- LSK has the lowest ranking in Whale vs. Retail delta, signaling high retail dominance.

- LSK long positions aligned with the Whale vs. Retail analysis, where retail traders take excessively bullish stances.

The cryptocurrency market operates under a wide range of metrics that offer valuable insights into market sentiment and price trends.

One notable metric highlighting LSK [Lisk] is its ranking in the Whale vs. Retail delta, where it showed the lowest position which signaled strong retail dominance.

The impact of retail dominance

Analysis from HyblockCapital revealed that LSK ranked at the first percentile in the Whale vs. Retail delta on the histogram, marking a highly atypical scenario.

Source: Hyblockcapital

Historically, extreme retail dominance has been followed by price declines, suggesting an overinflated retail market sentiment.

This dynamic is evident in the Whale vs. Retail Delta metric, where retail traders hold a larger proportion of long positions compared to whales.

Source: Hyblockcapital

This disparity often signals that retail traders are excessively optimistic, which can lead to a correction when the market adjusts. Thus, the charts visually confirm this behavior.

Lastly, price analysis confirms that after periods of high retail dominance, LSK’s price tends to drop.

SOURCE: Hyblockcapital

This trend implies retail investors enter at less favorable market conditions, causing price declines as their positions are liquidated. The combination of these indicators suggests that retail-driven price spikes may be short-lived.

This could lead to downward corrections as market expectations fail to align with reality.

Critical price levels: Where LSK might face pressure

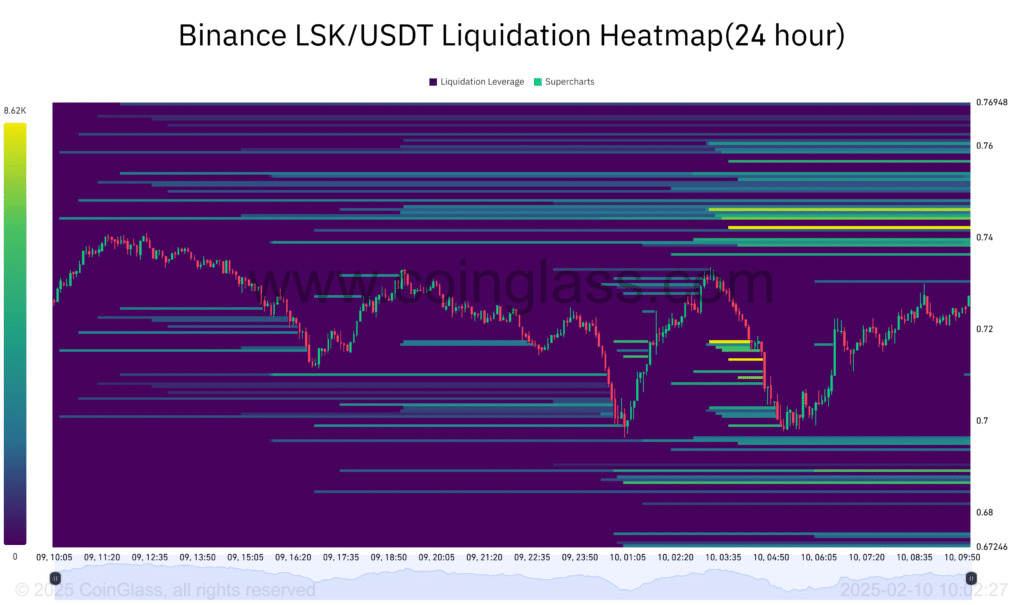

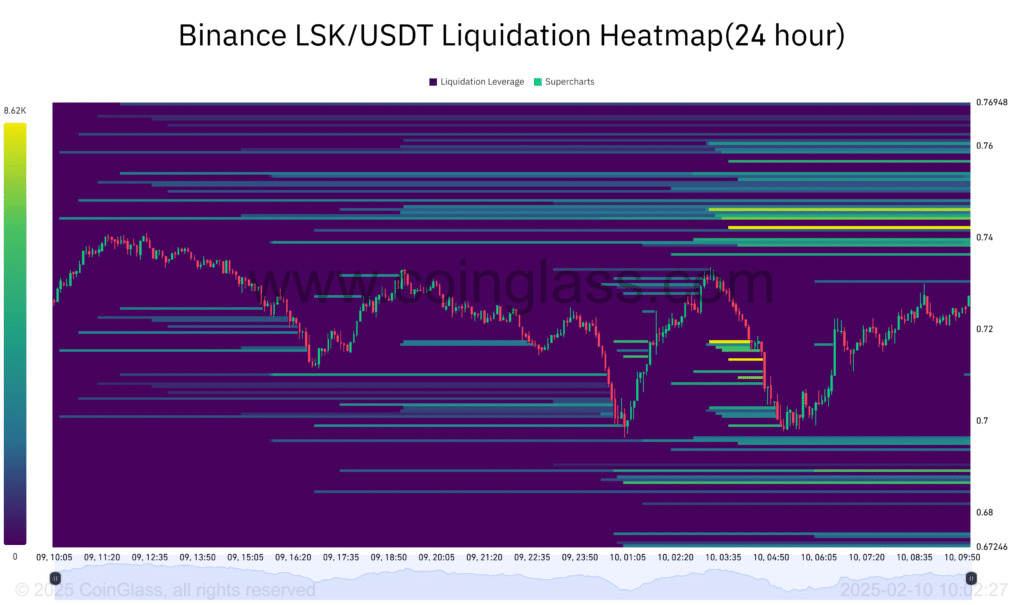

Alternatively, the liquidation heatmap for LSK has shown critical price levels where liquidation events are likely to occur.

Source: Coinglass

At the time of writing, there was a dense concentration of liquidations around the $0.74 and $0.72 levels. These levels act as psychological price points where significant buy and sell orders could emerge due to forced liquidations.

As LSK’s price approaches these levels, the market may experience resistance or support, exacerbating price movements—particularly in a downward trend where high retail dominance is present.

Retail investors, especially those using leverage, are more vulnerable to liquidation at these levels, which may have a cascading effect on LSK’s price.

Is LSK overbought?

The Long/Short Ratio, on the other hand, highlights the volume and account distribution between long and short positions. The data reveals that long positions often peak before a price downturn.

Source: Coinglass

This peak in long positions aligns with the Whale vs Retail analysis, where retail traders take excessively bullish stances, eventually leading to price corrections.

Also, a higher ratio of long positions relative to short positions signals market optimism that often precedes a decline. This has been mirrored in the retail-driven trend observed in the price and Whale vs Retail delta charts.

These signals suggest that the market is potentially overbought, which could trigger a downward adjustment in LSK’s price.

What lies ahead for LSK?

The current data strongly suggests a continued downward price movement in the short term. High retail dominance, coupled with the liquidation levels and the growing volume of long positions, paints a picture of a market susceptible to a price correction.

– Realistic or not, here’s LSK market cap in BTC’s terms

Historical patterns further support this outlook, as retail dominance has historically led to market peaks followed by declines.

The current analysis of LSK’s market behavior, primarily driven by retail dominance, points towards a cautious approach.