- Bitcoin’s network valuation outpaces activity as demand weakens and supply pressure rises.

- Exchange inflows and negative DAA divergence suggest selling risks persist despite price stability.

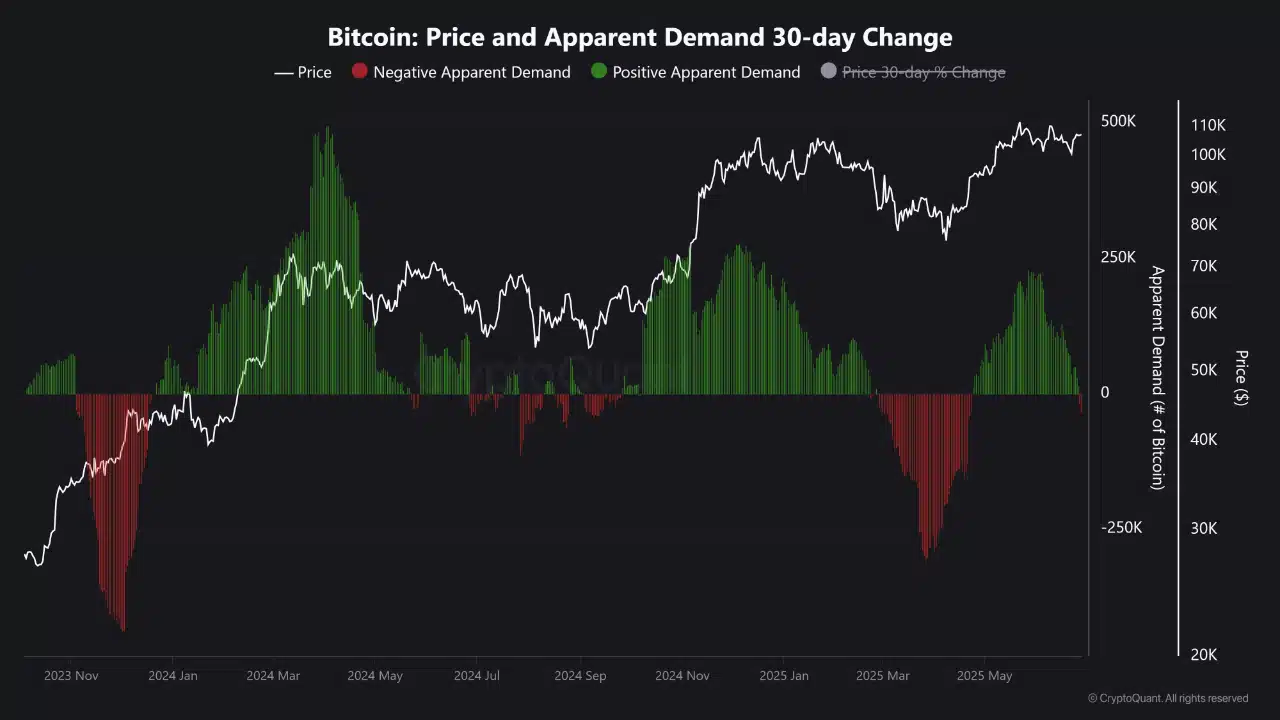

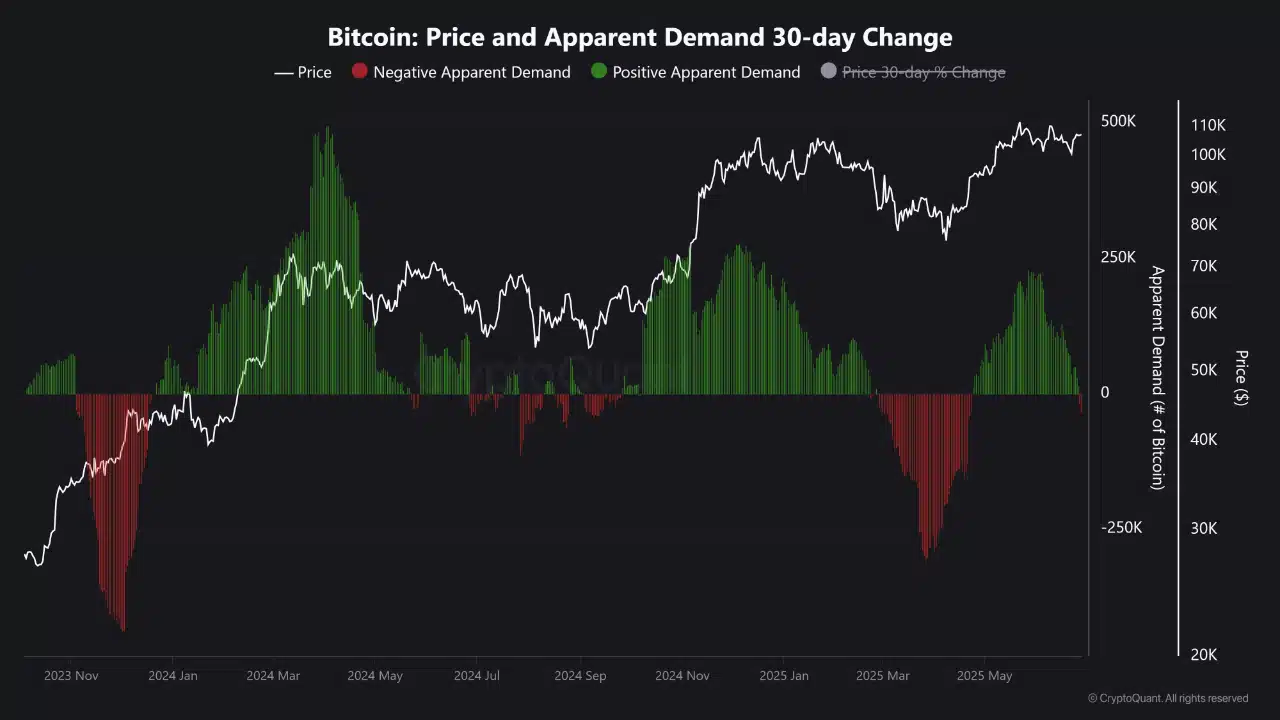

Bitcoin’s [BTC] market environment has become increasingly fragile, with key demand metrics flipping bearish while supply-side signals intensify across several indicators.

At the time of writing, Bitcoin traded at $108,129.78, reflecting a modest 0.68% gain in the last 24 hours.

However, this uptick contrasts sharply with underlying on-chain weakness. Apparent Demand, which measures the ability of new buyers to absorb supply from miners and long-term holders, has turned negative again.

This shift highlights renewed distribution from experienced holders and miners, exposing Bitcoin to short-term downside risks amid fading organic demand and limited new capital inflow.

Source: CryptoQuant

Are rising miner profits and valuation metrics flashing early warning signs?

At the time of writing, the Puell Multiple jumped 25.73% to 1.26, indicating that miners are now significantly more profitable than usual, often a precursor to increased selling pressure.

Simultaneously, Bitcoin’s NVT Ratio also spiked 84.17% to 55.17, showing that market cap is outpacing transaction volume. This is a common signal of overvaluation.

Together, these metrics suggest that while price remains elevated, underlying network activity and supply dynamics are misaligned.

This imbalance could expose Bitcoin to a pullback, especially if demand fails to absorb coins, miners may soon offload into the market. Caution is advised amid these rising warning signs.

Source: CryptoQuant

Are profitable holders reducing the likelihood of strong support?

As of writing, over 98.82% of UTXOs were in profit, while only 1.17% were in loss, signaling that most holders sit on unrealized gains.

Although this could suggest strength, it also means fewer market participants are incentivized to buy the dip.

