- LDO surged by 10.06% over the past 24 hours.

- Lido Dao has broken the bullish pennant as buyers dominated the market.

Over the past week, Lido DAO [LDO] has experienced sustained gains on its price charts, hiking by 27%.

In fact, as of this writing, Lido DAO was trading at $2.14. This marked a 10.06% increase on daily charts. Equally, the altcoin has made significant gains on monthly charts, surging by 12.68%.

Despite the recent price pump, LDO remained approximately 88.45% below its ATH of $18.62. Notably, current market conditions has left the community eyeing a sustained recovery.

Inasmuch, analyst Kartha has suggested a potential 80% rally, citing a bullish breakout.

Market sentiment

In his analysis, Kartha observed that LDO has broken the bullish pennant on daily timeframe.

When prices break out of this pattern, especially to the upside, it signals the continuation of a bullish trend. A breakout here is usually accompanied by high volume, signaling strong buying activity.

Source: X

According to him, a successful retest here could result in a 60-80% bullish wave in the midterm. If this becomes the case, LDO will see a growth to between $3.39 and $3.82.

What LDO charts suggest

According to AMBCrypto’s analysis, Lido DAO was experiencing a strong upward momentum at press time, as buyers dominated the market.

Source: TradingView

This strengthened uptrend was evidenced by a sustained rise in the +DI of DMI, while ADX has declined.

Since making a bullish crossover two weeks ago, +DI has surged to 27.36. This suggested that momentum was strong, while the downtrend lost momentum.

