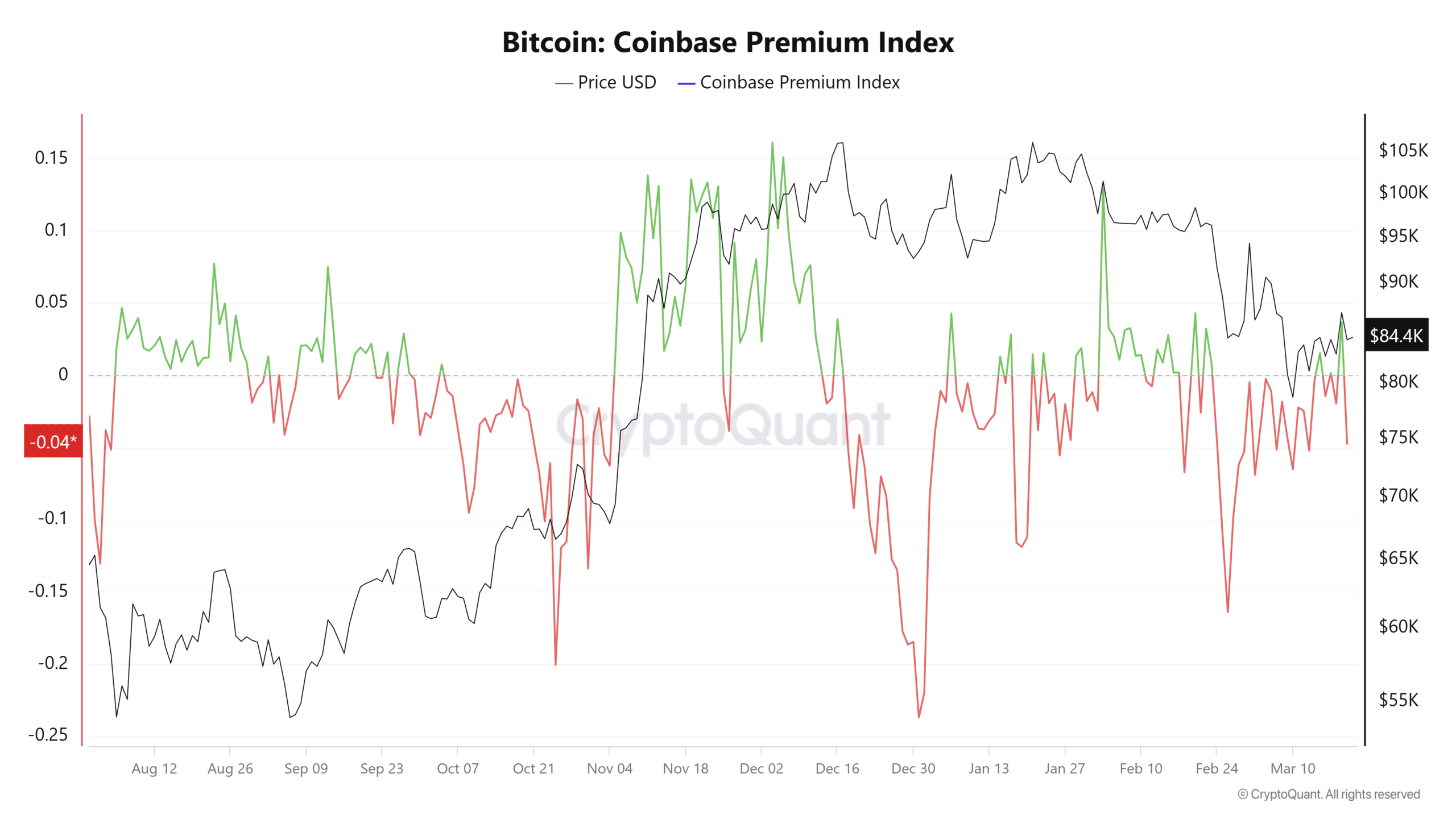

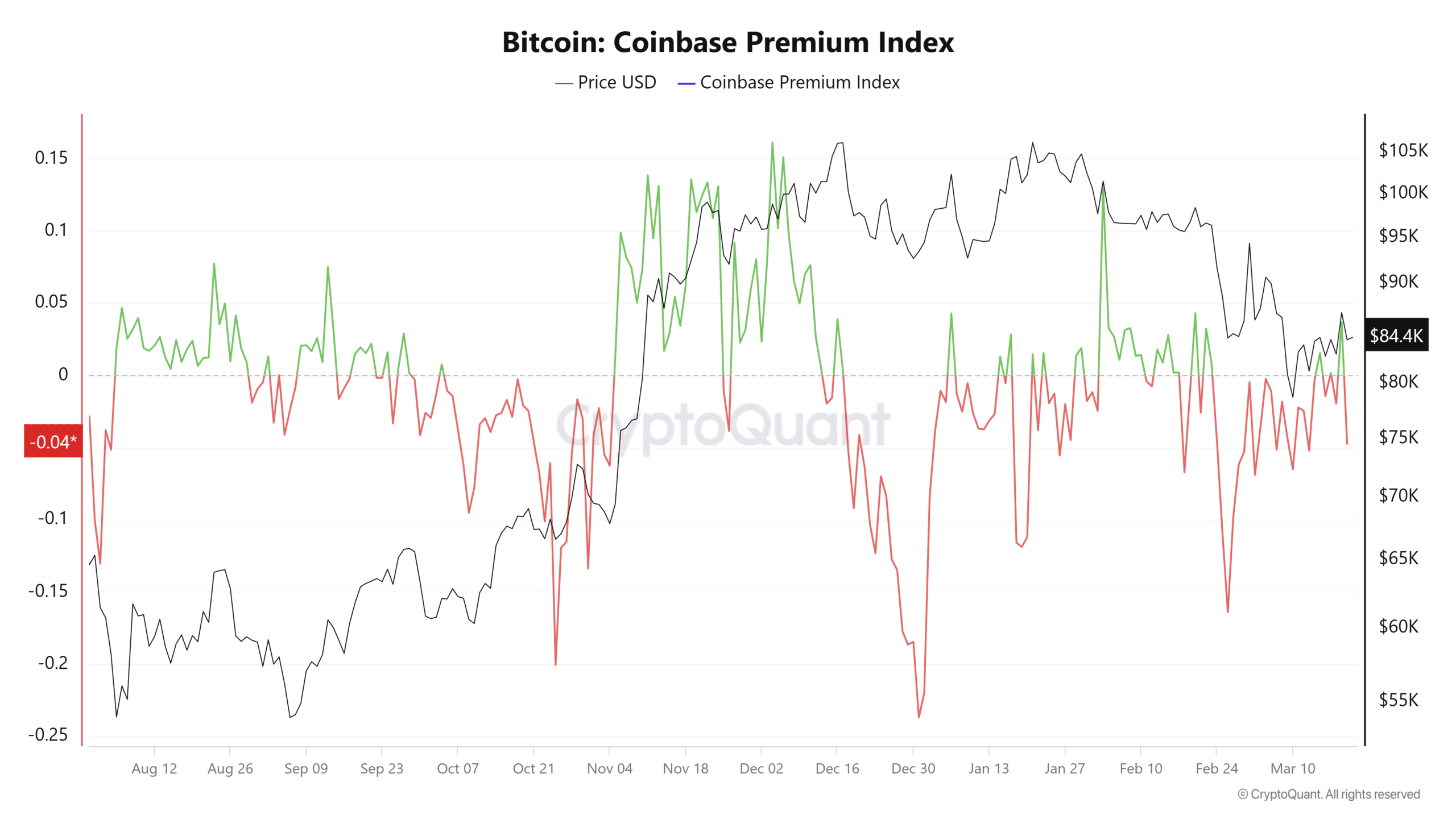

U.S investors are selling

Finally, American investors are following the same path as Hyperliquid whales, currently selling, as reflected by the Coinbase premium dropping to -0.04. When this premium enters negative territory, it alludes to significant selling pressure.

Source: CryptoQuant

Typically, U.S investors influence Bitcoin’s long-term movement, meaning that if their selling pressure continues to climb, Bitcoin could fall further. However, if selling eases, Bitcoin could rebound in line with the institutional investors’ bullish wave.

Overall, a key shift in either direction—bullish or bearish—will lend us more clarity on Bitcoin’s next few weeks and months.