Moreover, such a skewed profit/loss distribution often precedes local tops, where profit-taking becomes widespread.

The lack of loss-heavy holders also weakens psychological support zones, making price floors less reliable.

Are positive netflows a warning sign for upcoming sell pressure?

At press time, BTC registered a net inflow of $57.5 million—the first notable positive flow in a sea of outflows.

Exchange netflows turning green signal that investors may be preparing to sell, as more coins are being deposited onto exchanges.

This shift in exchange activity could indicate a reversal in market sentiment, with holders moving from accumulation to distribution.

Given the backdrop of weak demand and overbought signals, rising exchange deposits could apply additional pressure on BTC’s price if followed by increased sell orders.

Can BTC rally while active address growth remains bearish?

Despite BTC’s price hovering near $108K, the DAA divergence chart remains deeply red.

This shows that growth in active addresses continues to lag behind price action, signaling that speculative price moves are not being backed by real user adoption.

Historically, negative DAA divergence has foreshadowed corrections, especially when price climbs while address activity stagnates or declines.

The current extended red zone in divergence raises concern that market strength is surface-level and lacks fundamental support.

Can BTC sustain its price without real demand?

Bitcoin continues to trade above $108K, but multiple on-chain signals point to growing weakness beneath the surface.

Rising miner profitability, positive exchange netflows, and a surging NVT Ratio indicate increasing sell-side pressure and possible overvaluation.

Meanwhile, negative DAA divergence and a high percentage of profitable UTXOs suggest limited buyer support.

Without a meaningful recovery in demand and network activity, BTC could face heightened volatility and struggle to sustain its current position in the near term.