- Large transaction volumes for Maker rose by over 1,400% in just two days

- Despite rising whale activity, technical indicators and on-chain metrics flashed mixed signals for MKR

Maker (MKR), at press time, was valued at $1,513 following a hike of just under 2% over the last 24 hours. Here, it’s worth noting that the token’s performance has mirrored that of the broader cryptocurrency market with gains of 24% over the month.

Despite these gains, however, Maker has been stuck in the $1,419 – $1,550 range over the last two weeks. An uptick in whale activity could aid in a breakout past these levels though.

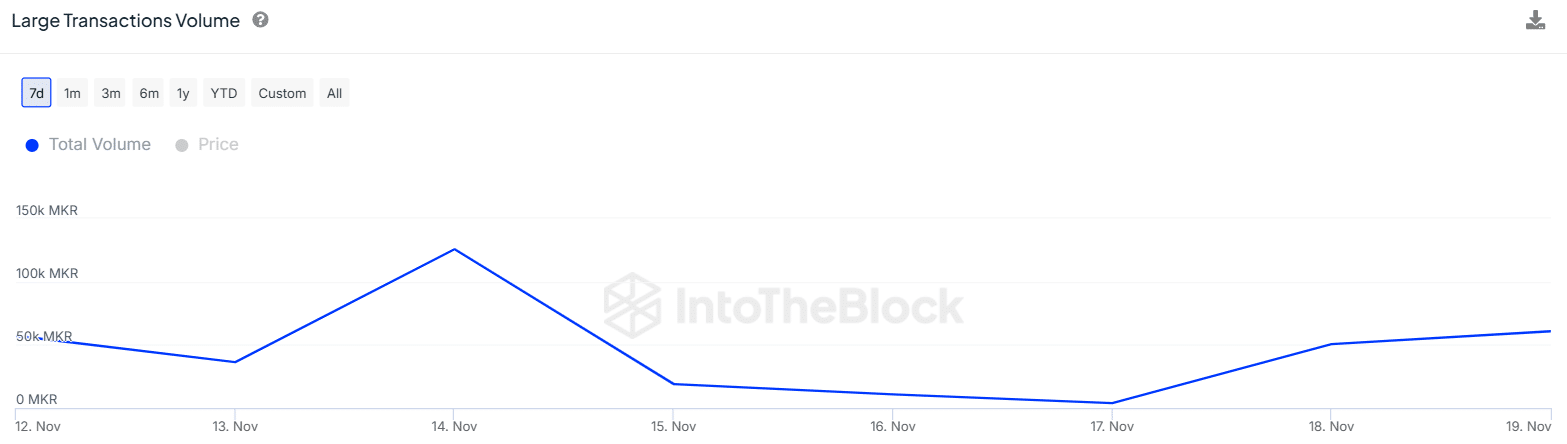

In fact, data from IntoTheBlock revealed that large MKR transactions exceeding $100,000 rose by 1,400%, from 3,840 to 60,730 in just two days.

(Source: IntoTheBlock)

51% of the total MKR supply is held by whales. Therefore, if trading activity from this cohort increases, MKR could break above or below the consolidation range depending on whether these traders are buying or selling.

