- A crucial support level was identified at $1.88, aligning with the 78.6% Fibonacci retracement level.

- External factors, including growing adoption of liquid staking and Ethereum’s staking mechanism, may further fuel LDO’s upward trajectory.

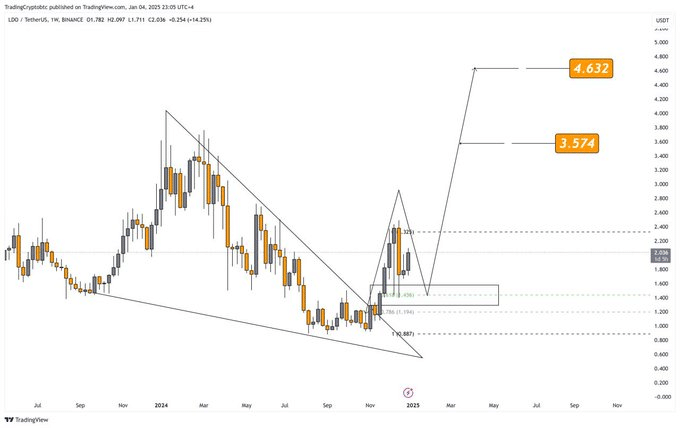

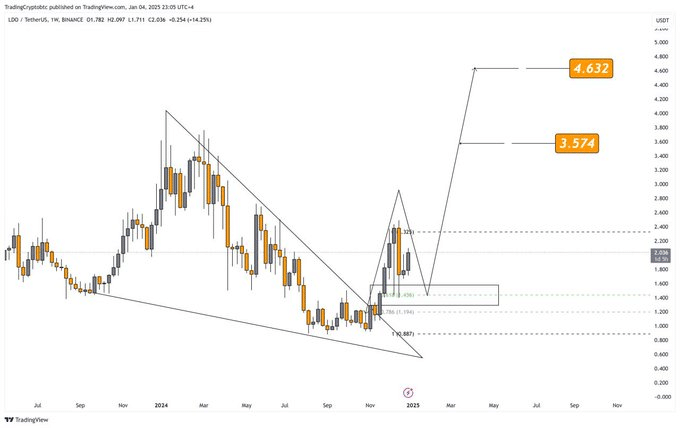

The recent price action of Lido DAO [LDO] has piqued interest within the crypto trading community, as the token demonstrated significant potential for upward momentum.

Emerging from a falling wedge pattern, LDO’s current trajectory signaled a bullish breakout opportunity, reinforced by critical support and resistance levels.

Falling wedge pattern

The falling wedge pattern on LDO’s weekly chart suggested a bullish reversal.

This pattern, defined by a narrowing range of price movement, typically signals declining bearish momentum and the onset of a potential breakout.

In this case, LDO’s breakout above the wedge coincided with a strong surge in volume, affirming buyers’ confidence.

Source: TradingView

Sequentially, a crucial support level was identified at $1.88, aligning with the 78.6% Fibonacci retracement level. This level acted as a springboard for the token, propelling it toward the $2.40 resistance area.

Although LDO faced rejection at $2.40, the subsequent pullback to $1.40 demonstrated robust buyer interest, leading to a 50% recovery.

Notably, the next critical threshold is a daily close above $2.70. Achieving this milestone could pave the way for further bullish momentum, with potential targets of $3.574 and $4.632 as identified on the chart.

This may be crucial to confirming the strength of any breakout.