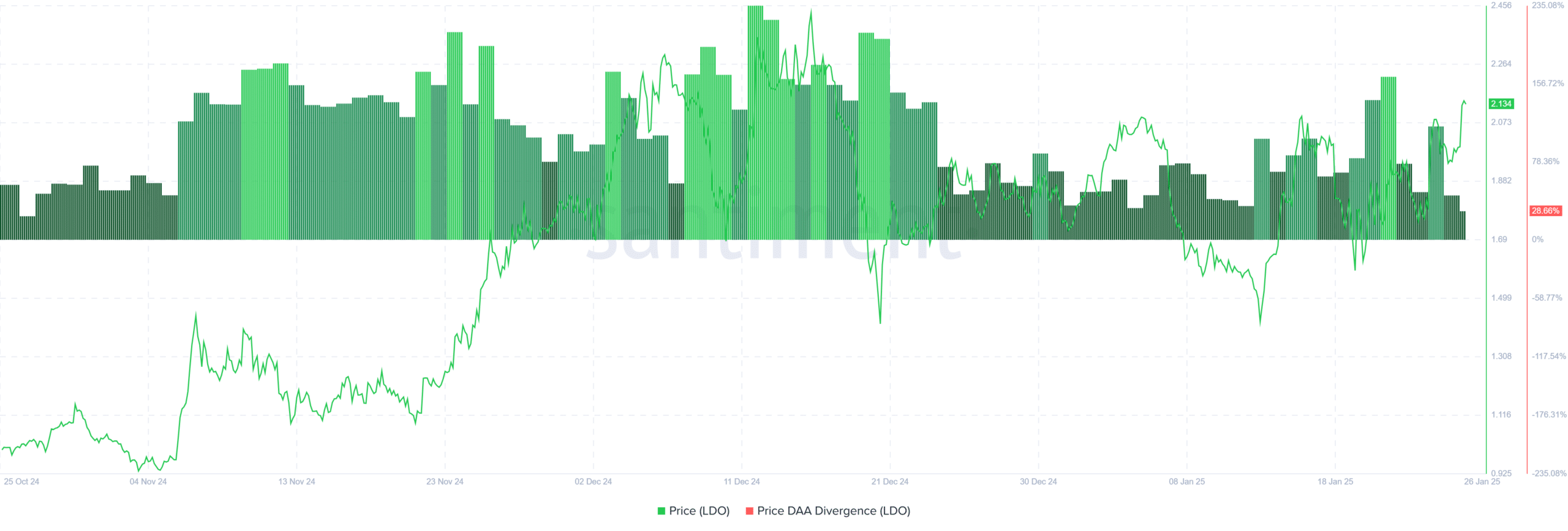

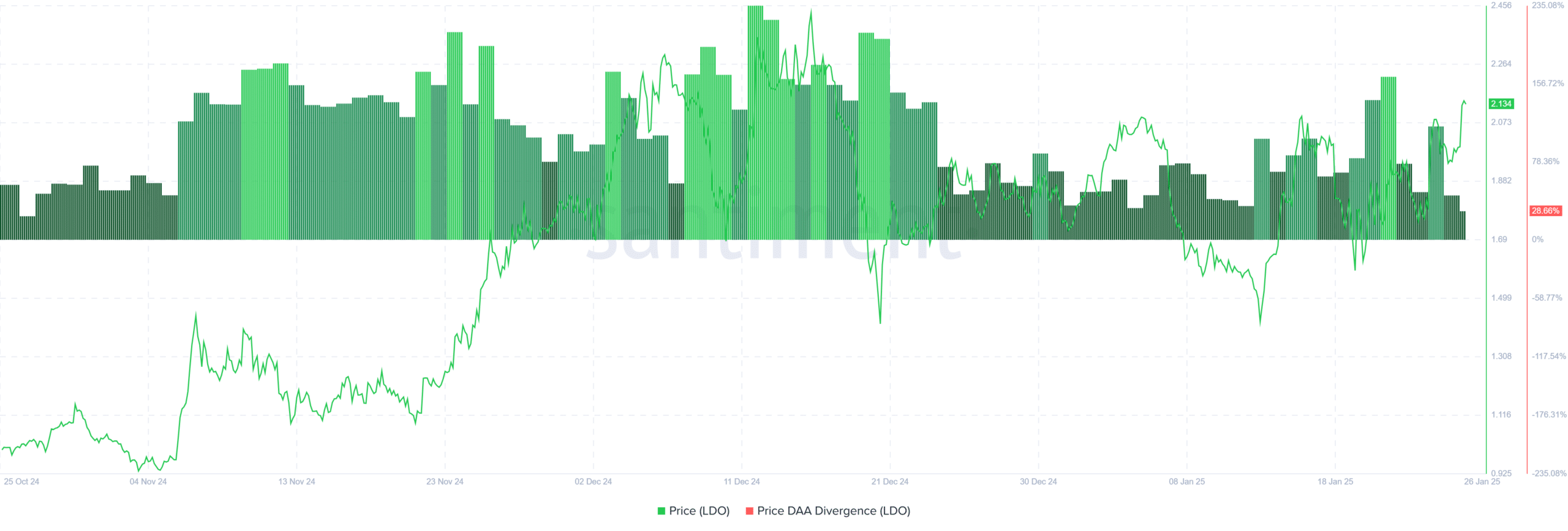

Source: Santiment

Looking further, LDO’s adoption rate and active users have continued to rise relative to its market cap. This was evidenced by a positive price DAA divergence, which signaled a surge in the number of active addresses.

Thus, new addresses were entering the market, as they perceived the altcoin as undervalued.