Key levels to watch

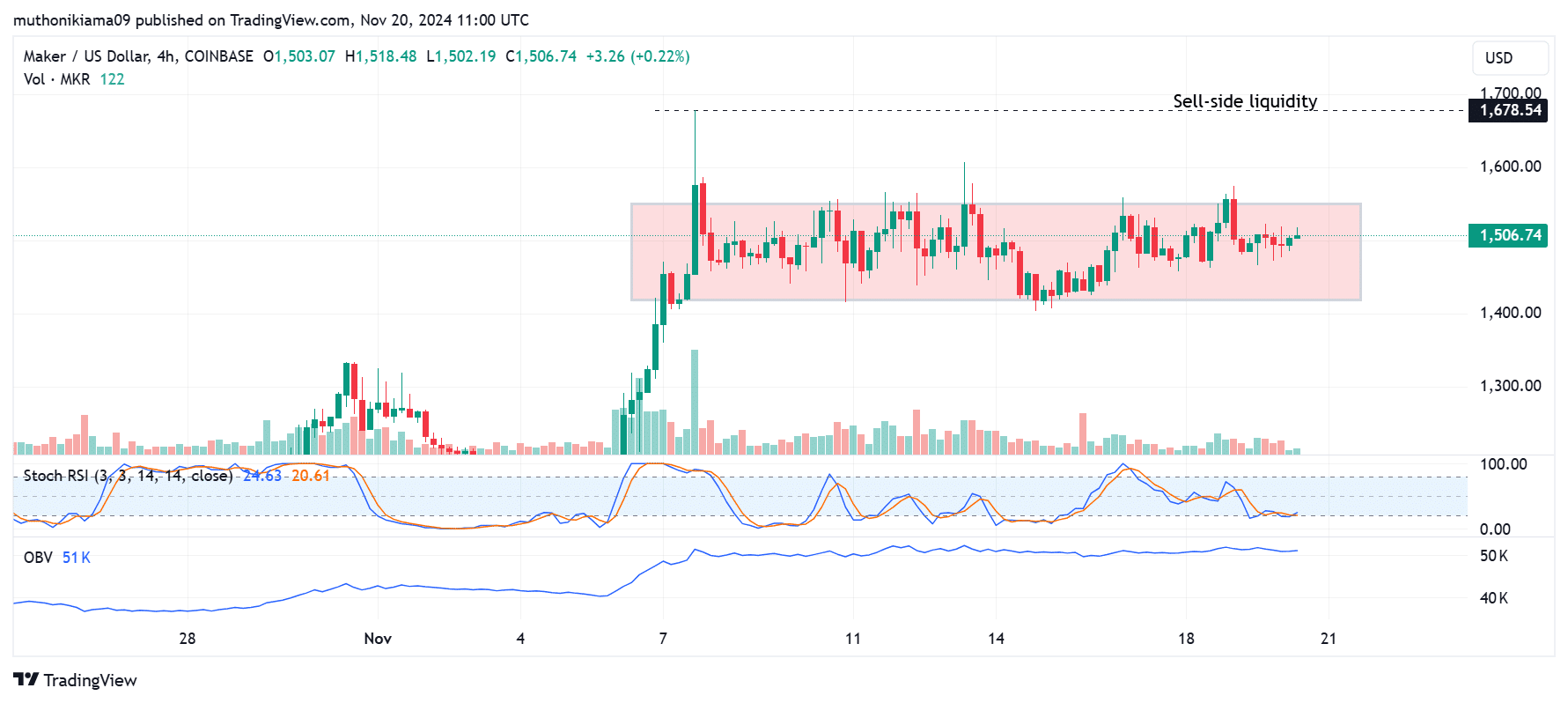

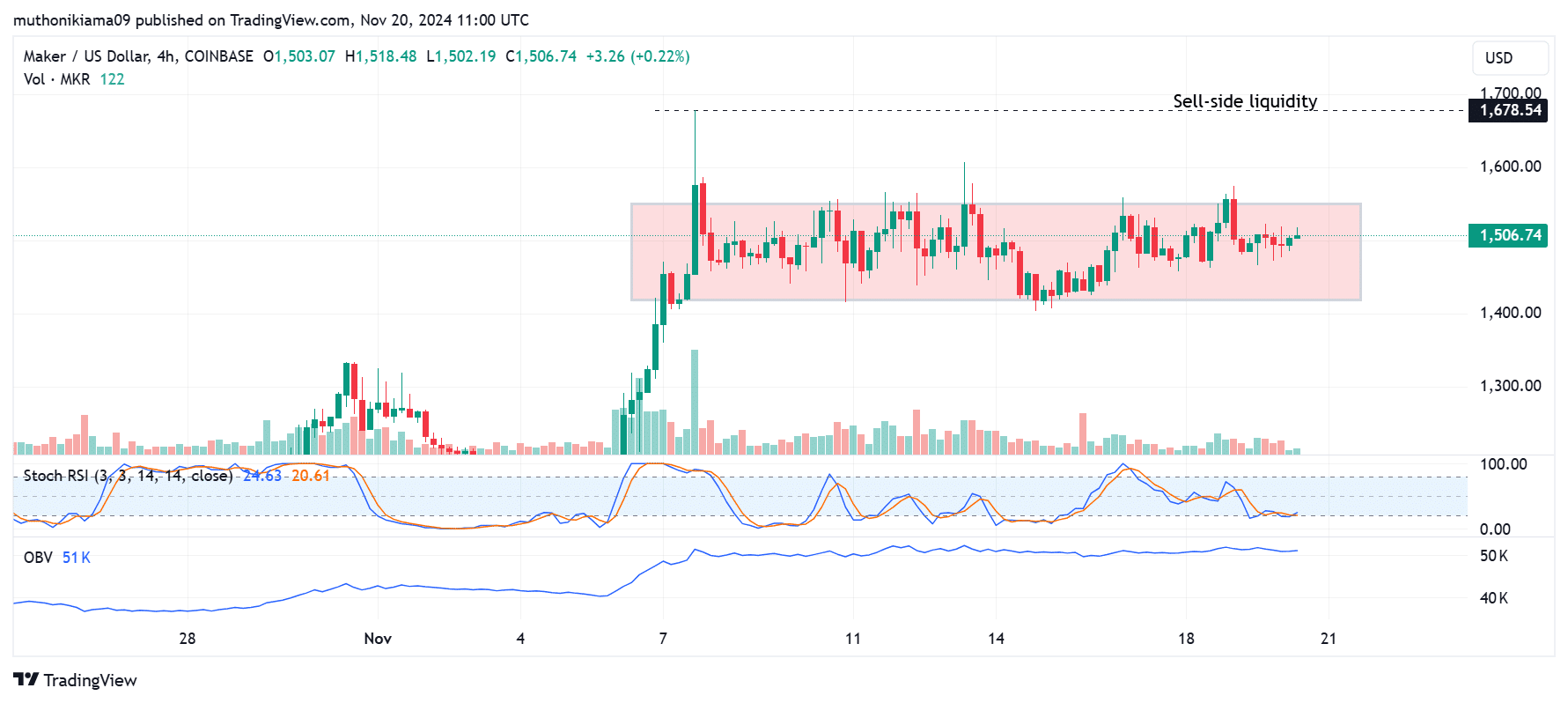

For Maker to confirm a bullish breakout from the consolidation range seen in the four-hour chart, it needs to break above resistance at $1,550 with high buying volumes.

The short volume histogram bars highlighted a lack of strong buyer interest to push the price above this resistance. Moreover, the on-balance volume indicator seemed to have flattened, indicating that buying and selling pressure may be balanced.

Traders should watch out for the sell-side liquidity at $1,678. Maker could rise to take out this liquidity and if buyers step in during this upswing, it could lead to a sustained rally. Conversely, if such a move fails to attract buyers, MKR could return to the consolidation range or trend lower.

(Source: Tradingview)

At the time of writing, the Stochastic Relative Strength Index (RSI) with a reading of 24 showed that MKR was oversold. This could also lead to an upward correction in the short term.

At the same time, traders should watch out for the support level at $1,419. A drop below this support could result in a bearish breakout from consolidation and cause MKR to enter a downtrend.