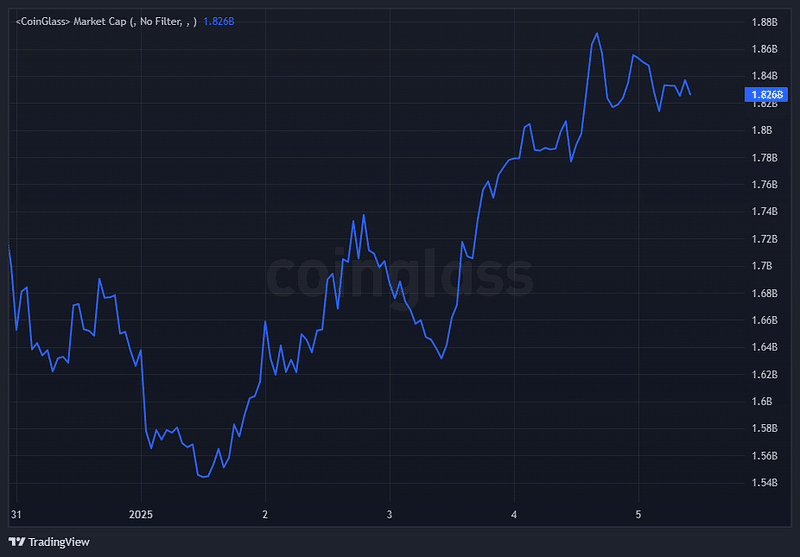

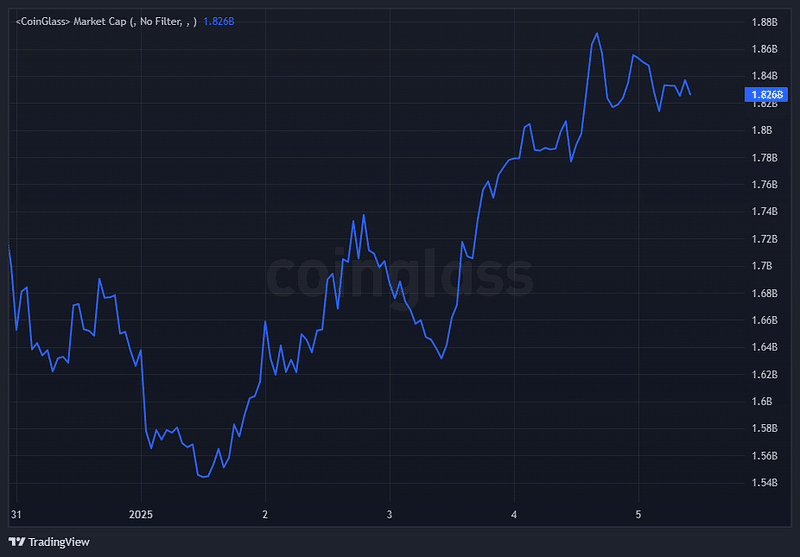

Total market cap

The total market capitalization of LDO was 1.28 billion USD at press time, reflecting its significant role in the decentralized finance (DeFi) ecosystem.

This figure positions LDO as a key player in liquid staking, further supported by its contribution to the Total Value Locked (TVL), which has reached 35 billion USD across DeFi platforms.

Source: Coinglass

Also, in recent weeks, LDO’s market cap has shown resilience despite broader market corrections, highlighting sustained interest from institutional and retail investors.

The upward trajectory of the market cap aligned with LDO’s breakout from the falling wedge, reinforcing the bullish narrative.

Looking ahead, a consistent rise in market capitalization could signal continued adoption and investor confidence.

Meanwhile, external factors, such as growing interest in liquid staking protocols and Ethereum’s staking mechanism, may further bolster LDO’s market cap.

Contrary to the analysis, it is advisable to be cautious of macroeconomic events that might affect overall crypto market sentiment.

