- Buy/Sell Ratio hit 1.1 as the UTXO bands confirmed profit holding among short-term holders

- Long-term holder conviction climbed on the back of short bias, hinting at potential short squeeze

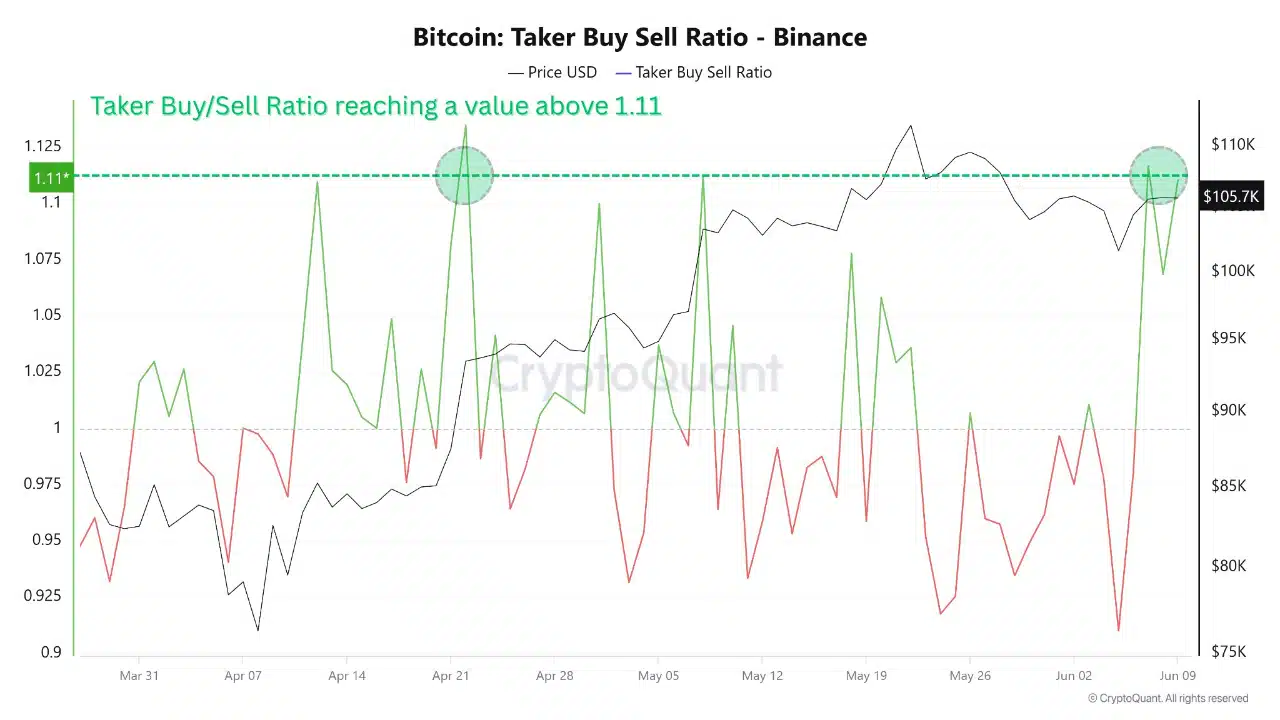

Bitcoin [BTC] is in the news today after its Taker Buy/Sell Ratio hit 1.1 while its price surged to $107,642. This, after daily gains of 1.84% amid bullish UTXO and long-term holder signals.

The aforementioned uptick in the Buy/Sell Ratio could be a sign of growing aggressive demand from takers. Similarly, the UTXO bands revealed that recent buyers have been holding on to profits. Such a behavioral shift usually means that short-term traders are anticipating further gains, rather than exiting early.

Combined with a broader bullish context, these metrics only reinforce market confidence and may provide a solid base for another upward move.

Source: CryptoQuant

Are long-term holders setting the tone for the next surge?