Declining NVT ratio shows THIS

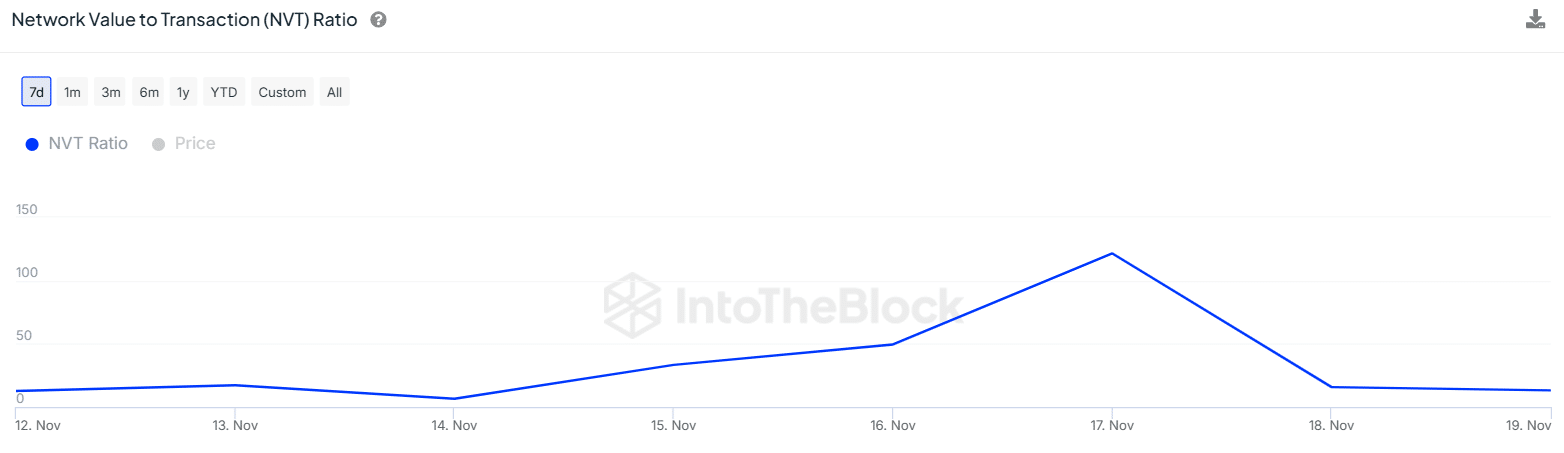

Maker’s Network Value to Transaction (NVT) ratio declined from 121.47 to 13.17 over the last two days, indicating that there has been a surge in transactions on the network.

(Source: IntoTheBlock)

Whenever the NVT ratio drops, it means that a token could be undervalued. However, a look at the Market Value to Realized Value (MVRV) ratio, which rose from 0.84 to 0.87 in the aforementioned period, suggested that this might not be the case.

This divergence could indicate that high transactions are due to profit-taking activities by whales. This could fuel a downward trajectory on the charts.