Lido traders hope for a rally

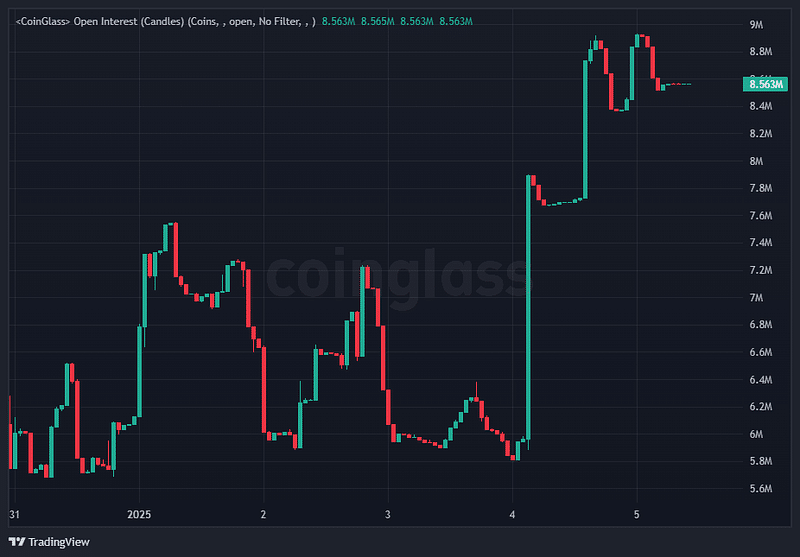

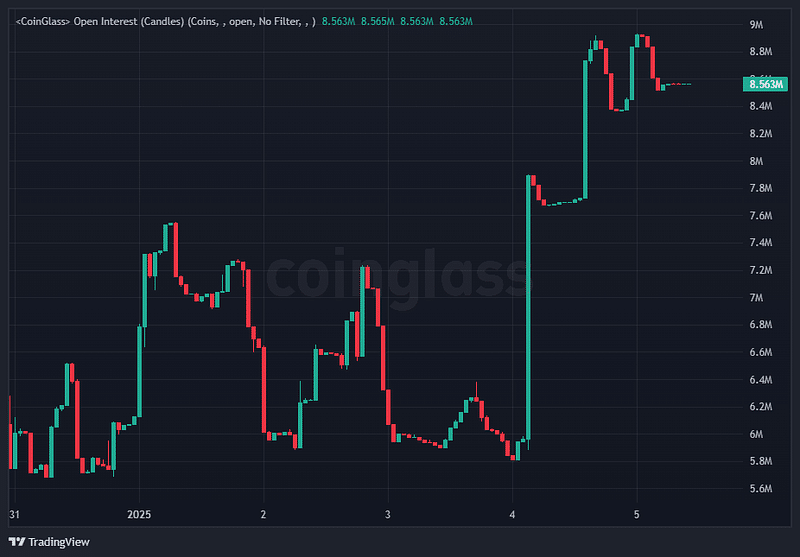

Open Interest, which reflects the total number of outstanding contracts in the derivatives market, provides valuable insight into LDO’s trading dynamics.

A recent surge in Open Interest coincided with the token’s rebound from its $1.40 support level, indicating increased participation from both long and short positions.

Source: TradingView

The rise in Open Interest, coupled with price recovery, suggests renewed confidence among traders anticipating further volatility.

Notably, the absence of major liquidations during the $1.40 to $2.40 rally highlights balanced market sentiment, with neither bullish nor bearish positions overwhelming the order books.

Should Open Interest continue to climb, it may signal growing speculation around LDO’s ability to sustain its bullish momentum.

Traders should monitor Funding Rates closely as well, as a sharp rise could indicate overheated long positions, potentially leading to a short-term correction.

Conversely, stable or declining funding rates would support a steady price ascent.

LDO exhibited a promising bullish outlook at press time, based on the technical and market analysis provided.

Emerging from a falling wedge pattern, the token has demonstrated a reversal from bearish momentum, supported by strong volume and key Fibonacci retracement levels.

Read Lido DAO’s [LDO] Price Prediction 2025–2026

The $1.88 support level served as a pivotal base for the recent price recovery, with the potential targets of $3.574 and $4.632 indicating significant upside opportunities.

The market capitalization of $1.85 billion underscores LDO’s central role in the DeFi ecosystem, supported by its contributions to the TVL.