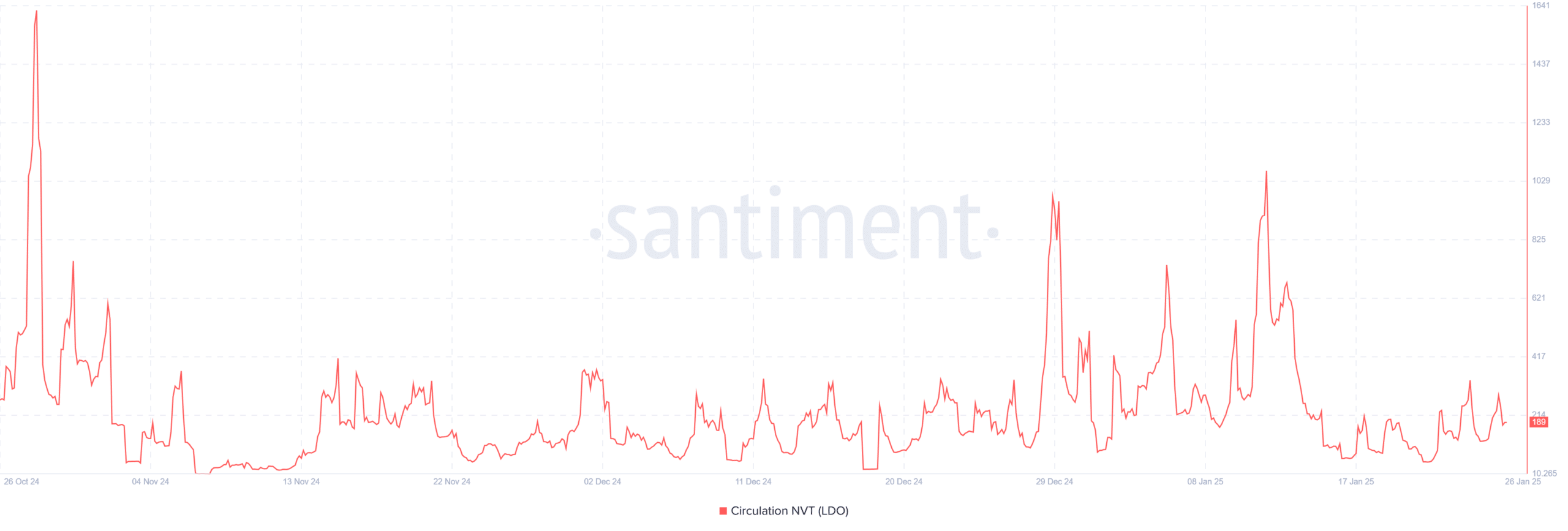

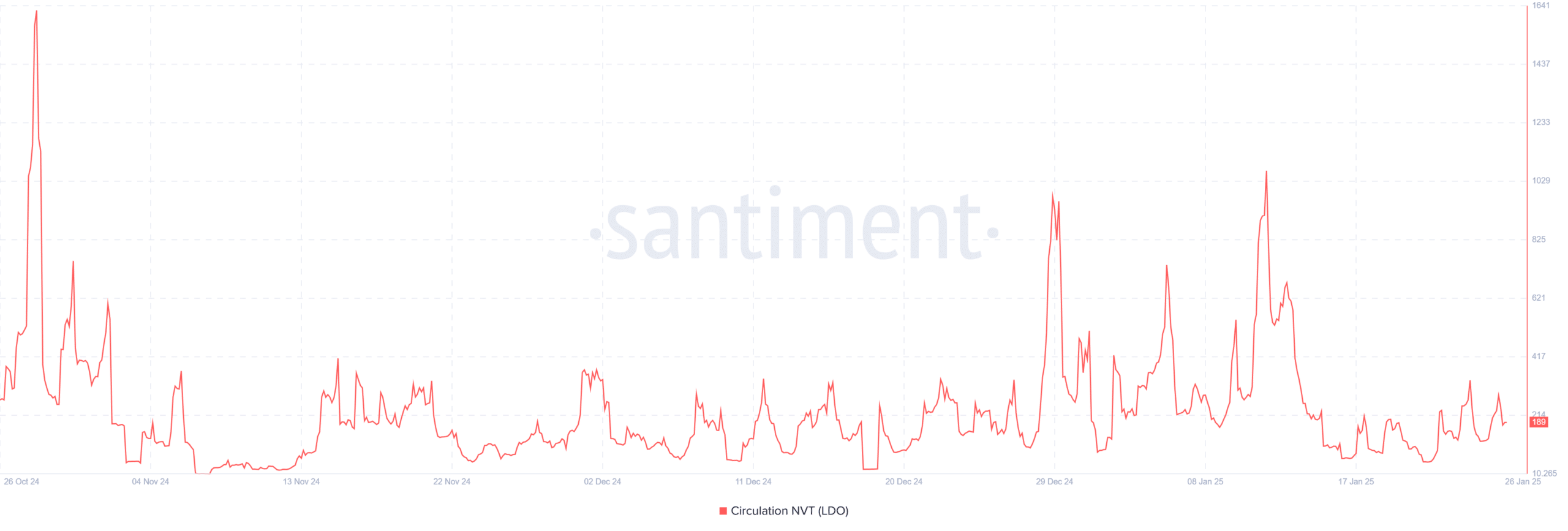

Source: Santiment

The market phenomenon was further confirmed by a declining circulative NVT, which emphasized the growing network and utility, while the market cap and market value were not increasing.