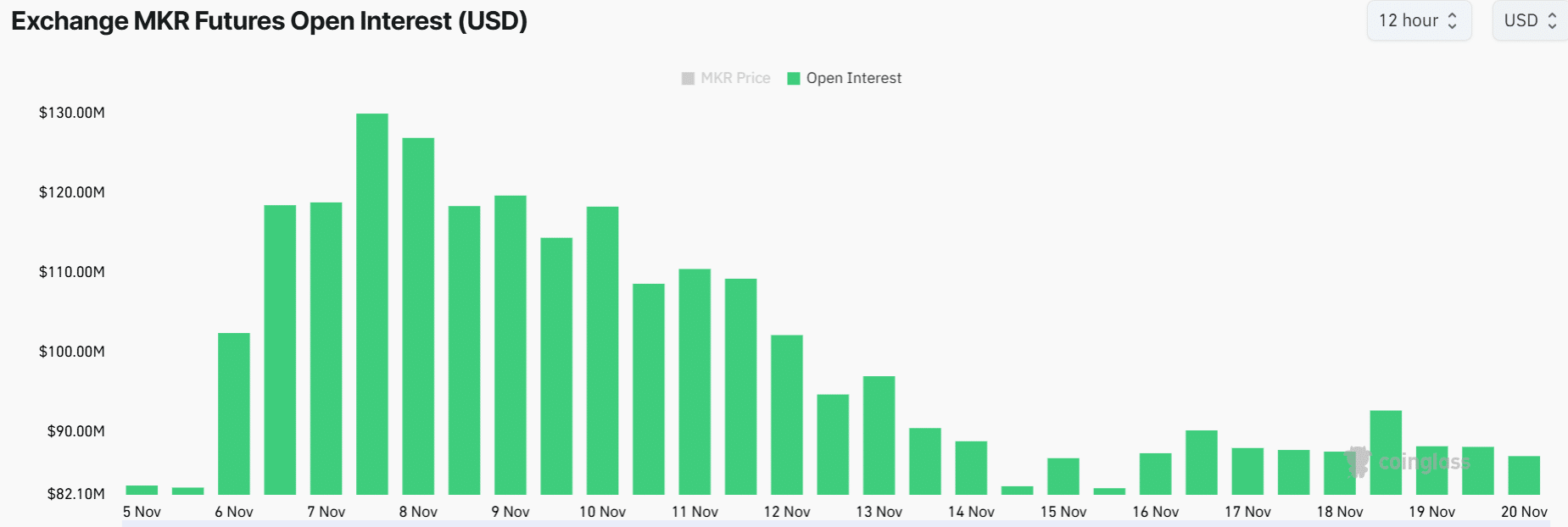

Derivatives market depicts uncertainty

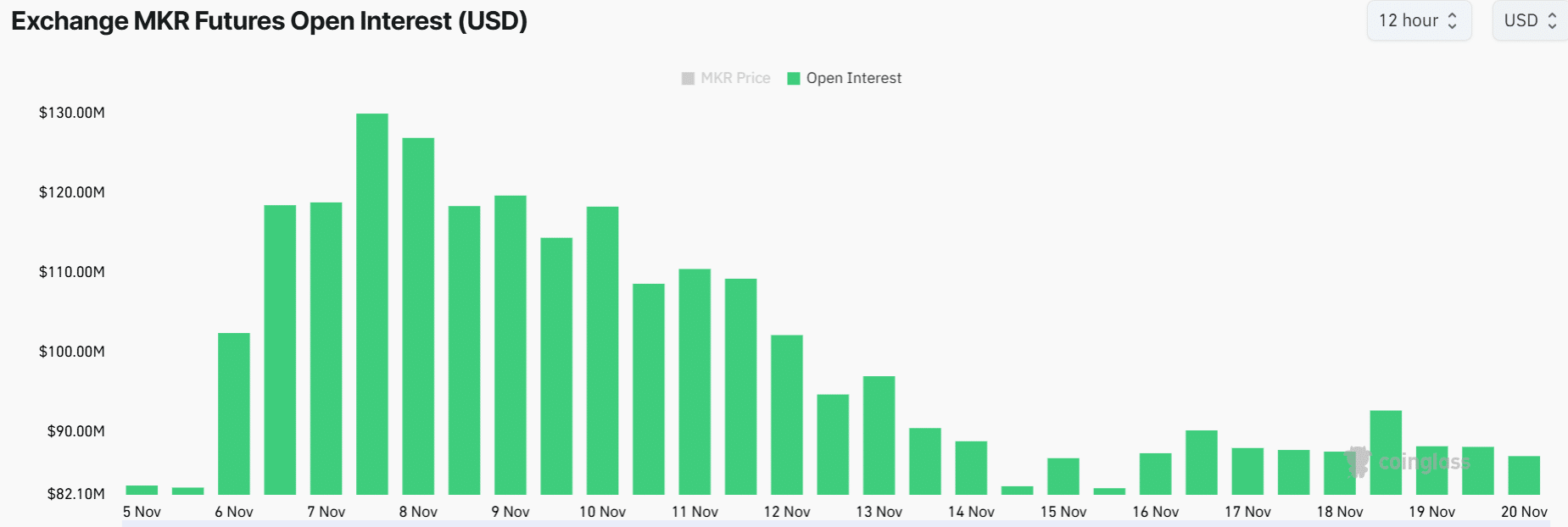

On the derivatives market front, traders have been uncertain towards Maker. This, after the Open Interest fell from $129M to $86M in just two weeks.

(Source: Coinglass)

When the Open Interest drops, it shows that traders are closing their positions on a token due to uncertainty over future price performances.

This decline in speculative activity could also be one of the key factors leading to Maker being stuck in a consolidation phase.