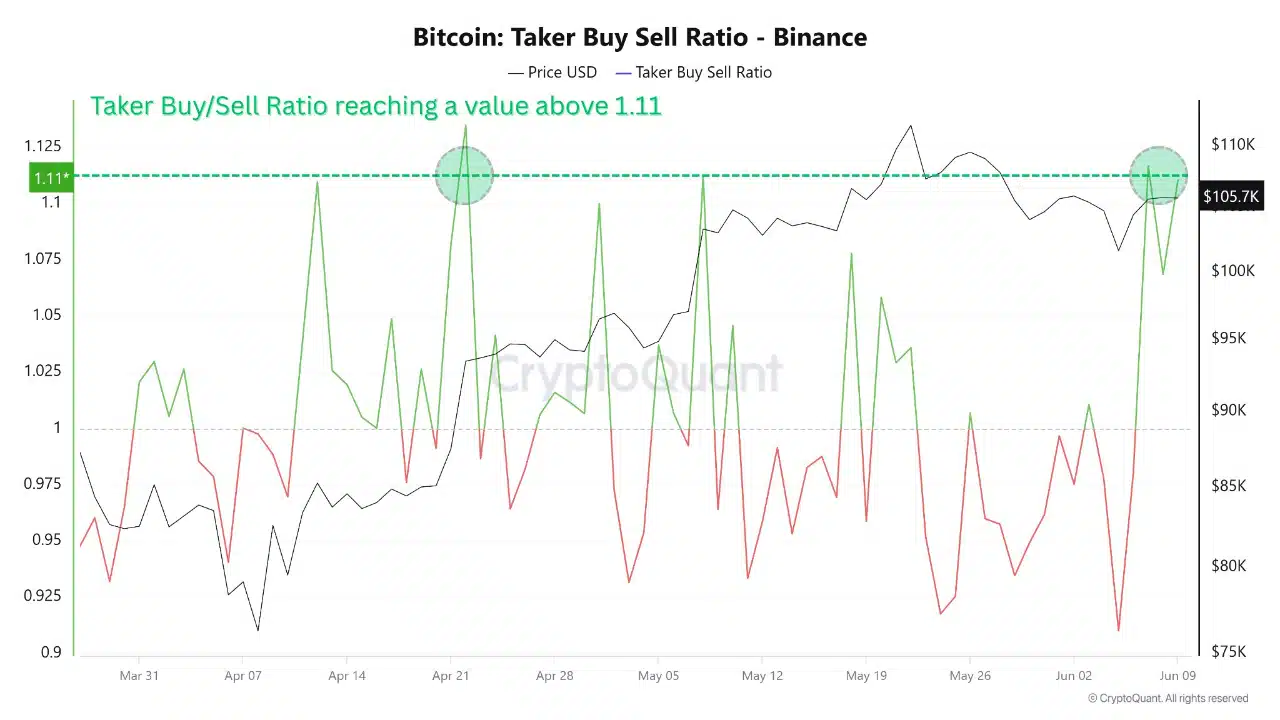

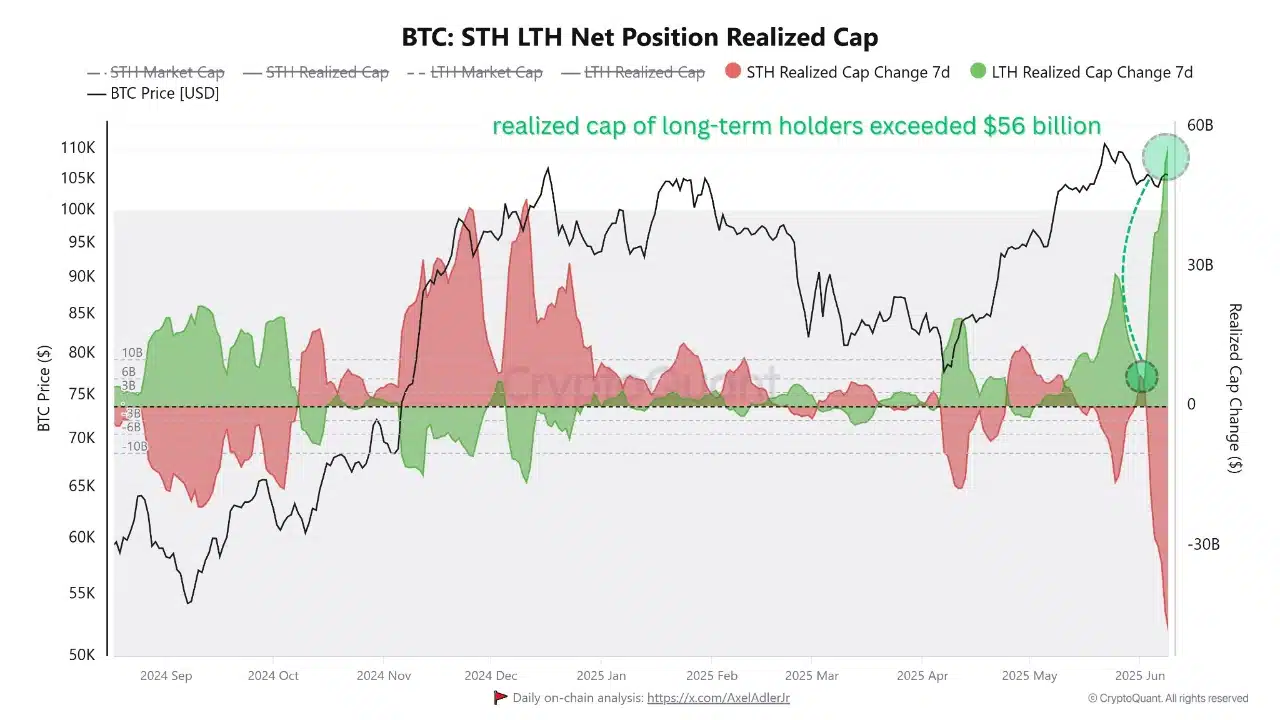

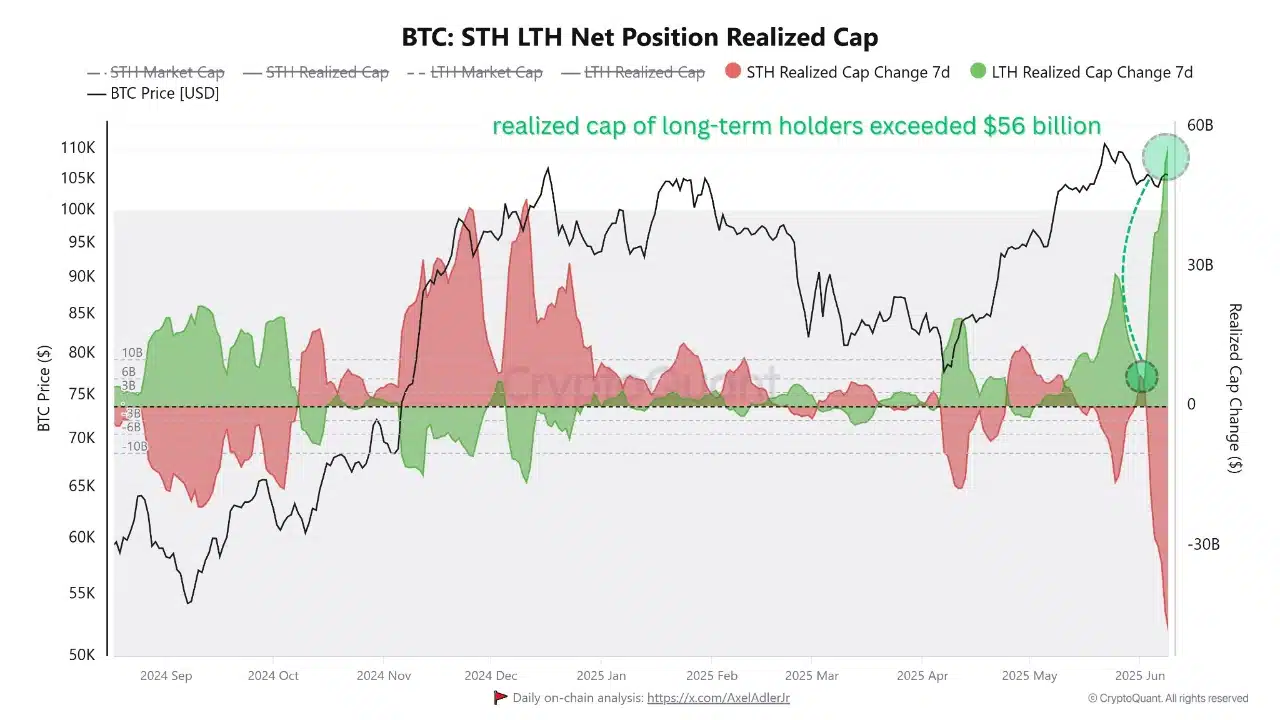

The Realized Cap for long-term holders has now exceeded $56 billion, underscoring a wave of conviction among investors. In fact, coins aged over 155 days are increasingly being moved to wallets with low activity – A sign of unwillingness to sell into strength.

Historically, these wallet behaviors align with the early stages of long-term uptrends. Especially as seasoned participants lock away supply.

The expansion in this realized cap metric further confirmed that smart money has been positioning with confidence.

What this also means is that the prevailing trend is evidence of the strong foundational support beneath BTC’s price action.

Source: CryptoQuant

Is rising Coin Days Destroyed a red flag or routine rotation?

Coin Days Destroyed (CDD) for exchange inflows increased by 3.83% to 291.4k, indicating that some older coins recently moved towards exchanges.

While this may appear bearish, the scale of movement has been modest and didn’t quite signal widespread selling. On the contrary, it could reflect routine rebalancing or profit realization by a small cohort of holders.

Also, in contrast to this slight uptick in CDD, broader metrics such as the LTH realized cap and taker buy pressure have remained firmly bullish. At the time of writing, the overall narrative still favored accumulation over distribution, despite this temporary churn in older holdings.

Source: CryptoQuant