This signaled undervaluation, and LDO could reverse to the upside to catch up with the network demand.

Source: Coinalyze

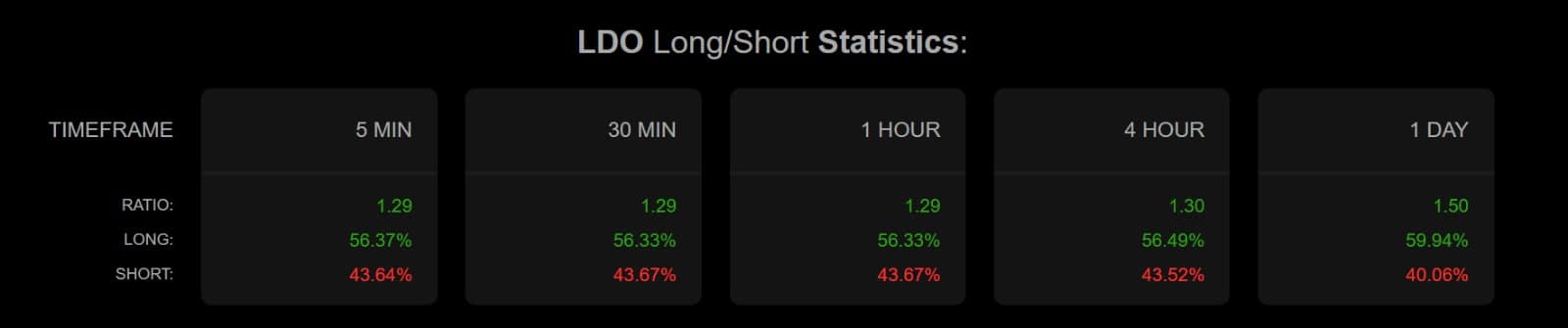

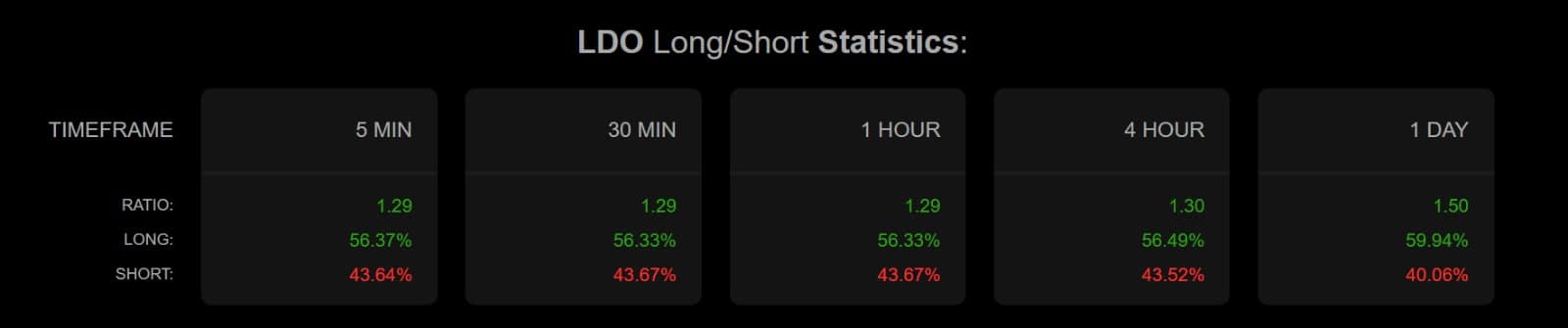

Finally, Lido DAO’s investors had turned increasingly bullish, as evidenced by the Long/Short Ratio. As such, on daily timeframes, longs accounted for 59.94% while shorts accounted for 40.06% of positions.

With a ratio of 1.50, it suggested that the majority of investors were bullish and expected prices to rise.

Read Lido DAO’s [LDO] Price Prediction 2025–2026

Simply put, LDO is signaling a potential sustained uptrend. With market participants bullish, the altcoin could make more gains.

Therefore, if these conditions hold, LDO could reclaim $2.5 and find the next significant resistance at $2.8. However, a correction will see it drop to $1.92.