Will low volatility trigger Bitcoin’s next big move?

Bitcoin’s 30-day volatility dropped to 21.68% – Its lowest level in nearly a month. Such tight price consolidation often precedes explosive moves in either direction.

However, when coupled with strong long-term holder accumulation and positive short-term UTXO dynamics, this volatility contraction could favor an upside breakout.

As it stands, market participants appear to be waiting for a catalyst, with suppressed volatility providing the springboard for a possible surge.

Therefore, BTC’s calm price behavior should not be misinterpreted as weakness, but rather a precursor to potential market expansion.

Source: IntoTheBlock

Can a crowded short trade ignite a squeeze for BTC?

On Binance, 60.51% of traders were holding short positions, with the long/short ratio plunging to 0.65 at press time. Such an overwhelming short bias creates a highly contrarian signal.

If spot market buyers continue to apply upward pressure, short positions could begin unwinding, triggering a squeeze. In this environment, even a moderate rally could liquidate a significant portion of over-leveraged short positions.

Source: Coinglass

Despite minor signs of spent coin movement, Bitcoin’s on-chain data has continued to flash signs of confidence.

A surge in taker buy volume, rising LTH conviction, and a historically low volatility band all seemed to point to favorable conditions for an upward breakout. Especially with shorts heavily crowded.

If buyers retain control, BTC may be on the verge of its next leg higher.